Day Trading In Somalia

Despite significant challenges, Somalia’s economy has shown remarkable resilience and a promising potential for growth, offering a hopeful outlook for day trading opportunities.

According to the International Monetary Fund, Somalia’s GDP has grown by an estimated 3.7% to over $12 billion, driven by sectors such as agriculture, telecommunications, and remittances from the Somali diaspora.

Are you ready to start day trading in Somalia? This guide will get you started.

Quick Introduction

- While the Central Bank of Somalia (CBS) plays a key role in regulating the markets, Somalia’s financial sector is still developing to strengthen the CBS’s capacity and improve the overall regulatory environment for retail investors.

- The Somali Stock Exchange (SSE) is still in its nascent stages, with efforts underway to establish a formal trading platform. As a result, traditional day trading activities are limited.

- Somalia’s largely informal economy, characterized by limited oversight and taxation by the Federal Government of Somalia, likely encompasses day trading activities. However, this informal nature complicates tax compliance for active traders, so consult a tax professional.

Top 4 Brokers in Somalia

After years of exhaustive testing, these 4 platforms stand out as the best for day traders in Somalia:

Best Brokers For Day Trading In Somalia

What Is Day Trading?

Day trading involves buying and selling financial instruments, such as stocks, commodities, and currencies, within the same day to profit from short-term price movements.

Active Somali traders may prefer stocks listed on the SSE, particularly shares of prominent local companies in the agriculture and telecommunications sectors, such as Dahabshiil Group and Hormuud Telecom. However, Somalia does not have a formal stock index.

Additionally, forex trading in Somalia is a popular choice due to the volatility of the local currency, the Somali shilling (SOS), though availability and liquidity issues pose challenges for day traders.

Somalis may also be interested in commodities, notably livestock given the thriving sector’s importance for the country’s economy.

Is Day Trading Legal In Somalia?

The legality of day trading in Somalia is unclear because of the country’s developing regulatory system.

While no specific laws or regulations explicitly address day trading, the financial markets in Somalia are largely unregulated, and the CBS is still establishing a comprehensive regulatory system for the financial sector.

The government must formally regulate or supervise online trading activities, given the current financial system. So, while it is not illegal, there are no specific protections or guidelines for day traders.

The absence of a robust regulatory framework means that you may face significant risks, including issues related to market transparency, security, and legal recourse in case of disputes.As such, I suggest choosing a platform licensed by ‘green tier’ bodies in line with DayTrading.com’s Regulation & Trust Rating, such as the FCA in the UK or ASIC in Australia. These are known for their stringent oversight and investor protection, which can provide a more secure trading environment for Somali day traders.

How Is Day Trading Taxed In Somalia?

After years of conflict and instability, the country is still rebuilding its institutions, including its tax administration. As a result, no specific tax laws explicitly address the taxation of day trading or other forms of online trading.

The general tax system in Somalia is still developing, with efforts focused on establishing basic tax infrastructure. The government has been working to implement general taxation policies, but enforcement still needs to be improved, especially in areas outside major cities.

Much of Somalia’s economy operates informally, with limited oversight or formal taxation. Day trading is likely part of this informal sector, which further complicates the issue of taxation.

However, it is worth noting that Somalia’s regular personal income tax ranges from 6% to 18% and is payable to the Federal Government of Somalia.

Getting Started

Embarking on your day trading journey in Somalia is a straightforward process, broken down into three simple steps:

- Choose a broker that accepts day traders in Somalia. The CBS oversees Somalia’s financial industry, but its regulatory framework needs to be developed more to match established markets like the UK, Europe, and Australia. Many Somalis choose international brokers, often offering stronger investor protections, such as negative balance protection. However, our research shows Somalis may have limited access to local financial markets, and instead may need to focus on regional markets across Africa and further afield.

- Set up your account. You’ll typically need a government-issued ID (like Somalia’s Citizens Identity Card launched in 2023) and proof of address to verify your trading account, like a recent utility bill. Once approved, you can fund your account using wire transfers, debit cards, or, if available, local mobile payment services like Premier Wallet.

- Start day trading. You can trade Somali companies listed on the SSE, prominent commodities like livestock and agriculture, or the Somali shilling (SOS) against other currencies. The most common currency pair is SOS/USD, but there are limited options for trading the SOS against other currencies.

A Trade In Action

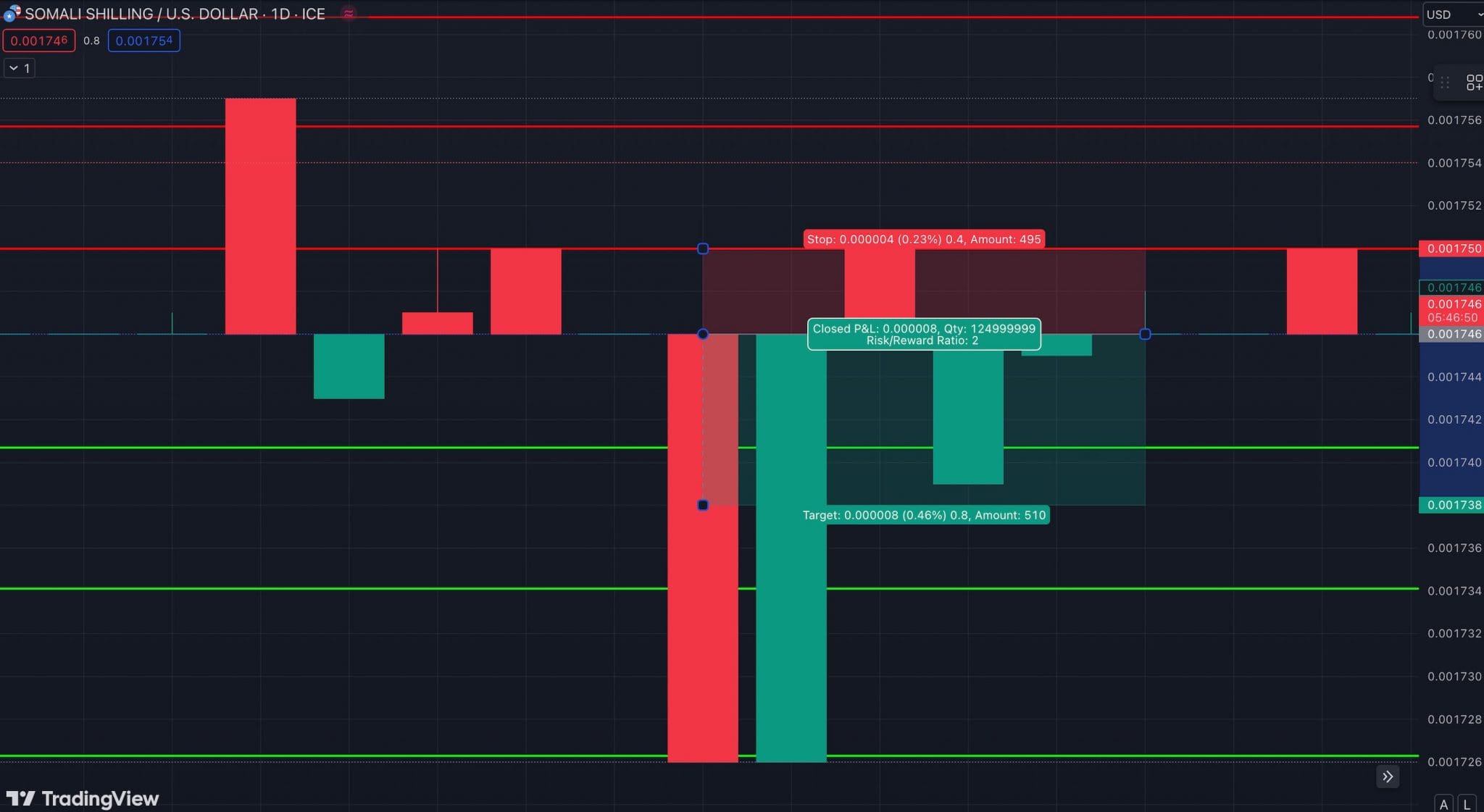

Let’s consider a scenario day trading the SOS/USD. Given Somalia’s economic challenges and the relative stability of the US dollar, the SOS/USD exchange rate can experience significant volatility.

Event Background

I began my trading day by closely monitoring the news for any economic events that could impact the SOS/USD currency pair.

Earlier in the week, there had been a significant buzz around a major announcement from the Central Bank of Somalia regarding new monetary policies to stabilize the SOS and curb inflation.

The announcement was scheduled for today, and I anticipated it would create volatility in the SOS/USD pair.

Trade Entry & Exit

As the news broke at 10:00, the Central Bank of Somalia revealed that it would raise interest rates to combat rising inflation and shore up the value of the SOS.

This was a significant move, as higher interest rates typically lead to a stronger currency due to increased demand for higher-yielding assets.

However, the Somali economy’s overall fragility made the market reaction uncertain. There was a risk that the market might interpret the rate hike as a sign of desperation, leading to a sell-off of the SOS.

I pulled up my charts and noticed that the SOS/USD pair had been in an uptrend, trading around 0.001746 just before the announcement. The Relative Strength Index (RSI) was also at 70, indicating that the pair was already in overbought territory.

With this information in mind, I decided to take a contrarian approach. I believed the market would initially react by selling the SOS, causing the SOS/USD to decline.

I entered a short position and placed a stop-loss at SOS 0.001750, just above the previous day’s high, to protect myself if the market continued to rise.

My target was SOS 0.001738, where I anticipated the pair would find support based on previous price action. At around 13:30, the pair had fallen, and my take profit order was filled.

Bottom Line

Limited market infrastructure, regulatory uncertainties, and a lack of liquidity are the primary challenges for day traders in Somalia.

The absence of a well-established stock exchange also means that traders often rely on informal networks and international platforms to engage in trading activities.

Despite these challenges, the potential for growth in Somalia’s financial sector is significant for skilled traders with a robust approach to risk management.

To get started, head to DayTrading.com’s selection of the best day trading platforms in Somalia.

Recommended Reading

Article Sources

- Central Bank of Somalia (CBS)

- Revenue Department - Federal Government of Somalia

- Somali Stock Exchange (SSE)

- Taxation in Somalia - SOMINVEST

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com