Day Trading in Qatar

A highly developed economy with robust regulation, a thriving commodities sector and a favorable tax environment make Qatar an attractive locale for day traders.

Qatar has one of the world’s highest GDPs per capita, thanks to plentiful hydrocarbon resources that include an estimated 12% of the world’s natural gas reserves.

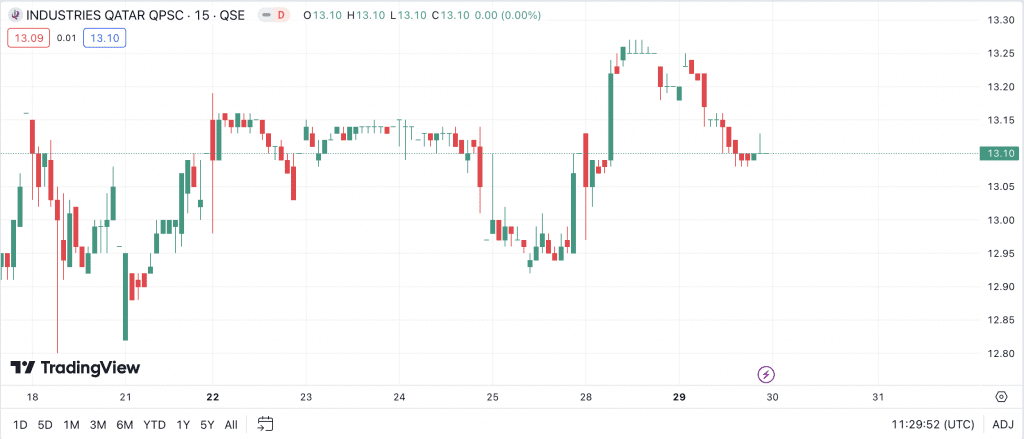

As a result, the Qatar Stock Exchange (QSE) lists many companies like Industries Qatar whose performance correlates with the prices of energy commodities.

This guide provides everything you need to know to start day trading in Qatar.

Quick Introduction

- Day traders in Qatar may be interested in important regional commodities like oil and natural gas or stocks listed on the Qatar Stock Exchange (QSE) such as Qatar National Bank.

- Financial markets in Qatar are overseen by the Qatar Financial Centre Regulatory Authority (QFCRA), Qatar Financial Markets Authority (QFMA), and Qatar Central Bank (QCB), with more international brokers entering the market.

- Qatar stands out with its attractive tax environment, with individuals not typically required to pay taxes on profits from short-term trading to the General Tax Authority (GTA).

Top 4 Brokers In Qatar

Our latest tests point to these 4 platforms as being best-in-class for active Qatari traders:

All Day Trading Platforms in Qatar

What Is Day Trading?

If you open and close a trade in currencies, stocks, commodities, or derivatives like CFDs in Qatar, or another instrument within a single day with a view to profiting from changes in the price, then you are day trading.

Qatar’s geographic location and large oil and natural gas reserves present diverse opportunities to profit from short-term price movements, and the developed economy and low taxes make it attractive for active traders.

Besides the crucial energy commodities of natural gas and oil, traders in Qatar may gravitate toward the influential service, finance and energy companies listed on the QSE such as Doha Bank and telecom leader Ooredoo.

Is Day Trading Legal In Qatar?

Day trading is legal in Qatar, which has a robust set of regulations related to online trading established by the Qatar Financial Centre Regulatory Authority (QFCRA). However, many traders choose to sign up with overseas firms since the Qatari watchdogs are not the most active licensers.

Nevertheless, the QFCRA, Qatar Financial Markets Authority do monitor financial markets to root out fraud, providing a degree of protection to local traders.

I recommend carefully researching and vetting any broker before trusting your money with them.

This will help you avoid scams like the one run by at least 64 individuals whom Qatari authorities caught with 4 million riyals of embezzled funds, according to Doha News.

How Is Day Trading Taxed In Qatar?

The great news for day traders is that their earnings from trades are unlikely to be taxed at all in Qatar, which does not levy any income tax at all on individuals. This means you may be able to keep all of your net profits if you’re a retail trader.

If you are a Qatari with a company that profits from day trading, you may be liable to pay corporate tax of 10% of your profits. Tax requirements for foreign companies vary.

Getting Started

When you start day trading in Qatar, follow these steps to hit the ground running:

- Choose a top broker in Qatar: Consider your needs, whether that’s a fast, intuitive platform, low fees on Qatari markets, or customer support in Arabic. A demo account is an excellent way to test a broker before depositing riyals.

- Open an account: You’ll normally need to provide the broker with your personal details including proof of address and valid identification, such as your Qatari ID (QID) card. Once submitted, accounts are often open within a couple of working days.

- Fund your account: Some brokers have QAR accounts, making deposits and withdrawals hassle-free for Qataris. You can then transfer using convenient and affordable payment methods like PayPal, bank cards or potentially even Qatari-based Ooredoo Money (if supported).

A Trade In Action

Let’s examine how a day trade might play out in Qatar’s markets…

My trade is based on a news event from the United States: the report showing that the inflation rate is cooling, giving hope of long-awaited interest rate cuts in coming months.

I think this will cause an increase in energy stocks, as falling interest rates will increase energy demand. Since the Qatar Stock Exchange trades on Sundays, I see a chance to make a trade based on this prediction before most other stock markets open on Monday.

I decide to place a buy order on Industries Qatar on Sunday morning. I wait to observe the initial price action on the stock at the market opening, as I expect a significant shift after the two-day break.

The price opens at QAR 13.13, significantly above the last session’s QAR 13.07 close. When it quickly falls to QAR 13.05, I see my opportunity to open a trade, setting a stop loss at QAR 12.95, which is close to the lows in last Thursday’s session, and a take profit order of QAR 13.20.

It doesn’t take long for Industries Qatar’s price to move in my expected direction, shooting up to 13.26 by 10 am. Since my take profit order has been hit, I profit to the tune of QAR 0.15 per share.

Bottom Line

With a highly attractive tax regime, affluent population and opportunities spanning the country’s ample hydrocarbon resources and prominent stock exchange, Qatar presents an appealing environment for active traders.

To get started, see DayTrading.com’s pick of the top day trading platforms in Qatar.

Recommended Reading

Article Sources

- Qatar Stock Exchange (QSE)

- Qatar National Bank (QNB)

- Qatar Financial Centre Regulatory Authority (QFCRA)

- Qatar Financial Markets Authority (QFMA)

- Qatar Central Bank (QCB)

- General Tax Authority (GTA)

- World's Richest Countries - Visual Capitalist

- Qatar Natural Gas - Worldometer

- Qatar Investment Scam - Doha News

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com