Best Unregulated Stock Brokers in 2025

Traders opt for unlicensed stock platforms for perks like zero commissions, high leverage, easy account setups, and joining bonuses like free shares. However, the risks are huge.

You may get zero investor protection, poor quality stock screeners and market analysis, and potential scams like the one reported by The Economic Times where victims lost millions to a stock trading fraud on social media. This is why we primarily recommend trading stocks through a regulated broker.

However, for those willing to forego legal safeguards, launch into DayTrading.com’s pick of the best unregulated stock trading platforms. Every brokerage has been evaluated by our stock market experts and enthusiasts.

Top 6 Unregulated Stock Brokers

Based on our tests, analysis and ratings, these 6 unlicensed platforms stand out as the best for trading stocks:

Here is a short summary of why we think each broker belongs in this top list:

- Videforex - Trade binary options and CFDs on global stocks from US, European, Russian and Asian exchanges, as well as 37 indices covering a wide range of global markets. The access to stocks trumps many binary options brokers.

- Binarium - Go long or short on blue chip stocks like Apple and Microsoft. You can place high/low binaries on the user-friendly platform. The suite of stocks is focused on US markets, however.

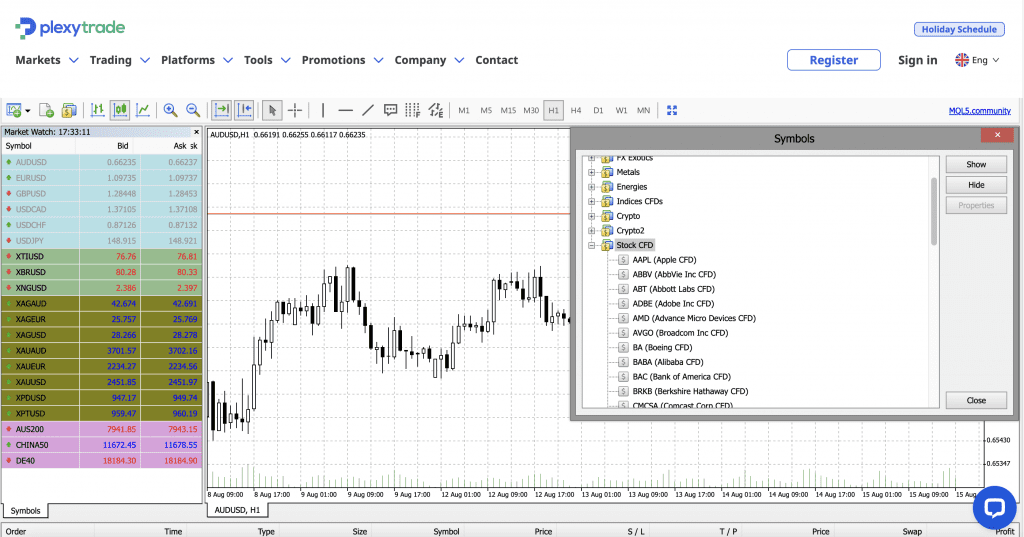

- Plexytrade - Plexytrade's range of 48 US stock CFDs trails most competitors, though the selection of 15 popular global indices (including S&P 500, Nasdaq 100, and Dow Jones) is reasonable. Still, the lack of stock market research tools like stock screeners and the minimum deposit requirement to access the economic calendar (a typically free feature at other stock brokers) is disappointing.

- RaceOption - Go long or short on over 50 major global shares and map out your strategies using the intuitive charting tools. Those with $1,000+ starting capital can also enjoy their first 3 trades risk-free.

- LonghornFX - Access a modest selection of 60+ US and European company stocks including Amazon and Volkswagen. Major global indices like the S&P 500 and FTSE 100 are also available. Stock traders can enjoy convenient access to the MT4 platform via desktop, web browser and mobile.

- Amega - Trade 25+ global stocks with CFDs commission-free with fast execution and STP pricing. This is a narrow selection vs competitors, focussed on US markets. Eight indices are also available to speculate on the movements of US, European, UK and Australian markets.

Best Unregulated Stock Brokers in 2025 Comparison

| Broker | Stock Exchanges | Leverage | Platforms | Minimum Deposit |

|---|---|---|---|---|

| Videforex | Dow Jones, FTSE UK Index, Hong Kong Stock Exchange, IBEX 35, Nasdaq, S&P 500, SIX Swiss Exchange | 1:500 | TradingView | $250 |

| Binarium | - | - | Own | $5 |

| Plexytrade | Australian Securities Exchange (ASX), CAC 40 Index France, DAX GER 40 Index, Dow Jones, Euronext, FTSE UK Index, Hang Seng, Hong Kong Stock Exchange, IBEX 35, Japan Exchange Group, Nasdaq, New York Stock Exchange, Russell 2000, S&P 500, SIX Swiss Exchange | 1:2000 | MT4, MT5 | $50 |

| RaceOption | DAX GER 40 Index, FTSE UK Index | 1:500 | TradingView | $250 |

| LonghornFX | CAC 40 Index France, DAX GER 40 Index, Dow Jones, FTSE UK Index, IBEX 35, Japan Exchange Group, Nasdaq, S&P 500 | 1:500 | MT4 | $0 |

| Amega | Australian Securities Exchange (ASX), DAX GER 40 Index, FTSE UK Index, S&P 500 | 1:1000 | MT5 | $20 |

Videforex

"Videforex will serve traders looking for a no-frills, easy-to-use platform to speculate on the direction of popular financial markets through binaries. With a sign-up process that takes a matter of minutes and a web-accessible platform, getting started is a breeze. "

William Berg, Reviewer

Videforex Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| Fractional Shares | No |

| Demo Account | Yes |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Stock Exchanges

Videforex offers trading on 7 stock exchanges:

- Dow Jones

- FTSE UK Index

- Hong Kong Stock Exchange

- IBEX 35

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Pros

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- Traders can earn up to 98% payouts on 100+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

Cons

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

Binarium

"Binarium has been designed with simplicity in mind, featuring a fast, fully digital sign-up process and an intuitive platform and app with 4 chart types and 12 indicators. With binaries spanning 5 minutes to 3 months, it caters to short- and medium-term traders."

William Berg, Reviewer

Binarium Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | Own |

| Minimum Deposit | $5 |

| Automation | No |

| Account Currencies | USD, EUR, AUD, RUB |

Stock Exchanges

Binarium offers trading on 0 stock exchanges:

Pros

- Binarium claims to segregate client funds with EU banks, meaning traders’ money should not be misused and providing an important layer of protection, which is especially relevant given its offshore status.

- The $10,000 demo account, deposit-doubling welcome bonus, smooth sign-up, and 24/7 support make for an attractive onboarding experience.

- Binarium has the best education centre we’ve seen amongst binary options brands, complete with information on core topics like trading basics and account options, plus professional video guides to using the platform.

Cons

- Despite being operational since 2012, Binarium is an unregulated broker with limited transparency on its website, raising safety concerns and potentially putting your capital at risk.

- Payouts of up to 80% are on the low side of binary options platforms based on our evaluations, which may deter traders looking for the possible best returns, though you can get back up to 15% of losing trades.

- Binarium has some way to go to match the investment offering of binary firms like Quotex, with a particularly weak selection of around 20 currencies and 3 cryptocurrencies.

Plexytrade

"Plexytrade is a newcomer in the brokerage scene with attention-grabbing features like 1:2000 leverage, zero spreads on select instruments and fast execution speeds of less than 46 milliseconds. However, the absence of regulation is a significant concern, while the non-existent research and educational tools place it far behind industry frontrunners."

Christian Harris, Reviewer

Plexytrade Quick Facts

| Bonus Offer | 120% Cash Welcome Bonus |

|---|---|

| Fractional Shares | No |

| Demo Account | Yes |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Automation | Yes |

| Account Currencies | USD, EUR |

Stock Exchanges

Plexytrade offers trading on 15 stock exchanges:

- Australian Securities Exchange (ASX)

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- New York Stock Exchange

- Russell 2000

- S&P 500

- SIX Swiss Exchange

Pros

- US residents are accepted as clients, distinguishing Plexytrade as one of the rare offshore brokers that cater to US-based traders.

- There are various VPS packages starting from $50 per month, but they become complimentary once specific deposit thresholds are reached.

- Plexytrade offers among the highest leverage we’ve seen, up to 1:2000, catering to advanced traders willing to forego regulatory protections.

Cons

- There are no social or copy trading features for inexperienced traders to replicate the trades of more experienced investors, trailing category leaders like eToro.

- There are no research and educational materials, falling short of alternatives like IG, while access to the economic calendar is restricted to clients with balances of $500.

- Deposits and withdrawals are exclusively facilitated through cryptocurrencies, as Plexytrade does not support bank cards, bank wire transfers, or e-wallets.

RaceOption

"RaceOption will appeal to investors looking for a feature-rich binary options trading experience with regular contests, account-based perks, and copy trading. The catch is its unregulated status, with little to zero investor protections available based on our investigations."

William Berg, Reviewer

RaceOption Quick Facts

| Bonus Offer | 20% - 200% Deposit Bonus |

|---|---|

| Fractional Shares | No |

| Demo Account | Yes |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Automation | No |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Stock Exchanges

RaceOption offers trading on 2 stock exchanges:

- DAX GER 40 Index

- FTSE UK Index

Pros

- Payouts on popular underlying assets like EUR/USD can reach 95%, beating out most alternatives based on our evaluations, and increasing potential returns, while the first 3 trades are risk-free in Silver and Gold accounts.

- RaceOption is in the less than 1% of brokers that offers video chat, available 24/7 in multiple languages, although the knowledge of agents about trading and regulatory issues needs improvement from our direct experience.

- RaceOption makes account funding a breeze with fee-free and near-instant deposits via bank cards and cryptos, plus guaranteed withdrawals processing within 1 hour.

Cons

- RaceOption is one of the only brokers not to offer a demo account, which when considered alongside the absence of education, makes this broker a poor choice for beginners.

- RaceOption is an unregulated, high-risk broker that doesn’t provide investor compensation or legal recourse options should you run into trading or withdrawal issues.

- While still affordable for many retail investors, the $250 minimum deposit raises the entry barrier, especially compared to Deriv and World Forex who are designed for budget traders.

LonghornFX

"LonghornFX is geared towards advanced traders looking for ECN pricing with high leverage up to 1:500. Hedgers and scalpers are well catered for, trading without restrictions on the MetaTrader 4 desktop, web and mobile platform."

William Berg, Reviewer

LonghornFX Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP |

Stock Exchanges

LonghornFX offers trading on 8 stock exchanges:

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- FTSE UK Index

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

Pros

- LonghornFX stands out by offering an unlimited demo account and virtual bankroll, allowing aspiring day traders to test and refine strategies before risking real funds.

- Traders willing to forego certain regulatory protections can access high leverage up to 1:500, amplifying both profits and losses on forex, stocks, indices and cryptos.

- LonghornFX supports traders with 24/7 assistance that was fast and helpful during testing, plus an extensive Academy featuring 1,650+ market analysis articles, 10 educational pieces, and 4 video guides.

Cons

- LonghornFX hasn't earned the reputation and regulatory credentials of DayTrading.com’s most trusted trading platforms, increasing the risk to your funds in the event of disputes or broker insolvency.

- Despite reasonable daily market analysis, LonghornFX still lacks the webinars, live trading sessions and comprehensive research provided by best-in-class brokers, which could help inform trading decisions.

- The less than 200 instruments seriously limits potential trading opportunities, with an especially weak selection of stocks that falls way behind the 12,000+ shares at IG.

Amega

"Amega is built for active traders with dynamic leverage up to 1:1000, fast execution speeds of 100 ms, the advanced MetaTrader 5 platform, and zero restrictions on trading strategies."

Tobias Robinson, Reviewer

Amega Quick Facts

| Bonus Offer | $20 for all verified Accounts, Lucky Deposit draws and Unlimited Cashback |

|---|---|

| Fractional Shares | No |

| Demo Account | No |

| Platforms | MT5 |

| Minimum Deposit | $20 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

Amega offers trading on 4 stock exchanges:

- Australian Securities Exchange (ASX)

- DAX GER 40 Index

- FTSE UK Index

- S&P 500

Pros

- Amega supports a growing selection of payment options, including cryptos and international banking solutions with an accessible $20 minimum deposit.

- The One account keeps things simple for aspiring traders, featuring the full range of forex, stocks, indices and commodities with no hidden fees or swap fees, and $1 cashback per lot.

- The MetaTrader 5 platform is excellent for day trading with low latency, sophisticated order types, and up to 128 indicators and 21 timeframes to aid precise analysis.

Cons

- As brokers increasingly invest in their own trading software and add third-party solutions like cTrader to meet various trader preferences, Amega trails behind with just MT5.

- Despite offering negative balance protection, Amega still lacks authorization from a trusted regulator, making it a high-risk option with no access to investor protection.

- Although the library of educational guides is growing, it falls far behind the likes of eToro which offers quizzes, videos and a social trading network for a complete learning journey.

Our Methodology

To find the top unlicensed stock brokers, we took our database of 224 online trading platforms, identifying all those that offer stock trading and that are not regulated by a financial body.

Then we ranked the remaining stock brokerages by their overall rating, assigned by our experts after weighing hard data with direct observations during hands-on tests.

Choosing A Non-Regulated Stock Trading Platform

Finding the right brokerage will depend on your individual trading needs. However, drawing on our own experience examining unlicensed stock brokers, there are several things to consider:

Trust

Find a stock trading platform you can trust.

Unregulated stock brokers will not provide the same level of protection as firms licensed by authorities recognized by DayTrading.com’s Regulation and Trust Rating, particularly ‘green tier’ regulators.

However, there are still clues that a broker is legitimate: A clean record with no lawsuits, many years of offering equities, and positive reviews from other stock traders and industry experts.

What regulatory protections could I lose with an unregulated stock broker? You may lose investor protection in the event your broker goes under (eg $500k in US) and dispute resolution services to address issues (eg Financial Ombudsman in UK). Also, you might not get negative balance protection (eg required in Europe) to stop you losing more than your deposit, which is key for day traders using leveraged stock CFDs.

- NordFX is among the most established unlicensed stock platforms we’ve tested, with a long history since 2008 and operations in multiple regions including Latin America, Europe and Asia, catering to global traders.

Stock Markets

Choose a brokerage with access to the stocks and indices you want to trade.

Unlicensed brokers sometimes provide access to niche stock markets, but in our experience, they usually offer fewer equities.

For example, regulated XM offers over 1,300 stocks, covering European, US and Latin American markets, whilst many unlicensed firms like OspreyFX offer fewer than 100 shares covering just one or two regions.

What stock markets could I lose access to with an unregulated broker? You may not get stock markets in further afield regions such as South America or Asia Pacific. Our investigations also show you likely won’t get opportunities through fractional stocks, share baskets, or extended hours trading.

- EagleFX offers 70+ equities, which surpasses most unlicensed brokers. You can trade shares on US and European stock exchanges, which should be sufficient for beginners but restricting for experienced investors.

Tools

Pick a provider with a platform or stock trading app you enjoy using, and that has the tools you need.

Our investigations show unlicensed stock brokers typically offer fewer platform options than their regulated peers, especially when it comes to in-house terminals.

Having said that, MetaTrader 4 (MT4) is still widely available which sports a highly customizable interface and enough charting power to meet the needs of most short-term stock traders.

What stock trading tools could I lose with an unregulated broker? You may not get a choice of desktop, web and mobile platforms to suit your trading needs, or access to supplementary tools like stock screeners, market analysis, economic calendars, stock recommendations, and company metrics like EBITDA and P/E ratio.

- Plexytrade is one of the few unregulated stock trading firms to offer both MT4 and MT5, catering to day traders at every level. Both platforms have dozens of indicators and drawing tools, and integrated research features from one flexible workspace.

Trading Conditions

Select a platform with transparent, competitive stock trading conditions.

Be wary of unauthorized stock trading providers advertising commission-free stock trading (a trend in recent years), but then charging higher costs elsewhere, for instance access to stock screeners, market data, and analyst stock picks.

Leverage is also a key consideration. Stock traders often turn to unregulated platforms to access higher leverage (sometimes 1:20+) than is available in tightly controlled regions.

This means a $10 outlay on Amazon shares will multiply your results 20x, increasing the potential for large profits but also huge losses. We don’t recommend beginners trade stocks with high leverage.

What financial protections could I lose with an unregulated broker? You may lose responsible leverage limits (eg 1:5 on stocks in the EU), upfront information about stock spreads and commissions (average spreads are a more reliable cost indicator than minimum spreads), and order execution guarantees (fast execution with minimal slippage is important for active stock traders).

- Amega is a great option for those looking for transparent pricing, with zero commissions on stocks, low spreads from 0.08 pips on popular share CFDs like Apple, and no deposit or withdrawal fees.

Customer Support

Select a company with customer support you can rely on. This can be key for active stock traders who need queries answered urgently.

However, don’t expect the same level of assistance at non-licensed stock trading providers. We’ve spent countless frustrating hours getting unhelpful responses to our stock trading queries through automated chatbots and live agents who can barely write in English and have little to zero understanding of their company’s own stock trading products.

What customer support features could I lose with an unregulated broker? You may not get access to multilingual customer support or localized assistance 24/7. You may also experience slow response times and sometimes no answer at all. Dedicated account managers are also rare at unregulated stock brokers.

- LonghornFX refreshingly performs better than the vast majority of unlicensed stock trading firms we’ve examined, with around-the-clock assistance via email and live chat, and response times of less than one minute during our latest round of testing with enquiries into its stock trading conditions.

Bottom Line

Choosing an unregulated broker is an enticing proposition for many aspiring stock traders looking for huge leverage, trading bonuses, and account opening that can take less than 5 minutes.

To find the right broker for you, see DayTrading.com’s choice of the best unregulated stock trading platforms.

Unauthorized stock brokers are extremely high risk. Barely any of the unlicensed stock trading platforms we’ve used provide investor protection and they are often cagey when it comes to trading fees and order execution. You could lose your investment.

FAQ

Am I Safe If I Trade Stocks Through An Unregulated Broker?

No. Trading stocks through an unlicensed broker will never be safe.

Unauthorized brokerages simply aren’t subject to the same level of scrutiny as regulated firms. Your funds and personal data may not be secure and the overall quality of the stock trading environment is usually far below the level we expect from authorized brokers.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com