Forex Trading In Saudi Arabia

Saudi Arabia is a small player in the global forex market. In 2022, it accounted for just 0.1% of daily foreign exchange turnover, according to the Bank for International Settlements (BIS).

But like the rest of the Kingdom’s financial markets, currency dealing is on the move as the country looks to diversify its economy and reduce its dependence on oil revenues.

As part of its Vision 2030 drive, it established the Financial Sector Development Program to improve the robustness and expansion of its financial industry, and to promote the growth of fintech startups.

This beginner’s guide unpacks what you need to know to start forex trading in Saudi Arabia. We’ll look at currency pairings and the ideal time to trade, and run through the Kingdom’s regulatory and tax landscape.

We’ll also show you how a trade featuring Saudi Arabia’s official currency – the riyal (SAR) – and a popular international currency might play out in the real world.

Quick Introduction

- Saudi Arabia’s forex market is small but growing as the country takes steps to boost its financial sector and diversify its economy.

- Residents can trade the Saudi riyal (SAR) against a spectrum of other currencies. However, shallow liquidity means that major pairings like the EUR/USD remain the most popular.

- The currency market is regulated and supervised by the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA), whose remit includes ensuring that trading practices adhere to Sharia law.

- Personal income tax doesn’t exist in Saudi, making it a popular destination for active forex traders.

Best Forex Brokers In Saudi Arabia

Drawing on our tests as of December 2025, these 4 platforms excel as the best for forex traders in Saudi Arabia:

How Does Forex Trading Work?

The forex market is where traders buy and sell different currencies with the goal of making a profit from exchange rate fluctuations. It’s by far the world’s biggest financial market, which means that traders get to enjoy deep liquidity and frequent price volatility.

Trades involve buying a currency while selling another, which is why they are quoted in pairs. Examples include the EUR/USD, where individuals exchange the eurozone single currency against the US dollar.

Going long involves buying the first currency (known as the base currency) against the second currency (the quote currency). Taking a short position works in the opposite way.

Individuals can trade Saudi Arabia’s riyal (SAR) against a broad range of local and global currencies. Available pairings include:

- SAR/USD (versus the US dollar)

- SAR/EUR (against the euro)

- SAR/GBP (versus the British pound)

- SAR/JPY (against the Japanese yen)

Along with these major currencies, traders also deal the SAR against the more exotic currencies of the Kingdom’s major trading partners. The SAR/CNY pairing allows individuals to trade the riyal against China’s yuan, for instance, and the SAR/AED pits the local currency against the United Arab Emirates’ (UAE’s) dirham.

However, pairings featuring the SAD tend to suffer from low liquidity, which typically results in weaker levels of volatility and higher trading costs (through elevated bid and ask spreads).

Consequently, short-term traders typically stick to pairs involving only major currencies, such as the EUR/USD and GBP/USD.

Certain brokers offer forex trading using the SAR instead of a major international currency. This can lead to lower transaction costs due to the elimination of conversion fees, and can provide more convenience for Saudi’s local traders.DayTrading.com has created a list of top brokerages offering riyal-based trading accounts.

Is Forex Trading Legal In Saudi Arabia?

Yes. Governance of financial markets is the responsibility of the Saudi Central Bank (SAMA) – previously known as the Saudi Arabian Monetary Authority – and the Capital Market Authority (CMA).

SAMA is tasked with overseeing Saudi’s foreign exchange framework, including managing the SAR/USD peg and ensuring that currency markets remain liquid.

It also works to ensure that financial markets work in accordance with Sharia Law. Under Islamic principles, the payment of interest (or riba) is prohibited, while restrictions are also placed on speculative activities and the amount of leverage (borrowed money) that a trader can access.

SAMA works alongside the CMA, which was created in 2003 “to create a transparent, fair and regulated market that keeps pace with the current developments in other international financial markets.”

The CMA works to ensure that the forex market operates in an efficient, transparent and fair manner, and that investors and traders receive strong levels of protection.

I recommend checking that the broker you choose is CMA-approved before disclosing any personal information or depositing any cash.You can do so by consulting the body’s ‘Authorised Capital Market Institutions’ search facility on its website.

Is Forex Trading Taxed In Saudi Arabia?

No. To encourage local and foreign investment and attract overseas workers, individuals don’t pay any personal income tax on their earnings.

Instead, the Kingdom seeks to raise revenue from other sources such as oil and corporate tax. This puts its tax regime in line with many of its Middle Eastern neighbors like the UAE and Kuwait.

It also makes Saudi Arabia a particularly attractive place to be a forex trader.

When Is The Best Time To Trade Forex?

Forex traders can do business 24 hours a day excluding weekends, whether they’re based in Saudi Arabia or elsewhere. However, they tend to prefer to do business when market liquidity is deeper, which typically leads to better trading opportunities and lower dealing costs.

The best time to trade in Saudi is generally between 15:00 and 19:00 Arabia Standard Time (AST), the Kingdom’s official time zone. AST is three hours ahead of Greenwich Mean Time (GMT).

This window corresponds with the start of trading in New York and the afternoon session in London. This is significant, as these European and North American cities are home to the two largest forex markets on the planet.

A Forex Trade In Action

Now we’re ready to consider what a currency trade in Saudi Arabia might look like in practice. In this example, I’ll be trading the SAR against a major global currency following the release of key economic data.

The Background

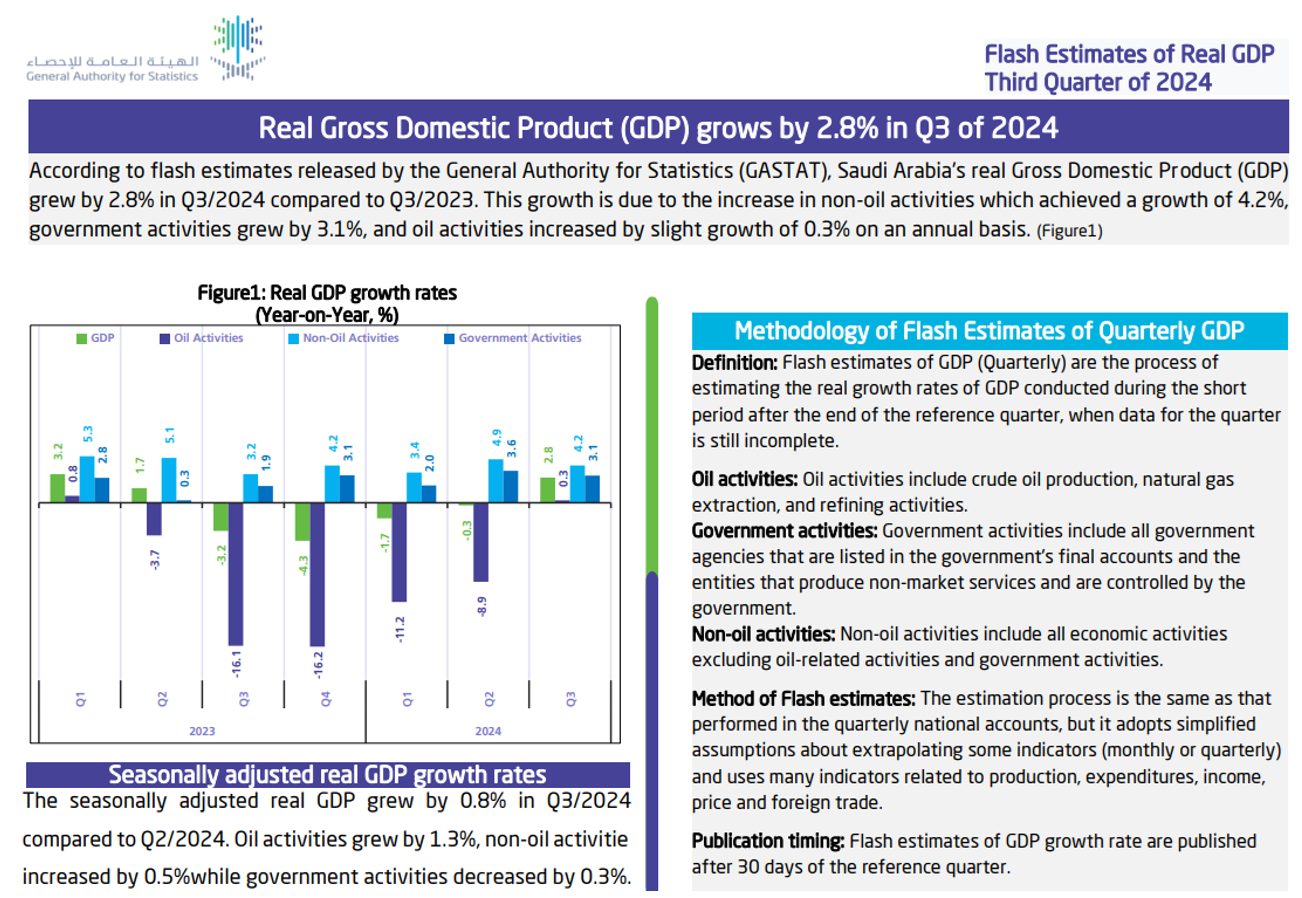

My strategy is to purchase the SAR/EUR pairing before the General Authority for Statistics (GASTAT) releases fresh GDP data, and to sell it shortly thereafter for a profit.

At the time, I predicted that Saudi’s economy would grow 3.1% in the last quarter, higher than the 2.9% that the broader market had priced in. If I’m correct, the base currency (SAR) could rise sharply against the quote currency (EUR).

I take a bullish stance on the SAR/EUD after studying a raft of recent economic data. Oil exports, consumer spending trends and labor market conditions all have a huge impact on the country’s economy.

Before I put in my trade, however, I also carry out technical analysis on the pairing. Studying the charts can help me better identify the direction and size of any price movements, and give me a better reading of potential entry and exit points.

The Trade

With these steps completed, I open my trading menu and prepare to open my position. The time is 08:50 AST, giving me ample time to place my trade before the growth numbers are announced.

On the downside, the timing of the release falls outside the ideal trading window of 15:00 and 19:00 AST. Yet I’m confident the significance of the data may result in high liquidity for the SAR/EUR pairing. My trade may also benefit from the Tokyo market being open at the time of the release.

At this time, the currency cross is trading at 0.2438. So I execute my trade by placing:

- A ‘take profit’ instruction at 0.2459

- A ‘stop loss’ order at 0.2427

These types of orders are popular ways that traders manage risk. If the SAR/EUR ascends to my ‘take profit’ level, my position is automatically closed, and a profit is booked before the market has a chance to fall again.

My ‘stop loss’ works in the opposite way. It shuts my position if the pair drops to my pre-selected level, which in turn limits any losses I may incur.

Shortly after inputting these orders, GASTAT announces that third-quarter GDP growth was 3%. This is lower than I had tipped, but is fractionally better than what the market had priced in, prompting the SAR/EUR to rise.

Within an hour, the pairing has moved to my ‘take profit’ level, closing my position. This has given me a profit of 21 pips.

Bottom Line

Saudi Arabia’s forex community is small but rapidly growing as authorities work to boost its financial sector. A favorable tax environment also makes the Kingdom a highly attractive destination to deal in currencies.

Forex trading is overseen by local regulators. However, the CMA is only classified as a ‘yellow tier’ regulator under DayTrading.com’s Regulation & Trust Rating, which can expose traders to a greater level of risk.

Individuals can potentially boost the protection they receive by choosing a brokerage that’s approved by an overseas ‘green tier’ regulator.

Our list of top brokers for day trading forex can help you get started.

Recommended Reading

Article Sources

- Financial Sector Development Program – Kingdom of Saudi Arabia

- Triennial Central Bank Survey – Bank for International Settlements (BIS)

- Foreign exchange intervention in Saudi Arabia - BIS

- Saudi Central Bank (SAMA)

- Capital Market Authority (CMA)

- Individual - Taxes on personal income - PwC

- Time in Saudi Arabia – Time.is

- General Authority for Statistics (GASTAT)

- The World Bank In Saudi Arabia – World Bank

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com