Quadcode Markets Review 2025

Awards

- Best Forex Broker Australia – Forex Awards 2023

- Best All-in-One Brokerage Solution – UFAWARDS 2023

- Most Innovative Trading Platform Globe – Le Fonti Awards 2022

Pros

- The charting package rivals popular platforms like MT4 with 100+ indicators and up to 9 chart displays

- The platform continues to excel for its ease of use with a modern design and customizable workspace

- The demo account can be opened in under 2 minutes while the replenishable $10,000 bankroll and no time limit means you can routinely test day trading strategies

Cons

- Spreads are wider than low-cost brokers based on comparisons during key trading sessions, potentially eroding profits for day traders

- The market research trails best-in-class brokers like IG with limited technical summaries or sentiment data

- Customer support is fast based on tests of the live chat but the knowledge of agents is limited to basic queries

Quadcode Markets Review

In this Quadcode Markets review, I test and compare the platform and trading tools extensively. I analyze the broker’s strengths and weaknesses and evaluate how it stacks up against other brokers, considering the needs of different types of traders.

Regulation & Trust

3.3 / 5The best sign of a trustworthy broker is authorization from credible regulators, and despite being relatively new on the scene, having launched in 2021, Quadcode Markets scores fairly well.

Two of its entities are overseen by the Australian Securities and Investments Commission (ASIC) (no 327075) and the Cyprus Securities Exchange Commission (CySEC) (licence 247/14), both of which are top-tier regulators.

Its global entity is registered with the Securities Commission of the Bahamas (SCB) (licence no SIA-F219). This is not such a well-regarded regulator, but this is fairly standard for brokers’ global branches.

This oversight ensures that the broker implements important safety measures, including negative balance protection and segregated client accounts.

Overall, I see this, as well as the selection of awards Quadcode has racked up already, as positive signs that earn it a fairly high trust score.

That said, it still lags behind top-rated alternatives like IG which has 50 years in the industry, listing on the London Stock Exchange, and licenses from a long row of tier-one regulators.

Quadcode has done impressive work to win clients’ trust considering its short time in the industry, and traders in Europe and Australia can be assured of top-tier regulatory oversight.

Accounts & Banking

3 / 5Retail traders have access to one live account at Quadcode Markets, which offers the full range of tradable assets with zero commissions.

This model has its advantages. Firstly, the commission-free pricing structure keeps things simple for beginners.

Equally, the single account makes getting started straightforward. Other brokers we’ve evaluated, such as IronFX, offer more than 6 accounts, which can complicate the sign-up process if you are new to trading.

On the downside, there are several negatives. Firstly, there is no raw spread account – a popular solution with experienced day traders. IC Markets offers this type of account on top of its commission-free Standard account, and this added flexibility ensures a wider range of traders are catered for.

Also, while the single account will appeal to new traders, the $250 minimum deposit is higher than many rivals, especially our highest-rated broker for beginners – Pepperstone, which has no minimum.

My other minor complaint is that there is no swap-free account. These are increasingly provided by leading brokers, and as a result, Quadcode isn’t the best option for Muslim traders. If complying with Islamic Finance principles is important to you, I recommend AvaTrade.

Deposits & Withdrawals

Quadcode Markets offers convenient and low-cost payment methods including PayPal, Neteller, Skrill and Apple Pay, as well as bank cards and wire transfers.

It is good to see that all deposits offer near-instant processing, except wire transfers which take 3-5 business days. I have also been pleased to find that the broker doesn’t charge any transaction fees.

Withdrawal times depend on the funding method, with Quadcode’s processing time of 1-3 business days around the industry average.

Demo Account

Quadcode offers a free demo account that is available to all users who complete a simple registration process. This provides an excellent way to test the in-house platform and practice day trading strategies under real-time market conditions.

Notably, the broker’s demo account is one of the most convenient I’ve used since it is easy to access and can be replenished with up to $10,000 in virtual funds and there is no time limit.

It took me less than 2 minutes to open an account, sign into the platform and start trading.

Assets & Markets

3 / 5Quadcode offers a modest range of instruments that will give beginners enough scope to build a fairly diverse portfolio, with hundreds of stocks and a reasonable selection of currency pairs, commodities, indices and ETFs.

Its large suite of cryptos is the highlight, offering short-term trading opportunities on lesser-known tokens as well as established digital assets.

Importantly, all instruments are traded via CFDs so you can speculate on rising and falling prices without taking ownership of underlying assets, such as shares.

I recorded the assets available in the Quadcode Markets platform:

- Stocks: 375 company shares from the US, UK and Europe

- Forex: 63 currency pairs including all the majors plus a good selection of minors and exotics

- Crypto: 26 cryptos paired with USD or USDT, including BTC, ETH and BNB

- Commodities: 9 commodities include gold, brent crude oil, copper and a few soft commodities such as wheat

- Indices: 12 stock indices including the US 500, UK 100 and GER 30

- ETFs: 22 funds that track global indices as well as sectors including energy and cannabis

Looking at the negatives, and as you can see from my analysis of competitors below, Quadcode Markets does not offer the extensive investment offering you can find at brokers like Pepperstone (great for beginners) and CMC Markets (great for experienced traders). This is despite Quadcode adding another 100+ stocks to its roster.

| Quadcode Markets | Pepperstone | CMC Markets | |

|---|---|---|---|

| Total Assets | 500+ | 1,250+ | 12,000+ |

| Forex | 60+ | 90+ | 300+ |

| Stocks | 370+ | 1000+ | 10,000+ |

Leverage

Quadcode Markets’ European and Australian entities are bound by regulations that set the maximum leverage to 1:30 on major forex pairs, with this amount scaling down to 1:5 on stocks and 1:2 on crypto.

Importantly, trading on margin is risky – both profits and losses are magnified.

Fees & Costs

2.5 / 5Quadcode’s commission-free trading model means the broker takes its cut from floating spreads, which vary according to market conditions.

However, spreads were wider than low-cost alternatives during my tests. For example, I got a spread of 1.2 on the EUR/USD during prime trading hours for US and European markets – noticeably wider than the 0.7 pips I got at CMC Markets on the same pair.

In fact, I recorded and compared Quadcode’s fees with two suitable alternatives, and as you can see from my analysis below, they both primarily offer lower prices on popular assets, with the exception of some commodities.

| Quadcode | CMC Markets | IG Group | |

|---|---|---|---|

| EUR/USD | 1.2 | 0.7 | 0.8 |

| Stocks | 1.3 | 0.02 | 0.02 |

| Oil | 0.07 | 3.5 | 2.8 |

You will also need to pay interest for overnight positions, which is industry standard. I found you can expect to pay -0.00002% on long positions on the EUR/USD.

That said, day traders can avoid this fee by closing positions before the markets close.

The only other charge to bear in mind is the $10 inactivity fee which kicks in after 90 days of no trading activity, making Quadcode Markets a poor choice for casual traders.

In conclusion, Quadcode Markets trails the cheapest brokers. Also, the lack of a raw spread account or fee rebates makes it less suitable for advanced day traders.

Platforms & Tools

3.8 / 5I comprehensively tested the Quadcode Markets platform and there is no doubt ample investment has gone into designing a slick, intuitive and powerful trading solution.

Traders with little or no experience will find it simple to navigate the interface. All the key functions, including risk management tools like stop loss and take profit levels, are easily accessible in the same tab when you place an order, allowing for fast and enjoyable trading.

The Trade interface is also well-organized and eye-catching, with instruments sorted into tabs at the top – making it easy to analyze multiple assets simultaneously.

The inclusion of categories like Top Fallers and Most Volatile provides another helpful feature for discovering market opportunities. It’s also something that you don’t get in MetaTrader 4’s Market Watch, for instance.

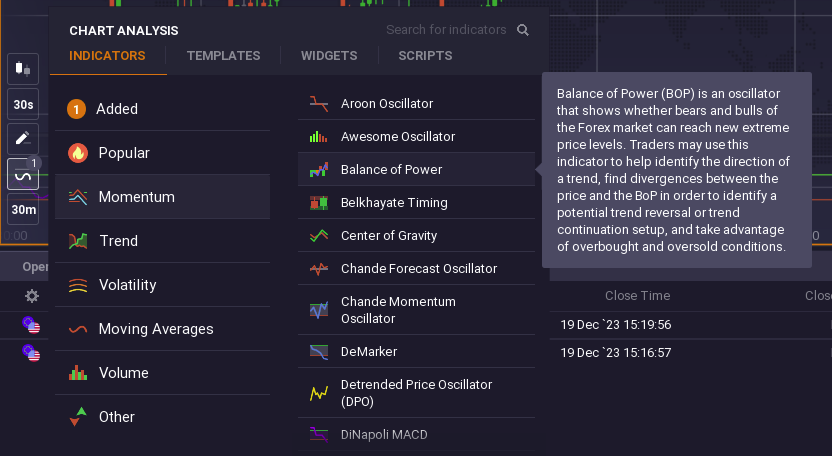

The platform also rivals popular MT4 when it comes to charting. While using the platform, I found you can display up to 9 charts at once and switch between 18 timeframes ranging from 5 seconds to 1 month, catering to short-term traders.

There are also 100+ indicators such as Bollinger Bands and RSI, and you can input scripts to make your own. Again, this makes for a comprehensive solution for day traders who often use technical analysis.

Considering the negatives, my many hours using the Quadcode platform revealed that it lacks a number of features which could elevate the trading experience:

- There are no signals or copy trading, which can help aspiring traders find opportunities.

- There is no support for automated trading, a feature that many experienced day traders look for.

Moreover, traders who wish to use a different platform, like the familiar MetaTrader 4, either due to personal preference or to use algorithmic trading tools for example, will sadly not have the option.

If you want access to popular third-party software like MetaTrader, plus well-designed in-house software, I recommend an alternative like CMC Markets, which continues to offer a first-rate user experience with regular improvements to its web platform.

Mobile App

Quadcode Markets offers an iOS and Android app for mobile traders that features most of the functionality of the desktop platform.

It’s obvious the broker has spent time ensuring the mobile trading experience is excellent with widgets and charts that respond well on phones and tablets.

It also delivers the same strong charting package, with 4 types of charts, 18 timeframes and a huge library of integrated indicators.

Custom alerts are another feature I really like, allowing you to send notifications to your phone when a chosen asset reaches a specified price level.

Research

1.5 / 5Quadcode Markets trails the top brokers for market research.

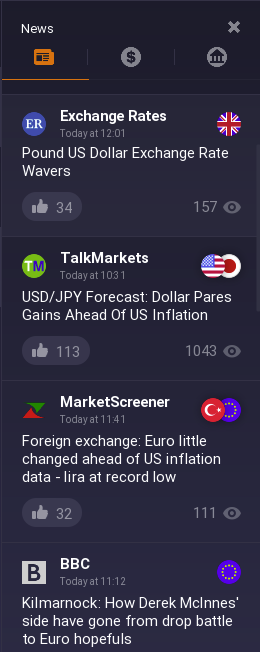

The integrated analysis sidebar in the platform with tabs for news, an economic calendar and an earnings calendar, can help you track events that could impact various markets. However, it doesn’t offer the depth of insights that best-in-class research brokers like IG provide.

For example, a lot of the research at Quadcode is from third-party sources, covering major headlines and basic technical analysis on major forex pairs like support and resistance. But because the research is often from different outlets, there is no uniform format which gets frustrating over time. The very slow scroll bar is also painful to use, but that’s a minor complaint.

In contrast, IG offers a wealth of market research and insights in a consistent and easy-to-digest format. This includes IGTV, which hosts live videos three times a day with real-time charting analysis and forward insights.

IG also provides data on the percentage of clients buying and selling securities on the platform, and whether they are bearish or bullish, helping you gauge market sentiment.

Education

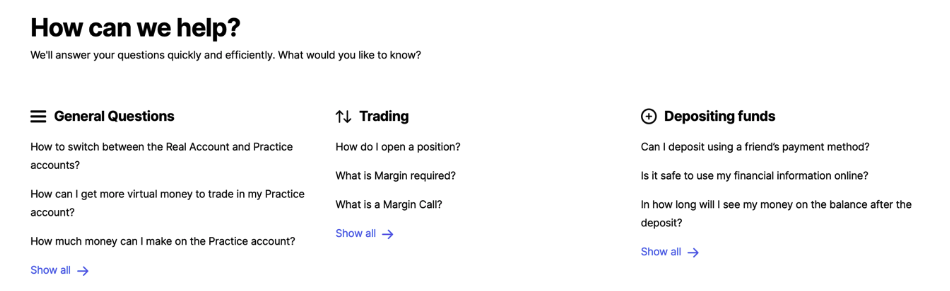

0.5 / 5Quadcode Markets’ educational offering is threadbare at best, consisting only of a single video describing the basics of forex margin trading and a small ‘Help’ section with frequently asked questions.

This is disappointing, especially for beginners who often need upskilling on how financial markets work, how to discover trading opportunities, and how to get the most out of a broker’s platform.

As a comparison, our top-rated broker for beginners – Pepperstone, offers great educational tools, including videos, webinars and guides. They also have training materials specifically aimed at day traders.

Customer Support

2.5 / 5Quadcode’s customer service is a mixed bag with some real positives alongside serious shortcomings.

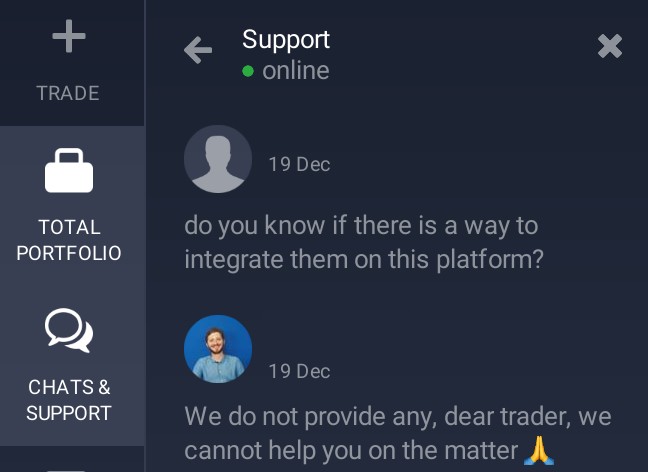

On the plus side, I like that the live chat function is handily built into platform, allowing you to seamlessly contact agents whenever you need assistance – not something offered by many brokers.

Also, agents responded within 1 minute each time I tested the chat support and they were polite and professional each time.

On the downside, I found that customer service representatives could only support with the basics and couldn’t answer questions about automated trading capabilities on the platform, for example.

Besides live chat, customer service can be contacted via email or phone, though frustratingly the only number available is in Cyprus (+357 24 267 222).

Should You Trade With Quadcode Markets?

My review of Quadcode Markets shows it is a legitimate broker that has made big strides in the industry in a short time. The user-friendly platform is great for beginner traders who want to speculate on popular global markets, including stocks, indices, forex, commodities, cryptos and ETFs.

However, there’s not much that stands out beyond the platform based on my first-hand experience using Quadcode. The pricing trails the cheapest brokers, the research tools are basic, and the education is non-existent.

So, while Quadcode Markets will hopefully continue to improve its offering, it falls behind the top brokers in too many crucial areas.

FAQ

Is Quadcode Markets Legit Or A Scam?

Our research suggests Quadcode Markets is a legitimate broker with authorization from top-tier regulators like the ASIC.

Still, online trading is risky – only invest what you can afford to lose.

Is Quadcode Markets A Regulated Broker?

Yes. Quadcode Markets has an Australian branch regulated by the ASIC, a European branch regulated by the CySEC, and a global entity that is regulated in the Bahamas.

Is Quadcode Markets Good For Beginners?

Quadcode’s intuitive platform makes it an attractive option for beginners, who should have no problem learning how to place trades on the demo account.

However, the lack of educational content and $250 minimum deposit set this broker behind our top picks for beginners, such as Pepperstone.

Does Quadcode Markets Offer Low Fees?

My tests of Quadcode Markets shows it offers average trading fees. While there are no commissions, spreads came in higher than the cheapest brokers during testing.

Casual traders should also be aware there is a $10 inactivity fee.

Is Quadcode Markets Good For Day Trading?

Quadcode Markets is not the best broker for day traders. Despite a well-designed platform with excellent charting tools, the average fees will cut into the profit margins of serious day traders.

There is also no raw-spread account or support for automated trading.

Does Quadcode Markets Offer A Good Trading App?

Quadcode Markets offers a stable mobile app that closely mirrors the desktop platform. It features the same modern design, 24/7 in-app support, access to financial news and basic video tutorials, plus you can easily switch between live and demo mode.

Top 3 Alternatives to Quadcode Markets

Compare Quadcode Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- RedMars – Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available – Standard, Pro and VIP – serving a range of budgets and experience levels, with a fast and fully digital account opening process.

Quadcode Markets Comparison Table

| Quadcode Markets | Interactive Brokers | Dukascopy | RedMars | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 3.6 | 3.8 |

| Markets | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $100 | €250 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, CySEC, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | CySEC, AFM |

| Bonus | – | – | 10% Equity Bonus | – |

| Education | No | Yes | Yes | No |

| Platforms | Traderoom | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT5 |

| Leverage | 1:30 (Retail) 1:500 (Pro) | 1:50 | 1:200 | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 9 | 6 | 11 | 13 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

RedMars Review |

Compare Trading Instruments

Compare the markets and instruments offered by Quadcode Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Quadcode Markets | Interactive Brokers | Dukascopy | RedMars | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Quadcode Markets vs Other Brokers

Compare Quadcode Markets with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 4 Quadcode Markets customer reviews submitted by our visitors.

If you have traded with Quadcode Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Quadcode Markets

Article Sources

- Quadcode Markets Website

- Quad Code AU Ltd - ASIC License

- High Tech Invest Ltd - SCB License

- IQ Option Europe Ltd - CySEC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

After attempting to remove assets from QCM, they surprised me with a 20% fee on total assets. There was no forthcoming information on paying a 20% fee on removing assets from their site. Customer service was worse than marginal, polite but offering little assistance with lengthy wait times. I would expect a fee on the trading acquired once using QCM but not on the total amount.

I use Quadcode in Australia where it’s head quartered. It’s a no frills broker so decent if you don’t need loads of features like research and copy trading but you’ll find it limiting if you do. I’d give it a higher rating if they added more tradable assets.

What I like about trading at Quadcode is the platform. But it feels like all the effort has gone into that and they’ve forgotten to provide helpful support. Multiple times I’ve had questions they can’t seem to help with. A learning academy and copy trading would be neat additions too. The last broker I day traded with had that and it helped me find trading opportunities.

I’ve been trying Quadcode Markets for crypto trading and been pretty impressed. What I really like is the wide choice of cryptos and that in the platform if you click on the three dots next to the asset and then create alerts then you can set up push notifications for specific price levels.