Forex Trading In Singapore

Singapore’s strategic location as a global financial hub is attracting forex traders. Whilst according to a report by the Bank for International Settlements (BIS), the Singapore dollar (SGD) ranks as one of the 15 most traded currencies, underlining Singapore’s importance in the foreign exchange market.

Learn how to start forex trading in Singapore through practical insights and example trades.

Quick Introduction

- The Singapore dollar (SGD) is actively traded in the forex market, particularly against popular currencies like the US dollar (USD), euro (EUR), Japanese yen (JPY), and Australian dollar (AUD).

- Forex trading in Singapore is regulated by the Monetary Authority of Singapore (MAS), helping to ensure a secure and transparent trading environment.

- The forex trading community in Singapore is supported by advanced technological infrastructure, cutting-edge tools, and a range of educational resources, helping beginners navigate the forex market.

Top 4 Forex Brokers In Singapore

Our latest tests show these 4 platforms stand out as the best for trading currencies in Singapore:

How Does Forex Trading In Singapore Work?

In Singapore, initiating forex trading involves registering for an account with an online brokerage. These firms serve as intermediaries, connecting you to the foreign exchange market and providing you with platforms and FX apps for analysis and trade execution.

You can then speculate on the exchange rates of various currency pairs – such as USD/SGD (US dollar/Singapore dollar), EUR/SGD (euro/Singapore dollar) or SGD/JPY (Singapore dollar/Japanese Yen), aiming to profit from fluctuations in these rates.

Brokerages typically extend short-term trading opportunities across numerous currency pairs, encompassing majors (the most traded currencies globally), minors (major currencies excluding the USD), and exotics (one major currency and one currency from a developing or emerging economy).

Is Forex Trading Legal In Singapore?

Forex trading is legal in Singapore. The MAS regulates forex trading and oversees the financial markets in Singapore.

Forex brokers operating in Singapore need to be licensed and regulated, ensuring that they adhere to strict regulatory standards and provide a secure trading environment.

As long as you trade with forex brokers licensed to operate in Singapore – and you comply with relevant regulations – you can legally participate in forex trading in Singapore.

Is Forex Trading Taxed In Singapore?

Forex trading profits are generally not subject to Singapore taxes if you engage in trading as part of personal investment activities and not as a source of income.

Forex trading falls under the category of capital gains, and Singapore does not impose capital gains tax. Therefore, any profits made from trading currencies online, whether realized or unrealized, are typically not taxed.

Although forex trading profits are not taxed in Singapore, you are still required to comply with reporting requirements set by the Inland Revenue Authority of Singapore (IRAS). You must accurately report your trading activities and any capital gains or losses in your annual tax returns, even if no tax is payable on forex trading profits.

Losses incurred from forex trading can generally be offset against other income for tax purposes, but there are specific rules and limitations regarding the treatment of capital losses in Singapore.

When Is The Best Time To Trade Forex?

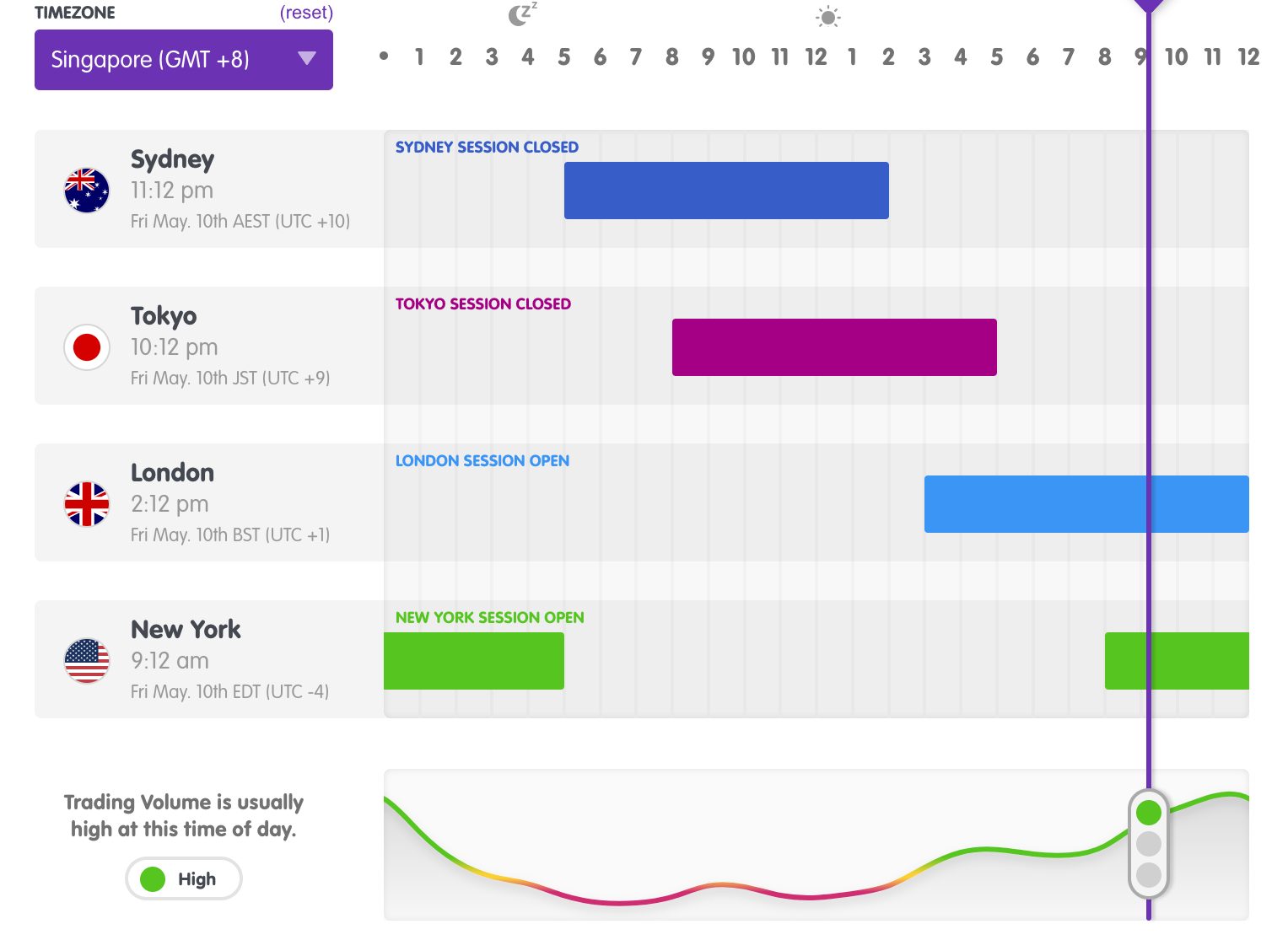

In the Singapore Standard Time (SGT) timezone, the most favorable times to trade the SGD are during the Asian trading session, typically from 9:00 am to 5:00 pm SGT. This period sees increased activity as traders in the Asia-Pacific region, including Singapore, engage in forex transactions.

Additionally, the overlap between the Asian and European trading sessions, occurring from around 1:00 pm to 5:00 pm SGT, presents opportune moments for SGD trading. During this time, liquidity and volatility tend to be higher as traders from both regions are actively participating in the market – providing optimal conditions for day trading in Singapore.

Towards the end of the Asian session and the start of the European session, approximately from 5:00 pm to 9:00 pm SGT, trading activity may also remain robust, offering further potential trading opportunities.

Example Trade

To help you understand how trading forex works in practice, here’s a step-by-step guide to a short-term (intraday) trade I made on the USD/SGD currency pair:

Event Background

Before making a trade, I tried to understand the significance of Singapore’s recent GDP data release.

GDP is a key economic indicator that measures the overall economic performance of a country. A higher-than-expected reading is typically positive/bullish for the SGD, while a lower-than-expected reading is seen as negative/bearish for the SGD.

Market Analysis

Before the GDP data release, I conducted thorough market analysis on the USD/SGD currency pair.

I analyzed technical indicators, such as support and resistance levels, and fundamental factors – including interest rates and geopolitical events – to gauge market sentiment.

Economic Calendar

I also consulted an economic calendar to determine the exact date and time of the GDP data release.

Economic calendars are available on various financial websites and trading platforms (the one on TradingView is excellent), and provide information on upcoming economic events and their potential impact on currency pairs.

Interpretation Of Data

Based on my analysis of the GDP data and market conditions, I had to decide whether to buy or sell the USD/SGD currency pair.

As the GDP number was lower than the previous reading (0.1% compared to 1.2%), I anticipated SGD depreciation, so entered a long position (buying USD/SGD). Conversely, if I expected SGD appreciation, I would have entered a short position (selling USD/SGD).

Pre-Trade Entry

As the GDP data release approached, I monitored the market closely for any price action or volatility.

Once the data was released, I observed the initial market reaction and waited for a clear trend to emerge before entering a trade.

Position Sizing & Risk Management

When I was ready to make a trade, I determined my position size based on my risk tolerance.

I also implemented an appropriate risk management technique – in this case a stop-loss order – to limit a potential loss of 2% of my account balance in case the market moved against my position.

Trade Entry

Once the forex trade was opened, I monitored the market closely for any changes in price action or new developments.

I also adjusted my stop-loss level as the price moved in my favor to manage risk and optimize potential profits.

Trade Exit

As I had already set a stop-loss and expected to hold the trade for the remainder of the trading day, I didn’t have to worry about setting a take-profit level. However, I could have potentially closed the trade early if the market moved against my position before hitting my stop-loss level.

As the trend was strong, I held my position open for the entire trading day to maximize profits – a total of 15 hours and 45 minutes for a gain of 59.4 pips.

Post-Trade Analysis

After closing the trade, I conducted a post-trade analysis to evaluate my performance and identify any areas for improvement.

I also reviewed the impact of the GDP data release on the USD/SGD currency pair and assessed the effectiveness of my trading strategy.

I recommend all beginners start with forex demo accounts. These allow new traders to gain practical experience without risking real capital.

Engaging with online forex communities also provides opportunities to learn from other traders’ experiences and share knowledge.

Bottom Line

Forex trading in Singapore is well regulated under the oversight of the MAS. You can access a wide range of currency pairs through MAS-licensed brokers, utilizing advanced trading platforms and tools.

Singapore’s strategic position as a global financial hub, coupled with its robust regulatory framework, provides you with a conducive environment for participating in the dynamic forex market.

With access to 24-hour trading sessions and a wealth of resources, forex trading in Singapore offers opportunities for profit and growth for both novice and experienced traders.

Recommended Reading

Article Sources

- OTC foreign exchange turnover in April 2022 - Bank of International Settlements

- Gains from sale of property, shares and financial instruments - IRAS

- Forex market time zone converter - BabyPips

- Monetary Authority of Singapore (MAS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com