Rakuten Securities Review 2024

Pros

- A user-friendly copy trading tool is available to account holders

- Over 2 million traders have signed up with Rakuten Securities

- A $50 minimum deposit and fixed spreads make the broker a good pick for beginners

Cons

- Limited selection of tradeable assets with no stocks

- Only one trading platform

- High fees on some instruments

Rakuten Securities Review

Rakuten Securities is an ASIC-regulated firm with more than two decades of experience in the online trading sector. With global offices and an international customer base, Rakuten offers traders several benefits including fixed spreads and leverage up to 1:30 for retail investors and 1:400 for pro traders.

Read this review to learn our experts’ opinion of Rakuten Securities and for a breakdown of the trading platforms it offers, the assets available, and the payment methods accepted. We also share guides on how to place trades at Rakuten and get the most out of the broker’s tools.

Company History & Overview

Chaired by CEO Hiroshi Mikitani since he founded the firm as Japan’s first online broker in 1999, Rakuten Securities has grown to operate offices in Japan, Hong Kong (Rakuten Securities HK and Rakuten Securities Buillion), Australia, and Malaysia. In just under 25 years, Rakuten has served over 2.6 million clients.

The Rakuten conglomerate provides services in a group of industries, including calling and messaging with Rakuten Viber, marketing with Rakuten Advertising, and entertainment with Rakuten TV, Viki, or Kobo. The group also has its own Economic Research Institute in Tokyo, where studies are funded and conducted for institutions including the Indian Economic Times and Rakuten Trade.

Rakuten has also boosted its global brand awareness since 2015 by investing in popular sports, acquiring the J-League football club Vissel Kobe that year, partnering with the La Liga team FC Barcelona the following year, and NBA team the Golden State Warriors in 2017.

With its fingers in so many pies, the Rakuten Group has built a solid reputation and a huge net worth of approximately $9 billion. As a result, Rakuten Securities is not a minor player in the online brokerage world and has some clout behind it.

Trading Platform

Rakuten Securities uses one of the most well-regarded trading platforms created by MetaQuotes Software – MetaTrader 4. As one of the world’s most popular platforms – especially among forex traders – MT4 is a solid piece of trading software that many traders will already be familiar with.

As Rakuten Trade does not support any other trading platform or offer its own proprietary software, users will need to download MT4 to trade with this broker. MT4 is compatible with Windows, Android and iOS operating systems.

MT4 has 9-time frames (M1, M5, M15, M30, H1, H4, D, W1, Mn), 30 pre-downloaded indicators, including Bollinger bands and a stochastic oscillator, 3 execution modes, and 3 different chart styles. Using the platform’s MQL4 language, traders can also program their own choice of indicators and bots to personalize their trading setup.

How To Place A Trade

- Create an account with Rakuten to receive login details for MT4

- Decide which asset you wish to trade – head to the Market Watch widget to open a price chart

- Use the tools and indicators provided by MT4 to forecast price movements

- Select the New Order button from the menu at the top of the platform

- Input the order details, including trade volume and execution mode

- Buy or sell the asset accordingly

Rakuten App

Rakuten’s trading platform, MT4, is available for download on mobile devices.

Traders can monitor their trades and open and close positions on the go by using MT4 on their Android or iOS mobile devices. Traders have access to all the relevant market data, analysis tools and charts, ability to make deposits and request withdrawals, all from their phones or tablets.

Assets & Markets

Rakuten Trade offers a modest selection of 70+ instruments. The broker has a good choice of forex instruments, but there are no stocks and just one cryptocurrency asset available.

Supported instruments:

- 40 forex pairs, such as USD/JPY, EUR/USD, and EUR/CAD

- 4 metals (gold, silver, palladium, and platinum), paired with up to 6 currencies, including USD, JPY, and EUR

- 11 CFD stock indices, including UK 100, Japan 225, and Euro Stoxx 50

- US crude oil and UK Brent crude oil

- BTC/USD is the only crypto

Fees & Spreads

Spreads for all currency pairs with Rakuten are fixed, starting from 0.5 pips. This is an attractive pricing model for beginners, meaning clients know how much trades will cost before they open a position. However, active traders may get better fees using a variable spread system offered by other brokers.

Our experts were pleased to find there are no deposit fees, additional commissions, maintenance fees, or inactivity charges.

Leverage

While using Rakuten Securities, our experts found that the maximum leverage offered depends on the account type you open.

Retail accounts have a maximum leverage of 1:30 for major currency pairs, 1:20 for minor currency pairs, gold, or a major stock market index, 1:10 for commodities (other than gold) or a minor stock market index, 1:2 for BTC/USD, 1:5 for shares or other assets. This is in line with other ASIC-regulated brokers.

Pro 1 accounts have a maximum leverage of 1:100, and pro 2 and pro VIP offer a maximum leverage of 1:400. Again, this is in line with competitors.

All accounts have a 70% margin call level and a 50% stop-out level.

Rakuten Securities Accounts

All traders will sign up for Rakuten Securities with a retail account. Those who meet certain criteria will have the option to upgrade to the three tiers of pro accounts, which offer higher leverage.

With retail accounts, traders have access to a maximum leverage of 1:30, spreads from 0.5 pips, and a maximum open position of 250 lots – all with a minimum deposit of 50 USD. Retail traders also benefit from an online trading guide, negative balance protection, and full product disclosure upon choosing an asset.

However, bear in mind that retail traders who move up to a pro account will not have the benefit of negative balance protection, meaning they can lose more money than is in their brokerage account. As the name suggests, these accounts are for professionals who know how to protect themselves with robust risk management strategies.

Traders who have net assets of over 2.5 million AUD or whose gross income for each of the last 2 financial years is at least 250,000 AUD are eligible to open pro accounts. Alternatively, traders who meet two of four criteria involving portfolio value, experience in the financial sector, and the frequency and notional value of their trades over the last year.

Retail Account

Retail accounts come with a minimum spread for forex pairs of 0.5 pips, with AUD/USD being 0.5 pips, GBP/JPY at 1.0 pips, and NZD/CAD at 2.5 pips.

Metals have a minimum spread of 1.8 pips for XAG/EUR and a maximum of 549.6 pips for XAU/JPY.

Oils have a spread of 0.6-0.7 pips. Stock indices have a minimum spread of 0.6 for the UK 100 and Germany 30, and a maximum spread of 8.2 for Spain 35.

These spreads are all competitive vs alternative brokers.

Pro 1 Account

With a pro 1 account, the spreads and fees remain the same as retail accounts.

The maximum leverage in Pro 1 accounts rises to 1:100.

Pro 2 Account

Pro 2 accounts come with higher spreads starting from 0.8 pips on forex pairs (EUR/USD and AUD/USD), 2.3 pips on metals (XAG/EUR), and the same spreads as retail accounts for CFD stock indices, cryptocurrencies, and oils.

Pro 2 account holders benefit from maximum leverage of 1:400.

Pro VIP Account

This account type offers the same fees and spreads as retail account types, and offers the same 1:400 maximum leverage as a Pro 2 account.

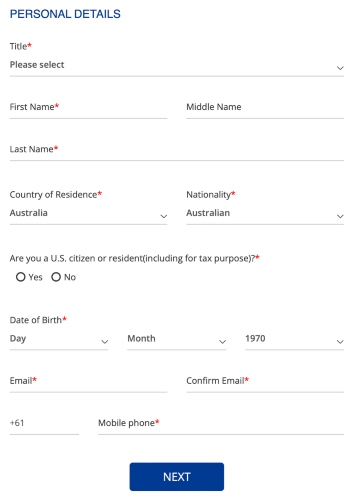

How To Open A Live Account

- Head to Rakuten Securities using the ‘Visit’ button in this review

- Enter your personal details and contact information on the registration form

- Verify your identity by providing copies of your ID documents (e.g. driver’s licence, passport)

- Set up your trading account security by creating a username and password

- Read and agree to the terms and conditions of the account

- Fund your account using one of the accepted payment methods

- Activate your account by completing the on-screen instructions

- Log in to your Rakuten account and start trading

Demo Account

Rakuten Trade also offers a free MT4 demo account to help traders practice strategies and sharpen their skills.

By entering a few details and creating a login with Rakuten Securities, you will be given sign-in details for your MT4 demo account. Simply download the trading platform and use these details to practice trading.

You can choose leverage of up to 1:400 with 100,000 EUR/USD/GBP/AUD in virtual money to make paper trades.

How To Open A Demo Account

- Visit the Rakuten Securities website and click ‘Open a Demo Account’

- Fill in your personal information, such as your name and address

- Choose the maximum amount of leverage you wish to access on your demo account: 1:30, 1:100, 1:400

- Agree to the terms and conditions of the paper trading account

- Activate your demo account by completing the verification process

- Log in to your Rakuten Securities demo account on MT4 and start trading

Rakuten Payment Methods

Rakuten Securities offers a good selection of deposit and withdrawal methods with no fees and near-instant payments.

Accepted deposits and withdrawals include Nab, credit and debit cards, POLi, Neteller, Skrill, Union Pay, and wire transfers for South East Asia. Transferwise is also available to make payments via bank transfer, debit or credit card, POLi Pay, and PAYID.

How To Make A Deposit

- Log in to the Rakuten Securities portal

- Select ‘Funding’ in the menu on the right

- Click the ‘Deposit to Account’ option

- Choose the deposit method and input the amount

- Complete the details and follow the instructions

- Confirm the payment

Regulations & Licensing

Rakuten Securities is regulated by the ASIC (Australian Securities & Investments Commission), which enforces rigorous measures to create a safe environment for traders, including restrictions on leverage and negative balance protection for retail investors.

In line with this regulatory oversight, Rakuten Securities holds client funds separately from its own, ensuring that traders’ cash will be protected in the event that the brokerage becomes insolvent.

Overall, we’re satisfied the brokerage is legitimate and trustworthy.

Additional Features

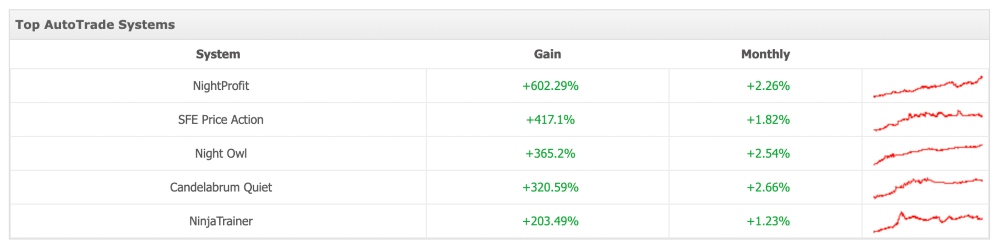

Copy Trading

By signing up for Rakuten Securities Australia (RSA) and navigating the website, traders can also access copy trading. This is a useful tool for beginners looking to learn from established traders and for experienced investors looking to generate an additional revenue stream.

You will be prompted to sign in or sign up for a Myfxbook account. Following activation (done via an email received in 2 business days), clients can set up their auto-trade systems.

Education

The Rakuten Securities website features blog posts to educate clients on trading. Topics cover a lot of ground including forex basics, fundamental and technical analysis, and trading psychology. Each section links to an extensive menu of blog posts, from the 4 posts under ‘Trading Psychology’, to 19 under ‘Technical Analysis’.

On the downside, there are other brokers with more informative educational materials, including videos and tutorials aimed at novice traders.

Trading Hours

There are not any explicit trading hours published by Rakuten Securities, however, maintenance is carried out on weekdays from 08:50-09:10 and 17:00-22:00 on Saturdays (Sydney local time).

Forex markets are typically open 24/5, though stock indices are impacted by local trading times. Ultimately, each asset will have different trading hours.

Customer Support

When we used Rakuten Securities, we found the broker offers a good range of customer service channels. Traders can quickly get help with account and platform queries.

Customer support is available via live chat, Skype, Facebook, WeChat (all under Rakuten Securities Australia) and WhatsApp (+614 5187 4916). You can also reach support via telephone (+612 9247 2483 or +612 8103 4890) and email (support@sec.rakuten.com.au).

Safety & Security

Regulated by ASIC and with a strong corporate history, Rakuten Securities is a safe and secure broker to trade with. However, it always pays to take extra precautions for maximum security, such as activating 2-factor verification for logging in and making withdrawals.

Rakuten Securities Verdict

Rakuten Securities has built a successful and trusted brand as an online brokerage for more than two decades. With a variety of assets to choose from, the most widely used trading platform, and regulation by one of the most reputable financial bodies, it has created a competitive and safe environment for clients to execute trades. The addition of copy trading also makes the firm a good fit for beginners, especially in Australia and Asia.

FAQs

Can Rakuten Securities Be Trusted?

Yes, Rakuten can be trusted. It has established a strong brand with over 2 million loyal customers, sponsoring huge sporting teams globally, and is overseen by a trusted regulatory body – the ASIC.

Is Rakuten Securities Legal?

Yes, Rakuten is operated under a registered business, with the Australian License Number 153 803 804, and an Australian Financial Services License of 418036.

Is Rakuten Securities A Good Or Bad Broker?

Rakuten Securities is a good all-round broker. The firm offers a full range of assets, fixed spreads, and operates with strong regulatory oversight. Copy trading is also available.

How Does Rakuten Trade Pay Out Profits?

The broker supports withdrawals via bank cards, popular e-wallets, and wire transfers. You can request a withdrawal via your client portal on the Rakuten website. Simply go to the ‘Funding’ section of the portal and request a withdrawal. Fees and estimated times are outlined in our Rakuten review.

Is Rakuten Securities A Good Option For Muslim Traders?

Rakuten offers an Islamic profile to those who select the ‘Islamic Account’ option when signing up. Traders who select this profile will need to prove their Islamic faith. There are no swap fees levied on Islamic accounts, however, if you hold an open position with a negative swap fee, administration fees are charged.

Top 3 Alternatives to Rakuten Securities

Compare Rakuten Securities with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Rakuten Securities Comparison Table

| Rakuten Securities | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 3.3 | 4.7 | 4.3 | 3.9 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | – | – | – | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:400 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 11 | 6 | 6 | 12 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Rakuten Securities and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Rakuten Securities | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Rakuten Securities vs Other Brokers

Compare Rakuten Securities with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Rakuten Securities yet, will you be the first to help fellow traders decide if they should trade with Rakuten Securities or not?