Ratio Spreads

Ratio spreads are advanced options strategies that involve buying and selling different numbers of options contracts with the same expiration date but different strike prices.

These strategies can be used to profit from specific market movements while limiting risk.

Note that this type of unbalanced structure typically requires greater collateral requirements than traditional call and put spreads that have equal amounts of options long and short.

Key Takeaways – Ratio Spreads

- Risk-Reward Profile

- Ratio spreads have a way of better limiting downside than other spread options trading strategies, but have complex payoff structures.

- Traders have to carefully assess max loss, max gain, breakeven points, and tail risks from large price movements.

- Flexibility in Design

- By adjusting ratios and strike prices, traders can tailor spreads to specific market outlooks and risk tolerances.

- Common ratios include 1:2, 1:3, and 2:3.

- Volatility Consideration

- These spreads can be particularly effective when implied volatility is high, as the sold options benefit from volatility contraction.

- Understanding option skew is also important for optimal structuring.

Key Characteristics of Ratio Spreads

- Involve buying and selling unequal numbers of calls or puts

- Use options with the same expiration date

- Use different strike prices

- Can be constructed using either calls or puts

Types of Ratio Spreads

Call Ratio Spreads

Call ratio spreads involve buying calls at one strike price and selling a larger number of calls at a higher strike price.

Put Ratio Spreads

Put ratio spreads, conversely, involve buying puts at one strike price and selling a larger number of puts at a lower strike price.

Common Ratio Spread Configurations

1:2 Ratio Spread

This is the most common ratio spread configuration.

Long 1 ATM, Short 2 OTM

- Buy 1 At-The-Money (ATM) option

- Sell 2 Out-of-The-Money (OTM) options

Long 1 ITM, Short 2 OTM

- Buy 1 In-The-Money (ITM) option

- Sell 2 OTM options

1:3 Ratio Spread

A more aggressive variation of the ratio spread.

- Buy 1 option (typically ATM or ITM)

- Sell 3 OTM options

2:3 Ratio Spread

A more conservative approach that offers better downside protection.

- Buy 2 options (typically ATM or ITM)

- Sell 3 OTM options

Specific Examples of Ratio Spreads

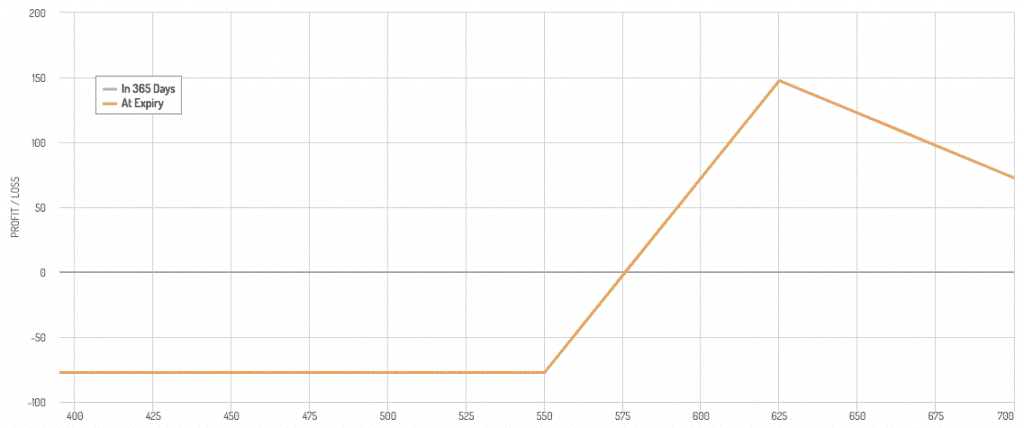

Example #1

Here’s an example of a type of bullish ratio spread.

You’re overweight on the OTM calls causing the structure to bend down after a point.

This is a long 3 calls / short 4 calls ratio, with the long calls ATM and short calls OTM.

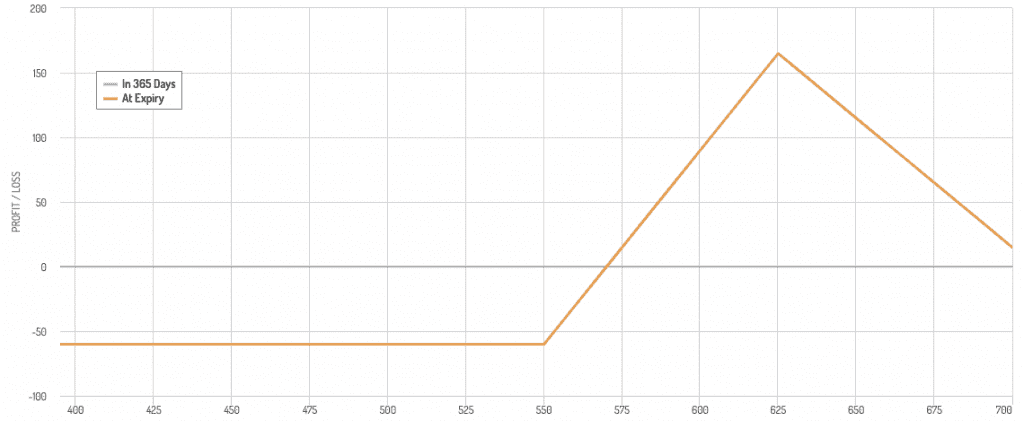

Example #2

The following trade structure is a 3 calls / short 5 calls ratio, with the long calls ATM and short calls OTM.

This might be used if the trader thinks larger gains are unlikely and can use some of the premium from selling an extra call to have a lower potential drawdown.

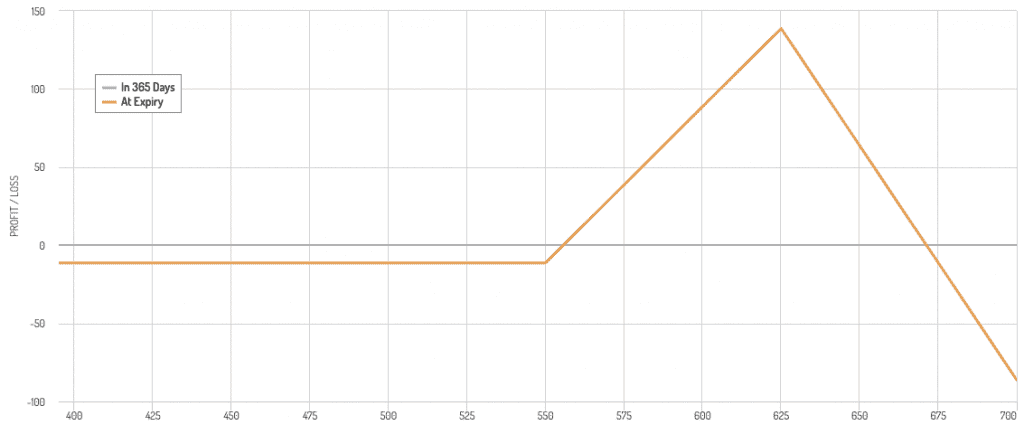

Example #3

In general, you can play around with these trade structures a lot until you get to something that best that aligns with your goals.

It’s always helpful to throw it up on an options payoff diagram with exact prices you’re considering to see how it’d perform (max profit, max loss, breakeven points, etc.).

Here is a long 2 ATM calls / short 5 OTM calls type structure:

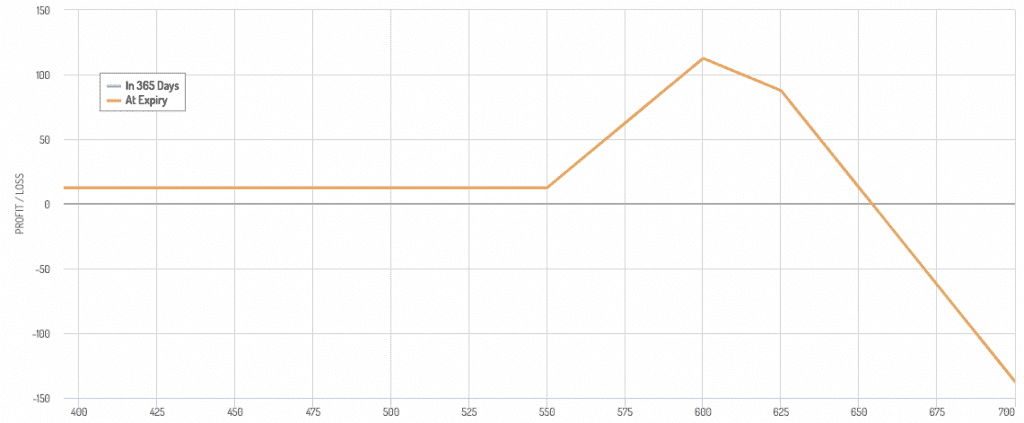

Example #4

Similar to the above example (long 2 ATM calls, short 5 OTM calls) but here the maturities of the OTM calls are staggered.

Also, owning some cheap short-term OTM hedges that you continuously roll can be helpful to chop off the right-tail risk (i.e., the underlying moving up too much).

This will get you some collateral back.

On top of that, it can also provide less pressure on other parts of your portfolio.

If, for example, this was an equity trade and you were to have another form of risk asset in your portfolio, you would have less equity left-tail risk in your portfolio with this trade structure and less potential need for risk-off assets elsewhere in the portfolio.

Advantages of Ratio Spreads

Limited Risk

The long option(s) in the spread are the potential profit engine.

Potential for Significant Profits

If the underlying asset moves to approximately the short strike price at expiration, the strategy can be highly profitable.

Flexibility

Traders can adjust the ratio and strike prices to suit their market outlook and risk tolerance.

Reduced Cost or Credit

The sale of multiple options can offset the cost of the long option(s) or even result in a net credit.

Disadvantages and Risks

Unlimited Risk (for call ratio spreads)

Call ratio spreads have theoretically unlimited risk if the underlying asset price rises a lot.

Short Gamma Risk

It can be a net short gamma risk and minor price movements can lead to short-term losses due to being overweight short options.

Complex Risk Profile

The payoff diagram for ratio spreads can be more complicated than simpler options strategies.

Assignment Risk

There’s a risk of early assignment on the short options, especially if they become ITM.

Margin Requirements

Ratio spreads often require very high margin, which can tie up trading capital.

When to Use Ratio Spreads

Neutral to Moderately Bullish/Bearish Outlook

Ratio spreads are often used when a trader expects modest price movements in the underlying asset.

Elevated Implied Volatility

These strategies can be effective when implied volatility is high, as the sold options benefit from volatility contraction.

Income Generation

Traders may use ratio spreads to generate income, especially when they result in a net credit.

Examples of Ratio Spreads

Call Ratio Spread Example

Assume XYZ stock is trading at $50:

- Buy 1 XYZ 50 Call for $3

- Sell 2 XYZ 55 Calls for $1 each

Net debit = $1 ($3 – $2)

Put Ratio Spread Example

Assume ABC stock is trading at $100:

- Buy 1 ABC 100 Put for $5

- Sell 2 ABC 95 Puts for $2 each

Net debit = $1 ($5 – $4)

Risk Management in Ratio Spreads

Setting Stop Losses

Implement stop-loss orders to limit potential losses, especially for call ratio spreads.

Adjusting the Position

Be prepared to adjust the position if the underlying asset moves significantly.

Monitoring Greeks

Pay attention to delta, gamma, and vega to understand how the position will behave as markets change.

Some brokers keep track of these for you (e.g., Interactive Brokers).

Advanced Considerations

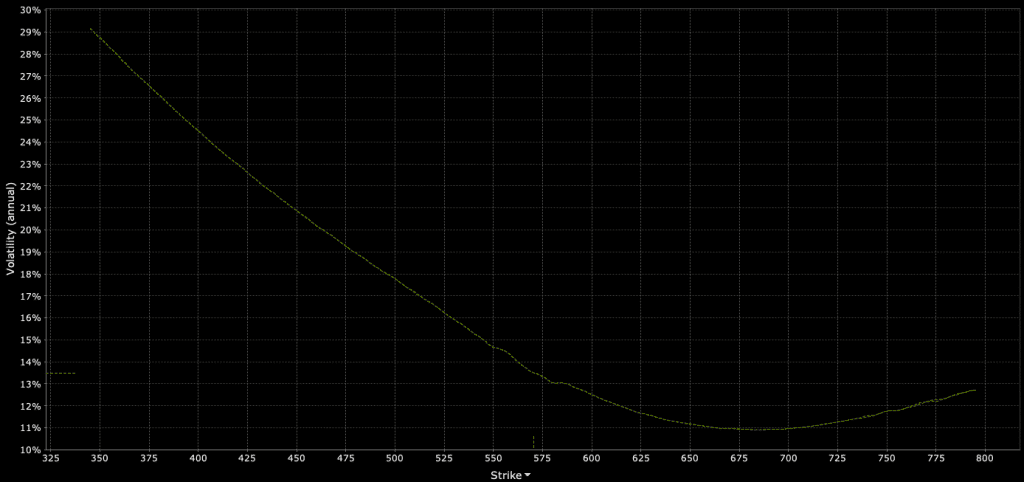

Skew

Option skew can impact the profitability of ratio spreads.

For example, OTM call skew tends to be cheaper than ATM call skew.

This means you could be paying more for your long call and getting less for your short calls, which constricts the profitability window of the trade.

This diagram shows this concept:

Understanding and exploiting skew can enhance returns.

Rolling the Position

Consider rolling the position to a later expiration date if the initial outlook remains valid but needs more time to play out.

Combining with Other Strategies

For experienced traders, ratio spreads can be combined with other options strategies to create more complex positions tailored to specific market views.

Conclusion

Ratio spreads offer traders a versatile trade structure for expressing nuanced market opinions while potentially limiting risk or generating income.

However, it requires a solid understanding of options mechanics and careful risk management.

As with any options strategy, traders should thoroughly test (in simulated trading/paper trading) and understand ratio spreads before implementing them in live trading.