Is Spread Betting Tax Free?

Spread betting has become popular in recent years, enabling retail traders to potentially generate profits without owning the asset they are speculating on, such as gold or crude oil. But one question that many spread bettors ask is this: is spread betting tax free?

On the face of it, the answer is yes: many of the taxes that are levied on other forms of investment methods are not levied on spread bets. This is true for capital gains tax and stamp duty – and also, in most cases at least, for income tax.

But unsurprisingly, the situation is a little more complex than it seems at first glance. This guide will explore the topic in detail and look at whether spread betting can make investors non-taxable profits.

Note, this article does not constitute professional tax advice. Speak to an accountant for specific guidance.

Spread Betting Brokers

Here is a summary of why we recommend these brokers in April 2025:

- Spreadex - Spreadex stands out as one of the few brokers that specializes in spread betting, offering 10,000+ instruments (rivalling top contenders like IG with 17,000+). There’s also valuable spread betting education covering strategies, tips and analysis. With user-friendly TradingView charts and advanced order types, both beginners and experienced spread betters are well catered to.

- AvaTrade - AvaTrade is a first-rate spread betting platform with opportunities on 1000+ stocks, indices, commodities and currencies, sporting leverage up to 1:400. The MetaTrader platforms cater to seasoned traders with advanced charting tools and alerts, while the extensive Academy is home to terrific education with 18 courses, 150 lessons, 50 quizzes and a video tutorial explaining how to spread bet at AvaTrade.

- Pepperstone - Pepperstone offers a competitive range of 1200+ spread betting instruments covering forex, indices, commodities, shares and ETFs. Spreads are some of the most competitive that we’ve seen during tests, starting from 0.6 pips for EUR/USD. Spread betting is also available on the MT4, MT5, cTrader and TradingView terminals, offering more platform flexibility than most alternatives.

- Trade Nation - Trade Nation offers hundreds of instruments via spread bets, though this notably trails top alternatives like CMC Markets (12,000+) and Spreadex (10,000+). We found the TN Trader platform to be a standout option for beginners during tests, thanks to its straightforward fixed-spread model. That said, offering just one platform for spread betting makes the broker more restrictive than most competitors.

- Vantage - Vantage continues to offer commission-free spread betting on forex, indices and precious metals. With 15 indices, including less commonly offered instruments like the VIX and Bovespa, Vantage is particularly suited to experienced equities traders. It’s also one of the few brokers that offers an unlimited demo account, allowing you to practice your strategies continuously.

- FxPro - Spread betters can access six asset classes through the FxPro's proprietary spread betting platform, Edge. Whilst it’s a shame that Edge is the only available terminal for spread betting, traders can access 50 technical indicators (more than MT4), plus an economic calendar and price alerts, providing a decent all-in-one spread betting environment. Customer support also performed well during tests, connecting us to an agent instantly and responding to our spread betting queries sufficiently.

Spreadex

"Spreadex will appeal to UK day traders who are interested in both spread betting on financial markets and placing traditional bets on sports events. Fees are low on short trades and profits are tax-free on spread bets. There's also a powerful proprietary charting platform, plus £0 minimum deposit required to get started. "

Tobias Robinson, Reviewer

Spreadex Quick Facts

| Bonus Offer | £300 cashback |

|---|---|

| Demo Account | No |

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting |

| Regulator | FCA |

| Platforms | Spreadex Platform, TradingView |

| Minimum Deposit | £0 |

| Minimum Trade | £0.01 |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, CHF |

Pros

- There are some attractive new account promotions, including double the odds and matched betting offers

- Spreadex gives UK traders the opportunity to make tax-free profits through spread betting

- There's an excellent range of instruments and trading vehicles for short-term traders

Cons

- The lack of a demo account will frustrate prospective clients who want to test Spreadex's services

- The proprietary terminal lacks comprehensive charting features of platforms like MT4 and MT5

- There's no support for expert advisors or other trading bots

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Bonus Offer | 200 Sign-Up Reward Points |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- The trading firm offers tight spreads and a transparent pricing schedule

Cons

- Fewer legal protections with offshore entity

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- There are no short-term strategy restrictions with hedging and scalping permitted

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

Cons

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

Headlines

- Spread betting is considered tax free in the UK and Ireland

- Profits from spread bets are exempt from capital gains tax and stamp duty tax

- Spread betting is viewed as a speculative activity so is treated as gambling rather investing

- Rules on taxation can change and individual circumstances may influence a spread bettor’s tax liability

Spread Betting Tax Implications

Firstly, is worth understanding what spread betting is…

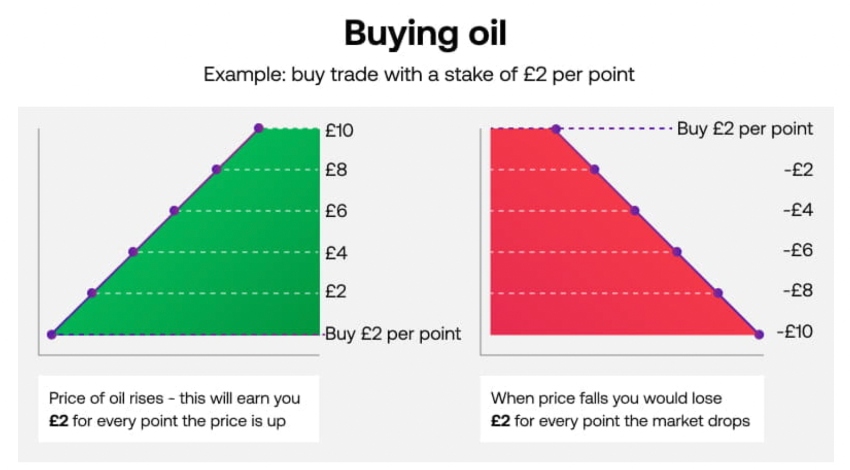

Spread betting is a leveraged financial product and derivative. It is an intangible bet – ownership of assets do not change hands. Spread bets come with high risk but potentially high rewards.

Yet when considering the tax implications, it is important to separate spread betting from similar forms of investing. It is often confused, for example, with trading CFDs (Contracts for Difference). But profits from CFDs are usually taxed under capital gains tax rules, whereas spread betting profits are not. The way that profits are calculated on each type of financial product is slightly different.

Spread Betting Taxes Breakdown

There are a variety of taxes to think about before spread betting. Most traders will probably jump to the conclusion that the only one they need to think about is income tax – but the reality is that retail trading is complex, and it can activate many aspects of the taxable system that the average investor may not have considered.

Capital Gains Tax

The most obvious potential charge is perhaps capital gains tax, known as ‘CGT’. But qualifying returns made from financial betting are not liable for this tax, which given that it can, in some cases, have a 20% rate, is a good thing.

So is spread betting tax free when it comes to capital gains? Yes.

Stamp Duty Tax

Those who have become land owners and bought and sold properties will be familiar with stamp duty tax. Stamp duty generally applies to more assets than just property, and some aspects of stock trading fall into its sphere of liability, especially under stamp duty reserve tax (SDRT). Luckily though, spread betting profits do not.

This is because spread betting products are actually derivatives that track the asset in question, and do not confer any ownership of the underlying asset. So while it might appear that you’re trading Meta stock, for example, what you’re actually doing is investing in a financial product that tracks the stock’s value and delivers profit or loss based on how the share price performs. From a tax perspective, therefore, spread betting is arguably better as it does not give rise to a tax liability.

So is spread betting tax free when it comes to stamp duty? Yes.

Income Tax

It is also important to consider any income tax implications when spread betting. This is where the exact definition of ‘betting’ comes into play.

Spread betting is, for income tax purposes, treated as gambling – which means that profits do not give rise to a liability.

The Money Advice Service does, however, caution that this might change in the event that a person relies on their income from spread betting to earn a living. In that case, it could be re-categorized as ‘trading’, which could mean there is income tax to be paid.

For that reason, it is worth consulting a tax professional if you execute a higher number of spread bets versus lower volume investors as this might push you into the ‘trading’ category, especially if your profits are high.

Your tax percentage will also depend on the income zone you are in. A high earner will need to pay more depending on the total value of their received (liquid) income.

So is spread betting tax free when it comes to income tax? Yes – unless spread betting profits are your primary source of income.

Offsetting Spread Betting Losses

So far, this article has investigated only whether or not the profits earned by spread bettors are taxable.

But what about losses? In some circumstances, losses made through trading can be treated as tax-deductible – which means that they can be offset (hedged) against other taxable profits made in other ways, bringing down the overall tax liability of the individual.

It is not, however, the case that spread betting losses can be used in this way. So while tax efficiency is the order of the day when it comes to profitable returns, a trader can’t bank on their spread betting losses being used to reduce the overall amount of tax they owe.

A useful tip for offsetting taxes on other trading products is to keep a journal. This will help collate key figures and information that can be used when filling in your tax return at the end of the year.

Individual – And Changing – Circumstances

Currently, the situation for most traders is that spread betting is quite tax-efficient. But there are two important notes of caution.

The first is that, as with almost all taxes, the individual’s circumstances are relevant alongside the wider tax rules. As the point about income tax above demonstrates, whether a person is using spread betting to generate a full-time salary versus part-time speculation varies.

Also, a quick 10 percent monthly yield can easily become vatable if the valuation of your earnings bypasses the income limits set in your region. So tax-free spread betting might not be a long-term solution. As a result, it is important for anyone who is spread betting to seek independent advice from a qualified tax professional before they proceed with gambling on an online platform or exchange.

Secondly, traders should keep an eye on any changes to the government’s approach to spread betting tax treatment. Just because capital gains tax, for example, is not levied on profits right now, does not mean that it never will be. This could change in 90 days, 6 months, per year, or even in 5 years’ time.

Finally, it is the responsibility of the taxpayer to check whether or not rules apply to them, so it may be worth periodically doing some research and keeping an eye on annual tax and budget announcements.

Is Spread Betting Tax Free?

Spread betting is a popular choice for many traders, not least because profits are usually treated as gambling returns and therefore do not incur a tax liability. With that said, the circumstances of each individual make it prudent to check with a professional tax advisor early on. Also, there is no guarantee that tax laws won’t change in the future.

But to answer the key question: is spread betting tax-free? The answer is yes for the majority of individuals.

FAQ

Do You Have To Pay Income Tax On Spread Betting?

If you don’t rely on profits from spread betting as a primary source of income, it is usually considered gambling and doesn’t give rise to a tax liability. However, you may need to check with an accountant for the exact laws applicable in your region and to your circumstances.

Why Is Spread Betting Tax Free?

Spread betting is normally considered gambling, so if you don’t make enough for it to constitute a significant source of income, it is usually a non-taxable way of speculating on popular financial markets. With that said, the rules vary globally, from England and Jersey to Australia.

Is Forex Spread Betting Tax Free?

Spread betting on currency is usually tax free. This is also the case when spread bets are placed on other markets, such as cryptos and bonds. Note, this is different to the traditional buying and selling of stocks, for example, where individuals get paid dividends and may need to pay tax.

What Countries Is Spread Betting Tax Free?

Spread betting is legitimate and not taxable in the UK and Ireland – profits are free from tax liabilities. This means local tax authorities, such as HMRC, do not ask for a proportion of your winnings. With that said, keep up with the latest regulations regarding this type of gambling because laws can change. Also contact an accountant if you are unsure whether you owe tax on spread betting profits.

Is Spread Betting Legal?

Spread betting is legal in several countries, including the UK and Ireland. However, the financial product is banned in other regions, including South Africa, Canada, Zambia, Zimbabwe, the US, Germany, France and Japan. Here, investors will need to use other instruments such as CFDs, futures, and options.

Article Sources

- Spread Betting Advantages - CMC

- HMRC Capital Gain Information

- SpreadBetting vs CFDs - Pepperstone

- How Spread Betting Is Taxed

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com