Day Trading in Palestine

Day trading in Palestine is a unique venture, offering a blend of challenges and opportunities that are distinct to the region’s economic, financial, and regulatory landscape.

The two main regions, the West Bank and Gaza Strip, have a combined GDP of $18.6 billion.

New to day trading in Palestine? This guide will get you started.

Quick Introduction

- While the Palestine Monetary Authority (PMA) and Capital Market Authority (PCMA) oversee the financial markets, there is a pressing need for a robust regulatory framework for online brokers in Palestine.

- The Palestine Exchange (PEX) offers short-term trading opportunities, and while the country doesn’t have its own currency, it provides access to a variety of relevant pairs utilizing the Israeli shekel (ILS), Jordanian dinar (JOD), and US dollar (USD).

- Short-term trading profits may be subject to personal income tax with rates generally ranging between 5% and 15%, and payments owed to the Palestinian Authority Ministry of Finance and Planning (PAMFP).

Top 4 Brokers in Palestine

We've evaluated 224 platforms and these 4 brokers emerged as the best for active traders in Palestine:

What Is Day Trading?

Day trading in Palestine offers the potential for reward, though it also comes with significant risk to your capital. It involves buying and selling assets like stocks, commodities, or derivatives to capitalize on short-term price changes.

The PEX lists various companies across different sectors, but the exchange faces several challenges, such as limited liquidity, low trading volumes, and the impact of political instability on investor confidence.

Forex trading in Palestine is also on the rise. The country does not have a currency. Instead, its economy relies on a multi-currency system, primarily using the Israeli shekel (ILS), Jordanian dinar (JOD), and US dollar (USD), which offers short-term traders opportunities.

Is Day Trading Legal In Palestine?

Day trading is permitted within Palestine and falls under the regulatory oversight of the PCMA. However, the practice is subject to specific rules and restrictions.

The region’s geopolitical environment presents unique challenges for traders, including limited access to global financial markets, restrictions on cross-border transactions, and a relatively underdeveloped domestic financial infrastructure.

Consequently, many Palestinian traders opt for international brokerages regulated by reputable authorities like the UK’s FCA, Australia’s ASIC, or the EU’s CySEC – ‘green tier’ bodies in line with DayTrading.com’s Regulation & Trust Rating.

How Is Day Trading Taxed In Palestine?

In Palestine, day trading profits are generally subject to income tax, with rates ranging from 5% to 15% depending on your income bracket. If online trading is a primary income source, these profits are often taxed as personal income.

Capital gains from trading securities listed on the PEX are typically exempt from taxation, encouraging investment in the local market. However, profits from trading assets not listed on the PEX or international securities may be subject to different tax rules, including potential capital gains tax.

Getting Started

Essential steps for successful day trading in Palestine include:

- Choose a broker regulated by Palestine’s PCMA, or another credible agency. Pay attention to the range of tradable instruments, including stocks (like those from Palestine), popular commodities such as gold, derivatives like CFDs in Palestine, user-friendly charting platforms, and reliable customer support.

- You typically need a West Bank ID or Gaza ID card and a recent utility bill to verify your account. Once approved, fund your account via wire transfers, debit cards, or even local e-wallets like PalPay (if it’s supported).

- Stock traders in Palestine can invest in companies listed on the PEX. Meanwhile, currency traders can speculate on exchange rate fluctuations involving the ILS and JOD. However, based on our research, these forex pairs often need more availability on online trading platforms.

A Trade In Action

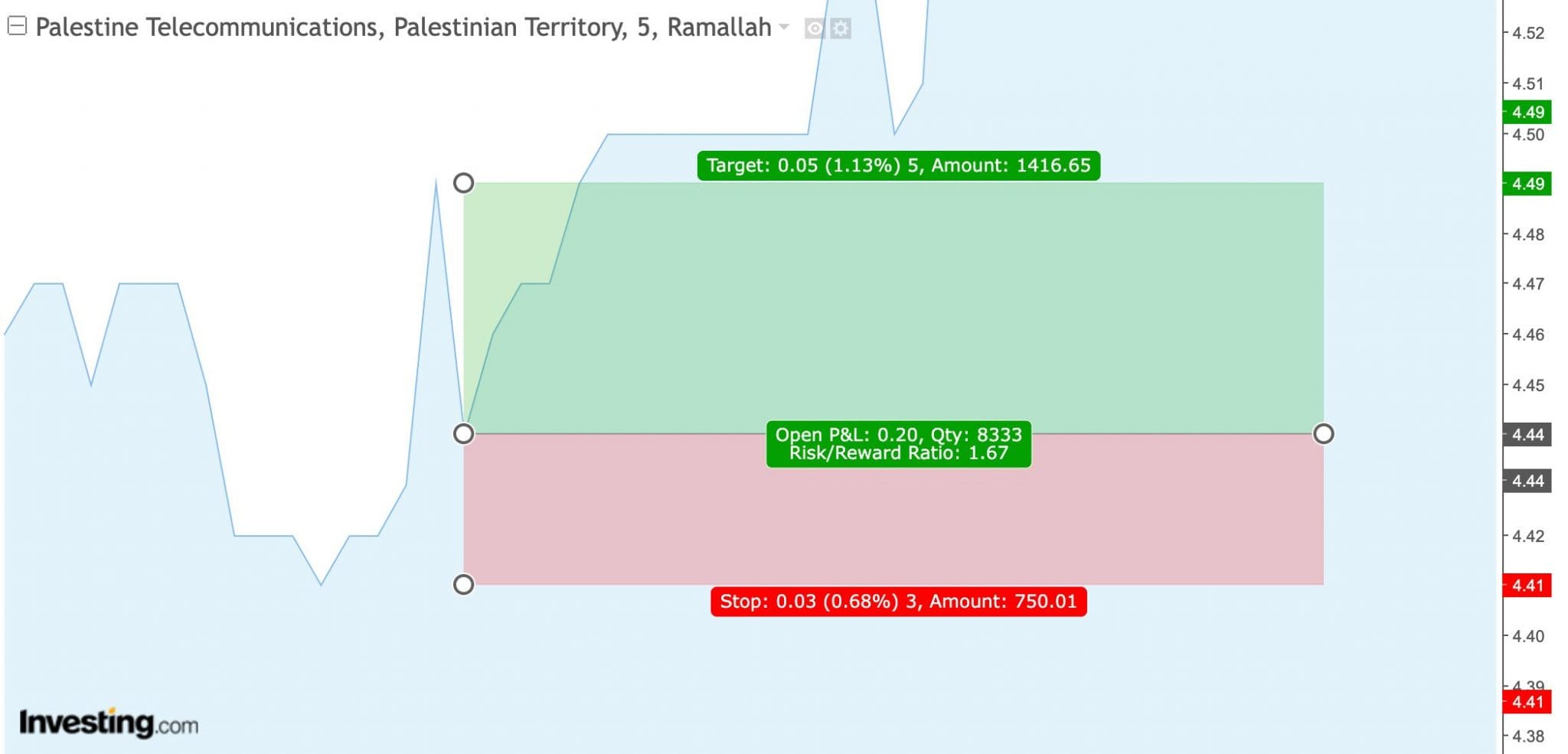

To help you understand how a short-term trade could work, let’s explore a scenario with Palestine Telecommunications Company (Paltel), a Palestinian-based company listed on the PEX that provides communication products and services across the Palestinian Territories.

Event Background

I began my trading session by analyzing Paltel’s recently released earnings report. The report revealed a significant increase in quarterly profits compared to the previous year, primarily driven by growth in data services and a rise in subscriber numbers.

This positive financial outcome suggested potential upward momentum in Paltel’s stock price.

Trade Entry & Exit

I began my analysis by studying Paltel’s historical price chart. The stock had been in a downward trend for the past few months, with a recent consolidation phase.

The earnings report was a positive catalyst, and I anticipated a bullish reaction from the market. Based on technical analysis, I set a price target, identifying a potential resistance level at JOD 4.49.

As expected, Paltel opened with a gap up, but not surpassing the previous day’s high. I decided to enter a long (buy) position shortly after the market opened at JOD 4.44, placing a stop-loss order at JOD 4.41 (-0.68% ROI) to protect my capital and a take-profit order at the potential resistance level (1.13% ROI).

The rationale behind my entry was the positive earnings report and the bullish price action.

As the day progressed, the stock experienced a little consolidation but then continued to rise, automatically triggering my take-profit order to secure a profit.

Bottom Line

Day trading in Palestine is legal and operates within a regulated framework overseen by the PCMA.

While the PEX offers opportunities for trading with certain tax exemptions on capital gains, active traders face challenges such as limited access to international markets and a complex tax landscape.

Despite these hurdles, the growing use of online platforms and cryptocurrencies opens new avenues for Palestinian traders to engage with global markets.

Recommended Reading

Article Sources

- Capital Market Authority (PCMA)

- Palestine Monetary Authority (PMA)

- Palestine Exchange (PEX)

- Palestinian Individual Taxes on Personal Income - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com