Share Baskets

Share baskets group individual stocks into one product, treating them as a single order. Traders can use share baskets to make a customized selection based on their personal interests, prosperous market sectors, or high dividend-paying companies.

This guide explains the mechanics of trading share baskets, understanding their operations, initiating transactions, plus the benefits and risks. We also share our pick of the top brokers for share baskets.

Quick Introduction

- Share baskets offer diversified exposure to various assets like stocks, bonds, or commodities in a single investment, spreading risk.

- These baskets are often curated around specific themes, sectors, or strategies, to align investments with particular trends or interests.

- Trading share baskets streamlines the process of managing multiple assets as they can be bought or sold in one transaction.

- Fees associated with share baskets, including management fees and transaction costs, can impact overall returns.

- Choose a reputable broker to help ensure access to a wide range of share baskets and favorable trading conditions.

Best Brokers With Share Baskets

We recommend these 4 brokers for share basket trading thanks to their low fees, reliable platforms and high trust scores:

What Is A Share Basket?

A share basket is a composite investment package that combines a range of assets such as stocks, bonds, commodities, and other securities, consolidating them into a unified and tradable entity.

These baskets are curated around specific themes, strategies, or sectors, offering you a convenient way to gain exposure to a diversified portfolio without individually managing each asset.

They provide a streamlined approach to online trading, allowing you to access a broader array of investments in one transaction, which can mitigate risk by spreading it across multiple holdings.

Share baskets also offer flexibility as they can be bought and sold like individual stocks.

Share baskets can be particularly beneficial if you are seeking diversification but lack the time or expertise to actively manage a wide array of individual assets.

How Do Share Baskets Work?

Share baskets operate through structures like ETFs or mutual funds, wherein you buy shares of the basket, representing a fractional ownership of the underlying assets within it.

When you purchase shares of a basket, you effectively gain exposure to the entire portfolio of assets held within that basket.

For instance, an ETF tracking the S&P 500 index will hold all the stocks in that index in proportion to their weightings. As the value of the underlying assets within the basket fluctuates, the value of the shares in the basket also adjusts accordingly.

For example, if you are using a dollar amount to allocate $10,000 across a basket of 20 securities, $500 of each security is purchased.

The process of trading share baskets is similar to trading individual stocks on an exchange. You can buy or sell shares throughout the trading day at market prices.

The creation and redemption mechanism of ETFs, in particular, helps to keep the price of the ETF close to the value of its underlying assets.

“>Overall, share baskets provide you with diversified exposure to multiple assets in a convenient and efficient manner, offering flexibility, liquidity, and the ability to tailor portfolios according to specific investment goals or market strategies.

Example Trade

Let’s assume you are intrigued by the potential of autonomous driving technology but aren’t certain which individual companies will emerge as leaders in the field.

Traditionally, you would research and invest directly in specific companies within the autonomous driving sector. You would need to analyze various companies, such as Tesla, nVidia, and other firms dedicated to autonomous vehicle technology.

You would then buy shares in individual companies based on your research and analysis, aiming to pick the companies you believe will outperform others in the industry.

Alternatively, you can invest in an autonomous driving share basket offered by a brokerage. This basket comprises various companies involved in autonomous vehicle technology, such as Tesla, Nvidia, Alphabet (Google’s parent company), and other related firms.

By purchasing this basket, you gain exposure to a diversified portfolio of companies within the autonomous driving sector, spreading your investment across multiple entities.

Comparatively, investing in the autonomous driving share basket provides diversification across multiple companies in the sector, reducing the risk associated with investing in any single stock.

Importantly, though, buying individual stocks can allow for more precise targeting of companies, potentially yielding higher returns if the chosen companies perform exceptionally well.

Trading Fees

The costs involved with trading share baskets will vary depending on the broker and assets within the created grouping. Some share basket brokers will charge a commission fee and others will offer a spread-based pricing model.

As an example, we have broken down the stock basket trading conditions at a top broker, CMC Markets:

| Big Tech | Gaming | UK Banks | |

|---|---|---|---|

| Margin Rate | 20% | 20% | 20% |

| Commission | $0 | $0 | $0 |

| Spreads | From 1.5 pips | From 3 pips | From 3 pips |

| Overnight Fee | 0.0145% | 0.0145% | 0.0135% |

| Annual Holding Cost (Sell) | 1.9% | 1.8928% | 4.9269% |

| Annual Holding Cost (Purchase) | 5.3% | 5.3% | 1.6269% |

FXCM, on the other hand, does not charge any fees to enter or exit a position. All costs are included within the spread. There is a 20% margin requirement and a maximum number of 200 contracts per trade for all share baskets.

How To Trade Share Baskets

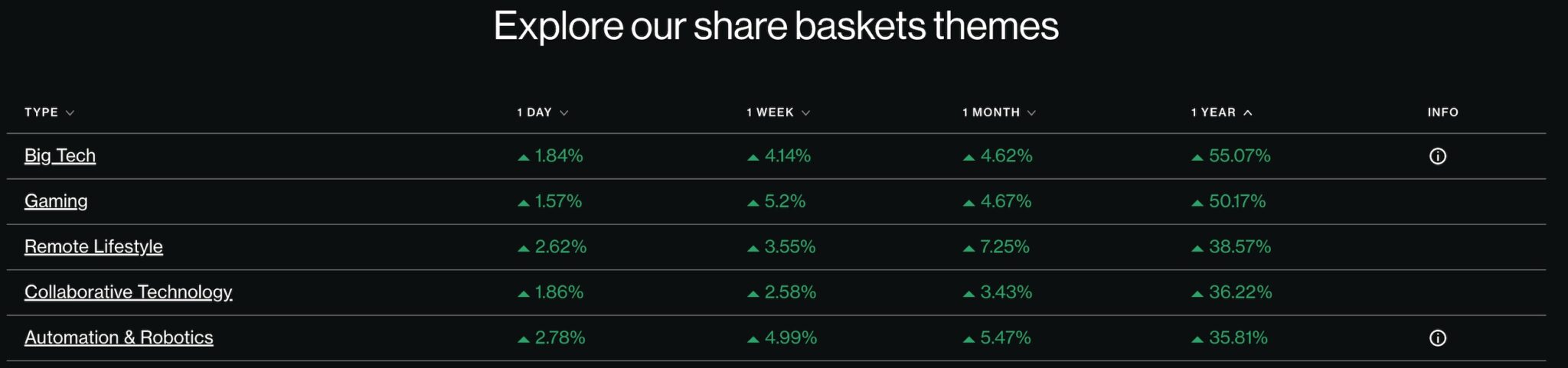

Share baskets are popular among investors who believe that securities tied together in a specific sector or by a certain theme will perform well.

These investors will usually be willing to buy the share basket and hold onto it through an acceptable amount of volatility, benefiting from dividends while waiting for the share basket’s value to reach its target level.

Importantly, you will need to find an online broker that offers share baskets trading. The best brokers will provide both pre-made share baskets and fully customizable products so you can add a bespoke selection of stocks to a collection.

FXCM, for example, offers 15 ready-made baskets. These are selected by themes, including US banks, airlines, travel & hospitality, and gaming. Each share basket contains four to six companies with varied inception weights.

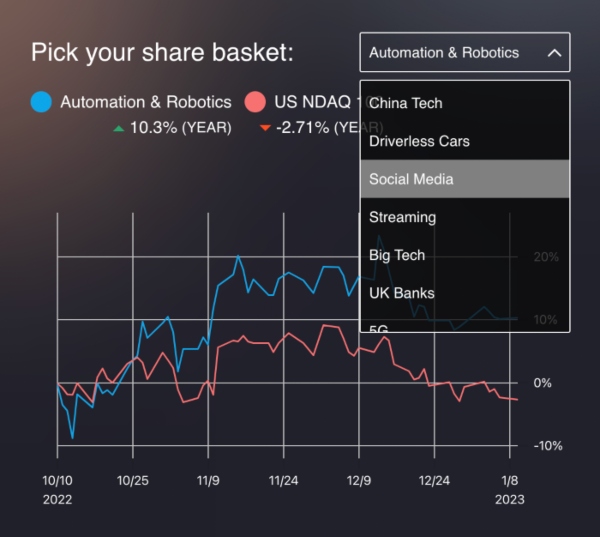

Some brokers, such as CMC Markets, offer share basket derivatives, providing an excellent way for traders to use this financial instrument in shorter-term speculative trades with leverage of up to 1:5.

CMC traders can spread bet or invest via CFDs on the broker’s basket portfolios designed around a specific theme. This includes social media, UK banks, renewable energy, and mobile payments. Helpfully, company weightings within each index are suggested by the broker’s analysts.

Interactive Brokers offers traders an advantage with the opportunity to create bespoke baskets from scratch.

Using the TWS BasketTrader, investors can drag individual assets into a basket and amend individual order sizes and prices before opening a position. The tool is fully flexible, meaning established basket portfolios can be managed and rebalanced at any time.

Pros & Cons Of Trading Share Baskets

Pros

- Basket shares allow you to spread risk across multiple assets or sectors in a single trade. This diversification can help mitigate the impact of volatility in any single asset and potentially stabilize overall portfolio performance.

- Trading basket shares streamlines the process of managing multiple assets, saving time and effort in research and transaction execution.

- Basket shares can cater to specific themes, sectors, or strategies, so you can align your investments with particular market trends, industries, or investment themes.

- Many basket shares, such as ETFs, trade on major exchanges and offer high liquidity, allowing you to buy or sell shares throughout the trading day at market prices.

- Trading basket shares can be cost-effective compared to buying individual stocks or securities separately due to lower expense ratios, reduced transaction costs, and often lower management fees.

Cons

- Too much diversification can lead to overexposure across various assets, potentially diluting the impact of successful investments and limiting potential returns.

- Some basket shares, especially ETFs, may not perfectly track the performance of the underlying assets or index due to factors like management fees, rebalancing, or imperfect replication of the index, leading to discrepancies between the product’s performance and the intended benchmark.

- Customization options can be limited, constraining the ability to fine-tune your portfolios to specific needs.

- Basket shares’ performance is subject to market fluctuations and can be impacted by broader market trends or volatility. A downturn in the market or specific sectors can affect the value of the entire basket, potentially leading to losses.

- Understanding the composition of some basket shares can be complex, especially when they include a large number of assets. Transparency in underlying holdings may vary, making it challenging to fully grasp the exact components and weights within the basket.

Bottom Line

Investing in share baskets offers a convenient avenue to access a diverse array of securities linked by a particular theme. This approach is ideal for traders and investors seeking exposure to specific sectors or company groups, safeguarding against the volatility individual companies might encounter.

Nonetheless, this broader diversification might result in comparatively lower returns when weighed against traditional stock trading strategies.

FAQ

What Are Share Baskets?

Share baskets represent a collection of individual stocks, such as those from US-based technology companies, consolidated into a single entity. This means they are bought and sold together as one instrument.

How Did Trading Share Baskets Start?

Stock basket trading first began in 1989 on the NYSE (New York Stock Exchange). The US SEC (Securities and Exchange Commission) approved the new product, originally permitting investors to purchase all the individual stocks of the S&P 500 in one order. On the first day, nine total ‘baskets’ were bought.

Since then, thousands of institutional firms and professional investors have used a share basket trading strategy to improve the efficiency of the trade process and maximize profits. Thanks to these benefits, it is now becoming increasingly popular among retail traders.

Can Anyone Trade Share Baskets?

Yes, most traders can access share baskets through a broker providing this service.

However, there are associated costs, and many share basket brokers enforce a minimum investment requirement, potentially making it less feasible for beginners to engage in this trading opportunity.

What Are The Advantages Of Share Baskets Trading?

Trading share baskets offers one key benefit: a degree of insulation from volatility. When one stock in a basket experiences a notable price decline, it can potentially be balanced out by another stock’s price increase.

Adjusting weightings and adding or removing stocks can further refine the basket, enhancing its stability as an index.

How Can I Invest In Share Baskets?

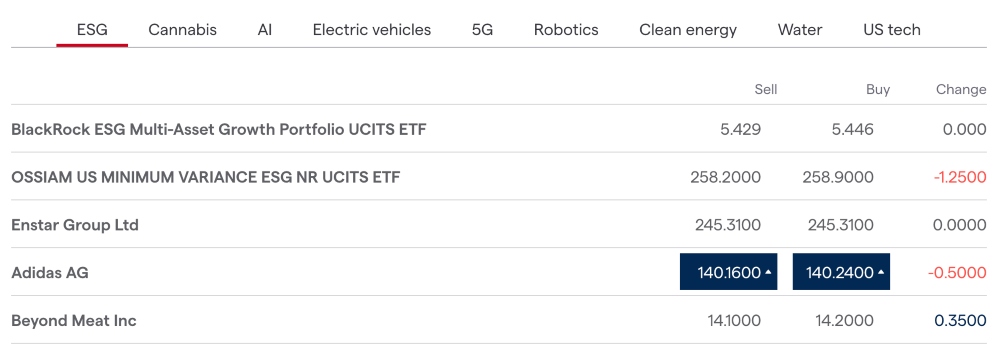

Initially, choose a broker providing share basket trading services, such as CMC Markets, IG or eToro. Following this, select from the provided curated share baskets or assemble your own portfolio from individual stocks.

What Is The Best Share Basket To Trade?

There isn’t a definitive ‘best’ share basket. Take the time to analyze markets and sectors before choosing an investment portfolio. Consider reviewing recent company updates, ESG efforts, product launches, and other relevant information.

Keep in mind, though, that past performance doesn’t guarantee future profits.

Do I have To Pay Taxes On Share Baskets?

As stock baskets may be made up of a group of dividend-paying stocks, investors may be impacted by dividend payments and may also be liable to pay taxes on them. Traders with a long position on a share basket will be credited a dividend adjustment, while those with a short position will be debited.

If you benefit from dividend payments from a share basket that includes US stocks, you may be liable to pay a withholding tax of 30% of the dividend adjustment. This will usually be automatically deducted from your account by your broker, but it’s worth checking.

Traders in the UK and other countries that have tax agreements with Washington can complete a W8-BEN form to mitigate their withholding tax liability.

Some brokers such as eToro have a quick and convenient system that allows users to sign the form by clicking a pop-up window, but you may need to fill out and supply the form yourself.

Article Sources

- CMC Markets - Share Baskets

- FXCM - Stock Baskets

- Interactive Brokers - TWS BasketTrader

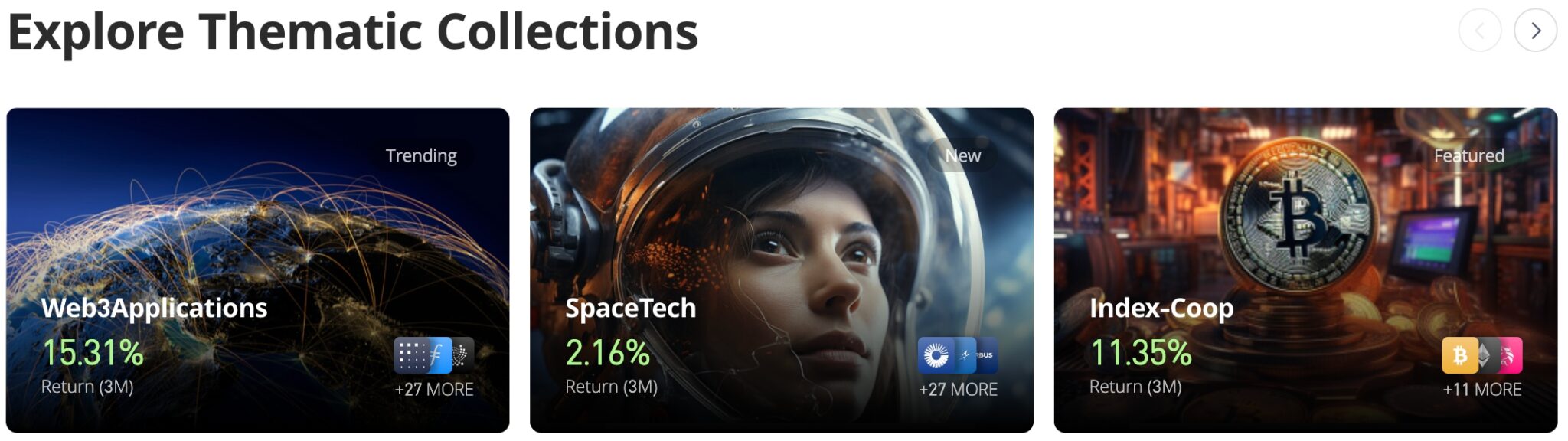

- eToro - Thematic Portfolios

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com