SurgeTrader Review 2025

SurgeTrader is a multi-asset prop trading firm based in the US. The organization offers funded trading accounts up to the value of $1,000,000 with no monthly subscription fees. Traders are eligible for up to 90% profit payouts. The ‘audition’ process is just one-step, with no minimum trading days.

This review of SurgeTrader will cover the trading rules, including profit splits, free trial, scaling plan, and more. We also explain how to get started with the evaluation process.

Key Takeaways

- SurgeTrader offers a more relaxed assessment phase than many prop firms

- Funded traders can manage accounts worth up to $1 million, significantly higher than many alternatives

- There are no restrictions on trading strategies and styles, with hedging and algo trading permitted

What Is SurgeTrader?

SurgeTrader is a US-based prop trading firm, with headquarters located in Naples, Florida. All trader accounts are managed by the ASIC-regulated brokerage, Eightcap, and venture capital backing is provided by Valo Holdings.

The company was established by an FX broker, institutional trader, and venture capitalist including founder Jana Seaman. The mission of the company is; to accelerate trader funding and help outstanding traders capitalize on their success.

The funded profile program is built on:

- No time limits

- Simple trading rules

- One-step evaluation

- Top-tier customer service

SurgeTrader has received accreditations from respected financial firms including MarketWatch, Yahoo Finance, and MarketScreener.com. Additionally, the brand invests funds and resources into local social programs such as St. Matthew’s House and Habitat for Humanity.

How SurgeTrader Works

SurgeTrader offers six pre-funded profiles. Each account is loaded with a trading value of between $25,000 and $1,000,000. A one-step evaluation assessment is required based on the account size selected.

Pending success with no breach of the rules, traders are granted access to a funded account under live market conditions. Trades are completed via the MetaTrader 4 or MetaTrader 5 platforms hosted by Eightcap.

What Can Be Traded?

The SurgeTrader-funded account program offers a range of instruments, including forex, stocks, commodities, indices, and cryptocurrency. Note, trading assets vary by platform.

Our experts were offered 362 instruments on the Eightcap MT4 desktop and mobile app platform:

- Indices – 12 major global indices including the AUS200, SPX500 and the FTSE100

- Forex – 45 major and minor currency pairs including GBP/USD, NZD/USD, and EUR/USD

- Commodities – Two precious metals and two energies including Gold and Light Crude Oil

- Cryptocurrency – 200+ crypto/fiat currency pairs such as BTC/USD, ETH/EUR, and LTC/GBP

- Stocks – 90 global company stocks such as McDonald’s, Walt Disney, Walmart, and General Motors

- Cryptocurrency Indices – Five cryptocurrency indices including the Top 10 Altcoin Index vs USD and the Top 10 Crypto Index vs USD

1000+ instruments are available on the Eightcap MT5 desktop and mobile app platform:

- Indices – 17 major global indices including the US2000, SPX500 and VIX

- Forex – 45 major and minor currency pairs including GBP/USD, NZD/USD, and EUR/USD

- Commodities – Two precious metals and three energies including Gold and Brent Crude Oil

- Stocks – 640+ global company stocks such as Unilever, Lloyd’s Banking Group, Nike, and Tesla

- Cryptocurrency – 370+ crypto/fiat currency pairs such as XRP/EUR, BNB/GBP, and DSH/AUD

On the downside, futures and options are not available.

Programs & Fees

Evaluation Phase

SurgeTrader has a one-part ‘audition’ phase with a fee that varies by account balance. This is advantageous vs competitors such as FTMO with a 2-step, lengthier evaluation course.

New traders can select the funded program tier, pay the one-off fee and meet the target requirements to be eligible for a funded account. Audition login credentials are provided within a few minutes to a registered email address, including a link to download the platform. The value traded within the assessment will be the value available to trade within live conditions (pending success).

A major benefit of SurgeTrader is that there are no minimum or maximum trading days required. Once the 10% profit return is achieved, and all other requirements are met, traders are eligible for a live-funded profile. Live account details are provided within 24-48 hours of the assessment criteria being met.

There is a 20% discount for additional audition attempts for investors that fail the initial assessment.

Traders must achieve a 10% profit, with a maximum daily loss limit of 4% and a maximum trailing drawdown of 5% to be successful.

- Starter Tier – $250 audition fee

- Intermediate Tier – $400 audition fee

- Seasoned Tier – $700 audition fee

- Advanced Tier – $1800 audition fee

- Expert Tier – $3500 audition fee

- Master Tier – $6500 audition fee

Free Trial/Promos

A 30-day free trial is available with a virtual default balance of $100,000. The SurgeTrader demo account can be requested via the prop trading firm’s website, though customer support is limited.

The paper trading profile is a good place to start for individuals new to funded accounts. It is a great way to explore the client dashboard and have a go at placing traders on the MetaTrader terminals.

The practice profile does not count towards audition success and accounts will be reset when an evaluation program is purchased.

SurgeTrader does offer occasional promos to new traders. This includes more lenient trading rules, discount codes, and contests. Keep an eye on the website during key calendar moments such as Black Friday or the start of a month for the latest coupon codes and sales.

Note, SurgeTrader has a no-refund policy on all product purchases.

Live Funded Accounts

Once the audition process has been completed and passed, access to a SurgeTrader-funded profile is available instantly.

All funded trader programs have a default profit payout of 75%. However, up to 90% profit splits can be achieved with an add-on purchase, making the brand aligned with alternatives such as SuperFunded and FundedNext. This add-on is available for $360.

All trading styles and strategies are accepted including hedging, copy trading, and algo trading. Commissions, spreads, other trading fees, and market opening hours are at the discretion of the partner broker, Eightcap.

There are three simple rules of a funded program that must be adhered to at all times:

- A stop-loss parameter is required for each trade

- All positions must be closed before 4 PM (EST) on a Friday

- A maximum lot size equal to 1/10000 of the size of the account

Account Options

- Starter Tier – $25,000 funding

- Intermediate Tier – $50,000 funding

- Seasoned Tier – $100,000 funding

- Advanced Tier – $250,000 funding

- Expert Tier – $500,000 funding

- Master Tier – $1,000,000 funding

The requirements of all accounts:

- Leverage – 1:10

- Daily Loss Limit – 4%

- Profit Share – Default 75%

- Maximum Trailing Drawdown – 5%

- Profit Target – 10% of the account value

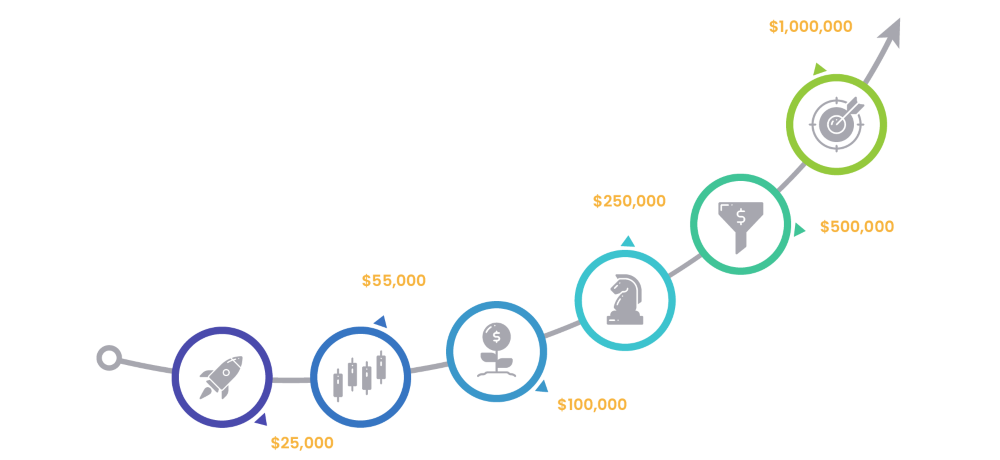

Scaling Plan

Upon passing the audition stage, traders are presented with two funded account options; claim the funded account balance that was completed within the assessment or scale up the funded account to the next available size.

There is no additional fee to scale up. For example, a trader auditioning for the $25,000 funded account ($250 assessment fee) can continue scaling up five times to the $1,000,000 account at no extra cost. The targets must continue to be met, including the 10% profit intention, whilst moving through the six profiles.

If the rules are breached during the scaling plan, audition attempts will be disqualified and traders must start again.

Withdrawals

Profit withdrawals can be requested at any time, but not more than once every thirty days.

To request a fund removal from a SurgeTrader account, select the ‘Withdraw Profits’ logo within the client dashboard. Enter the amount to withdraw.

Note, funds will be sent back to a third-party ‘Deel’ account. From here, money can be withdrawn via the payment methods available. This includes credit card, debit card and PayPal.

SurgeTrader will withdraw its profit share at the time of withdrawal request.

The trailing drawdown does not reset when a withdrawal is requested. This is locked according to the starting balance value.

Security & Regulation

The firm is licensed under the name Surge Capital Ventures LLC. As SurgeTrader is not a broker-dealer, it is not regulated by a financial authority.

However, Eightcap is regulated by the Australian Securities and Investment Commission (ASIC). This is a well-regarded financial regulator with strict rules and compliance. With this comes capped leverage to a maximum of 1:30, though the broker restricts leverage to 1:10 for prop trading activities.

Transmissions between the MetaTrader platforms and the broker’s server are encrypted using 128-bit keys.

Additional Tools

Client Dashboard

As well as competitive trading conditions via Eightcap, traders benefit from some useful additional resources and support.

The SurgeTrader client portal features an intuitive and easy-to-use proprietary dashboard to track trading activity and performance. Users can assess current account balances, loss limits, and outstanding values required to make a profit.

Real-time trade analytics are available to monitor a portfolio and improve trading.

BKForex

All funded account traders get a free 30-day membership to BKForex worth $175. The company offers insights and ideas via an online platform.

Led by expert advisors Kathy Lien and Boris Schlossberg, the suite of resources includes daily online webinars, access to an investor chatroom available 24/7, and integrated YouTube videos.

Other resources include:

- 12 strategy videos

- Monthly market outlooks

- Up to five daily trade ideas

- Live trading power hour insights

- Access to members-only indicators

- Proprietary fundamental analysis heatmap

- Access to the BKForex app and desktop dashboard

The Trader’s Corner Blog

The prop firm also provides a helpful daily blog forum covering topics such as how to analyze losses, reward-to-risk ratios, and why using trading journals is important.

Additionally, the posts cover instrument-specific details including the relationship between the USD and oil or how gold impacts the Australian Dollar.

Pros Of SurgeTrader

Our experts found several advantages to applying for a funded trading account with SurgeTrader:

- Available globally

- Scaling plan available

- No ongoing membership fees

- Good user reviews and ratings

- A simple, one-step evaluation process

- Educational resources and an intuitive client dashboard

- Various customer support options including live chat and email

- Trade on the industry-recognized MT4 and MT5 platforms via an ASIC-regulated broker

Cons Of SurgeTrader

Our SurgeTrader review also found several disadvantages:

- Relatively low leverage is available (1:10 max)

- Only one withdrawal is permitted every 30 days

- 90% payout only available with additional addons

Customer Service

SurgeTrader customer support is good, with various contact methods.

- Email – info@surgetrader.com

- Online Contact Form- Via the ‘Contact Us’ page

- Address – 405 5th Ave, South Naples, Florida, 34102

- Live Chat – Icon available on the bottom right of each webpage

- Phone Number – 866-998-0883 (toll-free) or 239-944-5317 (direct)

When we tested the live chat service, we received an automated response immediately and a human response within ten minutes.

SurgeTrader is also present on social media sites including Facebook, LinkedIn, and Instagram. Refer to these channels to stay up to date with the latest company news.

A lot of information can also be found on the prop trading firm’s website, with a comprehensive FAQ section.

SurgeTrader Verdict

SurgeTrader is a well-rounded funded trading account provider. The one-step evaluation process provides a quick and simple approach to getting new users on board. The choice of instruments and MetaTrader platform, plus a 30-day trial, also means there is something for all aspiring traders. The only major downside is the additional add-on purchase for the highest profit split.

FAQs

Is SurgeTrader A Legit Funded Trading Account Provider?

Yes, SurgeTrader is a legitimate funded account company. It is available to investors globally, operating from headquarters in Naples, Florida. The brand is also partnered with a top-rated, ASIC-regulated broker – Eightcap.

Is SurgeTrader A Good Prop Firm?

SurgeTrader is a decent prop trading firm. It offers a simple one-step evaluation phase with live account funding available within 48 hours following a pass. Users can trade on the global MetaTrader 4 and 5 platforms via an ASIC-regulated brokerage.

Is The SurgeTrader Evaluation Process Easy?

The SurgeTrader ‘audition’ is a one-step process. Investors must achieve a 10% profit based on the starting account balance whilst adhering to a maximum daily loss limit of 4% and a maximum trailing drawdown of 5%. This is certainly not easy, but given the removal of tight timescales and the availability of education and reliable customer support, it will be within reach for some talented traders.

Is SurgeTrader Regulated?

No, SurgeTrader is not a broker-dealer so is not regulated by a financial watchdog. However, the prop firm has partnered with Eightcap, a brokerage regulated by the Australian Securities and Investment Commission (ASIC).

What Account Options Are Available At SurgeTrader?

SurgeTrader offers six funded account options, ranging from a balance of $25,000 to $1,000,000. This is a decent range of funded profiles and more than many competitors.