Forex Trading In Russia

Russia’s capital markets are relatively young, having sprung up from the ruins of the Soviet Union in the early 1990s. Yet interest in forex trading is rising rapidly thanks to improving education and access to financial platforms, and support by the country’s robust, oil-backed economy.

This guide will reveal the key things beginners must know to begin forex trading in Russia. It will describe the regulatory environment and reveal the taxes that active traders must pay.

It will also provide a hypothetical example of a trade involving Russia’s official currency, the ruble (RUB), against the currency of another large economy.

Quick Introduction

- Traders can exchange the ruble (RUB) against a variety of currencies, although sanctions in recent years have severely impacted popular pairings like the RUB/USD and RUB/EUR.

- Foreign exchange trading is legal in Russia and regulated by the Central Bank of the Russian Federation (CBR), an ‘orange tier’ body in DayTrading.com’s Regulation & Trust Rating.

- The best time to trade forex is generally 16:00 to 20:00 MSK, when the London afternoon session overlaps with the New York morning session, increasing liquidity and profit potential.

- Active forex traders typically pay a progressive rate of personal income tax ranging between 13% and 22% to the Federal Tax Service of Russia (FTS).

Best Forex Brokers In Russia

Based on our latest tests as of January 2026, these 4 platforms are the very best for forex traders in Russia:

How Does Forex Trading Work?

The forex arena is the world’s largest financial markets. Banks, businesses, central banks and retail traders all exchange vast volumes of global currencies each weekday.

Research indicates that average daily trading volumes will reach a staggering $10.6 trillion by 2028, driven by the stabilizing global economy, regulatory changes, and rising engagement among speculators.

Traders work by buying one currency while at the same time selling another. And so forex instruments are quoted in pairings, the most popular of which is the EUR/USD. This involves the currencies of the world’s two largest regional economies, the euro and the US dollar.

When traders go long, they will buy the first currency in the pairing while simultaneously selling the second. These are known as the base and quote currencies respectively. Taking a short position involves selling the base currency and buying the quote currency.

Traders in Russia can deal the local currency, the ruble (RUB), against other global currencies. However, options have become severely limited following Western sanctions imposed following the start of the Russia-Ukraine conflict in 2022.

Restrictions in mid-2024 forced the suspension of USD and EUR trading on the Moscow Exchange (MOEX), Russia’s main financial marketplace. This resulted in reduced price transparency, lessened liquidity, and higher costs (due to wider bid and ask spreads).

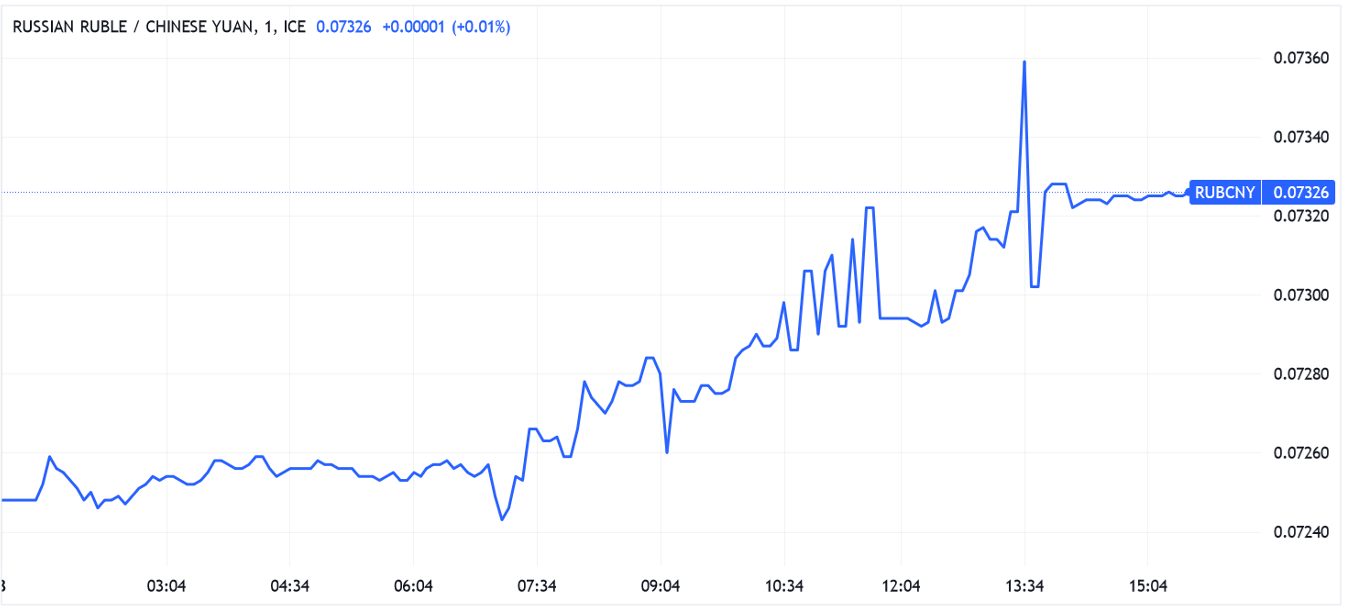

These sanctions mean that trading volumes of pairs involving the RUB and other important currencies have become more popular. One such example is the RUB/CNY, which sees traders pit the domestic currency against China’s yuan (CNY).

The close trading relationship between Russia and China has helped this specific pairing to blossom.

Is Forex Trading Legal In Russia?

Currency trading is legal and regulated by the Central Bank of the Russian Federation (CBR), the body responsible for overseeing the country’s financial markets, safeguarding the RUB, and ensuring broader economic stability.

According to its website, the CBR “organises and exercises foreign exchange regulation and foreign exchange control pursuant to the legislation of the Russian Federation.” It also “sets and publishes the official exchange rates of foreign currencies against the ruble.”

To protect investors and the legitimacy of the forex market, financial services providers must be licensed by the central bank to do business.

Local traders also use international brokerages that are authorized by overseas regulators (such as the UK’s Financial Conduct Authority (FCA)). However, the number of foreign companies operating in Russia has declined following recent Western sanctions. The CBR now discourages traders from using offshore brokers in favor of local operators.

Some international brokers allow traders to deal using the ruble instead of an overseas currency one like the US dollar. Advantages of this include the elimination of currency conversion costs that eat into profit and added convenience.See our pick of top brokerages offering RUB-based accounts.

Is Forex Trading Taxed In Russia?

Yes. Active traders may be required to pay personal income tax on their profits to the Federal Tax Service of Russia (FTS).

Tax is charged at a progressive rate. Individuals earning up to 5 million rubles a year pay tax at 13%. Those with higher personal incomes will be charged at a steadily rising rate, up to 22% for those earning 50 million rubles and above.

When Is The Best Time To Trade Forex?

Forex day traders can go to work 24 hours a day between Monday and Friday. Yet they tend to operate at certain times when trading volumes are higher, and the opportunities to trade more cheaply, easily, and more profitably consequently greater.

In Russia, there is no optimum time to trade that covers the whole country. Due to its vastness, there are 11 separate time zones, with Kaliningrad in the west and Vladivostok in the east separated by a vast 10 hours.

The best time to trade in Moscow is generally between the hours of 16:00 and 20:00. The city observes Moscow Standard Time (MSK), which is three hours in front of Greenwich Mean Time (GMT).

MSK coincides with the London market’s afternoon session and morning trading in New York. This is significant given these cities’ status as the world’s number one and two largest forex venues respectively.

A Forex Trade In Action

Now let’s consider what a forex trade could look like. In this example, I’ll run through how a trade involving RUB and the Indian rupee (INR) might happen.

I’ll be using the INR/RUB, a pairing that’s become more popular following the major restrictions described above.

The Background

My plan is to take a short position on the INR/RUB before the CBR makes its next interest rate statement. This involves me borrowing the base currency and selling it at the current market price.

If it falls against the quote currency as I expect, I’ll be able to buy it back at a lower price, then return it and pocket the difference.

After studying economic data, central bank minutes and comments from economists, I conclude that the CBR is likely to raise interest rates to 23%, an increase of 2% from current levels. This is higher than the 1.5% hike that the broader market has priced in based on broker consensus.

If I’m correct, the RUB could strengthen against a raft of international currencies, including the INR.

My pre-trade homework doesn’t just involve fundamental analysis. The fast-paced nature of forex trading mean I also need to study the charts to improve my chances of carving out a profit.

Technical analysis involves me studying price and volume data to identify entry and exit points for my trade. Traders use a wide variety of trend lines, chart patterns and indicators to get the information they need.

The Trade

With my research over, I open my trading menu and prepare to place the trade. I give myself 10 minutes to do this before the CBR makes its interest rate announcement at 13:30 MSK.

My trade involves setting up a ‘take profit’ and a ‘stop loss’ instruction to manage my risk. This protects me from rapid market movements that may see me lose out on a good profit, or even cause me to book a thumping loss.

At 13:20 MSK, the INR/RUB is changing hands at 1.1539. This encourages me to:

- Set up a ‘take profit’ instruction at 1.1507.

- Key in a ‘stop loss’ order at 1.1556.

Shortly afterwards, the CBR makes its rate declaration, advising that it’s hiked its lending benchmark to 23.1%. This is higher than the 23% I’d predicted, along with the 22.5% the market had priced in.

As a consequence, the RUB soars in value. Within 15 minutes, my ‘take profit’ level of 1.1507 has been hit, prompting my trading platform to close my position and deliver a profit of 32 pips.

Bottom Line

Forex trading in Russia has become more challenging following the conflict in Eastern Europe. But locals can still deal in a wide variety of currency pairings, while access to overseas brokerages is also still available, albeit at a reduced level.

Financial markets, including foreign exchange, are regulated by the CBR, though the central bank is only classified as an ‘orange-tier’ regulator in our Regulation & Trust Rating system.

DayTrading.com’s list of the best forex platforms can help you begin trading currencies in Russia.

Recommended Reading

Article Sources

- Global Foreign Exchange Services Market to Surpass $10 Trillion by 2028 Driven By Growth in International Transactions and Resurgence in Global Tourism – Researchandmarkets.com (via GlobeNewswire)

- Russia halts foreign exchange trading as US sanctions sow confusion – Financial Times

- New US sanctions force end of dollar and euro trading on Russia’s main exchange - CNN

- Central Bank of the Russian Federation (CBR)

- Legal Status and Functions - CBR

- Federal Tax Service of Russia (FTS)

- Russian lawmakers approve an increase in income taxes for the wealthy – Associated Press

- Current local time in Russia - Timeanddate.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com