Best Brokers For Penny Stocks

Trading penny stocks can feel like a treasure hunt, low-cost shares with the potential for big gains. But here’s the catch: finding the right broker is just as important as picking the right stocks.

Whether you’re chasing explosive growth opportunities or looking to test the waters with minimal capital, I know from first-hand experience that having a reliable trading platform can make all the difference.

5 Best Trading Platforms For Penny Stocks In 2025

From our tests, these 5 regulated brokers combine low fees, robust tools and great service for a top experience:

- Firstrade: Best for traders focused on OTC penny stocks and low-cost trading.

- Interactive Brokers: Best for advanced traders seeking global access and top-tier tools.

- IG: Best for beginners and those seeking an intuitive platform for trading penny stocks.

- Saxo Bank: Best for professionals valuing premium features and extensive research.

- Admiral Markets: Best for CFD traders and those leveraging MetaTrader platforms.

Top Penny Stock Brokers Comparison

The comparison table I’ve created for you below highlights the “best” broker depending on your priorities:

| Firstrade | Interactive Brokers | IG | Saxo | Admiral Markets | |

|---|---|---|---|---|---|

| Range of Penny Stocks | Extensive OTC stock coverage, great for US traders | Limited OTC options, strong on exchange-listed penny stocks | Focuses on exchange-listed penny stocks with minimal OTC | Substantial international range, but fewer OTC options | Only penny stock CFDs |

| Trading Fees | Commission-free for penny stocks | Low, tiered commissions; no hidden fees | Competitive fees, higher for infrequent traders | Premium pricing; high minimum deposit | Low spreads for CFDs, but extra costs apply |

| Research Tools | Basic tools, adequate for beginners | Advanced tools (Trader Workstation, IBKR scanners) | Solid research, fewer penny stock-specific tools | Top-tier insights for global markets | MetaTrader 4/5, which are less tailored to stocks |

| Execution Quality | Decent, especially for US market orders | Exceptional execution with fast order processing | Good execution for exchange-listed stocks | Excellent for large, high-value trades | Reliable for CFD trading, but less suited for stocks |

| Platform Usability | Beginner-friendly, simple interface | Complex for beginners, highly customizable for pros | Intuitive for all traders | Advanced platforms (SaxoTraderGO/PRO), but intimidating for beginners | Suitable for seasoned CFD traders, but less stock-oriented |

Category Winners

- Range of Penny Stocks: Firstrade offers the widest access to OTC penny stocks, especially in the US.

- Trading Fees: Firstrade leads with zero commissions, while IBKR offers great fees for high-volume traders.

- Research Tools: Interactive Brokers provides top-tier analysis, followed by Saxo for its global research.

- Execution Quality: Interactive Brokers excels in execution speed and quality, ideal for day traders.

- Platform Usability: IG and Firstrade are terrific for beginners, while Admirals and Saxo cater to pros.

I discovered that penny stocks can be an exciting way to dip into the stock market, but they come with huge risks. Proceed cautiously to making informed decisions.Below is a deep dive into each platform, highlighting why they made our list of the best brokers for trading penny stocks, along with their pros and cons.

1. Firstrade

Why We Chose It

Firstrade impressed in almost every category.

It’s one of the few brokers actively promoting the opportunity to trade penny stocks and it’s elite for US traders wanting commission-free trading on OTC penny stocks.

The user-friendly platform is a breath of fresh air amongst so many clunky solutions, while the zero-cost trades make it particularly attractive to budget-conscious traders.

So although it has limited research tools and a US-centric focus, its affordability and OTC coverage make it our definite first choice for penny stock traders.

Pros

- Zero commissions: You can trade penny stocks, ETFs, and options without paying a dime in commissions.

- Extensive penny stock options: There’s a superb array of OTC stocks that are simply unavailable on other platforms we tested.

- Easy-to-use platform: I really enjoy the straightforward interface with fantastic tools suitable for beginners.

- No minimum deposit: This makes it very accessible to traders with limited capital.

- Educational materials: It provides great resources for learning about stock trading.

Cons

- US-focused: There is limited availability for international traders.

- No advanced trading tools: The sophisticated analysis tools found on platforms like Interactive Brokers are lacking.

- Basic mobile app: The app offers functionality but it’s nowhere near as advanced as firms like IG that we tested.

- Limited support for other assets: It focuses primarily on US stocks, ETFs, and options, limiting diversification opportunities.

2. Interactive Brokers

Why We Chose It

Coming in a close second, Interactive Brokers (IBKR) stands out as one of the most comprehensive platforms I’ve seen for penny stock traders.

It offers access to a wide array of markets and robust analysis tools. Its low-cost structure and advanced trading capabilities make it perfect for both beginner and experienced traders.

So although there is limited OTC coverage and a steep learning curve for beginners, it remains ideal for experienced traders looking for exchange-listed penny stocks.

Pros

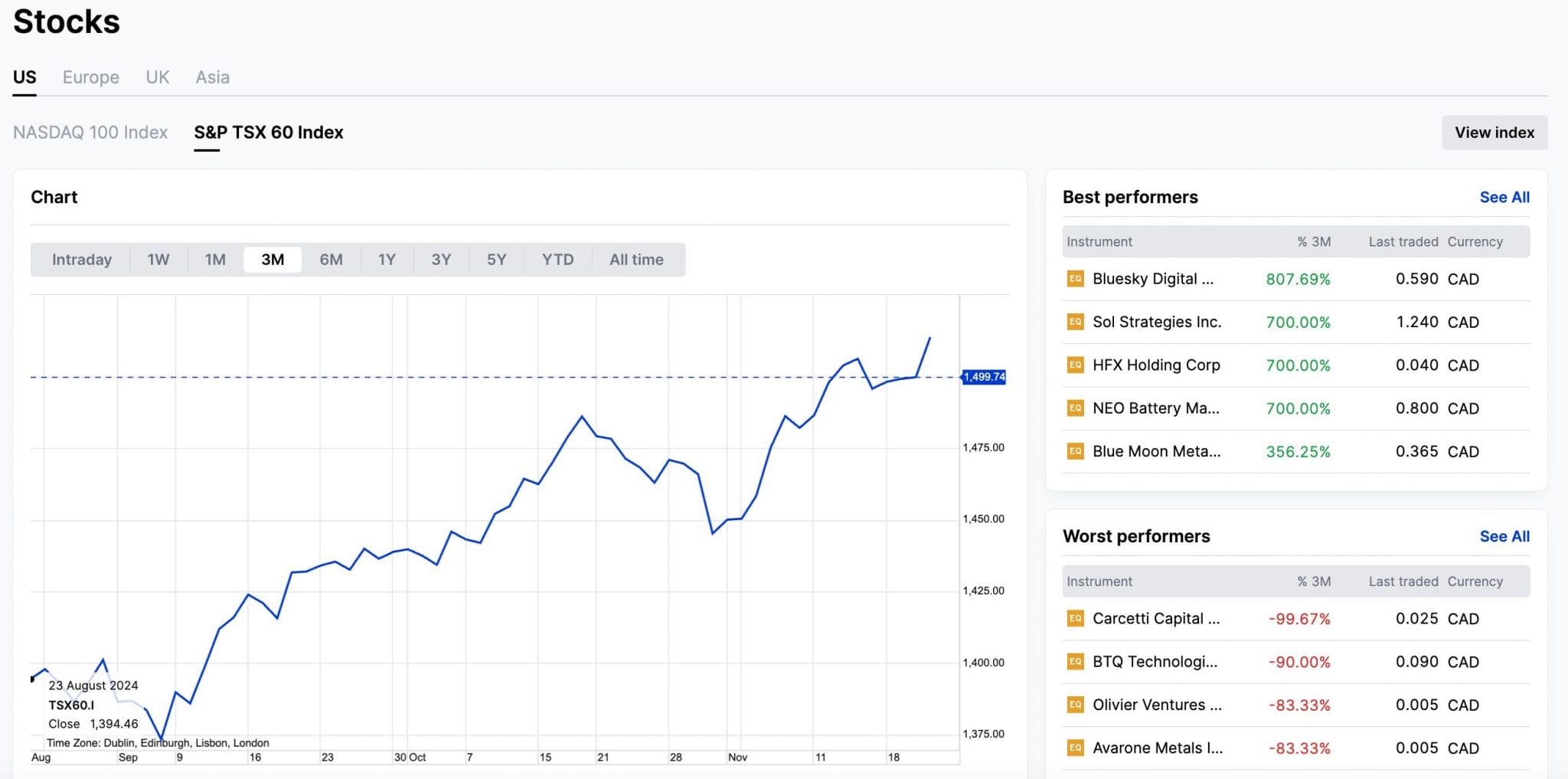

- Access to global markets: You can trade penny stocks listed on major exchanges worldwide and some OTC markets.

- Low commissions: It offers really competitive pricing for high-volume traders, including tiered and fixed-rate structures.

- Advanced tools: Features like Trader Workstation (TWS) provide cutting-edge tools for analysis and research.

- Regulated and trusted: IBKR is licensed in multiple jurisdictions, ensuring safety and transparency.

- Fractional shares: It enables investment in high-priced shares at fractional levels, increasing accessibility.

Cons

- Complex interface: There’s no getting away from the fact that the advanced platform can be overwhelming for beginners.

- Inactivity fees: IBKR previously charged inactivity fees, though it’s great to see these have been relaxed in recent years.

- Limited OTC penny stock options: While it supports some OTC stocks, it’s not as comprehensive as other brokers specializing in penny stocks.

- High minimum deposit (for some regions): Certain accounts may require minimums of €2,000 compared to frontrunner Firstrade with no minimum anywhere.

3. IG

Why We Chose It

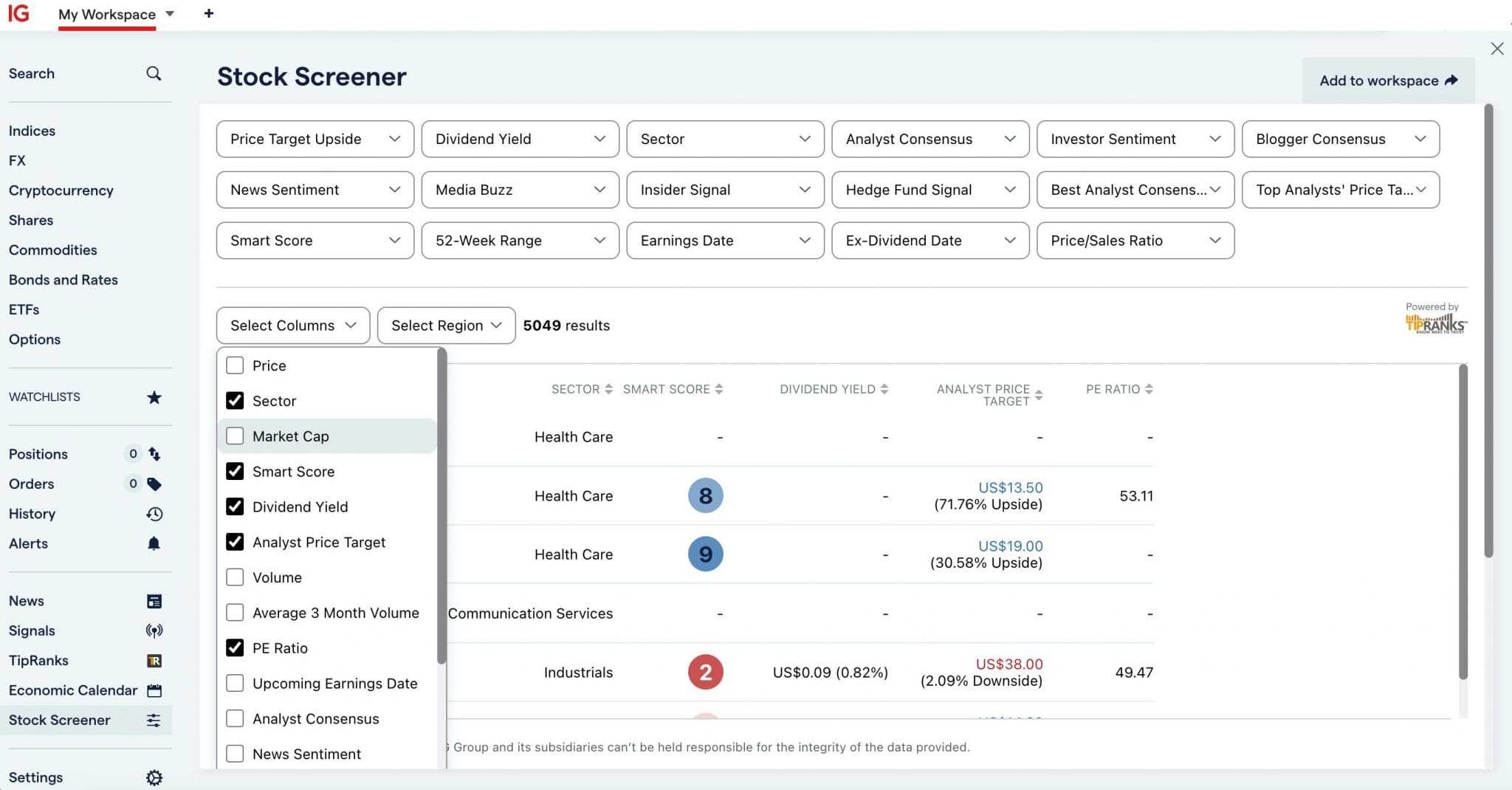

IG secured a podium finish for its intuitive platform which I thoroughly enjoy using, its solid execution, and terrific global market access.

It’s demonstrated that it can deliver a consistently excellent trading experience over the years, earning our ‘safest broker’ title in 2025 and runner-up in our ‘Best Trading App’ award.

Yes it has a limited OTC penny stock range and higher fees for infrequent traders, but it’s so brilliant for traders who value usability and simplicity that it still finished third in our overall rankings.

Pros

- User-friendly platform: Intuitive interface with mobile and desktop apps that cater to beginners and pros alike.

- Educational resources: Offers the best trading guides, webinars, and articles for learning that I’ve come across.

- Global reach: Access to international penny stocks on major exchanges for diverse trading opportunities.

- Competitive pricing: Reasonable fees for share dealing, with no hidden charges.

- Regulated broker: Operates under strict regulations in multiple regions, earning a near-perfect 4.9/5 in DayTrading.com’s Regulation & Trust Rating.

Cons

- Limited OTC stock access: IG focuses more on exchange-listed stocks, leaving OTC penny stock traders with fewer options.

- CFD-focused: A significant portion of its services revolves around CFDs, which might not appeal to all penny stock traders.

- Higher fees for infrequent traders: Although not a problem for most day traders, non-active traders may find costs add up.

4. Saxo

Why We Chose It

Saxo is a premium platform with a global reach and some of the best research tools I’ve experienced.

It offers access to a vast selection of stocks, including penny stocks, on international exchanges. Its advanced tools and comprehensive market research are ideal for professional traders.

The high fees, steep minimum deposit, and limited OTC penny stock focus are downsides, but for professionals who prioritize advanced tools over costs it has to get a mention.

Pros

- Global market access: Trade penny stocks on exchanges worldwide for access to diverse sectors and markets.

- Sophisticated tools: The SaxoTraderGO and SaxoTraderPRO platforms are excellent, offering professional-grade tools.

- Research and insights: Saxo provides top-notch market analysis and reports for informed trading decisions on penny stocks.

- Regulated and secure: It operates under stringent regulations, including DFSA, FCA, and FINMA, offering peace of mind.

- Customizable trading options: You can tailor your experience with account types and investment strategies.

Cons

- High fees: Premium features come at a cost, including higher fees for inactive accounts or small trades.

- Complex platform: I think the advanced tools could prove intimidating for beginners.

- High minimum deposit: Requires a significant initial investment to open some accounts, even an eye-watering $50,000.

- Not penny stock-focused: While the platform offers access to penny stocks, it is not its core focus.

5. Admiral Markets

Why We Chose It

Admiral Markets continues to be a solid choice for day traders who want access to penny stocks through CFDs.

It excels in its transparency, competitive pricing, and trading tools, making it an excellent pick for those focused on short-term trading strategies.

So if you’re familiar with MT4 or MT5 and want low-cost CFD trading, it’s a serious contender.

Pros

- Advanced tools: You get MetaTrader 4 and MetaTrader 5 compatibility for first-rate technical analysis.

- Low spreads: Admirals offers competitive spreads based on tests, even for penny stock CFDs.

- Educational content: There are comprehensive training materials for all trading levels.

- Regulated broker: It’s fully licensed in Europe, Australia, and other regions, providing security to traders.

- Customizable accounts: Various account types are available tailored to different trading needs.

Cons

- CFD-focused: It lacks direct access to penny stocks on exchanges, as most are offered via risky CFDs.

- Higher leverage risks: While leverage is a pro for some, it can amplify losses, especially with volatile penny stocks.

- Limited stock range: Admirals is not ideal for traders seeking a broad range of OTC penny stocks, Firstrade is far superior.

Bottom Line

Trading penny stocks can be an exciting and potentially rewarding venture, but it’s not without its challenges.

Over the years, I’ve discovered that the right broker can make all the difference by offering the tools, access, and support you need to navigate this high-risk, high-reward market effectively.

- For beginners: If you’re just starting out, brokers like Firstrade or IG are excellent choices. They combine user-friendly platforms with solid access to penny stocks, making them ideal for learning the ropes without being overwhelmed.

- For experienced traders: If, like me, you prioritize advanced tools, global market access, and execution quality, Interactive Brokers and Saxo offer the professional-grade platforms and resources you need.

- For CFD enthusiasts: If you prefer trading penny stocks through CFDs, Admiral Markets is a standout choice with its competitive spreads and robust MetaTrader tools.

Ultimately, the best broker for you depends on your trading goals, experience level, and the types of penny stocks you want to trade. Remember to:

- Research thoroughly before making investment decisions.

- Focus on risk management, as penny stocks are highly volatile.

- Avoid the hype and stick to a strategy grounded in data and analysis.

The world of penny stocks can be exciting but full of pitfalls. I’d advise you to remain sceptical, rely on hard data, and avoid emotional decisions.Being informed and cautious will help you navigate this high-risk market securely.

FAQ

What Are Penny Stocks?

Penny stocks are low-priced shares of small companies, typically trading for less than $5 in the USA and £1 per share in the UK, though the exact definition can vary by country.

They usually represent modest firms or startups that are not yet well-established. This makes them a risky bet, as these companies may lack proven track records or financial stability.

These stocks are often associated with high volatility, risk, and potential for significant gains. Their low price doesn’t always mean they’re undervalued; there’s often a reason they’re trading so low.

Where Are Penny Stocks Traded?

Penny stocks are typically traded on over-the-counter markets like OTCQB instead of major exchanges like NASDAQ or the UK FTSE because they don’t meet the stringent requirements for listing on larger exchanges.

To trade penny stocks, you’ll need a broker that supports OTC trading or offers access to these low-priced stocks. Or brokers that allow you to buy and sell penny stocks as CFDs.

Due to their risks, many brokerages have specific margin and leverage rules for trading penny stocks.

How Do I Trade Penny Stocks?

Trading penny stocks works much like dealing in regular stocks: you buy shares in a company with the hope that their value will increase, allowing you to sell them for a profit.

However, because penny stocks usually represent small, underdeveloped companies, their behavior and trading dynamics are quite different from larger, established stocks.

Should I Trade Penny Stocks?

Trading penny stocks might be for you, if:

- You want low entry into the stock market with minimal investment.

- You want to aim for quick profits from price surges.

- You want to potentially get in early on the next big thing.

However, it’s essential to approach penny stocks cautiously, thoroughly research them, and understand the risks involved before investing.

Is It Safe To Trade Penny Stocks?

Choosing a well-regulated broker can help provide a secure trading environment, but fully safe? No.

They’re highly volatile, with prices fluctuating wildly even in a single trading session. In fact, I’ve seen penny stocks explode in price or lose nearly all their value within hours due to small market movements or sudden news.

These stocks are not heavily traded, meaning fewer buyers and sellers are in the market. This makes it harder to sell your shares quickly without affecting the stock price.

Because they’re thinly traded and lightly regulated, penny stocks are also vulnerable to manipulation schemes, like pump-and-dump, where prices are artificially inflated and sold off, leaving other investors with losses.

Many penny stock companies don’t have to follow strict reporting rules. This lack of transparency makes assessing their actual value or growth potential harder.

Despite the risks, penny stocks attract traders like us because of their potential for explosive growth. If you invest in the “right” penny stock and the company grows significantly, your investment could skyrocket. Still, this is the exception, not the rule.

How Can I Succeed In Trading Penny Stocks?

To give yourself the best shot, start by following these steps:

- Do your homework: Investigate the company’s financials, leadership, and market potential.

- Set limits: Decide in advance how much you’re willing to invest (and potentially lose).

- Avoid the hype: Don’t get caught up in rumours or too-good-to-be-true promises.

- Use the right broker: Choose a broker that offers low fees, solid research tools, and access to OTC markets. Start by looking at our choice of the best brokers for penny stocks above.

How Do I Find The Best Penny Stocks To Buy?

Finding the “best” penny stocks requires thorough research and a bit of strategic thinking:

- Research promising sectors: Look for industries with growth potential (eg renewable energy, tech startups).

- Check news and announcements: Look for press releases, product launches, or acquisitions that could boost stock prices.

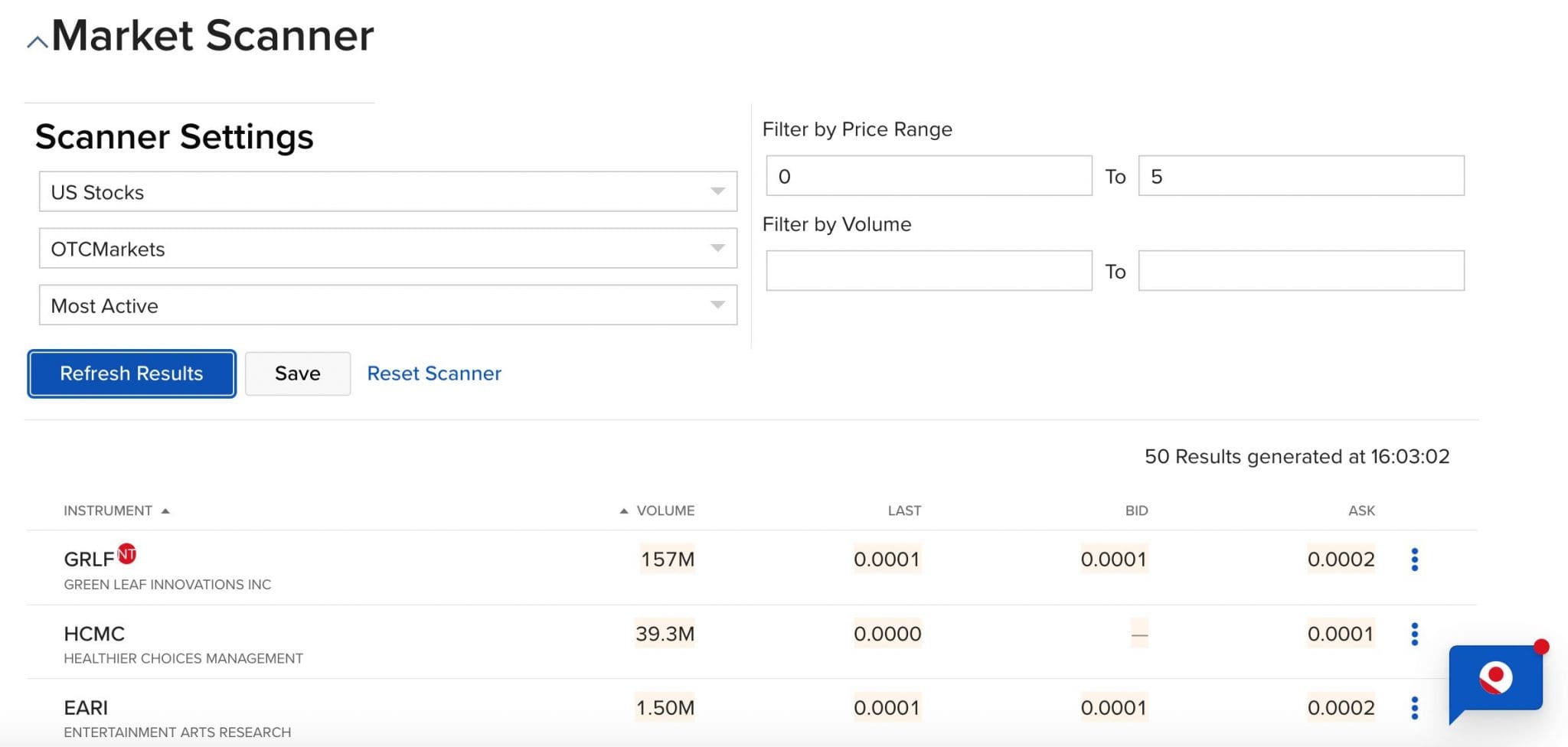

- Use stock screeners: Many platforms, such as Finviz, Yahoo Finance, or your broker’s tools, allow you to filter stocks by price, volume, and performance.

- Focus on fundamentals: Look for companies with steady financials, manageable debt, and a clear growth plan.

- Seek community insights: Engage with forums like Reddit or the DayTrading.com Community, but stay cautious about hype.

Where Can I Get A List Of Penny Stocks?

- Stock market platforms: Some brokers (eg Interactive Brokers) have tools that list penny stocks trading on OTC markets or major exchanges.

- OTC Markets website: The official OTC Markets website (otcmarkets.com) provides a comprehensive list of OTC penny stocks.

- Financial websites: Platforms like Yahoo Finance, MarketWatch, and Finviz often have dedicated sections for low-priced stocks.

- Newsletters and analysts: Some services offer curated lists of penny stocks, but be wary of paid promotions.

Article Sources

- Firstrade - Stock Trading

- Interactive Brokers - Stock Trading

- IG - Stock Trading

- Saxo - Stock Trading

- Admiral Markets - Share CFDs

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com