Best Swing Trading Brokers 2025

Swing traders aim to profit from short-to-medium-term price movements in financial markets. We’ve personally tested hundreds of platforms to bring you our pick of the best swing trading brokers, considering:

- The minimum deposit

- The fees for swing traders

- The offering of investments

- The platforms and research tools

- The safety and regulation

Best Brokers for Swing Trading 2025

Following our analysis, these 6 swing trading accounts stand out as the best:

Why Are These Brokers the Best for Swing Trading?

Here’s a quick breakdown of why these brokers stand out as the top choices for swing trading:

- Plus500 US is the best broker for swing trading in 2025 - Plus500 is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

Compare the Best Swing Trading Brokers on Key Elements

Discover the best broker for your swing trading strategy with our comparison of key features:

| Broker | Swing Trading Markets | Platforms | Regulators | Payment Methods |

|---|---|---|---|---|

| Plus500 US | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | CFTC, NFA | ACH Transfer, Apple Pay, Debit Card, Google Wallet, Mastercard, Visa, Wire Transfer |

| NinjaTrader | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | NFA, CFTC | ACH Transfer, Cheque, Debit Card, Wire Transfer |

| Interactive Brokers | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| eToro USA | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | SEC, FINRA | ACH Transfer, Debit Card, PayPal, Wire Transfer |

| FOREX.com | Forex, Stocks, Futures, Futures Options | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | NFA, CFTC | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| UnitedPips | CFDs, Forex, Precious Metals, Crypto | UniTrader | IFSA | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, PayPal, Perfect Money |

How Safe Are These Swing Trading Platforms?

Discover how reliable the top swing trading brokers are and the safeguards they offer to protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Plus500 US | ✘ | ✘ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| Interactive Brokers | ✘ | ✔ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| FOREX.com | ✘ | ✔ | ✘ | |

| UnitedPips | ✘ | ✔ | ✔ |

Compare Mobile Swing Trading Capabilities

This is how the top swing trading brokers measure up for mobile traders:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Plus500 US | iOS & Android | ✘ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro USA | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| UnitedPips | Web Access Only | ✘ |

Are the Top Brokers for Swing Trading Good for Beginners?

Beginners should use brokers that enable swing trading in a demo, alongside other tools for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Plus500 US | ✔ | $100 | 0.0 Lots | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro USA | ✔ | $100 | $10 | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| UnitedPips | ✔ | $10 | 0.01 Lots |

Are the Top Brokers for Swing Trading Good for Advanced Traders?

Experienced traders should look for sophisticated tools to support this medium-term trading strategy:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Plus500 US | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai & TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| UnitedPips | - | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare the Ratings of Top Swing Trading Brokers

Find out how the best swing trading platforms perform across key areas based on our latest ratings:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Plus500 US | |||||||||

| NinjaTrader | |||||||||

| Interactive Brokers | |||||||||

| eToro USA | |||||||||

| FOREX.com | |||||||||

| UnitedPips |

Compare Swing Trading Fees

The cost of swing trading can really add up over time, so here's how the to providers measure up on fees:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Plus500 US | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| Interactive Brokers | ✘ | $0 | |

| eToro USA | ✔ | $10 | |

| FOREX.com | ✘ | $15 | |

| UnitedPips | ✘ | $0 |

How Popular Are These Swing Trading Brokers?

Many traders prefer the most popular swing trading brokers - the ones with the largest user base:

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com | |

| UnitedPips |

Why Swing Trade With Plus500 US?

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Demo Account | Yes |

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | 0.0 Lots |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls, instilling a sense of trust

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Plus500 US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

Why Swing Trade With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

Why Swing Trade With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Swing Trade With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- A free demo account means new users and prospective day traders can try the broker risk-free

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

Why Swing Trade With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Why Swing Trade With UnitedPips?

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

Cons

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

How To Choose A Swing Trading Broker

These are the key considerations we took into account to compile a list of the best swing trading brokers:

Minimum Deposit

The top brokers for swing traders offer a low minimum deposit.

Signing up with a broker that has a low starting investment reduces the entry barrier, especially for beginners.

We consider anything below $500 accessible for the majority of traders, though many platforms have much lower starting deposits and some even have no account minimums.

- OANDA has no minimum deposit and offers excellent conditions for swing traders.

Fees for Swing Traders

Swing traders are fairly active, so we favor low-cost brokers to help protect profit margins.

The key things our team looked for are tight spreads and low commissions. It is also important to consider non-investing fees such as deposit and withdrawal charges, inactivity penalties, plus fees to access advanced market research tools to support decision-making.

Importantly, our tests have taught us that the cheapest brokers are not always the best, so we weigh the costs against the quality of the accounts, tools and order execution.

- Webull offers very low fees with zero commissions, no inactivity fee and free stocks when you sign up.

Offering of Investments

Diversification is important for swing traders, so we prefer online brokers that offer a broad selection of asset classes.

One of the benefits of swing trading is the ability to hold multiple positions across different markets and sectors, thereby reducing the impact of negative price movements in individual positions. As a result, we looked for brokers that offer opportunities on a range of assets, from stocks and commodities to forex and cryptocurrencies.

- eToro offers more than 5,000 instruments spanning a large suite of asset classes, including stocks, indices and ETFs.

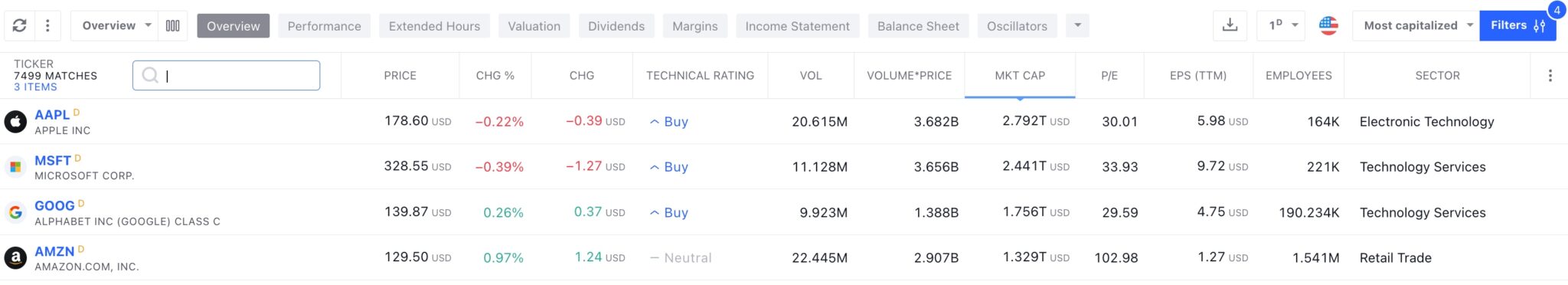

Platforms and Research Tools

The best swing trading brokers offer easy-to-use platforms with sophisticated tools.

Swing traders typically use a combination of technical and fundamental analysis to identify potential trades, so we searched for brokers with interactive charts, technical indicators, news streams, data on companies, and financial calendars.

Two of the most popular platforms with swing traders are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These offer comprehensive technical analysis features, including indicators and drawing tools, enabling swing traders to identify entry and exit points. They also support automated investing through Expert Advisors (EAs).

TradingView is another great option for swing traders, with powerful charts, real-time news, screeners and alerts. This is our top pick for charting software.

- Vantage supports MT4, MT5 and TradingView on desktop, web and mobile devices.

Safety and Regulation

Safety is a key consideration and the easiest way to discern a credible broker is through regulatory oversight.

Swing trading with a well-regulated broker will help protect your funds while ensuring the brokerage operates ethically. Our experts always check a broker’s regulatory credentials as part of the review process.

Trustworthy brokers are regulated by credible financial agencies, such as the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC) and the Cyprus Securities & Exchange Commission (CySEC).

- CMC Markets is authorized by several respected regulators, including the FCA and ASIC.

FAQ

What Is A Swing Trading Broker?

A swing trading broker is an intermediary that enables retail investors to speculate on short-to-medium-term price fluctuations in financial markets with the aim of making a profit.

The top swing trading brokers offer accessible accounts with low fees, excellent charting platforms and market research, plus access to a range of asset classes, such as stocks, commodities and forex.

Which Brokers Do Swing Traders Use?

We have listed the best brokers for swing traders. Our team considered several factors during testing, including the minimum deposit, fees for swing traders, the investment offering, plus the quality of the platform and research tools. We also evaluated firms’ regulatory status and account safeguards.

What Is The Best Swing Trading Platform?

TradingView is the best platform for swing trading in our view. We found it easy to use during our tests and it offers excellent tools for swing traders, including 14 charting types, 100+ technical indicators, news feeds, fundamental research, screeners, alerts and more.

Other excellent and widely available platforms for swing traders are MetaTrader 4 and MetaTrader 5.

How Much Money Do I Need To Open A Swing Trading Account?

This will depend on the brokerage, but most good swing trading brokers have a minimum investment of less than $500. Some firms even have no account minimum, such as OANDA and Webull, making them a good option for new swing traders and those with less starting capital.

Article Sources

- Eightcap - Swing Trading Educational Materials

- AvaTrade - Best Platform For Beginner Swing Traders

- Webull - Fee Schedule For Swing Traders

- Swing Trading: How to Make Profits Trading in The Stock Market: Investing In Options: Discover the Best Secrets in Swing Trading, Elder Graham, 2021

- How to Swing Trade for a Living: 10 Easy Ways to Make a Full Time Income, J.R. Lira, 2018

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com