Scalping Forex

Scalping involves the swift execution of many trades over a short period to exploit small price discrepancies. This strategy can be especially effective when trading forex due to the volatility, high liquidity and tight spreads associated with this asset class.

Quick Introduction

- Scalping forex is a short-term strategy where individuals seek to make tiny profits on multiple transactions over the course of the day.

- The fast-paced nature of forex scalping caters to energetic, stress-tolerant active traders.

- Not all forex trading platforms allow scalping, mainly due to the strain that this high-frequency trading system can place on their platforms.

- To refine their setup before risking money, we recommend forex scalpers use a broker that offers a demo account.

Best Scalping Forex Brokers

We recommend these 4 brokers for forex scalping thanks to their low fees, reliable order execution, stable platforms and demo accounts:

How Forex Scalping Works

Forex scalpers seek to exploit small price changes in currency pairings. Trades are usually opened and closed within a matter of minutes, even seconds, so market participants will look to execute dozens (perhaps even hundreds) of transactions each day to build up a decent profit.

Over the course of the day, traders usually try to ‘scalp’ between 5 and 10 pips from each trade they make.

The term pip is short for ‘percentage in point’ or ‘price interest point,’ and is a standard unit of movement in currency pairs.

The pip represents the smallest price move that can occur in the exchange rate of a currency pair. For the majority of currency pairs one pip is equal to 0.0001. The main exception is the Japanese yen, where one pip corresponds to 0.01.

In the EUR/GBP currency pairing – which compares the value of the euro relative to the British pound – a move from 0.8591 to 0.8592 would represent a movement of one pip.

To be successful at forex scalping, you must be able to make and execute decisions quickly, carefully manage risk, and be an expert at using technical analysis tools.

Pros and Cons Of Forex Scalping

Pros

- Rapid profit-building – Profits can be made quickly by trying to capture minor price movements across a large number of forex trades.

- Reduced risk exposure – As trades are typically open for only a short period, the exposure to market risk is minimized compared to longer-term trading strategies.

- Many opportunities to earn – High forex trading volumes provide hundreds of chances to turn a profit every day.

- Effective during ranging markets – By seeking to exploit small market movements, traders can make a profit even when currency pairs are largely rangebound.

- Less impact from macroeconomic events – Scalping strategies are driven by technical analysis rather than market developments and news releases. This means that forex traders generally require less knowledge of fundamental analysis compared to those using other trading approaches.

Cons

- High trading costs – Frequent trading means that transaction costs can rapidly mount up via spreads and commissions, putting the squeeze on trader profits.

- Mentally demanding – Short-term trading systems like forex scalping require constant attention and rapid decision-making. This can make them highly stressful and mentally draining.

- Danger of overtrading – A focus on high trading volumes creates the constant risk of a trader entering and exiting positions without undertaking thorough analysis.

- Technological risks – Problems like broadband outages and broker platform issues can disrupt dealing activity, resulting in missed trading opportunities and even creating losses.

Forex Scalping Strategies

Forex scalpers look to execute trades within extremely short timescales, usually seconds or minutes. The time intervals they use generally range from 1 minute (M1) to 15 minutes (M15).

However, not all scalping deals are based on fixed time intervals. Tick charts, for example, display the number of intraday trades that have been executed, each of which creates a new bar on the chart regardless of how much time has elapsed.

Two of the most common forex scalping systems involve using M1 and M5 charts. Here are some examples of how a trader can make these work in practice.

1-Minute Scalping

The 1-minute scalping forex strategy can work well for aspiring traders due to its relative simplicity. Decisions are made quickly, and beginners receive rapid feedback on their choices, allowing for a faster learning curve.

That said, scalping on the M1 timeframe is still demanding and requires a strong level of concentration. Generally, a trader will be looking to profit around 5 pips per trade. This low target means that trading volumes are key, and a forex scalper may find themselves placing over 100 trades per day.

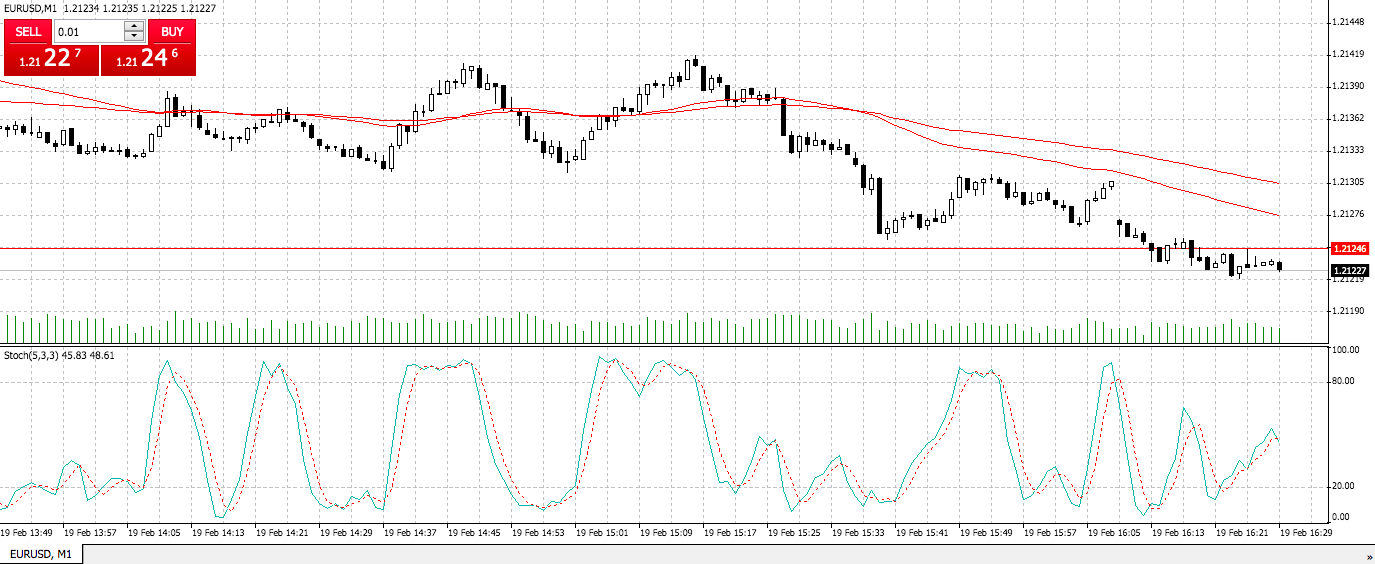

They can then set their Stochastic Oscillator to 5,3,3, and set their exponential moving averages (EMAs) to periods of 50 and 100.

The indicators will provide signals for long and short orders. For a long order, traders will wait until the 50-EMA crosses above the 100-EMA, meaning an uptrend is likely. Once the price comes back to the EMAs and the Stochastic indicator is above the 20 level, then a long position can be opened.

Conversely, for a short order, forex scalpers must wait for the 50-EMA to fall below the 100-EMA, with the Stochastic indicator falling below 80.

Tip: Forex traders can use this system within the London and New York trading sessions when volatility is highest.

5-Minute Scalping

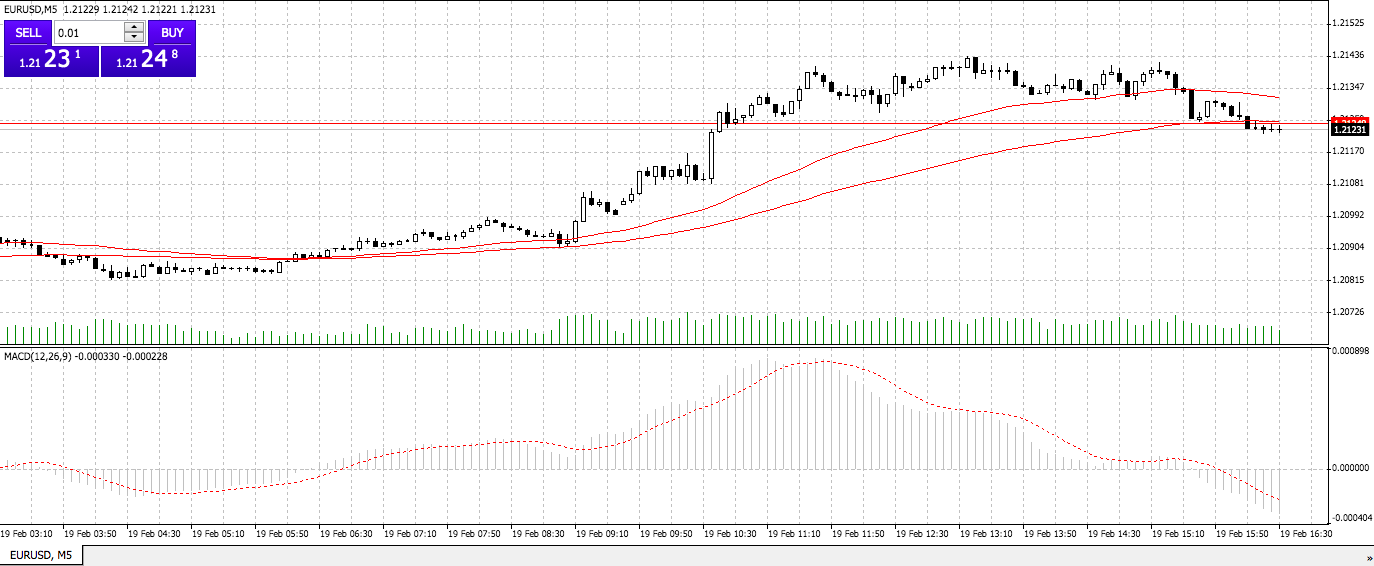

Traders who plump for a 5-minute scalping forex strategy can use a 50-EMA and 100-EMA, as well as a Moving Average Convergence Divergence (MACD) set at 12,26,9. Individuals trading on an M5 timeframe can have a profit target of 10 pips per trade.

For long trades, scalpers will wait for the asset to trade above both EMAs. Once the price has broken above the 50-EMA by 10 pips or more, and if the MACD crosses to positive within the previous 5 bars, then a long position can be opened.

The initial stop can be set at 5 bar low from the entry. The trader can then exit in two halves:

- At two times risk (moving the stop to breakeven)

- Then again when the price breaks below 50-EMA by 10 pips

If the price is simply trading between the two EMAs, then the trader can hold off from opening.

For a short trade, the investor can wait for the asset to be below both EMAs. Once it has broken below the 50-EMA by 10 pips or more, and once the MACD crosses to negative within the last 5 bars, then a short position can be opened.

Again, the trader can establish the initial stop at the 5 bar high from the entry and exit the first half at two times risk, moving the stop to breakeven, and the remainder when the price breaks above the 50-EMA by 10 pips.

They should not take the trade if the price is simply trading between the 50 and 100 EMA.

How To Start Scalping With Forex

Using a forex scalping system can help a trader get started more quickly than, say, if they decided to trade using the longer time intervals associated with day trading or swing trading.

This is because the short-term price movements that scalpers try to exploit are less driven by fundamental factors like economic indicators, central bank decisions and political events.

So new forex traders need not spend as long learning about such phenomena compared with investors who use other trading strategies.

That said, forex scalping trading does offer unique challenges to novice investors. Its high-speed nature can be stressful for inexperienced traders, while market noise (random price movements) can also throw up confusion.

Forex scalping also requires a solid understanding of technical analysis.

Talking Technical

This discipline involves looking at historical price data and trading volumes to try and successfully predict future market movements.

Charting provides traders with immediate and visual cues that allow them to make rapid dealing decisions, a critical part of forex scalping.

Individuals will use chart patterns, moving averages, and trendlines to determine whether a currency pairing is trending upwards, downwards or sideways.

As you can see, some brokerages like Plus500 allow their customers to carry out technical analysis using their trading platforms.

Traders can also buy charting software that offers advanced tools and customization benefits.

Technical analysis is a complex discipline that demands a lot of attention. Scalpers who don’t know their Bollinger Band from their Ichimoku Cloud can often find themselves in a lot of trouble!

Automated Trading

Certain brokers also offer the option of automated forex trading. Forex robots (also known as Expert Advisors (or EAs)) scan the market and complete trades based on technical and fundamental criteria that have been pre-programmed by the trader.

These algorithmic trading systems execute trading decisions far more precisely, consistently, and quickly than humans are able to. This can make them perfect for forex scalping, although forex robots require regular monitoring.

As with charting programs, individuals can usually get more sophisticated trading robots from third-party vendors. Traders can also design their own automated trading software and code their own algorithms for a more personalized experience.

Trading Costs

Forex scalpers need to pay particularly close attention to possible transaction costs when choosing which broker to use. Frequent traders like these can rapidly rack up eye-watering costs that eat into profits.

Brokerages usually make their money through the spread. This is the difference between the bid (selling) price and the ask (buying) price of a currency pair. However, some companies can choose to charge fees for each trade on top of, or instead of, a spread.

Tip: You can keep costs to a minimum by trading major currency pairs like the EUR/USD or GBP/JPY. High liquidity means that the spreads on these pairings are much tighter than on minor or exotic pairs.

Bottom Line

Scalping forex has both benefits and drawbacks for new traders. While detailed knowledge of fundamental analysis isn’t necessarily essential, having a sound understanding of technical analysis is crucial. And this can take time to build up.

Forex scalping can also be challenging for beginners due to its fast-paced nature. To succeed, you need a good understanding of the forex market and the ability to make quick decisions.

That said, many forex trading platforms offer simulators/demo accounts that help new traders to familiarize themselves with market behavior and hone their forex scalping strategies.

FAQ

What Is Forex Scalping?

Forex scalping is a strategy where traders aim to capture small profits consistently throughout the day by placing a large number of trades on currency pairs.

How Many Trades Do Forex Scalpers Make?

Forex scalpers tend to execute dozens or even hundreds of transactions in a single day, though the exact number depends on broader market conditions.

Is Forex Scalping Trading Difficult?

A small profit-per-trade makes reaching financial goals challenging and risky. A heavy reliance on complicated technical analysis also means beginners should use forex scalping education resources including demo accounts and trading guides to get up to speed.

What Are The Risks Of Forex Scalping?

Trade execution delays, market noise, and excessive use of leverage (or borrowed funds) are all common risks faced by forex scalpers.