Best Day Trading Platforms and Brokers in Saudi Arabia 2025

Despite its historical reliance on petroleum, Saudi Arabia aims to diversify its economy into other industries, such as the financial and private sectors, by 2030. This economic shift offers exciting opportunities for day traders looking to speculate on various markets, from stocks listed on the Saudi Exchange to traditional Saudi investments like crude oil.

Yet to trade these, amongst other instruments, you’ll need an online broker. The Saudi Capital Market Authority regulates brokers domestically, but you can also register with overseas platforms. If you opt for this route, make sure you adhere to Saudi Central Bank regulations and local tax rules.

We’ve pinpointed the best day trading platforms in Saudi Arabia. Every broker listed accepts traders from Saudi Arabia, while some also offer SAR accounts for convenient deposits.

Top 6 Platforms for Day Trading in Saudi Arabia

Following our hands-on assessments, these 6 platforms are the standout options for Saudi day traders:

This is why we think these brokers are the best in this category in 2025:

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

Best Day Trading Platforms and Brokers in Saudi Arabia 2025 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| XTB | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 (EU) 1:500 (Global) |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| Exness | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, commission-free pricing, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP, PLN |

Pros

- First-class 24/5 customer support is available, including a friendly live chat with response times of under two minutes during testing.

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- With an excellent range of educational materials, including training videos and articles integrated into the platform, XTB supports traders at all levels.

Cons

- Not being able to adjust the default leverage level of XTB products is frustrating, as manual adjustment can significantly mitigate trade risk, especially in forex and CFD trading.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

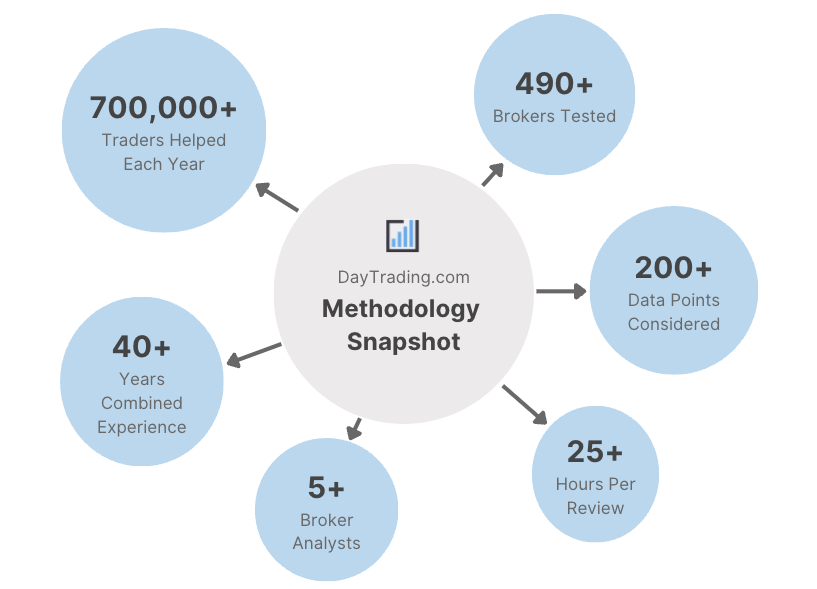

Methodology

To list the best day trading platforms in Saudi Arabia, we leveraged our database of 223 brokers, removed all those not accepting Saudi traders, and sorted those left by their overall rating.

Our ratings blend 100+ data points with findings from our personal observations during testing.

- We verified that each broker accepts Saudi day traders.

- We only recommended trusted brokers.

- We ensured that each broker offers a wide range of markets.

- We prioritized brokers with competitive day trading fees.

- We favored brokers with reliable charting platforms.

- We checked each broker’s leverage and margin requirements.

- We examined each broker’s execution quality.

- We made sure that each broker offers convenient account funding.

How To Choose A Day Trading Broker In Saudi Arabia

Based on our years of experience and extensive analysis, there are several factors to consider when choosing a broker:

Choose A Trusted Broker

This should give you peace of mind when depositing Saudi riyals while helping to protect you from trading scams.

Trading scams have unfortunately risen in recent years, with Saudi investors losing over $10 billion to fake forex websites in just 5 years, as reported by Arab News.

This is why we always thoroughly check the broker’s regulatory credentials, as well as their overall reputation in the industry.

The Saudi Capital Market Authority (CMA) regulates domestic brokers, although the regulator is not as prominent as leading agencies like the FCA in the UK or the ASIC in Australia.

- AvaTrade sets the standard with its multi-regulated trading environment and long track record since 2006. The firm is licensed by several ‘Green Tier’ authorities including Cyprus’ CySEC and the ADGM/FSRA in Abu Dhabi, while offering a custom risk management tool, AvaProtect.

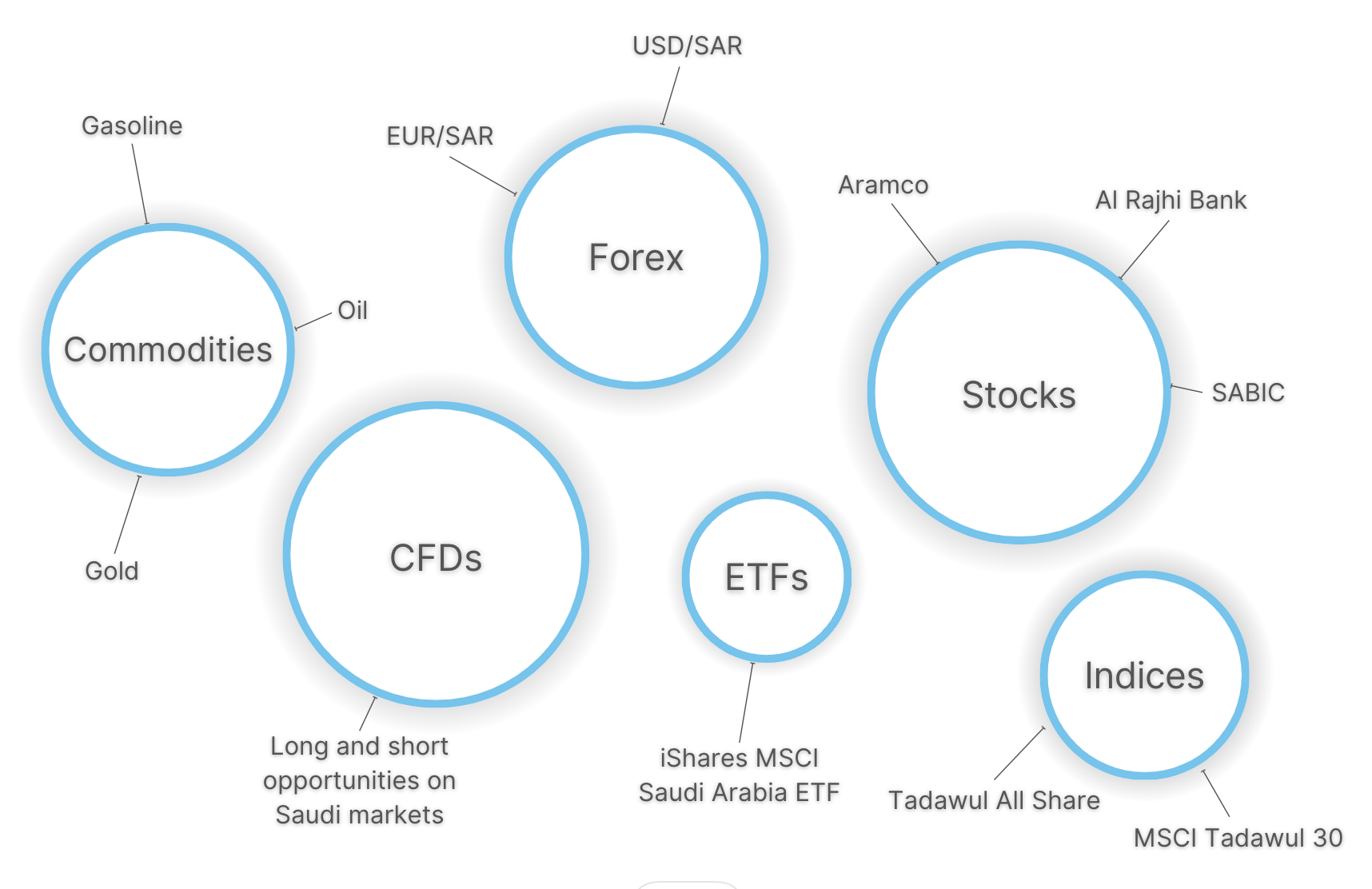

Choose A Broker With A Broad Range Of Markets

The best brokers offer a wide selection of asset classes, allowing day traders to explore diverse opportunities.

Saudi day traders may prefer local markets, such as currency pairs containing the Saudi riyal (SAR) or prominent stocks listed on the Saudi Exchange (Tadawul), like Aramco and SABIC.

These aren’t widely offered by many brokers, but traders can explore other notable opportunities, including key export commodities like crude oil and gasoline, as well as global stocks and currencies.

- Pepperstone offers a great range of opportunities for Saudi traders, including 90+ major, minor and exotic currency pairs, hard and soft commodities including oil, plus a superb selection of ETFs with exposure to Saudi Arabian stocks, notably the iShares MSCI Emerging Markets ETF.

Choose A Broker With Competitive Day Trading Fees

Securing low fees is important for active day traders who make frequent daily transactions.

We examine key fees like spreads and commissions during our tests, as well as non-trading costs like deposits and withdrawals, plus charges for depositing funds in Saudi riyals.

We then judge these against the broker’s complete package, assessing whether any higher costs are justified. For example, you might get access to regional stock market analysis on Middle Eastern exchanges, or access to financial updates from the Saudi Central Bank.

- Alpari is a great choice if you’re looking for low fees, with ECN spreads from 0.0 pips on popular assets like EUR/USD and crude oil. You also get access to a powerful economic calendar where you can filter events by country, including Saudi Arabia.

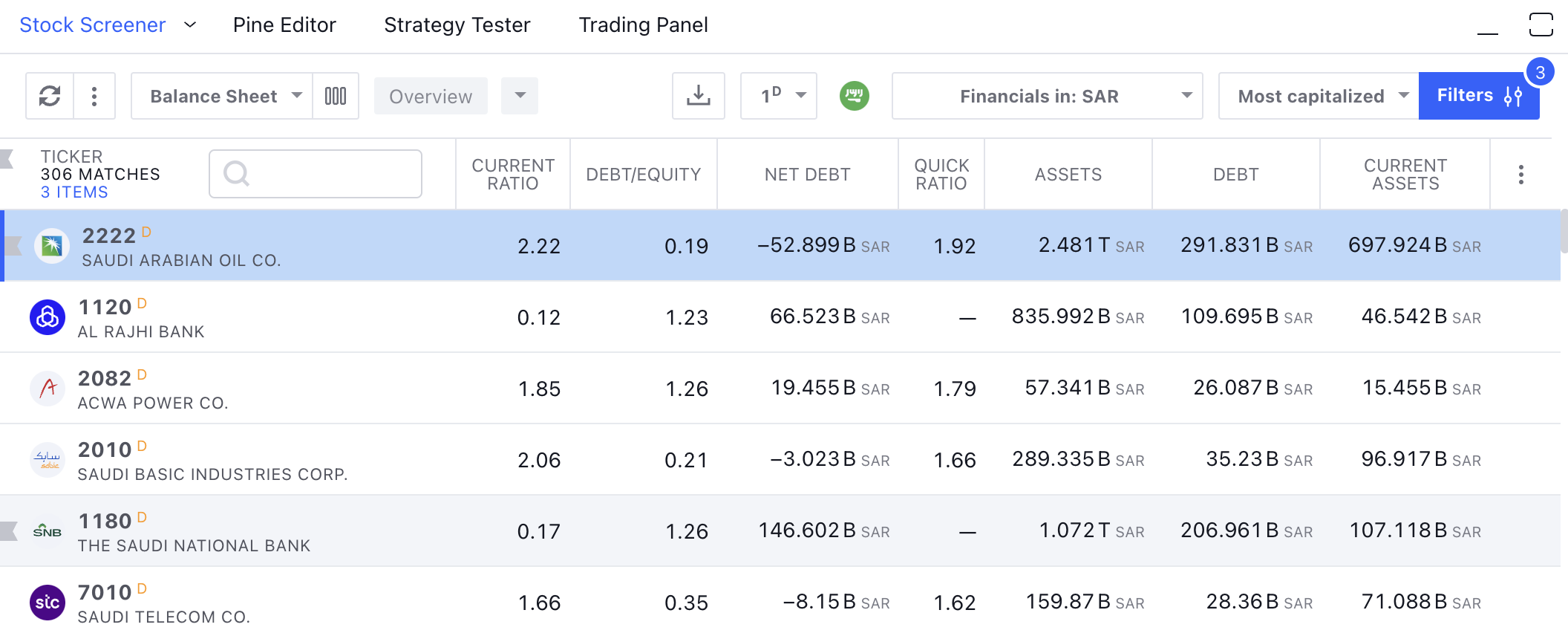

Choose A Broker With Reliable Charting Tools

A choice of charting platforms allows you to explore various environments for technical analysis.

Most brokers we test offer the industry-pioneering terminals, MetaTrader 4 and MetaTrader 5, which offer excellent packages of charting tools and features to suit all short-term strategies and experience levels.

That said, I find the MetaTrader interfaces quite outdated and clunky and prefer the more seamless feel of TradingView.

Additionally, the integrated stock screener is a standout feature, allowing me to filter Saudi stocks and customize metrics to my preferences.

- Exness remains a top pick for day traders of all experience levels, offering MT4, MT5 and a proprietary terminal powered by TradingView. It’s also one of the few brokers offering live accounts based in SAR for convenient local funding.

Choose A Broker With Reliable Order Execution

Fast-paced trading strategies depend on the speed and efficiency of the broker’s execution capabilities.

This will help to ensure trades are executed in optimum conditions, especially if you’re trading volatile Tadawul-listed stocks like SADAFCO, or crude oil.

We look into each broker’s order execution policies, preferably looking for speeds of less than 100 milliseconds. Where possible, we also examine latency (the measure of time delay) and slippage (the difference in price between order receipt and execution).

- IC Markets maintains its position as one of the fastest brokers in the industry, securing speeds of less than 13 milliseconds via superior connection technology. We also love using IC Insights, which lets you search and analyze stocks and cryptos with data provided by TipRanks.

Choose A Broker With Clear Leverage And Margin Requirements

If you’re day trading, you may well use leverage to maximize your potential profits. However, it’s important to understand your margin requirements upfront before you enter the trade.

Leverage allows you to increase the value of your trade while only depositing a small margin. While this can boost your potential gains, it can also cause significant losses, so risk management is crucial.

Let’s say I want to speculate on Aramco share CFDs using leverage of 1:5.If my initial margin is 950 SAR, my leveraged position would actually be worth 4,750 SAR (5 x 950 SAR).

- Deriv lets traders leverage up to 1:1000 on popular assets, though such high levels are not recommended for beginners. Instead, aspiring traders could explore the broker’s multipliers up to 30x where you cannot lose more than your initial stake.

Choose A Broker With Convenient Funding

To open a live account for day trading, you’ll need up to 250 USD (around 935 SAR), although most of the brokers we test require less than 100 USD (around 375 SAR).

It’s also advantageous to opt for a broker with locally supported payment methods, which can help reduce transfer fees and processing times. According to research by Medium, mobile payment solutions like Apple Pay are becoming increasingly prominent in Saudi Arabia.

- XM offers a very low $5 minimum deposit – ideal for those on a tighter budget. It also offers a range of convenient funding methods for Saudi traders, including Apple Pay.

FAQ

Who Regulates Day Trading Platforms In Saudi Arabia?

The Capital Market Authority regulates day trading platforms in Saudi Arabia. However, this body doesn’t actively oversee many brokers and local traders can also register with overseas firms, as long as they adhere to Saudi Central Bank regulations and tax rules from the Zakat, Tax and Customs Authority.

Which Is The Best Broker That Accepts Day Traders In Saudi Arabia?

See our list of the best day trading platforms in Saudi Arabia to find a suitable option.

Pepperstone, for example, offers ETFs with Saudi exposure alongside crude oil, whilst Exness is an excellent all-rounder with high-quality platforms and SAR accounts.

Recommended Reading

Article Sources

- Saudi Arabia Reducing Dependence on Oil - Reuters

- Saudi Exchange (Tadawul)

- Saudi Arabia Forex Trading Scam - Arab News

- Saudi Capital Market Authority

- Saudi Central Bank

- Saudi Arabian Oil Group (Aramc0) - Saudi Exchange

- Saudi Basic Industries Corporation (SABIC) - Saudi Exchange

- Saudia Dairy and Foodstuff Company (SADAFCO) - Saudi Exchange

- Mobile Wallets and Digital Payments in Saudi Arabia - Medium

- Zakat, Tax and Customs Authority

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com