Spread Betting Demo Accounts

Many online brokerages offer new investors a demonstration, or ‘demo’, account to trial both their software service, and to allow you the investor to test and train your trading prowess. Here we look at why this is good practice, and provide a list of the best spread betting demo accounts.

Spread betting is an efficient way of taking a position, making a bet on a wide variety of assets, such as shares, indices, commodities, forex, composite funds.

It is efficient because, firstly, as you are not buying and selling the asset you can usually avoid the tax triggered by acquisition and disposal of assets (i.e., Stamp Duty and Capital Gains Tax). Read more about tax implications here.

Secondly, it is an efficient use of funds because you don’t have to buy the underlying asset (share, currency, and so on) thus your money can be used to cover bigger bets – this is called leverage.

Spread Betting Demo Accounts

Here is a short overview of each broker's pros and cons

- AvaTrade - AvaTrade is a first-rate spread betting platform with opportunities on 1000+ stocks, indices, commodities and currencies, sporting leverage up to 1:400. The MetaTrader platforms cater to seasoned traders with advanced charting tools and alerts, while the extensive Academy is home to terrific education with 18 courses, 150 lessons, 50 quizzes and a video tutorial explaining how to spread bet at AvaTrade.

- Pepperstone - Pepperstone offers a competitive range of 1200+ spread betting instruments covering forex, indices, commodities, shares and ETFs. Spreads are some of the most competitive that we’ve seen during tests, starting from 0.6 pips for EUR/USD. Spread betting is also available on the MT4, MT5, cTrader and TradingView terminals, offering more platform flexibility than most alternatives.

- Spreadex - Spreadex stands out as one of the few brokers that specializes in spread betting, offering 10,000+ instruments (rivalling top contenders like IG with 17,000+). There’s also valuable spread betting education covering strategies, tips and analysis. With user-friendly TradingView charts and advanced order types, both beginners and experienced spread betters are well catered to.

- Trade Nation - Trade Nation offers hundreds of instruments via spread bets, though this notably trails top alternatives like CMC Markets (12,000+) and Spreadex (10,000+). We found the TN Trader platform to be a standout option for beginners during tests, thanks to its straightforward fixed-spread model. That said, offering just one platform for spread betting makes the broker more restrictive than most competitors.

- Vantage - Vantage continues to offer commission-free spread betting on forex, indices and precious metals. With 15 indices, including less commonly offered instruments like the VIX and Bovespa, Vantage is particularly suited to experienced equities traders. It’s also one of the few brokers that offers an unlimited demo account, allowing you to practice your strategies continuously.

- FxPro - Spread betters can access six asset classes through the FxPro's proprietary spread betting platform, Edge. Whilst it’s a shame that Edge is the only available terminal for spread betting, traders can access 50 technical indicators (more than MT4), plus an economic calendar and price alerts, providing a decent all-in-one spread betting environment. Customer support also performed well during tests, connecting us to an agent instantly and responding to our spread betting queries sufficiently.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Spreadex

"Spreadex will appeal to UK day traders who are interested in both spread betting on financial markets and placing traditional bets on sports events. Fees are low on short trades and profits are tax-free on spread bets. There's also a powerful proprietary charting platform, plus £0 minimum deposit required to get started. "

Tobias Robinson, Reviewer

Spreadex Quick Facts

| Bonus Offer | £300 cashback |

|---|---|

| Demo Account | No |

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting |

| Regulator | FCA |

| Platforms | Spreadex Platform, TradingView |

| Minimum Deposit | £0 |

| Minimum Trade | £0.01 |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, CHF |

Pros

- The broker offers an easy-to-use proprietary charting platform and mobile app

- There's an excellent range of instruments and trading vehicles for short-term traders

- Traders have the opportunity to bet on sports events from their brokerage account

Cons

- There's no support for expert advisors or other trading bots

- No third-party e-wallets are accepted

- The proprietary terminal lacks comprehensive charting features of platforms like MT4 and MT5

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Bonus Offer | 200 Sign-Up Reward Points |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- There is a low minimum deposit for beginners

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

Cons

- Fewer legal protections with offshore entity

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- There are no short-term strategy restrictions with hedging and scalping permitted

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

Cons

- Unfortunately, cryptos are only available for Australian clients

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

Cons

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

The spread in spread betting means the difference between the broker’s buy and sell price, there is no commission to pay on a spread bet as the broker’s costs are built into the spread.

In order to understand how anyone thinking of entering this market can benefit from the best spread betting demo accounts, we need to look at leverage as it is the supercharger in the trading process, it magnifies your gains but also your losses.

Leverage And Risk

Leverage means that you only need to front up a small percentage of the asset value to take a position. The amount you put up is your equity (or margin).

While this gives you more bang for your buck it also exposes you to greater risk, as a few points change in the price of the underlying asset can wipe out your stake.

For example, if you have £1,000 on your account and maximum leverage granted by the broker/platform of 10:1 then you can take a position with an asset value of up to £10,000.

If the price moves against your bet your margin could be wiped out, however, brokers will offer a stop-loss limit, so that your position is closed at a pre-set level if the market moves against you.

Practise

We can see that leverage increases the size of the bet you can make, and thus the amount of profit, but it also increases your risk.

Most spread betting platforms are duty bound to report that between 65% and 75% of retail investors (out of an estimated total of 100,000 UK traders) lost money on spread betting.

Spread Betting Demo Accounts

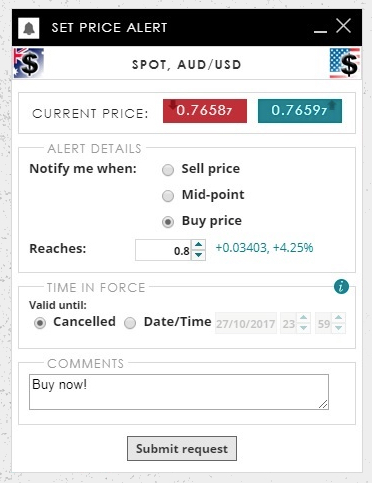

In practice, it is tricky to track price changes and calls upon your margin, so it is vital to be familiar with the tools offered by the different brokers, how these are presented, their sensitivity, and how they work together.

The demo account should exactly imitate the live spread betting platform. This is crucial not only in order to familiarise yourself with a particular platform but also in helping you select the platform which best suits you. You are training in the demo, and like anything, practice will make perfect.

The best spread betting demo accounts are the ones that give you the information and tools to help you to make fast decisions and execute them in a simple and clear way.

Charts

Typically, the brokers will use a Candlestick chart to show price movements over the time period you select. Each day’s prices are represented by an icon that looks like a candle with a wick at both ends (appropriate for day traders).

The candle part represents the price movement during exchange trading hours, the wicks track any up or down price movement in after-hours trading. This chart is usually the central part of the screen and takes up the largest area.

The key tools are the size, stop, and limit settings that you can use to govern the position which you decide to take.

‘Size’ is simply the amount you want to trade; the ‘stop’ is your limit on losses for that trade, and the ‘limit’ setting enables you to set when you want to take your profits.

Data, Market Sentiment, Discussion Groups

All of these sources of information play a part in influencing Wall Street and City professionals, so a good spread betting demo account will have a Twitter feed somewhere on your dashboard.

Bloomberg, Reuters, CNBC, AP and a few mavericks will often feature. You will have to research outside the demo when you have a particular asset focus. There are many sources of good and not so good data, and no-one knows what will actually happen.

Learn

The most useful exercise a potential spread betting investor can undertake is to play in a demo account to test spread betting skill and stamina.

Taking a position is different from reading a headline and thinking, for example, gold might rise or fall over the next week.

You have to risk your virtual money. Going through the process of typing in the amount and then pressing the ‘place deal’ button gives your choices an intense focus. Whether it is a demo or not you, and your skin, are in the game.

Trading Psychology

Most spread betting will come from the gut and depend on your nerve. A demo account used properly may give you an edge over your competition.

Using the best spread betting demo accounts means you are able to test the amount you want to invest in assets as any losses you incur will only be of the virtual money the platform allocates to you when you open the account.

You will learn the best times to trade which assets. You will see which types of announcement affects asset prices and how. All of these are useful but the crucial benefit a spread betting demo account gives you is an arena in which to test your nerve.

Very quickly a user becomes possessive over even their virtual funds, we don’t want to lose so we pay close attention. We will be bruised, beaten, and disheartened at times, and this will help us reach that top quartile of all spread betting investors – the ones who make money.