Best TradeLocker Brokers In 2025

TradeLocker is a next-generation trading platform that’s quick, intuitive, and built for serious day traders. With lightning-fast execution, seamless TradingView charting, and a clean, responsive interface, it works great on both desktop and mobile – no clutter, no lag.

Whether you’re scalping the 1-minute or swing trading the daily, it delivers the tools without the bloat of older platforms. And its TradingView integration isn’t just a feature – it’s core to the experience, giving you pro-level indicators and charting from the off.

But performance depends on your broker. The best brokers don’t just connect you to TradeLocker – they optimize it, ensuring faster fills, better pricing, and a dependable trading environment.

Best Brokers With TradeLocker 2025

Based on our latest tests, these are the top brokers that offer TradeLocker in April 2025:

- Plexytrade: Crypto-first setup, smooth TradeLocker performance, ideal for new and crypto-focused traders.

- Sage FX: Blazing-fast execution, ultra-tight FX spreads, ideal for scalpers and day traders.

Compare Top TradeLocker Brokers

Here’s a quick side-by-side of the two standout TradeLocker providers:

| Minimum Deposit | Typical Spreads (EUR/USD) | Max Leverage | Supported Assets | Regulation | |

|---|---|---|---|---|---|

| PlexyTrade | $50 | From 0.1 pips | 1:2000 | CFDs, forex, crypto, stocks, indices, commodities | Unregulated* |

| Sage FX | $10 | From 0.1 pips | 1:500 | CFDs, forex, crypto, stocks, indices, commodities, futures | Unregulated* |

Broker-Specific Differences: Same Platform, Different Experience

One of the biggest surprises in our testing? Not all TradeLocker brokers deliver the same experience.

The core platform is the same – same TradingView charts, same sleek layout – but what really matters to traders varies depending on the broker behind the scenes.

We put our top picks – Plexytrade and Sage FX – through side-by-side tests, placing the same trades on the same assets at the same times. The differences weren’t always huge, but they were noticeable and in some cases, they could definitely impact your PnL over time.

Here’s what we found:

Execution Speed And Slippage

- Sage FX came out slightly ahead on execution speed, especially on major FX pairs during peak hours. Orders were consistently filled in under 100ms.

- Plexytrade was still quick, but we noticed a touch more slippage on high-volatility crypto pairs like BTC/USD.

Example: During a market-moving CPI release, our BTC long on Sage FX filled with zero slippage. The same trade on Plexytrade slipped. It’s not significant, but it’s worth noting for scalpers.

Spreads And Trading Costs

- Both brokers advertise raw spreads starting from 0.1 pips, which mostly held true in our tests.

- Sage FX seemed to offer slightly tighter spreads on FX pairs (EUR/USD averaged 0.2–0.3 pips).

- Plexytrade was more consistent with crypto spreads, especially on altcoins like ETH/BTC.

Neither broker charges a commission on most pairs, but overnight fees vary slightly, so check the fine print if you hold positions past rollover.

Account Security And Wallet Options

- Both brokers let you deposit and withdraw via crypto, but Sage FX has more wallet options built into the dashboard, including internal transfers between accounts.

- Plexytrade’s wallet setup is simpler but still easy to use. We appreciated the low $50 deposit requirement, perfect for testing the platform with minimal risk.

Platform Customization And Add-Ons

While TradeLocker itself doesn’t support custom plugins (yet), brokers can tweak specific default settings like:

- Chart themes (Sage FX defaults to dark mode, Plexytrade uses light)

- Asset groupings in the watchlist

- Max leverage by asset (Plexytrade offers up to 1:2000, but Sage FX allows flexible scaling by account tier)

Support And Onboarding

- Plexytrade impressed us with live chat response times; they answered within 30 seconds and followed up by email.

- Sage FX was a bit slower via chat, but their knowledge base is solid and includes walkthroughs for setting up TradeLocker.

So, Which Broker Should You Go With?

If you’re into forex scalping or trading news events, Sage FX edges out due to its faster fills and tighter FX spreads.

If you’re focused on crypto trading and want a simple entry point, Plexytrade offers a no-fuss experience that is perfect for casual trading.

Below are detailed reviews of what it’s like to use TradeLocker at each of our top providers.

Plexytrade TradeLocker Review

Is Plexytrade Good For TradeLocker?

Plexytrade is a newer name on the block, but it’s quickly building a rep among crypto-first traders and those who want an easy, low-barrier way into TradeLocker.

The integration is clean, and their version of TradeLocker runs fast, without any of the lag or bugs we’ve seen on some smaller broker setups.

During our testing, we found Plexytrade’s version of TradeLocker super smooth, especially when switching between markets or placing trades from the TradingView charts. Execution was solid, and the minimal deposit ($50) makes it easy to try without commitment.

Broker Snapshot

- Founded: 2022

- Regulation: Offshore (unregulated, like many high-leverage crypto brokers)

- Minimum Deposit: $50

- Leverage: Up to 1:2000

- Assets: CFDs, forex, indices, stocks, commodities, crypto

- Trading Fees: Raw spreads, no commission on most trades

- Funding: Crypto only

Pros

- Great for crypto traders (especially altcoins)

- Seamless TradeLocker integration with TradingView

- Fast and friendly support

Cons

- Not regulated (higher risk for large balances)

- Limited fiat payment options (crypto only)

- Slightly higher slippage on fast-moving pairs during high volatility

Best For

- New traders who want to try TradeLocker without a big commitment

- Traders looking for fast access and a minimalist experience

- Crypto-focused traders

I opened a $25 account just to test the waters and was honestly surprised how smooth everything felt. The BTC spreads were tighter than expected.

Sage FX TradeLocker Review

Is Sage FX Good For TradeLocker?

Sage FX was one of the first brokers to roll out TradeLocker, which shows; they’ve nailed the implementation. The layout is smooth, execution is lightning fast, and their FX spreads were among the tightest we saw in our hands-on testing.

They also offer a more robust backend than many offshore brokers, with multi-wallet options, internal transfers, and strong account management tools right from the TradeLocker dashboard.

Broker Snapshot

- Founded: 2020

- Regulation: Offshore (unregulated)

- Minimum Deposit: $10

- Leverage: Up to 1:500

- Assets: Forex, crypto, commodities, indices, stocks, futures

- Trading Fees: Raw spreads, typically no commission

- Funding: Crypto only

Pros

- Speedy execution, especially on major FX pairs

- Excellent user experience inside TradeLocker

- Multi-wallet system for account flexibility

- Tight spreads during most sessions

Cons

- Still offshore and unregulated

- Some spreads widen significantly outside of peak hours

- Live chat support isn’t as fast as some competitors

Best For

- Active forex traders and scalpers

- Traders who want ultra-fast execution via TradeLocker

- Users who manage multiple accounts or wallets

Execution on EUR/USD is near-instant based on testing, even during high-impact news. If you’re into scalping, Sage FX’s TradeLocker setup is probably one of the best out there.

Which TradeLocker Broker Should You Choose?

At this point, it’s pretty clear that TradeLocker has carved out a sweet spot for traders who want a clean, fast, TradingView-powered experience, but picking the right broker to run TradeLocker on? That’s where things get personal.

Here’s our breakdown of the best TradeLocker brokers by trader type, based on our testing, platform feel, and real-world usability.

Best For Beginners: Plexytrade

If you’re just getting started with online trading, Plexytrade makes it easy.

The $50 minimum deposit, smooth TradeLocker integration, and simple crypto funding process mean you can be live and trading in less than 10 minutes.

Why Plexytrade?

- Low entry barrier

- Intuitive dashboard and fast setup

- Friendly for crypto-based traders

Best For Scalpers And Day Traders: Sage FX

For active traders who care about every pip and every millisecond, Sage FX’s TradeLocker setup is a beast.

Execution is seriously snappy, and the raw spread account gives scalpers and intraday traders the tight pricing they need.

Why Sage FX?

- Tight spreads, even on majors

- Lightning-fast execution during peak hours

- Customizable watchlists and fast chart responsiveness

Best For Prop Firm-Style Trading: Sage FX

Yes, Sage FX again, but with good reason. While it doesn’t offer full prop firm funding, Sage FX is an excellent “prop-like” environment thanks to its wallet system, stable spreads, and platform stability.

Why Sage FX?

- Fast internal transfers (great for multiple strategies)

- Account flexibility to simulate prop-style rules

- Reliable execution for challenge-style trading

Best For Crypto Traders: Plexytrade

Looking to actively trade crypto 24/7? Plexytrade is better suited here, with deeper crypto market support and more altcoin pairs available directly in TradeLocker.

Why Plexytrade?

- Broader crypto asset list

- Crypto-only funding and withdrawals (no fiat hassle)

- Spreads on BTC and ETH were surprisingly tight during our tests

The best way to know if a broker is worth it? Trade with them. Most TradeLocker brokers we’ve evaluated let you start with $10–$50 and offer demo trading accounts. Set up a few trades, test the support, and see how the platform runs on your device.

How We Chose The Best TradeLocker Brokers

TradeLocker might be offered by over 20 brokers, but not all of them are worth your time. That’s why we didn’t just copy a list off supporting brokerages TradeLocker’s website. Instead, we took a no-nonsense, hands-on approach to pick our top providers.

Our selection process had two core phases:

- Expert Curation – We started by narrowing the field. The industry experts that sit on our testing panel hand-picked a shortlist of brokers that actually integrate TradeLocker well.

- Real Testing – Then we rolled up our sleeves. Experienced traders on our team opened accounts, placed trades, and ran side-by-side tests across multiple brokers. We tracked slippage, execution speed, spread consistency, support quality, and overall platform smoothness.

The result? We’re only comfortable putting our name behind two brokers that support TradeLocker – Sage FX and Plexytrade.

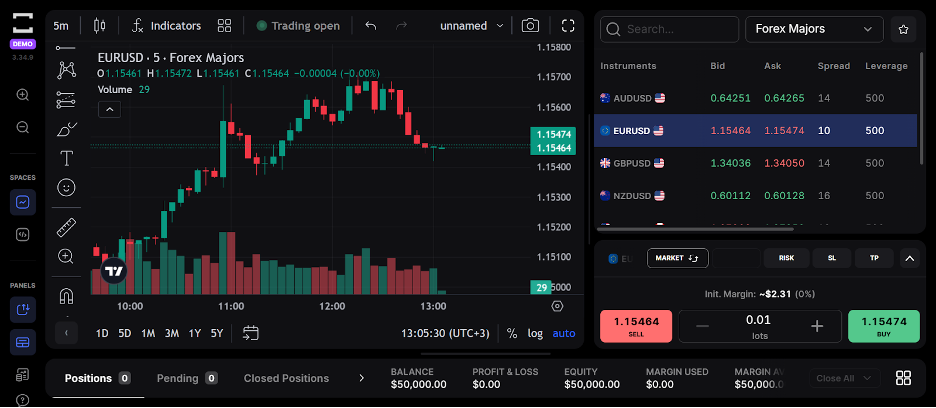

Exploring The TradeLocker Platform

So what’s it like to use TradeLocker? One word: clean.

The first time I logged in, the layout felt refreshingly uncluttered. There were no overwhelming menus or clunky pop-ups, just a slick, minimalist interface that put your charts and trades front and centre, exactly where they should be.

Here’s how everything breaks down once you’re inside the TradeLocker platform:

Dashboard Layout: All Killer, No Filler

As soon as you load up the platform, you’re greeted with a spacious charting window powered by TradingView. You’ll also find a small but mighty left-hand navigation bar where you can quickly jump between:

- Markets (customizable watchlists)

- Orders

- Positions

- Wallets

- History

The entire experience feels more like a modern app than a legacy trading terminal, which is a breath of fresh air.

Charting: TradingView Integration

This is hands-down one of the biggest selling points. TradeLocker doesn’t just bolt on TradingView; it builds the entire trading experience around it. That means:

- Dozens of indicators and drawing tools

- Multiple timeframes, from 1-second to 1-month

- Customizable chart styles (candles, bars, Heikin Ashi, etc.)

- Smooth chart syncing across desktop and mobile

Whether you’re backtesting a strategy or eyeballing your next breakout, everything feels familiar, especially if you’re already a fan of TradingView.

Order Entry: Fast, Simple, and Customizable

Placing trades on Trade Locker is quick and snappy. Click the buy/sell button from the chart or your watchlist, and the order panel slides in with:

- Market, limit, stop, and stop-limit options

- Adjustable lot size and leverage

- TP/SL inputs with visual chart markers

- Estimated margin, cost, and PnL preview

I really like how easy it was to fine-tune position size without hopping through three different menus. It’s all right there, smooth and logical.

Watchlists And Market Scanner

You can create custom watchlists, select from lists like forex majors, pin your favourite instruments, and sort by market type (forex, crypto, indices, etc.).

The live quotes are cleanly displayed, and switching between symbols is super fast; no awkward lag or loading hiccups like you get with some web platforms.

Mobile Trading: Surprisingly Good

I tried TradeLocker on Android and iPhone, and the experience was solid. You still get complete charting and quick order access, and your open trades are just a tap away.

Great for managing trades on the go without feeling stuck with a watered-down version of the platform.

Bottom Line

TradeLocker is only as good as the broker behind it. The charting is slick, and the UI is top-tier, but your execution, pricing, and support all depend on who you sign up with.

If you’re still unsure, start small. Open demo or low-balance accounts with Plexytrade and Sage FX – our go-to choices, test out your style, and go from there.

TradeLocker is built to be trader-friendly, so take your time and make sure the broker you pick is, too.

FAQ

Is TradeLocker Suitable For Day Trading?

Yes, we’ve found it’s actually one of the better browser-based platforms for short-term traders. Fast execution, clean layout, and no app downloads make getting in and out of trades easy.

That said, you’ll need to pair it with a broker that offers tight spreads and low latency, like Sage FX.

The TradeLocker software is best used with raw spread or ECN-style accounts if you’re day trading.

Can I Use TradeLocker With A Demo Account?

Yes, absolutely. Most brokers that support TradeLocker offer free demo accounts so you can test the platform risk-free.

It’s a great way to get a feel for the interface, charting tools, and order execution – especially if you’re new or just trying out a new strategy.

Is TradeLocker Better Than MetaTrader?

It depends on what you value. If you’re after a modern, intuitive UI with built-in TradingView charts, TradeLocker easily beats MetaTrader in looks and usability.

But if you rely heavily on custom indicators or automated EAs, MetaTrader (especially MT4) still has the edge. I say this having spent years using MT4.

TradeLocker vs MetaTrader:

- TradeLocker = cleaner interface, better charting, smoother mobile experience

- MetaTrader = stronger for algorithmic trading and legacy tools

Do All Brokers Support TradeLocker?

No, not yet. TradeLocker is still relatively new, so only a growing list of brokers currently offer it.

You’ll need to look specifically for brokers with TradeLocker support, such as Plexytrade, Sage FX, and a few others.

Always check the broker’s platform list before signing up.

Is TradeLocker Safe For Live Trading?

Yes, TradeLocker is safe to use, but remember, the broker you use it with determines how secure and trustworthy your trading experience will be.

The platform handles order routing and charting smoothly, but always go with transparent brokers about their policies, pricing, and withdrawals.

Can I Trade Crypto, Forex, And Indices On TradeLocker?

Yes, you can, as long as your broker supports those markets.

TradeLocker’s layout is asset-agnostic, meaning you can chart and trade anything your broker offers. From Bitcoin to EUR/USD to US30, it’s all about what’s available on the backend.

Some brokers even offer synthetic assets or prop firm-style accounts through TradeLocker.

Does TradeLocker Support Algorithmic Trading Or Bots?

Yes, TradeLocker now supports trading bots via TradeLocker Studio.

This feature allows traders to create, backtest, and deploy automated trading strategies without requiring coding skills. You can describe your trading strategy using natural language inputs, and the AI-powered Studio will generate the corresponding bot code.

These bots can be tested using historical data to evaluate performance before deployment.

Are There Any Fees For Using TradeLocker?

TradeLocker itself doesn’t charge fees, but your broker might.

The costs you’ll face, like spreads, commissions, or overnight swaps, come from the broker you’re using. TradeLocker is just the interface; the broker sets the pricing model.

Always double-check your broker’s fee page or live account specs.

Can I Customize Indicators And Templates On TradeLocker?

You can customize a lot, but not everything. Since TradeLocker uses TradingView charts, you can add popular indicators, switch themes, and save chart layouts.

However, you won’t be able to import custom TradingView scripts or community-built indicators – yet.

You get the essentials, not the complete TradingView ecosystem.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com