Day Trading Simulators

A free day trading simulator replicates real-time market conditions, allowing traders to practice strategies in a risk-free environment. Similar to demo accounts, no deposit is required and virtual funds are provided. We have tested free trading simulators and listed them below with full reviews.

To list the best day trading simulators in 2026, we took into account:

- The assets and markets you can practice trading

- How closely the simulator mirrors live market conditions

- Whether there is a backtesting engine with access to historical data

- The quality of the broker’s live account if you switch to real-money trading

Brokers With The Best Day Trading Simulators

These are the top 6 simulators for day traders with paper funds:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - When we used Interactive Brokers’ demo, it closely replicated the live TWS platform, including access to global markets and advanced order types. Execution speed was realistic, though some slippage was noted in fast-moving assets. Set up required basic details. Virtual balance was $1M, but paper trading was activated only after account approval.

- NinjaTrader - During our tests, NinjaTrader’s demo delivered near-instant execution and low slippage, ideal for futures and active traders. The platform exactly mirrored the live environment, including depth-of-market tools. Set up required email only, and users received $50,000 virtual balance. The demo had no time limit, making it great for long-term strategy testing.

- eToro USA - When we tested eToro USA’s demo, we found execution speeds slower than ECN brokers, but acceptable for social and crypto trading. The platform matched live trading closely, with $100K virtual balance and full access to stocks, crypto, and ETFs. No KYC needed. Slippage was moderate during volatile periods. No demo expiry.

- Plus500US - During our hands-on tests, Plus500’s demo was instantly available with no personal details needed and no expiry. The interface closely matched the live platform, with access to CFDs on forex, stocks, crypto, and indices. Execution was swift, though spreads were wider - EUR/USD averaged 0.8–1.2 pips. $40,000 virtual balance auto-refilled when depleted.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - When we tested FOREX.com’s demo trading account, it provided full access to over 80 currency pairs plus crypto, commodities, and indices. Execution speed was solid during our paper trades, with EUR/USD spreads averaging 1.2 pips on standard accounts. The platform matched live conditions well. No personal info was needed, and the $50,000 demo lasted 30 days.

Day Trading Simulators Comparison

| Broker | Free Trading Simulator | Trading Platforms | Instruments |

|---|---|---|---|

| Interactive Brokers | ✔ | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| NinjaTrader | ✔ | NinjaTrader Desktop, Web & Mobile, eSignal | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| eToro USA | ✔ | eToro Trading Platform & CopyTrader | Stocks, Options, ETFs, Crypto |

| Plus500US | ✔ | WebTrader, App | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| OANDA US | ✔ | OANDA Trade, MT4, TradingView, AutoChartist | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| FOREX.com | ✔ | WebTrader, Mobile, MT4, MT5, TradingView | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

Cons

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- The broker offers a transparent pricing structure with no hidden charges

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

How We Compare Brokers With Trading Simulators

To rank the best day trading simulators, our experts considered:

Investment Offerings

Most day trading simulators offer access to stocks and forex. However, the top programs also provide other assets and instruments, including commodities, cryptocurrencies, and futures.

We prefer providers that offer access to a wide range of markets. Not only does this provide portfolio diversification opportunities, but it also means you don’t need to open several paper trading accounts at different firms.

Entry Requirements

The top brokers provide free access to their day trading simulators, which will serve most beginners. This also comes with the advantage that you can effectively test an online broker before upgrading to a real account.

Alternatively, experienced traders may prefer to trial ideas through a paid service that offers richer market data and more advanced tools. TraderSync is a good option here.

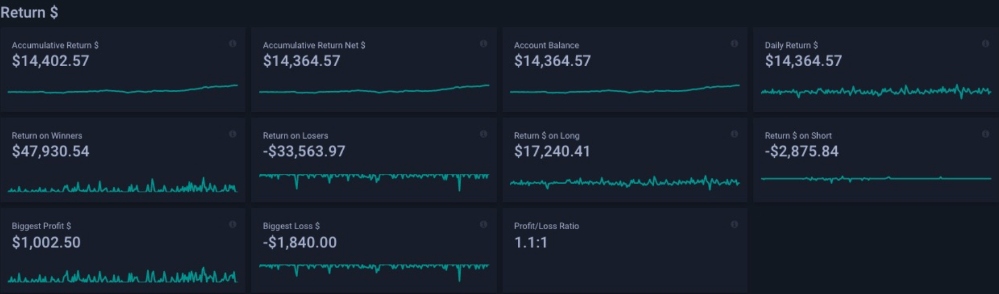

The user-friendly software offers custom playlists whereby you can quickly replay various trade setups. It also offers data on daily returns, total profits, total losses, returns from going long and short, and the net overall profit or loss.

Platform Features

The quality of the trading platform or app where you will simulate trades is an important consideration.

We look at the breadth of technical analysis tools, such as charts and indicators.

Our team also note that many investors are interested in automated trading. So, we consider whether there is access to a free simulator on MetaTrader 4 (MT4) – industry-leading software that comes with Expert Advisors (EAs).

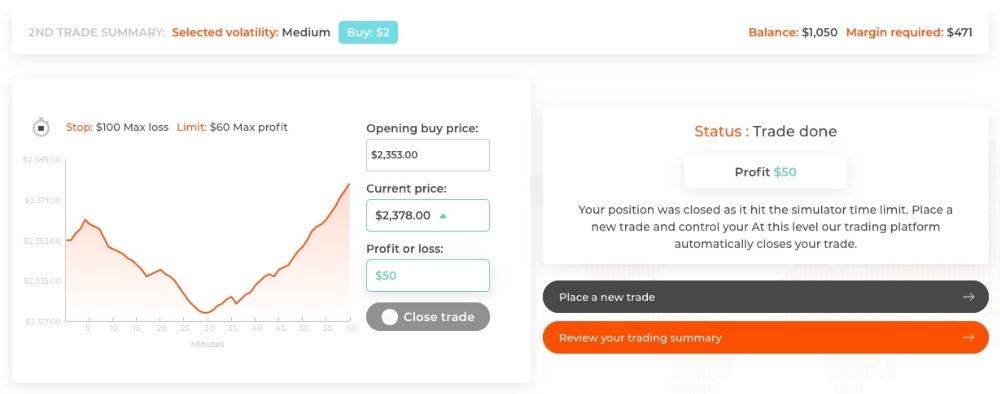

Having said that, beginners may prefer a no-frills day trading simulator from a broker like TradeNation.

This easy-to-use program walks you through the basics of setting up a day trade, from using margin to risk management parameters:

How you access the simulator service is also key. The best brokers offer a simple browser-baed solution, while other firms offer platforms that can be downloaded on Windows, Mac and Linux operating systems.

Alternatively, there may be mobile apps available for Apple and Android devices.

Simulated Market Conditions

Our experts assess how well the simulator mirrors true market conditions.

Good providers offer accurate and realistic pricing spanning a variety of markets as well as sufficient historical data for backtesting.

Based on our tests, the top firms offer upwards of 4 years of historical information with level 2 market data.

Live Account Conditions

A day trading sim is a great place to start, but many traders will eventually want to upgrade to a real-money account. With this in mind, our team evaluate the live trading conditions available at providers.

In our experience, the best brokers offer an accessible minimum deposit of <$500, tight spreads with low to zero commissions, and around-the-clock customer support to help new traders get started.

We also favor brokers authorized by tier-one regulators, such as the UK Financial Conduct Authority and the Australian Securities & Investments Commission. This is a good indication that a brokerage can be trusted.

Final Thoughts

A day trading simulator is one of the best ways to improve your trading skills. After spending time in a fake trading account, you can then switch to a live account with real money.

With this in mind, day trading simulators should not be treated as a game, but rather a tool to build confidence and test trading concepts.

Also, remember that there is no guarantee that strategies which are successful in a simulator will make money in a real account.

FAQs

What Is A Day Trading Simulator?

A day trading simulator works like a demo account, allowing traders to test and refine strategies using virtual funds.

The best programs closely replicate live conditions and also offer a backtesting engine, so traders can simulate strategies using historical data.

How Do Day Trading Simulators Work?

Day trading simulators use market data to create a trading environment that is similar to live conditions. As a result, clients can test out strategies using both real-time information and historical data.

Most brokers with day trading simulators do not require a deposit to access the test environment. Upon sign-up, you will receive a sum of virtual funds to practice trading stocks, forex or another product. This is typically in the range of $10,000 to $100,000.

What Is The Best Day Trading Simulator?

Our experts have reviewed, compared and listed the best day trading simulators with full reviews.

To rank the top simulators, we considered the assets you can practice trading on, the quality of the trading software, the amount of virtual money available, and any joining requirements.

Should I Use A Day Trading Simulator?

Day trading simulators offer several advantages. Primarily, they provide a risk-free environment to test new strategies. Beginner traders can build their confidence and develop good trading habits, while seasoned investors can trial new trade setups.

The best trading simulators are also available outside of core trading hours, allowing you to backtest ideas on the weekend, for example.

What Are The Risks Of Day Trading Simulators?

Day trading simulators cannot replicate the emotions you feel when trading with real money. As such, a day trading sim will not expose you to the same level of pressure, which can lead to over-confidence in paper trading mode.

Often, simulators will not account for all the costs that come with live trading. For example, sims rarely include slippage, which is the difference between the expected price and the actual execution price.

Finally, a strategy may work when you backtest it against historical data, but there is no guarantee it will work going forward with real money.

Are Day Trading Simulators Free?

Many brokers offer free day trading simulators. For example, eToro provides free access to its stock market and forex trading simulator for all traders that register an account.

There are even trading sims where no login details or sign-up is required, available from brokers like TradeNation. However, in our experience, these normally offer fewer features and tools.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com