Quantower Review 2025: Testing Results & Top Brokers

Short-term trading is a game of precision, speed, and strategy, and Quantower delivers a suite of tools tailored to meet these needs. It’s a powerhouse platform designed for serious traders – whether you’re scalping, day trading, or experimenting with algorithms.

Let’s explore Quantower’s key features, insights from our tests, and the best brokers supporting this platform.

Quantower stands out in the competitive world of trading platforms because of its versatility and functionality. Here’s why short-term, day traders like me love it:

- Customizable Interface: Personalize your workspace to fit your trading style.

- Lightning-Fast Execution: Crucial for scalping and day trading strategies.

- Wide Integration: A seamless connection with multiple brokers for flexibility.

Top 6 Quantower Brokers

Based on our latest tests, here’s our ranking of the best brokers compatible with Quantower:

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken - Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- FxPro - Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

- BitMEX - BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange.

Quantower Brokers Comparison

| Broker | Instruments | Regulators | Minimum Deposit |

|---|---|---|---|

| Interactive Brokers | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | $0 |

| Kraken | Cryptos | FCA, FinCEN, FINTRAC, AUSTRAC, FSA | $10 |

| IC Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA | $200 |

| Pepperstone | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | $0 |

| FxPro | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting | FCA, CySEC, FSCA, SCB, FSA | $100 |

| BitMEX | Crypto | Republic of Seychelles | $0.01 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Kraken

"Kraken will suit traders looking for a diverse list of cryptos including Bitcoin and a good security track record."

William Berg, Reviewer

Kraken Quick Facts

| Bonus Offer | Lower fees when trading volume exceeds $50,000 in 30 days |

|---|---|

| Demo Account | Yes |

| Instruments | Cryptos |

| Regulator | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Platforms | AlgoTrader, Quantower |

| Minimum Deposit | $10 |

| Minimum Trade | Variable |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF |

Pros

- Low minimum deposit of $10

- Excellent range of 220+ more established cryptocurrencies

- Mobile investing

Cons

- Does not support many newer altcoins

- Slow verification process on Pro account

- Low leverage on spot trading

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

Cons

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

BitMEX

"Active traders who want access to a good range of crypto derivatives will be intrigued by BitMEX's offering, with Perpetual Contracts available. The 100x leverage on Bitcoin is also higher than many alternatives."

William Berg, Reviewer

BitMEX Quick Facts

| Bonus Offer | Fee reduction for BMEX token holders |

|---|---|

| Demo Account | Yes |

| Instruments | Crypto |

| Regulator | Republic of Seychelles |

| Platforms | BitMEX Web Platform, AlgoTrader, TradingView, Quantower |

| Minimum Deposit | $0.01 |

| Minimum Trade | Variable |

Pros

- The Guilds social trading service allows traders to participate in competitions and earn rewards, including a weekly prize pool worth 4,000 USDT at the time of writing

- The exclusive crypto platform makes it more streamlined than other multi-asset terminals

- Comprehensive customizability is available within the platform, with movable widgets and order book filters

Cons

- Only Bitcoin is accepted for free withdrawals

- Withdrawals are only carried out at a specified time of day

- The broker was involved in a legal dispute with US regulators which resulted in fines

Why Use Quantower’s API Integration With These Brokers?

- Flexibility: Easily adapt your trading strategies with Quantower’s powerful tools.

- Customization: Use the Quantower API to build and test strategies that match your trading style.

- Seamless Data Flow: Enjoy uninterrupted data feeds and smooth order execution.

Connecting To Brokers Through APIs

Quantower makes it remarkably simple to connect and use its API with brokerages like OANDA or platforms like cTrader. Here’s how it works step-by-step:

Connecting Quantower To OANDA Via API

1. Create An API Token On OANDA

- Log in to your OANDA account.

- Navigate to the API settings under your account dashboard.

- Generate a new API token and copy it for use in Quantower.

2. Set Up The Connection In Quantower

- Open Quantower and go to the Connections Manager.

- Select OANDA from the list of supported brokers.

- Paste your OANDA API token into the required field.

- Choose your trading environment (live or demo).

3. Start Trading

- Once connected, Quantower will display your account balance, open positions, and market data.

- Use features like advanced charting, order placement, and risk management directly with OANDA’s pricing and liquidity.

The integration is seamless, and you can use OANDA’s data feed with Quantower’s powerful tools, such as the Depth of Market (DOM) and algorithmic trading.

This combination is perfect for traders who want OANDA’s reliability paired with Quantower’s advanced trading environment.

Using Quantower With cTrader API

1. Set Up cTrader API Access

- Log in to your cTrader brokerage account (e.g., IC Markets or Pepperstone).

- Obtain API credentials, usually from the platform’s developer or integration section.

2. Configure Quantower For cTrader

- In Quantower’s Connections Manager, find cTrader among the supported platforms.

- Input your API credentials (client ID, secret key, and other required details).

- Test the connection to ensure it’s active.

3. Start Using cTrader Data In Quantower

- cTrader’s deep liquidity and data precision combine with Quantower’s superior analytics.

- Use the Volume Analysis and Order Flow tools for better trading insights.

Why It’s Simple:

cTrader already supports advanced trading capabilities, and Quantower’s intuitive interface enhances this with features like algorithmic trading and Market Replay.

You don’t need deep technical knowledge to make this work; it’s designed to integrate seamlessly.

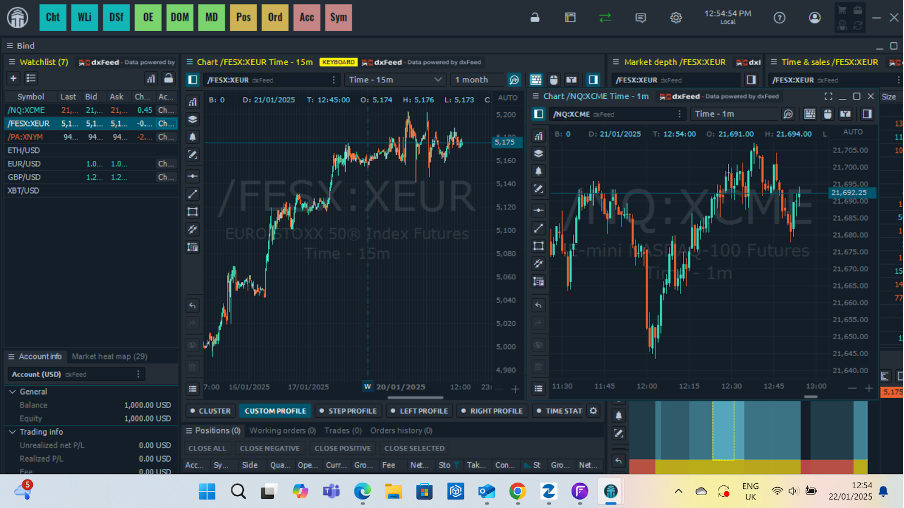

Key Features Of Quantower

Advanced Charting Tools

- Over 40+ built-in indicators like RSI, MACD, and Bollinger Bands.

- Support for custom indicators, which can be created using the Quantower scripting API.

- Multiple chart types, including candlestick, bar, and Renko.

The charting capabilities of Quantower are phenomenal. I found myself saving time by easily switching between timeframes and applying indicators without any lag.

Algorithmic Trading

- Build and test your trading algorithms directly within the platform.

- The built-in Backtesting Tool lets you validate strategies with historical data before going live.

Risk Management Tools

- Built-in tools for setting stop losses, take profits, and trailing stops.

- Position sizing calculators to help you manage risk effectively.

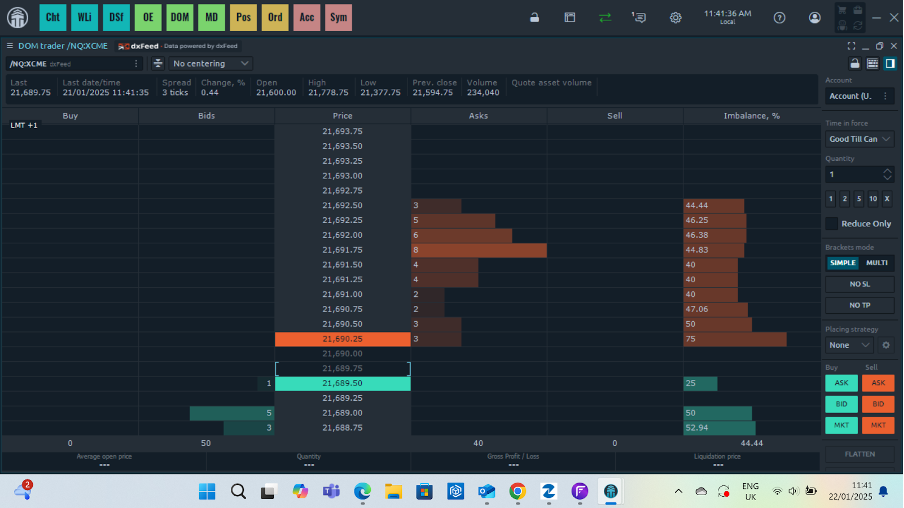

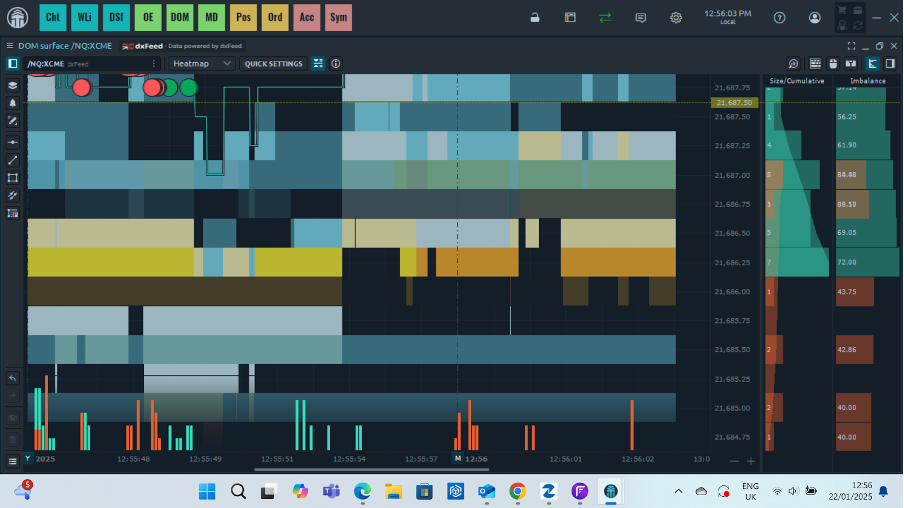

Depth Of Market (DOM)

- The DOM window offers a detailed view of market liquidity and order flow.

- It is ideal for scalpers who need precise data to enter and exit trades.

Market Replay

- Rewind and replay past trading sessions to review market behavior and refine strategies.

- An invaluable tool for learning and improving performance.

Using the Market Replay feature allowed me to identify flaws in my strategy and make adjustments that boosted my profitability.

Data Aggregation

- Combine feeds from multiple brokers or exchanges to get a unified market view.

- Ensure better decision-making with accurate and comprehensive data.

Customizable Hotkeys

- Configure hotkeys for quick actions like placing orders, modifying trades, or cancelling all orders.

- A lifesaver for day traders who need rapid response times.

Multi-Monitor Support

- Seamlessly extend your workspace across multiple monitors.

- Perfect for active traders who monitor multiple assets or strategies simultaneously.

Trading Simulator

- Practice trading without risking real money.

- Simulate real-time conditions to test new strategies or get familiar with the platform.

Cross-Platform Functionality

- Quantower is available for Windows and Mac users.

- Mobile app integration is in development, promising seamless trading on the go.

Quantower In Action: A Trader’s Perspective

I set up the platform to evaluate Quantower’s utility for short-term trading and focused on its core features. My objective was to test the usability, speed, and effectiveness of its tools in a live trading environment. Here’s how it went:

Setting Up My Workspace

From the start, I noticed the platform’s sleek and customizable interface. Setting up my workspace was intuitive:

- I connected a demo account to test stock and futures trading.

- Using Quantower’s workspace linking feature, I synced my charts, watchlist, and order book. This ensured that changes to one were reflected across all linked windows.

- The multi-monitor support was a standout feature; I spread my trading tools across two screens without performance lags.

- Importantly, the workspace felt personal and efficient, enhancing my ability to focus on critical trading data without distractions.

Charting Features

Quantower’s charting is a dream for technical traders.

- I tested indicators like RSI, Bollinger Bands, and Fibonacci retracements. These loaded quickly and were easy to configure.

- Switching between timeframes (1 minute to 1 hour) was seamless, with no noticeable delays.

- I tried their multi-chart layouts, which allowed me to view different timeframes for the same asset.

As a scalper, the responsiveness of charts is crucial. I appreciated how smoothly the platform handled live data streams, especially during volatile market hours.

Testing Depth Of Market (DOM)

For short-term traders, the Depth of Market (DOM) is essential. I focused on futures and crypto trading to evaluate order flow and liquidity.

- The DOM displayed detailed buy and sell levels with precise updates.

- I placed several limit orders directly from the DOM. The execution speed was impressive, with minimal slippage.

- I used the volume heatmap to spot liquidity clusters, which helped me identify potential breakout points.

Result: This tool felt indispensable for scalping. By spotting high-volume zones, I positioned myself ahead of rapid price moves.

Algorithmic Trading And Backtesting

I created a simple moving average crossover strategy using Quantower’s scripting API. The process was beginner-friendly yet powerful:

- I scripted a 50/200 MA crossover.

- Ran the strategy through six months of historical forex data using the backtesting feature.

- The backtest results included detailed metrics like profit factor, drawdowns, and win rate.

Outcome: The backtest revealed inefficiencies in my initial strategy. After tweaking stop-loss levels, I improved my net profitability.

Market Replay For Practice

The Market Replay tool became a personal favorite. I selected a high-volatility trading session from the previous week and replayed the market data.

- Practiced entering and exiting trades at 2x speed.

- I paused at key moments to analyse price action and refine my reactions.

Takeaway: This feature significantly improved my ability to trade under pressure. It’s an invaluable tool for both beginners and experienced traders looking to sharpen their skills.

Risk Management In Real-Time

Quantower’s risk management tools were tested extensively during live trading sessions:

- The position sizing calculator ensured that my trades aligned with my risk tolerance.

- Setting trailing stops and take-profit orders was quick and straightforward.

- I tested OCO (One Cancels the Other) orders, which worked flawlessly.

Benefit: Effective risk management is non-negotiable for short-term trading, and Quantower makes it easy to implement strategies that protect your capital.

Results And Overall Impressions

After a week of testing, here’s how Quantower performed from my perspective as an experienced short-term trader:

- Execution Speed: Lightning-fast, crucial for scalping and day trading.

- Usability: Intuitive interface with deep customization options.

- Reliability: Stable during high volatility and peak trading hours.

- Standout Features: DOM, backtesting, Market Replay, and multi-monitor support stood out.

- Improvements Needed: While the desktop platform excels, mobile functionality is still under development, limiting flexibility for on-the-go traders.

Tips

Drawing on my time personally using the platform, here are my key tips to get the most out of the software:

- Maximize Hotkey Efficiency: Spend time setting up hotkeys to reduce the number of clicks required during high-stress trading moments.

- Leverage Chart Linking: Use the workspace linking feature to connect multiple charts and tools for synchronised analysis.

- Dive into the Community: Quantower has a vibrant user community where traders share custom indicators and scripts. For example, I discovered a volatility indicator shared in their forums.

- Experiment with Market Replay: Revisit historical market data to understand how your strategy performs under different conditions.

Pricing And Accessibility

Quantower offers flexible pricing options to cater to traders of all levels:

- Free Plan: Includes essential features like charting, fundamental indicators, and limited broker connections.

- Pro Plan: Unlocks advanced features such as multi-connectivity, algorithmic trading, and DOM. Pricing is competitive, with monthly and annual subscription options available.

- Lifetime License: This is for traders who want unlimited access without recurring fees.

I got a great feel for the system with a free seven-day trial. But I reckon the Pro Plan is the best value for short-term traders due to its access to multiple brokers and advanced tools like Market Replay and backtesting.

Pros And Cons Of Quantower

Pros

- Intuitive and highly customizable interface

- Broad broker and exchange compatibility

- Excellent tools for short-term traders, including DOM and hotkeys

- Strong community support and resources

Cons

- Steep learning curve for beginners

- Limited mobile functionality (currently under development)

- Advanced features are locked behind the Pro Plan

Bottom Line

Quantower is a software that deserves your attention if you’re serious about day trading. It combines advanced features, intuitive design, and extensive broker support to give traders the tools they need to succeed.

While it may have a learning curve, the potential payoff in trading efficiency and precision is well worth the effort. Take it for a seven-day test drive, and it might become your new trading command centre.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com