Bookmap Review 2025: Testing Results & Top Brokers

Imagine if you could see exactly where the market’s big players are placing their bets. That’s the kind of clarity Bookmap brings to your trading game. This innovative platform can give day traders a crystal-clear view of what’s happening beneath the surface of price charts.

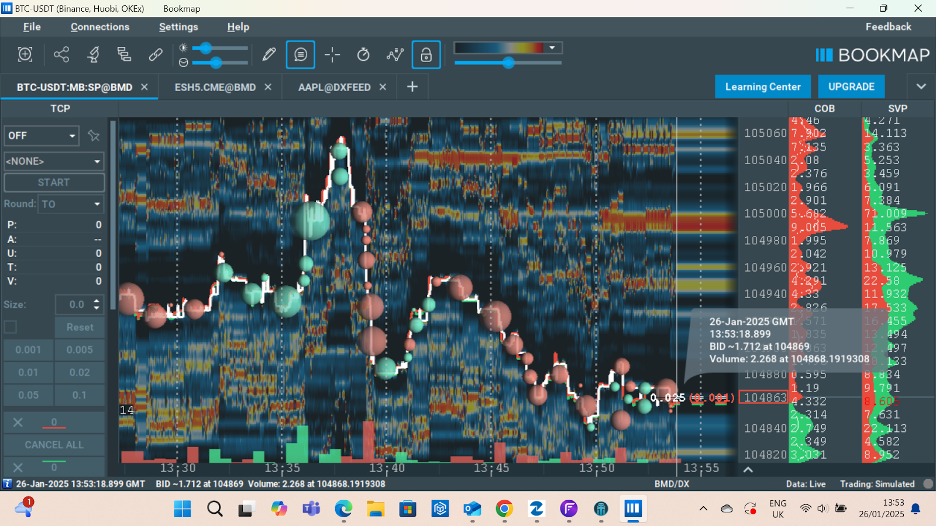

Instead of tracking price movements, Bookmap dives deeper – showing you real-time order flow, liquidity zones, and market depth through stunning visuals like heatmaps and unique “bubbles.”

Whether you’re scalping, day trading, or refining swing trading strategies, I believe that Bookmap delivers a level of market transparency you won’t find elsewhere.It has its shortcomings (such as the cost of advanced indicators), but the benefits significantly outweigh the drawbacks.

Top Bookmap Brokers For 2025

Bookmap integrates with a variety of brokers and data providers to offer comprehensive market data and trading capabilities. Here’s a list of supported platforms:

- Interactive Brokers: Connects via the Trader WorkStation (TWS) API for futures cross-trading.

- NinjaTrader: Integration is possible, but direct connections to data providers are recommended for better stability and data quality.

- Bybit: Suitable for crypto traders seeking advanced analysis tools and market data to inform decisions.

- Coinbase: Available with Coinbase Pro, giving users zero commissions and no data or exchange fees.

- OKX: Manage orders, access market data and automate crypto trading strategies.

- Rithmic: Provides full-depth market data and is widely used for futures trading.

- CQG Continuum: Offers access to full-depth market data for instruments like Crude Oil (CL).

- TradeStation: Supported for futures trading, with cross-trading capabilities via Rithmic or dxFeed data.

- iQFeed: Offers full-depth data for specific futures instruments, such as e-mini and micro contracts of the S&P 500 and Nasdaq-100.

- Tradovate: Support for trading and data services.

- GAIN Futures: Provides data services for futures trading.

- Trading Technologies: Support for trading and data services.

- Cedro: Offers connectivity to Brazilian stocks and futures markets.

Note: the availability of features and data depth can vary between providers. For the most accurate and up-to-date information, refer to Bookmap’s official Connectivity Guide.

For a demonstration of connecting Bookmap to Interactive Brokers’ TWS, this video is helpful.

What Makes Bookmap Stand Out?

- Bubble Visualization: Those iconic bubbles track trade executions, giving you an easy way to see where large volumes are trading – and fast.

- Heatmap Liquidity View: Visualize market liquidity with a real-time heatmap highlighting key interest zones.

- Deep Order Flow Insight: Stay on top of evolving order book activity and see where buyers and sellers are lining up.

- Custom Add-ons: From proprietary indicators to third-party plugins, Bookmap is all about customization.

- Multi-Market Coverage: Trade stocks, futures, forex, or crypto – all with the same powerful tools.

- Replay Functionality: Go back in time and analyze historical market data, which is perfect for backtesting and learning.

- Seamless Performance: Lightning-fast updates, even in the most volatile markets. Great for day traders.

- Flexible Integration: Works with a wide range of brokers and data feeds, so you can easily fit it into your existing setup.

Key Features

Bubble Visualization: Spot The Real Action

Bookmap’s bubbles are a total game-changer. Think of them as visual trade trackers that let you see where big volumes are being executed in real-time.

The size of each bubble reflects the trade size, while their placement shows precisely where those trades are happening on the price ladder.

This means you can instantly spot key levels where big players (or “smart money”) are entering or exiting positions.

This level of insight is priceless for scalpers and day traders like me – it helps traders identify liquidity spikes and market imbalances before they reflect in price.

Heatmap Liquidity View: Read Market Intentions

The heatmap is another one of Bookmap’s flagship features. It uses color gradients to represent market liquidity, showing you where buyers and sellers are stacking their orders at different price levels.

Lighter colors (like yellow and white) indicate higher liquidity, while darker colors (blue or black) represent areas of less activity.

This feature’s beauty is that it lets you anticipate where price might stall, reverse, or break out by tracking the battle between supply and demand.

Order Flow Analysis: The Market’s Micro-Structure

Most platforms stop at price charts – but Bookmap goes deeper by revealing the market’s “microstructure.”

This means you can see how the order book evolves in real-time, tracking the addition, cancellation, or execution of buy/sell orders.

Whether you’re looking to follow the momentum or spot areas of hidden strength or weakness, Bookmap’s order flow tools give you an edge over traders relying on standard candlestick charts.

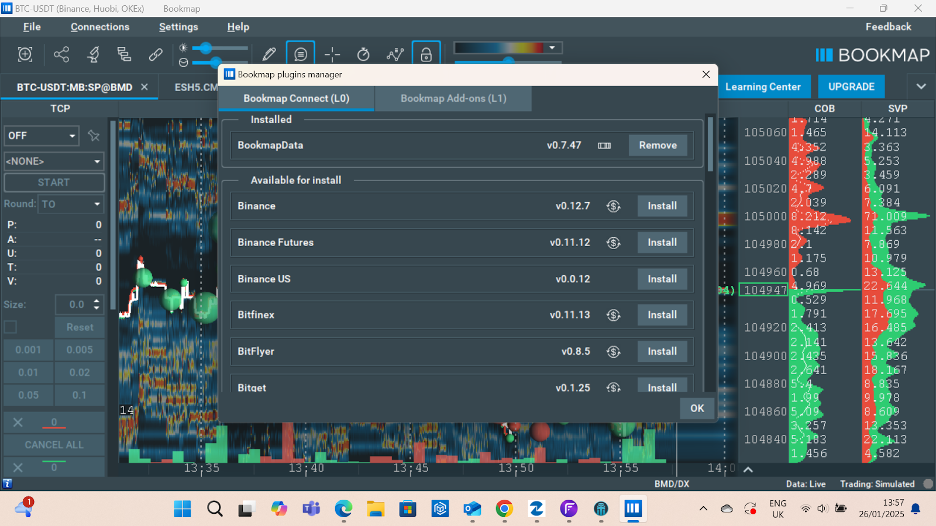

Custom Add-Ons And API Flexibility

Trading is personal, and Bookmap gets that. You can customize your setup with various add-ons, including proprietary indicators like Iceberg Detector or third-party tools for even deeper insights.

If you’re a tech-savvy trader, Bookmap’s open API lets you integrate your tools and algorithms for a fully tailored experience.

Multi-Market Coverage: All Your Favorites in One Place

Whether you trade stocks, futures, or crypto, Bookmap has you covered. The platform is compatible with major markets and data feeds, making it easy to switch between assets or diversify your trading portfolio.

There is no need for multiple platforms – Bookmap keeps everything in one place.

Replay Functionality: Learn from the Past

Have you ever wished you could replay a market session to see exactly what you missed? Bookmap’s replay functionality makes that possible.

You can go back in time, analyse past sessions’ order flow and liquidity, and refine your strategies based on what you learn. It’s an invaluable tool for both backtesting and sharpening your trading skills.

Lightning-Fast Performance: Trade Without Lag

In fast-moving markets, every second counts. Bookmap’s performance is built for speed, delivering real-time updates with minimal latency.

You’ll get a smooth, lag-free experience even during volatile market conditions, ensuring you can act on opportunities as they unfold.

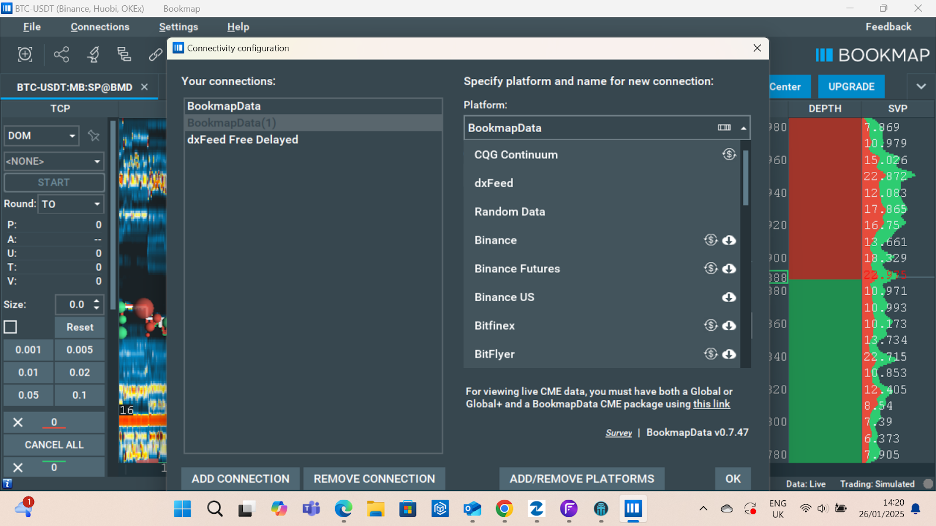

Flexible Integration With Brokers And Data Feeds

Bookmap integrates seamlessly with various brokers and data providers, making integrating into your current trading setup easy.

It supports popular brokers like Interactive Brokers and data feeds like CQG or Rithmic.

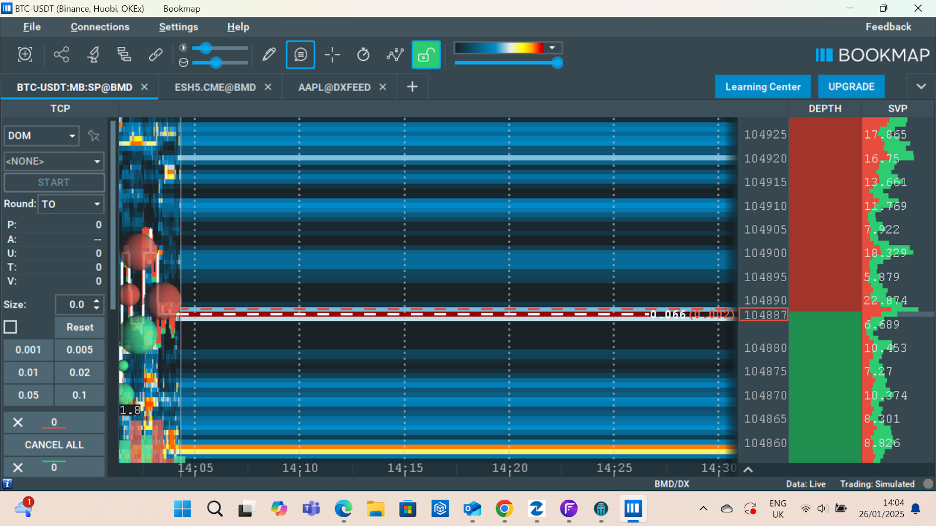

Depth Of Market (DOM)

The DOM displays the order book of a financial instrument, showing:

- Bid Orders: Buy orders stacked at various price levels.

- Ask Orders: Sell orders sitting at different price levels.

- Market Depth: The cumulative volume of orders, revealing liquidity zones where significant interest is concentrated.

Bookmap takes the concept of DOM further by visualizing this data in real-time. I think it makes it intuitive and actionable.

Bookmap redefines the traditional Depth of Market (DOM) by adding a visual and dynamic layer to how traders interpret market depth. Instead of relying solely on static numerical tables, Bookmap provides a graphical representation of the DOM alongside a real-time order book.

Here’s a detailed walkthrough of how DOM works on Bookmap and why it’s a must-have tool for short-term traders:

Instead of a static table of numbers, Bookmap’s DOM overlays a heat map directly on the price chart.

- Bright Colors (eg yellow/orange): Represent high levels of liquidity or large order clusters.

- Darker Shades (eg blue/grey): Indicate low liquidity zones.

This heat map is continuously updated, showing you where buyers and sellers are actively placing and pulling orders.

Cumulative Volume Delta (CVD)

Bookmap’s DOM includes the CVD indicator, which tracks the difference between buy and sell orders at any given moment.

- Why It’s Useful:

- Positive CVD signals more aggressive buying, hinting at upward pressure.

- Negative CVD shows dominant selling, often preceding downward moves.

Why All This Matters

With Bookmap, you’re not just looking at price charts – you’re understanding the story behind the market. You’re seeing where traders are placing their bets, where the big players are active, and where opportunities are hiding.

This level of insight can be a game-changer for anyone serious about trading, especially in fast-paced environments like futures or crypto.

How To Get Started

Step 1: Create An Account

Before diving into the platform, you’ll need to set up a Bookmap account.

- Go to Bookmap’s website.

- Click on the “Get Started” button at the top right corner.

- Choose between the Free, Digital Plus, or Global Plus plans depending on your trading needs. (The free plan is great for testing out the basics, while the paid plans unlock advanced features like heatmaps and custom add-ons.)

- Complete the registration process by entering your details and verifying your email.

Step 2: Download And Install Bookmap

- Once your account is ready, log in to your dashboard.

- Download the Bookmap software for your operating system (Windows, Mac, or Linux).

- Follow the installation instructions to get it up and running.

Step 3: Connect To A Broker Or Data Feed

To use Bookmap effectively, you’ll need to connect it to a broker or market data provider. Here’s how:

- Check Bookmap’s list of supported brokers and data feeds (eg Interactive Brokers, CQG, Rithmic, Binance).

- Sign up with a compatible broker or data provider if you don’t already have one.

- In Bookmap, navigate to Settings > Connections.

- Enter your broker/data feed credentials and establish a connection.

Step 4: Explore The Interface

When you launch Bookmap for the first time, the interface can feel a bit overwhelming. Here’s a quick rundown of the key components:

- Heatmap: Displays real-time liquidity levels across price ranges.

- Bubble Chart: Shows trade executions with bubbles representing volume.

- Order Book Panel: Tracks buy and sell orders at each price level.

- Volume Dots: Displays precise data on trade volumes.

Spend some time clicking around and familiarizing yourself with the layout. Bookmap’s intuitive design makes it easy to pick up after a bit of practice.

Step 5: Customize Your Setup

Bookmap lets you tailor the platform to your trading style:

- Adjust the timeframes to focus on specific market activity.

- Add custom indicators like Iceberg Detector or Large Lot Tracker for deeper insights.

- Use color customization to make the heatmap and bubbles stand out based on your preferences.

Step 6: Learn The Basics With Tutorials

Bookmap has a ton of free resources to help you get started:

- Check out their video tutorials on topics like order flow analysis and heatmap interpretation.

- Join live webinars hosted by professional traders to see the platform in action.

- Explore the Knowledge Base for step-by-step guides on advanced features.

Step 7: Practice With Replay Mode

Use Bookmap’s replay feature to analyze past market sessions. This is a great way to test strategies without trading live or risking real money.

- Load a historical data set from your connected broker or data feed.

- Watch the market play out in real-time, paying close attention to the heatmap and bubbles.

- Take notes on patterns and setups you’d like to try in live markets.

Step 8: Start Trading

When you’re ready to trade live:

- Confirm your broker connection is active.

- Open the instrument (eg stock, futures, or crypto pair) you want to trade.

- Monitor key levels of liquidity, watch for large bubbles, and follow the order flow.

- Execute trades directly through Bookmap or your broker’s platform.

Step 9: Leverage Community And Support

- Join the Bookmap Community Forum to connect with other traders and exchange tips.

- Contact Bookmap’s support team if you run into technical issues or need help setting up.

- Stay updated on the latest features and tools by following Bookmap on social media or their blog.

Step 10: Refine Your Strategy

As you become more comfortable with Bookmap, experiment with advanced features like:

- Add-ons for specific markets or trading styles.

- Tracking Iceberg Orders to uncover hidden market activity.

- Using the API to automate parts of your strategy.

Pros And Cons Of Bookmap

Pros

- Real-Time Market Transparency: The platform gives you unparalleled real-time insights into order flow, trade volumes, and liquidity levels. Features like the heatmap and bubble visualization allow traders to see the market’s “microstructure,” something few platforms offer.

- Bubble Visualization: Bookmap’s unique bubble feature stands out. The size of the bubbles directly correlates to trade size, providing instant clarity on where the big players are active. It’s a fantastic way to spot opportunities without staring at traditional charts all day.

- Customizability: Bookmap can be tailored to individual trading styles and strategies from custom indicators to API integration. This makes it appealing for both discretionary traders and algo-traders.

- Multi-Market Compatibility: Whether you’re trading stocks, futures, or crypto, Bookmap supports major brokers and data feeds across all these markets. It’s especially appealing to those who trade across multiple asset classes.

- Replay and Backtesting: The ability to replay past market sessions helps traders refine their strategies and learn from their mistakes. It’s a great learning tool, particularly for new traders trying to understand order flow dynamics.

- Strong Community and Educational Resources: Bookmap provides a wealth of tutorials, webinars, and a dedicated forum, making it easier to master the platform. The support team is responsive and reassuring for beginners or anyone troubleshooting issues.

- Fast Performance: The platform delivers updates with minimal latency, even during high volatility, ensuring traders never miss critical moves.

Cons

- Steep Learning Curve: The wealth of data and features can be overwhelming for new users. Traders unfamiliar with order flow or market depth may need time to understand and utilise the platform fully.

- Cost: Bookmap’s advanced features (like heatmaps and indicators) are locked behind paid tiers (Digital Plus or Global Plus), which can be expensive for retail traders. Additionally, you may need to pay for compatible brokers or high-quality data feeds separately.

- Limited Charting and Indicators for Technical Analysis: While excellent for order flow and liquidity, Bookmap isn’t a full-fledged charting platform. Traders who rely heavily on traditional indicators or multi-timeframe analysis might need to use it alongside another platform, such as TradingView or MetaTrader 4.

- Hardware-Intensive: Bookmap’s advanced graphics and real-time updates can be demanding on system resources. Users with older hardware might experience performance issues or lag.

- Not Ideal for Long-Term Traders: The platform is optimised for scalpers, day traders, and short-term swing traders. Long-term investors might find the granular data overkill and less applicable to their trading style.

Is Bookmap Right For You?

Bookmap is best suited for:

- Active traders (scalpers, day traders, or short-term swing traders).

- Those trading in high-liquidity markets like futures, crypto, and stocks.

- Traders who rely heavily on order flow, market depth, and liquidity data.

It might not be the best choice for:

- Long-term investors or traders focused on traditional technical analysis.

- Those with limited budgets, given the cost of subscriptions and additional data feeds.

Final Verdict: Is Bookmark Worth It?

For short-term traders, Bookmark punches above its weight. It’s not trying to reinvent the wheel but instead focuses on giving you the essential tools to spot opportunities and act on them quickly.

The platform shines in its market scanning, charting, and trade management capabilities, all while keeping the interface clean and intuitive. It’s not without flaws (advanced indicators could be more affordable), but the pros far outweigh the cons.

If you’re all about making quick, informed trades and need a platform that works as hard as you do, Bookmark is definitely worth a shot.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com