Short-Term Trading

Short-term trading is where you buy and sell assets, such as stocks, currencies, or commodities, over brief periods, typically ranging from minutes to several days.

In this guide, we look at the pros and cons of short-term trading, and how beginners can use various strategies to try and generate profits, though it remains a high-risk approach to online trading,

Quick Introduction

- Short-term trading involves holding positions for a limited time, from minutes to a few days. The focus is on capitalizing on short-term price fluctuations.

- Volatile assets provide more frequent opportunities. Volatility can lead to rapid price changes, allowing you to profit from both upward and downward movements, though it also increases the potential for large losses.

- Short-term trading often relies heavily on technical analysis to identify potential entry and exit points.

- Effective risk management is crucial in short-term trading to limit potential losses, which can be thumping.

- Short-term trading requires active monitoring of the markets. You need to stay updated on relevant events and be ready to execute trades when your criteria are met.

Best Short-Term Trading Brokers

These 4 brokers are best for short-term traders based on our tests:

All Brokers for Short-Term Trading

What Is Short-Term Trading?

Unlike long-term trading, where you hold assets for extended periods, short-term trading involves buying and selling assets over relatively brief timeframes.

The approach offers the advantage of potentially quicker profits as it aims to capitalize on short-term price movements. Technical analysis tools, such as charts and indicators, are often used to identify entry and exit points based on historical price data.

This technique also allows you to start trading with smaller amounts of capital and gain practical experience relatively quickly.

However, it is important to be aware that short-term trading can be more challenging and carries higher risks due to the rapid pace of decision-making and market volatility. Success in short-term trading requires a solid trading plan, disciplined risk management, and continuous learning.

Beginners should also be prepared for the emotional aspect of trading, as short-term price fluctuations can lead to both gains and losses, requiring a level-headed approach to decision-making.

Short-term trading can be an exciting way for new traders to engage with the financial markets, but it requires dedication and a commitment to education and practice.

Types of Short-Term Trading

Short-term trading encompasses various trading styles, each with its own characteristics and timeframes. Here are some of the most popular types of short-term trading strategies:

High-Frequency Trading

High-frequency trading (HFT) involves using advanced algorithms and computer systems to execute a large number of trades within milliseconds or microseconds. It is often associated with institutional trading firms.

Scalping

Scalping is an ultra-short-term trading strategy that seeks to profit from very small price fluctuations over extremely short timeframes, often seconds to minutes.

Numerous trades are executed in a single day, aiming for small gains per trade, and often using very high leverage.

Day Trading

Day trading involves buying and selling assets within the same trading day, with no open positions held overnight.

The aim is to profit from intraday price movements by using technical analysis, chart patterns and news to make quick trading decisions.

Events-Based Trading

News and events-based trading focuses on specific events or news releases, such as earnings reports or economic data releases, to make short-term trades based on the anticipated market reaction.

Swing Trading

Swing trading is a slightly slower-paced trading strategy that involves holding positions for a few days to a few weeks, attempting to capture short to intermediate-term price swings within a larger trend.

Technical and fundamental analysis are often used together to identify entry and exit points.

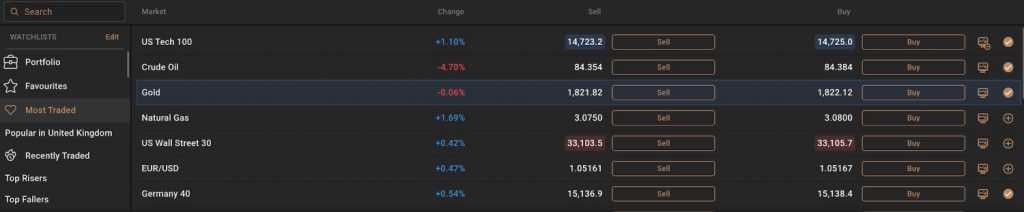

Best Markets For Short-Term Trading

Forex

Forex is one of the most popular short-term trading markets. Currencies can be traded 24 hours a day throughout the working week, and forex traders can choose from a large number of currency pairs.

The forex markets are also highly volatile, meaning price fluctuations can occur more frequently and/or dramatically. This can create opportunities for large profits, but it also comes with significant risks.

Stocks

Stocks consist of shares that represent the ownership of a fraction of a company. Stocks can be bought and sold on exchanges such as the New York Stock Exchange (NYSE).

Short-term equity in the stock market often relies on strategies that involve opening and closing positions within a single day. This is to avoid paying overnight charges.

Day traders may utilize derivatives based on the underlying price of an asset, such as contracts for difference (CFDs), to boost their earnings. Other traders simply buy and sell the actual shares.

Indices & ETFs

Indices track the performance of a basket of stocks. They are a highly liquid market to buy and sell in, making them good for short-term trading.

Indices tend to be less unstable than stocks themselves, reducing the trading risks. However, certain index prices can be volatile around earnings reports and important announcements.

Instead, many traders opt for exchange-traded funds (ETFs), securities that track the price of an index (or another asset) but can be traded like stocks. ETFs are becoming increasingly popular for short-term trading because of their cost-effectiveness and high liquidity.

Commodities

Many commodities are used in short-term trading, from precious metals like gold to energies such as natural gas. There are several ways to invest in commodities, such as futures and CFDs.

Trading directly in futures contracts is particularly risky but can be profitable. Futures contracts with a short duration are good for high-volume day trading.

Cryptocurrency

Short-term crypto traders aim to capitalize on the price fluctuations of digital currencies like Bitcoin, which can be traded 24/7. To navigate this dynamic market, this style of trading requires dedication, focus, and a well-planned strategy.

Crucially, traders need to be aware of the risks when trading cryptocurrencies on a short-term basis, due to their high volatility.

Pros and Cons of Short-Term Trading

- Quick Profit Potential: Short-term trading offers the opportunity for rapid profit accumulation by capitalizing on short-term price fluctuations.

- Flexibility: It provides flexibility to adapt to changing market conditions. You can enter and exit positions more frequently, allowing for quicker adjustments to market developments.

- Liquidity: Trading highly liquid assets makes it easier to enter and exit positions without significant price impact. This liquidity can reduce the risk of getting stuck in an illiquid investment.

- Risk Management: Strict risk management techniques, such as setting stop-loss orders and managing position sizes, can help mitigate losses and protect capital.

- Skill Development: Short-term trading can accelerate your learning process, helping you to develop analytical and decision-making skills. It provides a hands-on education in market dynamics and trading strategies.

- Information Overload: Short-term trading often requires processing a large volume of information, including news, data releases, and technical indicators, in a short amount of time. This can lead to information overload and decision paralysis, making it challenging to make timely and effective trading decisions.

- Trend Dependency: Short-term trading relies heavily on identifying and riding trends, which may not always be present in all markets.

- Limited Diversification: Lack of diversification can expose you to higher levels of risk if a single asset or sector experiences adverse price movements. Long-term trading typically provides more opportunities to diversify holdings across different asset classes and industries, reducing the overall risk.

- Overnight Risks: Holding positions overnight creates risk, including potential gaps in prices.

- Margin Requirements: Depending on your broker and strategy, short-term trading may require significant capital to meet margin requirements for multiple positions.

Short-Term Trading vs Investing

Short-term trading and investing are two distinct approaches, each with its own set of characteristics and objectives.

The primary difference between short-term trading and investing is the time horizon. Short-term trading involves buying and selling assets over brief periods. In contrast, investing involves buying assets with the intention of holding them for an extended period, often years or even decades, with the goal of long-term wealth accumulation and capital appreciation.

Short-term trading relies heavily on technical analysis to make relatively quick trading decisions. Investing, on the other hand, typically depends on fundamental analysis, assessing factors like a company’s financial health, growth potential, and industry trends.

Short-term trading tends to be more speculative and carries higher risk due to the frequent trading and exposure to short-term market volatility. Investing generally weathers market ups and downs with the expectation that investments will grow over time.

Short-term trading creates more frequent gains and losses, while investing may see less fluctuation in the short run, but potentially grow substantially over the long term.

Both approaches have their merits and drawbacks, and you should choose the one that aligns with your financial goals, risk tolerance, and trading philosophy.

Tips For Short-Term Trading

Successful short-term trading requires a well-defined strategy and a disciplined approach. While there is no one-size-fits-all answer, here is a general outline of key elements that can contribute to a successful short-term trading strategy:

- Technical Analysis: Use indicators and chart patterns to determine entry and exit points. Key things to look for are clear trends, support and resistance levels, and moving averages.

- Risk Management: Deploy effective risk management systems to protect your funds. Set stop-loss orders to cap losses, and establish your risk-reward ratio to make sure that gains will outweigh losses.

- Position Sizing: Decide the size of each trade based on your risk tolerance and capital. Avoid over-leveraging – this can cause significant losses.

- Time Frame Selection: Think about the the duration of your positions. Short-term trading typically involves holding positions for minutes to days, so choose a time frame that aligns with your strategy and market analysis.

- Entry And Exit Rules: Have clear criteria for when you will enter and exit trades. This can include specific price levels, technical signals, or fundamental triggers.

- Discipline: Retain discipline and control. Try not to chase the market or deviate from your strategy due to fear or greed. Stick to your plan, even if some trades result in losses.

An Example Short-Term Trade

Here is an example of a short-term trade involving the EUR/USD currency pair:

1. Market Research And Analysis

You start by analyzing the EUR/USD currency pair on a 1-hour chart. You notice that the pair has been in a recent uptrend, with higher highs and higher lows, and there is a potential bullish reversal pattern forming.

2. Define Your Trading Plan

You decide to enter a long (buy) position if the price breaks above a specific resistance level at 1.2000, which would confirm the bullish reversal.

You set your take-profit level at 1.2050 and your stop-loss level at 1.1970, aligning with your risk tolerance and maintaining a risk-reward ratio of approximately 1:2.

3. Risk Management

You calculate your position size based on your risk tolerance and the distance between your entry (1.2000) and stop-loss (1.1970) levels to ensure you’re only risking 1-2% of your trading capital.

4. Monitor Market Conditions

You continuously monitor the EUR/USD chart, watching for a clear breakout above 1.2000.

5. Execute The Trade

When the EUR/USD price breaks above 1.2000, you place a market order to buy the currency pair.

6. Manage Your Trade

You keep a close eye on the trade, watching for any signs of a reversal or adverse price movement. You adjust your stop-loss and take-profit levels if necessary based on the market’s behavior.

7. Exit The Trade

Once the EUR/USD reaches your predetermined take-profit level at 1.2050, your trade automatically closes, and you secure your profit.

Alternatively, if the price hits your stop-loss level at 1.1970, you exit the trade to limit your losses.

8. Review And Learn

After the trade is complete, you review your performance and the factors that influenced the trade’s outcome. You use this analysis to refine your trading strategy for future trades.

Bottom Line

In this tutorial, we have explored some of the most important areas of consideration when short-term trading. This style of online trading can be appealing for its potential quick returns, but it is not suitable for everyone, especially beginners, who may find it emotionally and mentally demanding.

Successful short-term trading requires a solid understanding of technical analysis, risk management, and the ability to make quick and disciplined decisions. Once mastered, it can offer excellent opportunities for profit within brief timeframes.

Use our list of the best brokers for short-term trading to get started.

FAQ

Is Short-Term Trading Suitable For Beginners?

Short-term trading can be challenging for beginners due to its inherent complexity, higher risk, and the need for quick decision-making. It demands a strong understanding of technical analysis, risk management, and the ability to handle the emotional stress associated with frequent trading.

A complete beginner may benefit from starting with a longer-term trading approach to gain a foundational understanding of financial markets and build skills before transitioning to short-term trading.

However, you can explore short-term trading with smaller capital amounts to gain experience gradually while learning from your trades. We also recommend starting with a demo account.

Is Short-Term Trading The Same As Day Trading?

No, although they share similarities. Short-term trading encompasses a broader range of strategies where you buy and sell assets over relatively brief timeframes, which can range from minutes to days.

Day trading, on the other hand, is a specific subset of short-term trading where you buy and sell assets within the same trading day, with no open positions held overnight.

Is Short-Term Trading The Same As Investing?

No, short-term trading is fundamentally different from investing. Short-term trading involves buying and selling assets over relatively brief time periods to potentially profit from short-term price fluctuations.

Investing involves a longer time horizon, where you purchase assets with the intention of holding them for an extended period, typically years or even decades, with the goal of long-term wealth accumulation and capital appreciation. Investing often relies on fundamental analysis and is less concerned with short-term price movements.

Can All Assets Be Traded In The Short Term?

While many assets can be traded in the short term, not all assets are equally suitable for short-term trading. The suitability of an asset for short-term trading depends on its liquidity, volatility, and trading hours.

Highly liquid assets like major currency pairs, large-cap stocks, and commodities are often preferred for short-term trading because they offer ample trading opportunities and narrow bid-ask spreads. Additionally, assets with sufficient price volatility provide opportunities for profit within short timeframes.

However, assets with low liquidity or erratic price movements may be challenging to navigate effectively.

Do You Need A Lot Of Money To Trade Short Term?

The amount of money you need for short-term trading can vary widely depending on your strategy, risk tolerance, and the assets you choose to trade. While having a larger trading capital can provide more flexibility and allow for larger positions, short-term trading can be adapted to different account sizes.

Many brokers offer the option to trade with leverage, which can amplify capital but also increase potential losses, so it should be used cautiously.

Start with a smaller amount and gradually increase your position size as you gain experience and confidence in your trading skills while maintaining strict risk management practices.

Article Sources

- Long-Term Secrets to Short-Term Trading, Larry Williams, 2011

- A Beginner's Guide to Short-Term Trading: Maximize Your Profits in 3 Days to 3 Weeks, Toni Turner, 2008

- The Complete Guide to Investing in Short-term Trading: How to Earn High Rates of Return Safely, Alan Northcott, 2007

- Street Smarts: High Probability Short-term Trading Strategies, Laurence A. Connors, Linda Bradford Raschke, 1995

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com