Sticpay Brokers 2025

Sticpay is a global money transfer service with a focus on Asian markets. The e-wallet provider partners with many merchants, along with top forex brokers to provide efficient and secure international payments.

Our review explores the benefits of trading with Sticpay, including its key features, such as the prepaid ATM bank card, account set-up and login, plus deposit and cashback options. We also list the best brokers that accept Sticpay deposits in 2025.

Best Sticpay Brokers

These are the best 6 brokers with Sticpay, based on our analysis:

Here is a short overview of each broker's pros and cons

- RedMars - Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- easyMarkets - Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Compare The Best Sticpay Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| RedMars | €250 | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | MT5 | 1:30 (Retail), 1:500 (Pro) |

| Exness | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| Deriv | $5 | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | 1:1000 |

| Fusion Markets | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| easyMarkets | $25 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral | 1:2000 |

| Vantage | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | ProTrader, MT4, MT5, TradingView, DupliTrade | 1:500 |

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Regulator | CySEC, AFM |

| Platforms | MT5 |

| Minimum Deposit | €250 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR |

Pros

- The broker is one of a limited number of firms to offer an account specially designed for VIPs with premium support and invites to exclusive events

- RedMars offers one of the best platforms for day trading, MT5, hosting 21 timeframes, dozens of analytical tools, flexible templates and algo trading

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

Cons

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

- The no-frills trading environment offers little beyond the basics, with no Islamic account, PAMM account or copy trading.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- After integrating TradingView and adding MT5 web trader, Deriv now offers a first-class selection of charting tools across desktop, web and mobile devices.

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

Cons

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

- Apart from the MFSA in the EU, Deriv lacks top-tier regulatory credentials, reducing the level of safeguards like access to investor compensation.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

Cons

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- Fusion Market trails alternatives, notably eToro and IG, in the education department with limited guides and live video sessions to upskill new traders.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

easyMarkets

"easyMarkets provides fixed spreads starting at 0.7 pips, making it an excellent choice for beginners seeking predictable trading costs. After adding a Bitcoin-based account, it’s also a stand-out option for crypto-focused traders who want to deposit, trade, and withdraw in digital currencies."

Christian Harris, Reviewer

easyMarkets Quick Facts

| Bonus Offer | 50% Deposit Bonus Or Up To A $2000 Tradable Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, ASIC, FSCA, FSC, FSA |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral |

| Minimum Deposit | $25 |

| Minimum Trade | 0.01 lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, CZK, MXN, CNY |

Pros

- With 20+ years in the industry, multiple awards, and authorization from two ‘green tier’ regulators, easyMarkets continues to earn its reputation as a secure broker for active traders.

- easyMarkets takes risk management seriously, with negative balance protection plus guaranteed stop losses and its dealCancellation (enhanced in 2024 to include periods of 1, 3, or 6 hours) in the Web Trader.

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

Cons

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- It’s quick and easy to open a live account – taking less than 5 minutes

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

Cons

- Unfortunately, cryptos are only available for Australian clients

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

Note: Sticpay has no affiliation with STC Pay.

How Did We Choose The Best Sticpay Brokers?

To identify the top Sticpay brokers, we:

- Searched our database of 500 online brokers to find all those that accept Sticpay payments

- Confirmed that they support Sticpay deposits and withdrawals for day trading

- Ranked them by their rating, based on 100+ data points and our in-depth observations

What Is Sticpay?

Sticpay is a global e-wallet service used for peer-to-peer transfers, online purchases and trading activities. The company has a presence in over 200 countries, including Canada, Sweden, and France and supports payments in 30+ currencies including USD.

Sticpay is particularly popular with financial institutions in APAC countries, such as Malaysia, China, South Korea, the Philippines, and Indonesia. The company is also legitimately authorized to operate within the EEA under the regulation of the FCA.

Benefits Of Trading With Sticpay

Easy Registration

To sign up for an iwallet account, clients need to submit proof of identity and their residential address. The process is quick and easy with applications usually processed within one business day. The platform negates the need for a lengthy application, helping individuals to start trading quickly.

Multiple Deposit Options

Sticpay accepts deposits via credit/debit cards, bank wire transfers, cryptocurrencies, and UnionPay. These can be accessed via the ‘money in’ section of a client’s account. The payment gateway’s base currency is USD, however, this default can be changed, unlike Skrill or Neteller e-wallet solutions.

Mobile App

Sticpay offers a convenient and safe mobile app. The mobile interface is user-friendly and offers all of the platform’s key features.

The app can be downloaded to iOS and Android (APK) devices which means traders can view transactions while on the move. This is a useful feature for individuals who already trade the financial markets from their mobiles.

Availability

You can find the Sticpay logo on numerous global brands and trading brokerages. It is a safe forex payment gateway bridging trading platforms to individual users via an integrated API. The transaction system supports many forex brokers in 2025, including XM, Tickmill, FBS, and Axiory.

Multi-Currency

Sticpay caters to its global user base by offering multi-currency settlement for customers as well as instant international transfers. 30+ fiat currencies are supported as well as four cryptocurrencies. For reference, Neteller supports 22 and Skrill, 40.

Account Tiers

Whilst some e-wallet providers charge users to access more premium services such as increased transaction limits and prepaid card access, Sticpay adopts a single tier system. This means all users can enjoy equal access to functionalities.

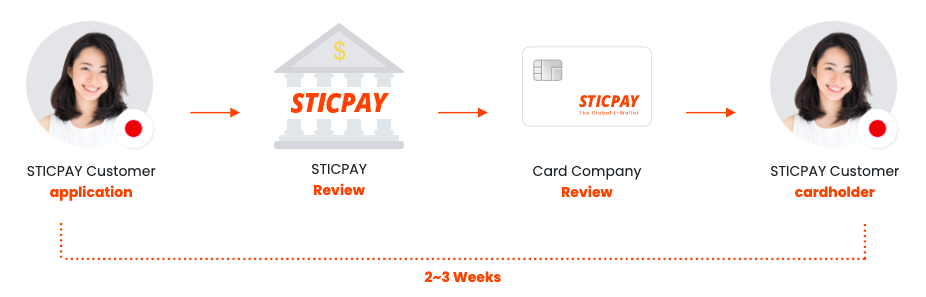

STIC CARD

A free-of-charge prepaid virtual card can be used globally. Clients can transfer funds from a Sticpay account, spend offline or withdraw from international ATMs. Visit the Stic Card section of the company’s website for more information including minimum fees and daily withdrawal limits.

Additional Features

The company is good at keeping its clients up to date with the latest news. Regular posts are published on the payment gateway’s website, along with posts via the @STICPAY Twitter account, where a comment utiliser is enabled.

Cons Of Trading With Sticpay

Fees

Traders may be charged for both deposits and withdrawals. Prices vary from broker to broker but take note, these charges can quickly cut into profits. The platform faces competition from cheaper alternatives. See below for further details on payment fees.

Excluded Countries

Some countries do not allow clients to use the Sticpay system. Traders from the USA, Côte d’Ivoire and Zimbabwe, for example, will not be able to register for a payment account and make deposits.

No Transfer Cancellations

Sticpay does not offer refunds or payment cancellation of any funds deposited into client accounts. All payments are final and irreversible.

Speed Reviews

Deposits and withdrawals are processed within 1 minute regardless of location. Note that your broker may have their own processing times which may cause a slight delay in funds reaching your trading account. In general, though, top forex brokers process deposits instantly and pay out profits within a few business days.

Security

Security features are robust with safe account login via password inscription. Traders that register should be reassured by the anti-fraud features and security verification measures, including segregating client funds with KYC checks on both merchants and individuals.

Sticpay also follows strict anti-money laundering policies, verifying client transactions with advanced technology solutions. The firm only acts as a payment solution to those merchants that comply with the regulatory laws of the countries in which they operate.

Note, funds and activities of clients in the EEA are covered under the Financial Ombudsman Service.

How To Deposit Using Sticpay

To make a deposit at your broker using Sticpay, you’ll first need to add money to your Sticpay account.

The minimum deposit is $100 or equivalent. Clients must access the ‘money in’ section of their account to select relevant deposit methods.

The process to deposit to your trading account is then fairly straightforward at most brokers. At EasyMarkets, for example:

- Log in to the ‘My EasyMarkets’ client area and navigate to the deposit section

- Select Sticpay from the list of available methods

- Enter the deposit amount and follow the instructions to complete to transaction

Sticpay also offers a domestic bank wire feature. This can help save the time and fees associated with using an intermediary bank partner. The service is established in 10 countries including the Philippines.

Charges

Fees vary by deposit and withdrawal method:

Deposits

- Credit and debit cards, including Visa and MasterCard – up to 3.85%

- International bank wire – 1%

- Local bank wire – Up to 4%

- UnionPay – 5%

Withdrawals

- International bank wire – up to 5%

- Local bank wire – varies by country

Internal transfer fees may also be charged by your FX broker. Sticpay does not apply inactivity fees vs ecoPayz’s $1.79 charge after 12 months. The firm does, however, charge a 1% transaction fee for member-to-member transfers. Member-to-merchant fees are charged at 2.5% + a $0.3 transaction fee.

Sticpay’s fee structure is not the most competitive. For example, Skrill users are charged just 1% for Visa and Mastercard payments, compared to 3.85% on Sticpay. With that said, the company does offer greater flexibility than other e-wallets via multi-currency accounts.

Rewards

Sticpay offers cashback services to clients using the platform to fund active trading accounts. Rewards are based on trading volume. Brokers affiliated with Sticpay’s cashback services include XM and JustForex. Check the cashback terms for your broker as they may vary.

Customer Care

To get in touch with the customer team at Sticpay visit Support on the website. The team generally responds quickly and can assist with a range of queries. Users can submit a ticket or alternatively, send an email to the relevant team:

- account@sticpay.com

- merchant@sticpay.com

- funds@sticpay.com

- affiliate@sticpay.com

Is Sticpay Good For Day Trading?

Sticpay offers a fast and secure payment solution operating across global merchants with simple account creation, 24-hour customer service support, a mobile app, and a pre-paid card option. On the downside, the platform does charge deposit and withdrawal fees which can erode profits.

It is worth noting that the platform’s fee structure is not the most competitive in the market but it does outstrip its competitors when it comes to flexibility and accessibility. Sticpay services are also limited in some countries so ensure your desired funding methods are available where you are based and check that your broker accepts the platform as a viable funding option.

FAQ

Is Sticpay Safe To Use In My Trading Account?

Sticpay implements advanced KYC and AML checks to enhance platform security. The company is legitimate, registered under Coopertoby Ltd, and, regulated by the Financial Conduct Authority in the UK. Sticpay is a trusted money transfer operator used by many global merchants including well-known trading brokers.

Can Traders Use Sticpay In India?

Yes, traders based in India can transfer funds locally and internationally. ISticpay accepts customers from most global locations, including the UK, Zambia, India, Nigeria, Argentina, Bahrain, Ecuador, Vietnam, Bangladesh, Kenya, Gabon, Guatemala, Nepal, Senegal, Tanzania, Costa Rica, South Africa, UAE, and many more. Note, some countries including USA do not permit the use of Sticpay.

Is Sticpay Available For Traders In South Africa?

Yes, Sticpay global e-wallet services are available to traders based in South Africa.

Which Brokers Offer Sticpay?

Several top-rated brokers support Sticpay deposits and withdrawals, though this can vary depending on your location. Notable firms include Deriv and Fusion Markets. You can refer to our list of top Sticpay brokers to find out if the payment method is available in your jurisdiction.