Samsung Pay Brokers 2025

The popularity of eWallets has risen rapidly in recent years and Samsung Pay has been at the forefront of digital wallet use since its release in 2017. The convenience and safety associated with making trading payments from smartphones have also proved a success.

In this review, we look at the benefits of Samsung Pay brokers, noting deposit and withdrawal timelines, plus payment fees. We also list the best trading brokers that accept Samsung Pay deposits in 2025.

Best Samsung Pay Brokers

Our exhaustive tests have revealed that these are the top 6 brokers with Samsung Pay:

Here is a short overview of each broker's pros and cons

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

- RedMars - Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

Compare The Best Samsung Pay Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| NinjaTrader | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| eToro USA | $100 | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | - |

| FOREX.com | $100 | Forex, Stocks, Futures, Futures Options | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | 1:50 |

| UnitedPips | $10 | CFDs, Forex, Precious Metals, Crypto | UniTrader | 1:1000 |

| RedMars | €250 | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | MT5 | 1:30 (Retail), 1:500 (Pro) |

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

UnitedPips

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

Cons

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Regulator | CySEC, AFM |

| Platforms | MT5 |

| Minimum Deposit | €250 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR |

Pros

- The broker is one of a limited number of firms to offer an account specially designed for VIPs with premium support and invites to exclusive events

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

- Getting started on RedMars is incredibly easy - you can be up and running in just a few minutes based on tests

Cons

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

- With just 300 instruments, RedMars offers a narrow trading environment, particularly compared to category leaders like BlackBull Markets which offers 26,000 assets

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

How Did We Choose The Best Samsung Pay Brokers?

To reveal the top Samsung Pay brokers, we:

- Leveraged our directory of 500 online platforms, focusing on all those that accept Samsung Pay payments

- Verified that they support Samsung Pay deposits and withdrawals for online trading

- Sorted them by their rating, based on over 100+ data points and our own observations

Samsung Pay Explained

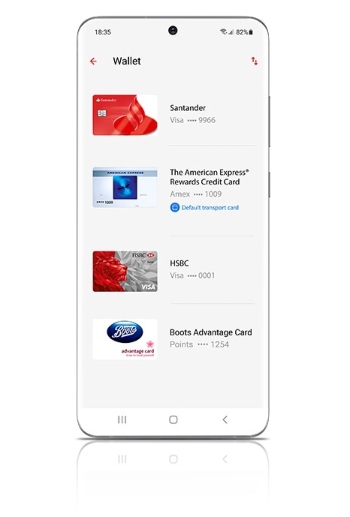

With the beta version of Samsung Pay having been released in 2015, it was fully launched to app stores across devices in 2017. Already implemented into the software on Samsung phones, the eWallet is user-friendly and easy to navigate, making it popular with online traders.

Although supporting devices consist predominantly of Galaxy phones, Samsung Pay should technically be compatible with any smartphone that has NFC (near-field communication), though it is not yet compatible with iPhones.

But how does it work? To make a transfer, you simply swipe up from the bottom of your screen utilizing your default card (or switching to another registered card) and process the transaction using the given authentication method, such as fingerprint or face recognition, as well as passcode protection.

Samsung Pay is one of the three most popular mobile wallet options, with Apple Pay and Google Wallet (formerly Google Pay) being its main competitors.

Despite the Google Pay and Apple Pay vs Samsung Pay debate, it remains a popular solution and a key factor for some in deciding what company to buy a smartphone from. The ease of the application is also what boosts its popularity – a selling point for active traders.

Fees

Another perk of using the mobile wallet is that there are no fees for app usage, nor are there enterprise price plans. You can deposit $500 from another debit card using Samsung Pay.

Generally, online brokers are not charging for deposits or withdrawals using Samsung Pay, but this varies between brands. It’s worth checking terms and conditions before you open a live trading account and make a transfer.

Speed

The instantaneous nature of making transactions is a central appeal. It is a fast and reliable method, often with an immediate depositing time. Broker withdrawal times may vary, but generally, this should be no more than three working days.

Security

As one of the three major mobile wallets, air-tight security is important. Fortunately, traders can feel safe in the knowledge that Samsung Pay does not store personal or financial information on their devices and is generally safer than using cash or cards.

Samsung Pay uses a two-layer method of security which can require a one-time code at login. It is safer than entering your card number somewhere online. Financials are secured too, if you lose your mobile, you won’t lose your actual wallet.

Despite this, it is always worth adding two-factor authentication on your phone for added security.

How To Deposit & Withdraw Using Samsung Pay

See our quick step-by-step guide to making Samsung Pay deposits and withdrawals.

Deposits

- Open the Samsung Pay app

- Tap the PAY tab at the bottom of the screen

- Swipe left to Samsung Cash card

- Tap ADD MONEY below the card and choose where to add money from

- You can use a card pre-registered to your account, or simply a bank transfer

- If this is the first time using the method then tap UPGRADE

- Follow the prompts on the screen and add the personal banking info

- Tap NEXT to finish

Withdrawals

- Open Samsung Pay on your phone

- Tap the PAY tab at the bottom

- Swipe left to Samsung Cash card, then tap SEND below the card

- Either enter a phone number manually or choose a contact from your phone. You can also choose from your recent transfers

- Enter the amount and send

- There is also the option to add a message

- Finish by tapping NEXT

Note that steps may vary between brokers, but most providers, such as Dukascopy, offer straightforward on-screen instructions from the client area. You can also speak to your broker’s customer support team if you need help or encounter any issues.

The minimum and maximum amounts you can send also are dependent on your trading broker. Some firms may even ask for a memo to be attached to the transfer (usually to be added in the comments section) to ensure the transaction reaches the right account.

However, this method is more common with bank wire transfers, e-wallets such as Samsung Pay usually don’t require a memo.

Benefits Of Trading With Samsung Pay

Samsung Pay has both its pros and cons. It activates immediately and is an affordable option for a digital wallet with zero fees. It is also fast and secure with online tokenization security and has an enticing rewards system.

Despite not having access to all major UK and European banks, it does offer compatibility with PayPal, the most popular online payment system to date. It is secure and reputable and goes out of its way to safeguard trader privacy.

Drawbacks Of Trading With Samsung Pay

Its shortcomings, however, are mainly in the lack of major banks it supports, including Barclays, NatWest, Lloyds TSB, Monzo and Halifax. Revolut is also not compatible, but other major banks such as Starling, HSBC, Nationwide and First Direct are.

Clients from the US can enjoy greater flexibility, as the system accepts both Visa and Mastercard alongside other major banks.

The other underlying issue is that you are only eligible to use Samsung Pay with a Samsung device, which is more limiting than its competitor Google Wallet. Finally, a relatively limited list of brokers currently accepts Samsung Pay deposits and withdrawals.

Is Samsung Pay Good For Day Trading?

Samsung Pay’s popularity is a result of several key factors. Its uses are extensive, the depositing and withdrawal scheme is simple and security is a priority. Client money is safeguarded in a downloadable app and, in many ways, continues to be a safer option than carrying around your financial details in a physical wallet. Although it may seem less secure at the beginning to put your details into an app, Samsung’s payment solution is a great option for active traders.

Use our list of the best brokers that accept Samsung Pay deposits to start trading today.

FAQ

Is Samsung Pay Free To Deposit To A Trading Account?

Samsung Pay does not charge users additional fees for using the app. Trading brokers may, however, have their own processing fees though deposits are typically free.

Is Samsung Pay Safe To Use At My Broker?

Samsung Pay goes a long way to protect customer privacy. It uses multiple security methods, for example, tokenization to keep personal and financial information secure. Furthermore, it constantly monitors and protects your phone from malware. It is a safe money transfer solution and a good option for active day traders.

Which Brokers Accept Samsung Pay?

Samsung Pay is not yet widely supported by online brokers. Popular brokers include Interactive Brokers. You can check out our list of top brokers with Samsung Pay to find a suitable option.

Can I Deposit Values Over £45 To My Trading Account With Samsung Pay?

Yes, this is subject to the retailer but lots of places accept mobile transactions over £45, including day trading brokers. Check individual transfer limits before signing up for an account and depositing funds.