RedMars Review 2025

Pros

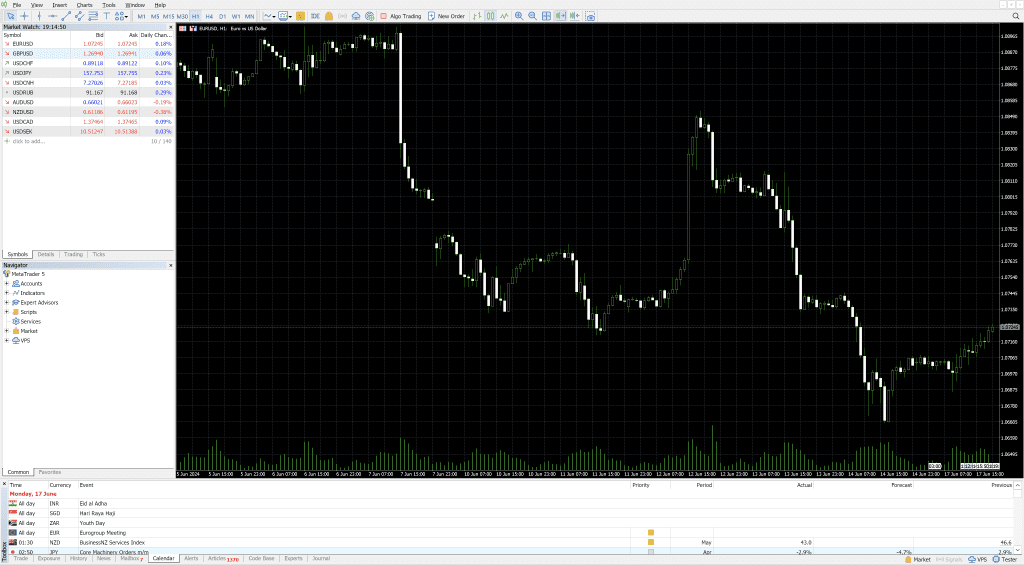

- RedMars offers one of the best platforms for day trading, MT5, hosting 21 timeframes, dozens of analytical tools, flexible templates and algo trading

- Getting started on RedMars is incredibly easy - you can be up and running in just a few minutes based on tests

- The broker supports a range of flexible payment methods, including wire transfers, credit cards, e-wallets, and notably cryptocurrencies

Cons

- With just 300 instruments, RedMars offers a narrow trading environment, particularly compared to category leaders like BlackBull Markets which offers 26,000 assets

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

- While RedMars' spreads are within industry averages, they don't offer a significant edge over the cheapest day trading brokers we've personally used, notably IC Markets

RedMars Review

This RedMars review delves into the day trading experience on their platform. Our analysis combines firsthand testing with insights from a vast database of around 500 online brokers.

Regulation & Trust

3.3 / 5RedMars is a somewhat trusted broker. It’s a registered trade name of Red Mars Capital Ltd., a Cyprus Investment Firm (CIF), authorized by the Cyprus Securities and Exchange Commission (CySEC), under license number 396/21 and registration No.HE399243 – a ‘green-tier’ regulator.

RedMars segregates client money from company funds. These segregated accounts are held with ‘reputable’ European credit institutions, adding another layer of protection.

RedMars also emphasizes regular account reconciliations, both internally and with external parties. This practice should ensure transparency and the accuracy of client funds.

As a safety net, RedMars clients are covered by Cyprus’s Investor Compensation Fund (ICF). The ICF is a government-backed program that can compensate eligible clients up to €20,000 per claim if RedMars defaults on its financial obligations.

On the downside, RedMars lacks the multi-regulated status of our most trusted brokers. Its track record is also fairly limited, having launched in 2020, and it’s not listed on a stock exchange, which would bolster its financial transparency.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | CySEC, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.5 / 5Live Accounts

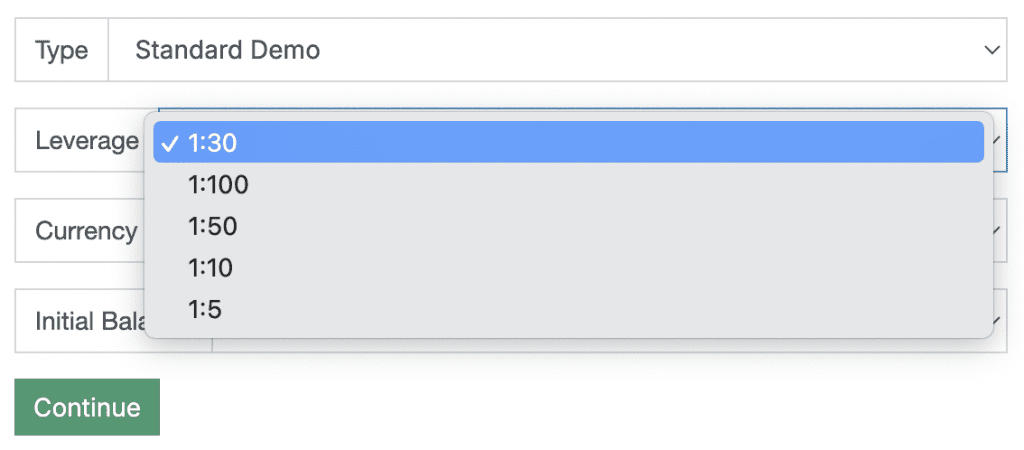

RedMars offers three account types, all providing access to the MetaTrader 5 platform and catering to day traders at all levels and budgets. They differ in terms of spreads, leverage, and commission.

- Most traders will choose the Standard account, which can be opened with a minimum deposit of €250. The average spread is 1.2 pips, and the maximum leverage is 1:30.

- The Pro account is more suitable for higher-volume traders but requires a minimum deposit of €5,000. This account reduces spreads to zero for some instruments, and the maximum leverage is 1:500, appealing to active traders.

- The VIP account is a tailor-made service reserved only for the broker’s ‘most valued customers’ who deposit at least €50,000. With You get a dedicated account manager, a ‘premium’ customer support team contact, and special invitations to global sports and entertainment events.

All accounts support expert advisors, scalping, hedging, and VPS (enables algorithmic trading strategies to run autonomously, independent of the trader’s device or Internet connection).

I found it easy to open a new RedMars account through the client dashboard — except for the VIP account, which can’t be opened manually.

Demo Accounts

RedMars offers demo accounts that work with MT5.

These accounts provided the ideal environment for testing day trading strategies using different instruments and leverage, building confidence in the platform and broker before trading in the live market with real money.

Deposits & Withdrawals

RedMars offers a variety of deposit and withdrawal methods. You can transfer funds via bank transfers, which typically take 3-5 business days to appear in my account.

While RedMars doesn’t charge fees for this option, intermediary banks may impose charges. For added convenience, credit and debit card deposits using Visa and Mastercard are accepted.

For those who prefer e-wallets, popular options like SticPay and FasaPay are also supported, though availability depends on your location.

If you want to leverage cryptocurrency, RedMars also allows deposits using that method. However, it’s important to note that these crypto deposits are automatically converted to USD or EUR upon entering your account.

This applies to withdrawals, too, where funds are returned to the original deposit method in the same currency. Keep in mind that RedMars currently only supports USD and EUR base currencies.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, FasaPay, Klarna, Mastercard, Neteller, PayPal, Skrill, Sticpay, Trustly, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | €250 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.8 / 5RedMars caters primarily to forex and CFD traders, with a narrow selection of tradable instruments covering currency pairs, stocks, indices, commodities and cryptos.

RedMars offers around 50 currency pairs, a reasonable selection though it trails the top forex brokers like CMC Markets (300 forex pairs), IG (100 forex pairs), or XTB (70 forex pairs). This focus on forex also comes at the expense of popular asset classes like real stocks, real ETFs, options, and even a more comprehensive range of cryptocurrencies.

While RedMars allows trading in 13 cryptocurrencies through CFDs, you won’t own the underlying assets. If you prioritize a broader crypto selection, platforms like DNA Markets, with over 120 crypto offerings, might be a better fit.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5The spreads offered by RedMars vary depending on your account type. For major currency pairs like EUR/USD and USD/JPY, spreads can start from 1.2 pips with the Standard account, and there are no commissions.

While this may be fine for swing traders, day traders and scalpers aiming to capitalize on every pip may find brokers like IC Markets, which offers zero spread accounts (albeit with small commissions), more appealing.

The Pro account reduces spreads, but there’s €3.5/lot-per-side commission.

I discovered while using RedMars that if my trading account is dormant (inactive) for only two months, I will be charged a one-off fee of €20 (or equivalent) and €10 (or equivalent) per month after that.

However, if I have more than one trading account and at least one of my trading accounts is active, then no inactivity fee will be deducted, even if one or more of my trading accounts is deemed inactive.

These costs fall within the ballpark of industry averages but don’t necessarily stand out as the most competitive, as you can see from our analysis below.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.7 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 15 | 0.005% (£1 Min) | 100 |

| Oil Spread | 15 | 0.25-0.85 | 0.1 |

| Stock Spread | Variable | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.8 / 5RedMars doesn’t offer day traders flexibility with its selection of trading platforms, limiting choice to either desktop, web, or mobile version of MetaTrader 5 (MT5) – MT4 isn’t even offered.

It’s disappointing that MT4 isn’t supported because it boasts a more straightforward interface suited for beginners and still provides advanced charting and analysis tools for more experienced traders.

Conversely, MT5 has more comprehensive charting and analysis tools, better caters to traders across multiple financial markets, and offers hedging capabilities.

Day traders who rely on specific charting platforms like TradingView or cTrader will find RedMars limiting. These popular platforms offer a range of features and functionalities that RedMars doesn’t integrate with. This lack of compatibility seriously hindered my preferred workflow and analysis style.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.8 / 5While some brokers offer educational resources by licensing high-quality analysis tools from established providers like Trading Central or Autochartist, RedMars falls short in this crucial aspect.

This lack of readily available research material is just one of the shortcomings that make RedMars an unsuitable platform for new traders.

While MT5 includes a primary and non-filterable economic calendar, RedMars doesn’t provide in-house blog content or webinars, leaving new traders ill-equipped for the market’s challenges, especially compared to category leaders like IG.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3 / 5Unlike leading brokers prioritizing trader education, RedMars offers scant resources for new traders. This lack of educational tools will force beginner traders to find knowledge elsewhere.

RedMars doesn’t even have a dedicated Education section on its website, highlighting its disregard for providing the kind of trading tutorials, webinars, and other prominent resources on platforms like eToro.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4 / 5RedMars’ contact options are limited and include a support email address and ticket system within the client area. There’s no phone number or live chat.

Another concern is that none of the social media links on the broker’s website worked during our latest testing.

This lack of readily available support options was a concerning aspect of my RedMars trading experience. I found that emailing customer support every time I had a question – and waiting at least 24 hours for a reply – was extremely frustrating.

And crucially, it falls way below the quality of assistance I get at alternative platforms, notably IC Markets.

| RedMars | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With RedMars?

While RedMars offers competitive spreads and commission-free trades and supports the popular MT5 platform, its newness shows.

The website could be more precise (broken links), there are no educational or research tools, and customer support is way below the standard we consistently get at leading brokers. And while it’s regulated in Europe, many traders based elsewhere can find more established, locally regulated trading platforms.

Ultimately, RedMars is fine, but it’s not great.

FAQ

Is RedMars Legit Or A Scam?

RedMars, a relative recent entrant to the brokerage market with headquarters in Cyprus, has a limited track record. While it is regulated by one ‘green-tier’ regulator, suggesting it’s a legitimate trading firm, it’s not as credible as the best day trading brokers.

Is RedMars A Regulated Broker?

Red Mars Capital Ltd is regulated by CySEC, the financial regulator of the Republic of Cyprus. CySEC aims to facilitate the sound development of the securities market and safeguard investor protection through efficient supervision.

Is RedMars Suitable For Beginners?

While RedMars may appeal to some traders, the need for a proprietary trading platform and educational resources could be a hurdle for beginners. New traders might find established platforms like eToro and Plus500 more user-friendly, as they offer intuitive platforms and fantastic educational materials.

Does RedMars Offer Low Fees?

RedMars keeps fees competitive by offering commission-free trading on the Standard account. While they may not boast the tightest spreads across all instruments, their overall pricing structure might still be attractive to some traders, especially if you can afford the minimum deposit for a Pro or VIP account.

Is RedMars A Good Broker For Day Trading?

RedMars’ competitive pricing, fast execution speeds, and compatibility with MT5 for scalping might appeal to day traders. However, short-term trading using the popular TradingView and cTrader charting platforms is not supported.

Does RedMars Have A Mobile App?

The MT5 mobile app, supported by RedMars, offers several benefits for traders, including the ability to trade on the go with real-time access to market data and charts. The app supports a wide range of trading instruments. It offers various technical analysis tools, push notifications for price alerts, and trading signals, ensuring that day traders can always stay connected to the markets.

Top 3 Alternatives to RedMars

Compare RedMars with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

RedMars Comparison Table

| RedMars | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 | 2.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €250 | $0 | $100 | $50 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 |

| Regulators | CySEC, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | – |

| Bonus | – | – | 10% Equity Bonus | 120% Cash Welcome Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:50 | 1:200 | 1:2000 |

| Payment Methods | 13 | 6 | 11 | 2 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by RedMars and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| RedMars | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

RedMars vs Other Brokers

Compare RedMars with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of RedMars yet, will you be the first to help fellow traders decide if they should trade with RedMars or not?