Saxo Bank Review 2025

Pros

- Excellent educational resources including podcasts, webinars and expert-led video insights

- High-level research hub with curated market research, plus unique insights with 'Outrageous Predictions'

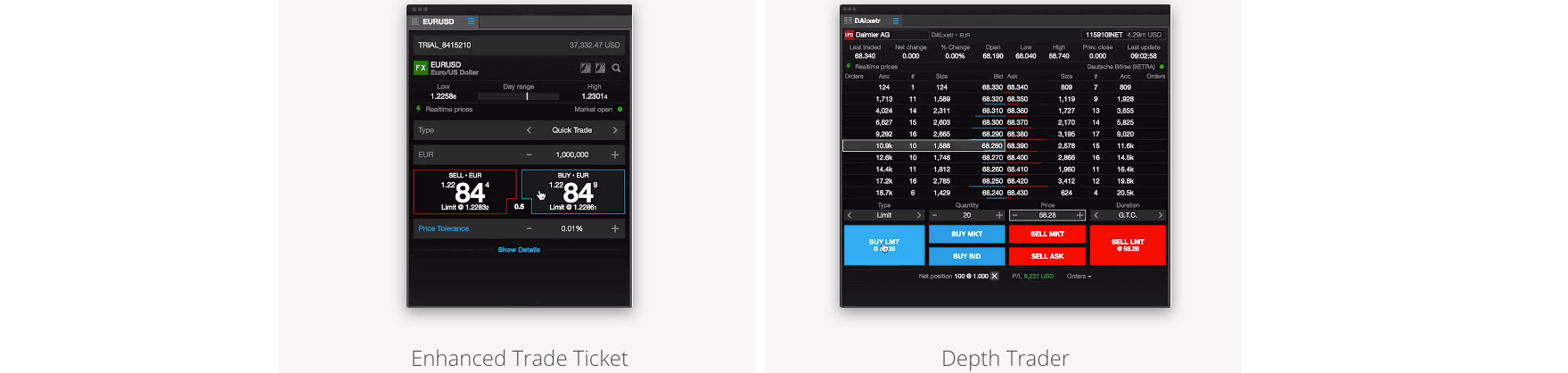

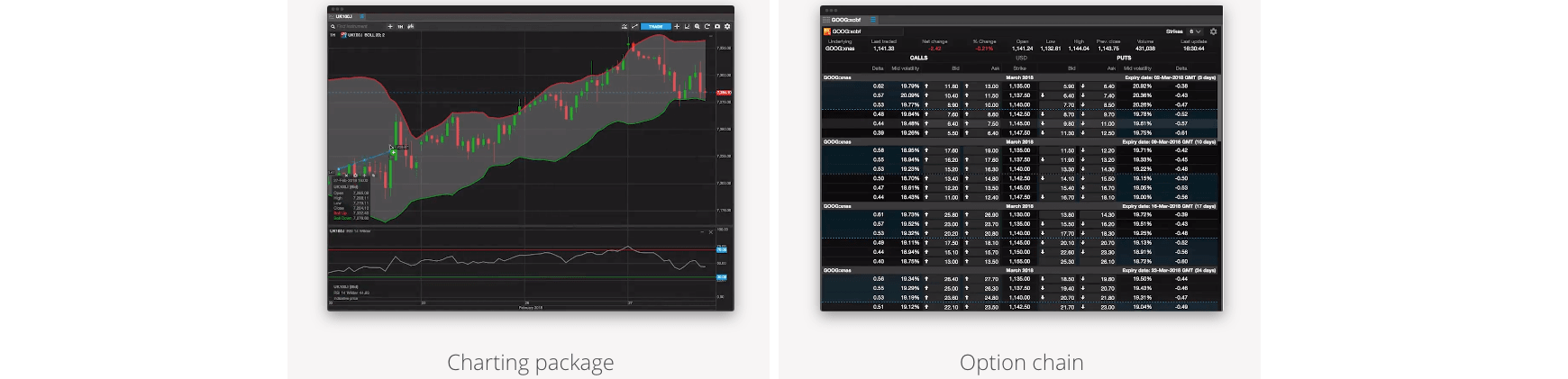

- Powerful proprietary trading platforms with comprehensive charting packages and advanced analysis tools

Cons

- Access to Level 2 pricing requires a subscription

- Clients from some jurisdictions not accepted including the US and Belgium

- High funding requirements for the trading accounts

Saxo Bank Review

Since the inception of the internet, a number of banking services, as well as activities, can be transacted or accessed on an online platform. This also applies to the numerous forms of trading as well as investment. Saxo Bank is one such institution that made this move by offering online services to customers. Clients of this Danish-based bank can access Saxo Bank trading on their Internet-connected devices among other investment services offered.

Company Details

Saxo Bank was established in the year 1992 as a privately owned company. The headquarters of the bank is in Copenhagen, Denmark and it has managed to set itself apart to become one of the leading retail brokerage innovators in Europe.

The safety of trading at the bank is assured by the 10+ financial regulators including the UK FCA. The bank is among the leading retail brokerage innovators in Europe as well as on the globe.

Trading Platform

The trading platform offers users a variety of instruments and asset classes that span across global financial markets.

The SaxoTrader suite runs on a myriad of devices and operating systems including Windows on desktops. The mobile suite runs on iOS, Android, and Blackberry among others and is referred to as SaxoTrader GO.

Saxo bank features a very unique and highly engaging web trading platform for accessing its asset classes. It entails a one-step login process upon loading the program.

However, for the Platinum and VIP accounts, there is an IP address link for login that is more secure. Though it might appear complex, it features an easy-to-follow menu that makes navigation through it convenient.

Assets / Markets

The well-designed Saxo Bank trading platform features a diverse product portfolio of markets that are available to trade.

Including:

- Forex

- Bonds

- Equities

- ETFs

- Mutual Funds

- Options

- Futures

- Warrants

- CFDs (Depending on region)

- Cryptos (FX and ETN)

- Commodities

Note, the availability of instruments varies between countries.

Recommended Alternatives To Saxo Bank

In the forex domain, there are more than 100 major and minor currency pairs that can be traded. Crypto derivatives on Bitcoin, Litecoin and Ethereum are also offered against fiat currencies such as USD, EUR and JPY.

Featuring over 5,000 bonds with 3,400 developed-market and 1,600 emerging marketing bonds, the Saxo Bank bond trading platform provides users with an interesting asset class to trade in. In addition, users can gain access to government bonds in over 40 countries.

Corporate bonds, though available, are limited to 7 countries.

Trading Fees

Saxo Bank historically had average fees based on our assessment, especially if you wanted to trade futures, options and bonds in lower volumes. However, we’ve been pleased to see the broker revise its pricing model in 2024, lowering its trading and non-trading fees.

The minimum commission on US stocks has been cut from 10 USD to 1 USD, on UK stocks it’s been reduced from 8 GBP to 3 GBP, and for US options it’s gone from 0.85 USD to 0.75 USD per contract.

The currency conversion fee, which applies to automated conversions, sub account transfers and FX options transactions, has also been slashed from 1% to 0.25%.

Futures cost 3 for USD contracts with Classic accounts, 2 for Platinum accounts, and 1 for VIP accounts.

Saxo also compares well to alternatives with its forex and metal spreads, starting from 0.4 pips.

Other welcome improvements are the removal of inactivity fees, which penalized casual investors and the minimum on custody fees.

Overall, the latest prices are competitive, especially if you qualify for a Platinum or VIP account, which offers the lowest rates, though the minimum deposit is high at $200,000 and $1,000,000 respectively, putting them out of reach for beginners.

Leverage

Forex is normally traded on margins, with each brokerage firm having its own leverage. Specifically, Saxo Bank leverage terms are based on a tiered margin methodology.

This entails a management mechanism against political and economic scenarios that may make the market volatile, leading to sudden changes. Saxo Bank has a maximum leverage of 1:30 which is in line with other regulated brokers in the European Union.

Mobile Apps

The Saxo bank mobile app is remarkable since it has the same outlay and design workability as its web-based platform. Despite the absence of basic data and Saxo Select, it is still highly usable. The Saxo Trader app can be downloaded from Google Play for Android systems and from the iOS store for Apple devices.

Payment Methods

Bank transfers take between 1 to 5 business days. The majority of European clients are required to transfer to a Saxo Danish account which necessitates an international bank transfer. Via the credit/debit card method, money is credited to the traders’ account instantly.

However, this is subject to a charge of 0.5-2.5% by your card operator. Stock transfers take place through the transfer of a stock portfolio. This might take a little longer since it must be processed by your current portfolio holder.

Saxo Bank withdrawal can be done to your bank account or a broker account. The account needs to be in your name. Withdrawal is free of charge.

Minimum Deposit

The minimum deposit varies depending on your location and currency:

- Belgium – 0 EUR

- MENA – 5000 USD

- Hong Kong – 10,000 HKD

- UK – 500 GBP

- France – 300 EUR

- Central Eastern Europe (EU countries) – 2000 EUR

- Central Eastern Europe (non-EU countries) – 10,000 EUR

- Denmark – 0 DKK

- Norway – 0 NOK

- Singapore – 0 SGD

- Switzerland – 2000 CHF

- Australia – 1000 AUD

- Japan – 100,000 JPY

Demo Account

An instant demo account offers traders the chance to view the platform and check functionality. A full demo account is then also offered alongside a real account, and this enables strategy testing and refinement.

Offers And Promotions

Research materials are accessible from both the web and desktop trading platforms. Saxo additionally runs a separate page known as tradingfloor.com where traders can get more information on market statistics. The content available includes equity research, news, opinions from Saxo’s strategists, trade signals, and macro events calendar.

Bonus

While there is no active bonus a present, the presence of competitive spreads on the various asset classes makes this almost negligible. This is significant to forex trading since it is commission based.

Moreover, an overview of the trade-related costs for any trade portrays Saxo Bank as midrange among other brokers. Bonus features are usually not available in market trading since such enticements cause over trading and are frowned on by regulators.

Regulation And Licensing

Saxo Bank is regulated globally by more than 10 financial regulators and is a highly reputable brokerage company in Europe:

- Saxo Capital Markets UK Limited is authorised and regulated by the Financial Conduct Authority (Firm reference number 551422).

- BG SAXO Società di Intermediazione Mobiliare S.p.A. is licensed by Italian Market Authority – Consob (Albo SIM – Registration Number: 296).

- Saxo Bank A/S Czech Republic is registered by the Czech National Bank (Registration Number: 28949587).

- Saxo Bank A/S Netherlands is registered by the Bank of the Netherlands (Registration Number: 34357130).

- Saxo Capital Markets Pte. Ltd. Singapore is licensed as a Capital Market Services provider and an Exempt Financial Advisor, and is supervised by the Monetary Authority of Singapore (Co. Registration Number: 200601141M).

- Saxo Bank (Switzerland) Ltd. (UID-Register Number CHE-106.787.764) is a licensed bank regulated by the Swiss Financial Market Supervisory Authority FINMA.

- Saxo Banque (France) SAS is licensed as a Credit Institution by the Bank of France (Registration Number: 483632501 R.C.S. Paris).

- Saxo Bank A/S is licensed by the Danish Financial Supervisory Authority and operates in the UAE under a representative office license issued by the Central Bank of the UAE.

- Saxo Bank – Representative Office is licensed by the Central Bank of the U.A.E. as a Representative Office (Registration number: 2017/995/13).

- Saxo Bank Securities Ltd. is licensed by the Japanese Financial Services Agency (Registration Number: 239).

- Saxo Capital Markets Hong Kong Ltd. is licensed by the Securities and Futures Commission in Hong Kong (Registration Number 1395901).

- Saxo Capital Markets (Australia) Pty. Ltd is licensed by the Australian Securities and Investments Commission (ASIC) (Registration Number: 126 373 859).

Additional Features

Investors willing to expand their knowledge on trading markets can be readily assisted by the education section of the platform. It features online webinars where traders can be taken through asset classes by trading experts.

Alternatively, one can become a “learner” at the Saxo Academy and choose from the infinite online tutorials available.

Account Types

Saxo has three main types of accounts namely Classic, Platinum, and VIP. The accounts differ on the amount of funding.

The Classic account requires the standard minimum deposit which varies by country, Platinum accounts a minimum of $200,000 and the VIP account a minimum of $1,000.000.

For the Platinum and VIP accounts, investors have advanced customer service, logins that are IP address linked, thus more secure and tighter spreads.

Trading Hours

The platform is open for trading 24 hours a day albeit 6 days a week. Various currency pairs have specific trading hours. For instance, the RON, ILS, SAR & AED and RUB currencies trading hours are 08:15 – 17:00 CET, 07:00 – 17:00 CET, 07:00 – 15:00 CET and 07:00 GMT – 19:00 GMT respectively.

Contact Details & Customer Support

- Reception: Varies by country – head to the Contact Us section of the broker’s website

- Fax: Varies by country – head to the Contact Us section of the broker’s website

- Website: https://www.home.saxo/

Safety & Security

Saxo’s web-based platform features high-security components since traders’ vital documents are required when opening an account. They include a copy of an ID, passport or driver’s license. The login steps to some account types are enhanced to protect user data. A case in point is the Platinum and VIP accounts which have an IP address link for secure login.

Saxo Bank Verdict

This review is aimed at giving a detailed description of Saxo Bank as a brokerage company. The bank provides complex and conducive services through its trading platform. The research and customer service team are always available to offer any assistance to traders.

Moreover, its diverse product portfolio comprising of asset classes and international markets assures heavy traders of an enticing trading arena. Despite requiring high minimum trading fees, it is a good brokerage company in terms of service delivery and it stands atop the global scene.

Top 3 Alternatives to Saxo Bank

Compare Saxo Bank with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Saxo Bank Comparison Table

| Saxo Bank | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 | 4.5 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | – | $0 | $100 | $100 |

| Minimum Trade | Vary by asset | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | TradingView, ProRealTime | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:30 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 4 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Saxo Bank and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Saxo Bank | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Saxo Bank vs Other Brokers

Compare Saxo Bank with any other broker by selecting the other broker below.

The most popular Saxo Bank comparisons:

- Saxo Bank vs Interactive Brokers

- Saxo Bank vs IG Group

- Saxo Bank vs eToro

- Saxo Bank vs Tiger Brokers

- CMC Markets vs Saxo Bank

- Saxo Bank vs Moomoo

- Saxo Bank vs Degiro

- Saxo Bank vs Webull

- Exness vs Saxo Bank

- Saxo Bank vs Tastyworks

Customer Reviews

4 / 5This average customer rating is based on 1 Saxo Bank customer reviews submitted by our visitors.

If you have traded with Saxo Bank we would really like to know about your experience - please submit your own review. Thank you.

Saxo Bank feels very solid and offers tons of instruments and markets to trade, and they also offer multiple technical indicators. What I miss so far is a feature to analyse/research my own portfolio and not just new trading opportunities. I built a portfolio of 100+ stocks and had no way to identify which ones I should keep or sell based on the criteria I had for picking them in the first place. For example, I might have acquired a specific stock because its dividend yield was high at the time, but later I might want to divest and find better opportunities, if its expected yield falls below some threshold. Managing a large portfolio of stocks becomes impossible because of this and I had to rethink my strategy entirely.

Also, I am unable to trade many of the ETFs on their platform due to regulation, but I can’t filter these ETFs out so I will find tons of unavailable ETFs in my research that I have to check one by one. It’s frustrating.