Plynk Invest Review 2024

Pros

- Easy-to-use app with no complex analysis features or terminology

- Commission-free stocks, ETFs and mutual funds

- Wealth of educational resources suitable for beginners

Cons

- Forex, futures, and options trading not available

- No live chat service or contact phone number

- Limited features for experienced investors

Plynk Invest Review

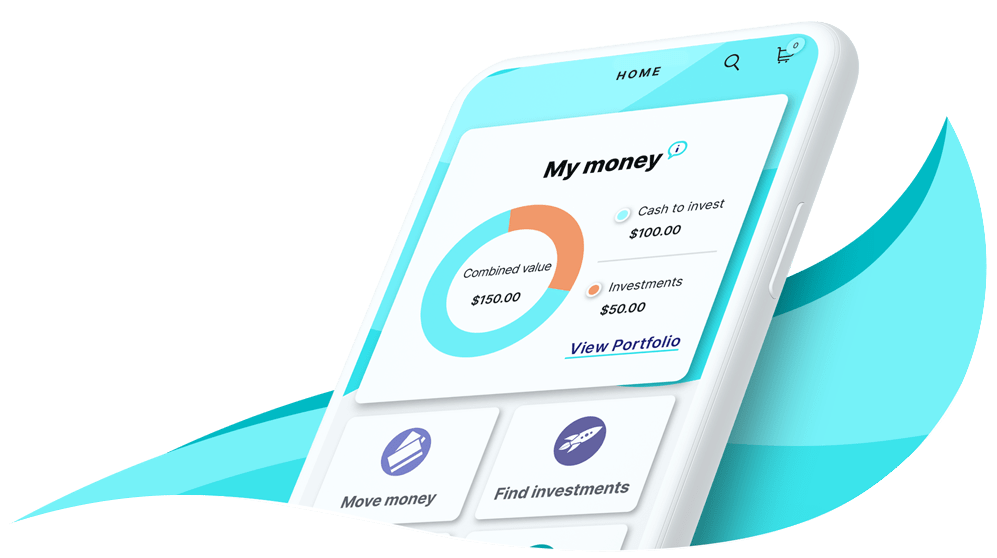

Plynk is an iOS and Android-compatible mobile investing app for US citizens. It offers a range of tradeable instruments, including stocks, fractional shares, mutual funds, and ETFs, alongside jargon-free educational materials for beginners.

This Plynk app review will cover customer service methods, login security, app download details, trading fees, sign-up bonuses, and more. Find out how to start investing with Plynk.

Company Details

Plynk is a relatively new investment app that launched in 2021.

The mobile service essentially aims to simplify the investing environment to provide an intuitive experience for new traders. The low-cost solution offers educational resources, investment tips, and portfolio management all within a simple-to-use mobile application.

Plynk is authorized and regulated by the US Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA).

Trading App

You can download the Plynk app for free to iOS or Android (APK) devices. Simply search ‘Plynk’ on the Apple App Store or Google Play.

Customer reviews are generally positive with many praising the innovative design, layout, and clear portfolio performance indicators. The app is ranked 4.6/5 on the Apple App Store.

Our experts were also pleased with the simplicity of the application. You can be assured of plain language, removing any complexities and confusing terminology. You can also view helpful investing tips and tricks, step-by-step guides, and illustrated charts so you can learn along the way.

Features include:

- Plynk Explore – Asset search navigation that provides investment suggestions based on your interests, goals, and risk appetite

- Recurring Investments – Set up automatic investments, meaning you can schedule regular fund deposits into your account and grow your total account balance over time

- Plynk Think™ – The firm’s in-built education center offers courses, lessons, articles, and e-books directly within the app. Study alongside building a successful investing career

- Gift Card Exchange – Apply unused gift cards to your Plynk Invest account balance. The app supports any old gift cards and redeems them as funds to invest in an asset class of your choice

Note, advanced day traders may be put off by the somewhat basic analysis features and cartoon illustrations. For more detailed technical and fundamental analysis features, consider an alternative like eToro.

How To Place A Trade

- Download the Plynk invest app to an iOS or Android device

- Register for a live trading account

- Link to your bank account so you can transfer money

- Deposit funds using one of the supported payment methods

- Find investment ideas based on your interest or search instruments

- Select an asset and review the price

- Select ‘Buy Now’ or ‘Add to Cart’

- Enter the amount you want to invest

- Select ‘One Time’ or ‘Recurring Investment’

- Swipe to confirm the order

- Track your performance via the portfolio navigation bar

Note, details of how to create an account and deposit funds are covered in more detail below.

Products & Assets

Traders can access a wide selection of stocks, exchange-traded funds (ETFs), and mutual funds. Fractional shares of stocks, ETFs, and mutual funds through dollar-based investing are also available.

In 2022, the online broker also launched Plynk Crypto, meaning users can diversify into the cryptocurrency trading environment. Users can trade and hold four popular coins via Paxos Trust Co; Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

Note, the Plynk app supports market orders only. Limit orders are not currently available.

Trading Fees

It is free to open a Plynk account and you can start trading from just $1.

The broker offers commission-free trading on stocks, exchange-traded funds (ETFs), and mutual funds.

Fees apply when trading cryptocurrency. For trades of $100 or below, a $0.50 charge applies. For positions over $100, a 0.5% charge applies. Costs are added directly onto positions. For example, if you invest $50 in Bitcoin, you will pay $50.50.

Customers can also expect a $75 fee for a full TOA delivery. Bounced checks, payment stops, and wire transfers will incur a $15 charge.

Additionally, a SEC fee is charged for all ‘sell’ orders. As of 2022, this fee was $22.90 per $1 million. This will be paid via Plynk and will cover all SEC costs plus clearing agencies, national securities exchanges, and other self-regulatory organization fees.

Note, a monthly $2 subscription charge may be introduced in the future for some trading features.

Taxes

Plynk provides a ‘Consolidated 1099’ tax form within the mobile app. You can access your profits or funds received from the investments made in your brokerage account, which can be used to file tax statements.

Note, it is your responsibility to comply with the tax rules in your local jurisdiction.

Leverage

Our experts were not offered margin trading opportunities. This is not surprising given that the app is aimed primarily toward beginners.

Instead, you can set up recurring investments within your brokerage account meaning you can build a healthy trading balance over time.

Plynk Payment Methods

There is no minimum deposit requirement to open a Plynk account.

The broker-dealer accepts payments via bank wire transfer only. It is disappointing to see no other deposit options, particularly e-wallet services and credit/debit cards.

To link your bank account to your Plynk account:

- Download the Plynk app and register for an account

- Complete the verification details and login

- Select the ‘Menu’ logo

- Click ‘Link Bank Account’ in the ‘Activity and Banking’ section

- Submit your banking login credentials in the pop-out window

- Enter the deposit value and confirm the payment

There is a $15 wire transfer fee, which is high vs competitors like OANDA and Robinhood.

Demo Account

Plynk does not offer a demo account.

However, it is free to download the app and open an account meaning you can explore platform features without having to invest personal funds. There is also plenty of guidance and tips and tricks alongside the educational resources so you shouldn’t have any issues when it comes to opening and closing trades.

Deals & Promotions

Ongoing Plynk promotions include a $10 sign-up bonus, which has recently replaced the $20 sign-up bonus available, and a deposit match program to the value of $100. Plynk has also previously run Bitcoin sweepstakes, refer-a-friend offers, and a learn-and-earn reward.

Total bonuses available per Plynk Invest retail customer, including referral gains, are subject to a total limit of $500 per year.

Regulation & Licensing

Plynk brokerage services are offered by Digital Brokerage Services LLC (DBS). The financial services firm is registered as a broker-dealer, authorized and regulated by the US Securities and Exchange Commission (SEC). The company is also a member of the Financial Industry Regulatory Authority (FINRA).

Additionally, the financial app is a member of the Securities Investor Protection Corporation (SIPC), which protects retail customers with up to $500,000 in compensation (including $250,000 for cash claims).

Plynk crypto accounts and services are offered by Paxos Trust Company (Paxos). Crypto assets are not protected by the Federal Deposit Insurance Corporation (FDIC) or insured under SIPC.

Plynk Core Fund

Any uninvested funds in a brokerage account will be held in the Fidelity Government Money Market Fund. Although the ‘fund’ is a low-risk, safe place to hold capital, money is not deposited to a traditional bank account and is therefore not covered by FDIC insurance.

Additional Features

While using Plynk, we found the broker offers limited additional features.

Having said that, the educational resources offered by the broker-dealer are strong. The simplicity and clear guidance are ideal for inexperienced investors and those just getting started. Articles are written in plain language with integrated video support and step-by-step guidance.

Cryptocurrency Features

Crypto account holders are only permitted to buy, hold, and sell crypto in the app. Customers are currently not able to transfer, exchange or use cryptocurrencies to make payments. You are also unable to transfer crypto assets to an external wallet solution.

Plynk Accounts

Retail traders can select from two account types; a brokerage account (for investing in stocks, ETFs and mutual funds) or a crypto account (for investing in cryptocurrency). Both accounts can be opened free of charge.

How To Open An Account

Once you have downloaded the Plynk application from the relevant app store, you can open a live account. There are some standard investment questions required to understand your previous experience, risk appetite, and financial goals.

The broker also follows AML and KYC requirements, therefore you will need to verify your identity. Once complete, you can create username and password credentials.

Crypto Account

Once your brokerage account is verified you can apply for the crypto profile. Select the cryptocurrency logo from the app’s navigation bar.

Choose ‘Get Started’ when the pop-out ‘Ready To Open A Crypto Account?’ is visible. Review the legal terms and conditions associated with trading digital currency. Then tick the relevant boxes to confirm the terms and select ‘Open Crypto Account’.

Trading Hours

Trading hours vary by instrument. The stock market is typically open between 9:30 AM to 4 PM (ET). Any investments opened outside of these hours will be executed when the market opens the following day.

Retail investors can trade cryptocurrency within the app 24/7, 365 days a year. Note, Paxos undertakes monthly maintenance from 7 PM to 8 PM (ET) on a scheduled date. Timings are published within the application before the planned date.

Customer Service

Plynk Invest offers limited customer support options. There is no phone number or live chat service available for instant support.

The broker-dealer does provide an email address (service@plynkinvest.com) for account-specific queries. Alternatively, you can find a basic FAQ section on the website with answers to common queries such as what to do if you forgot your username and how to withdraw money from a Plynk account.

The financial services provider is also active on social media channels including Twitter, Instagram, and Facebook. Posts cover the latest company news, upcoming promos, and top tips.

Security & Safety

The broker-dealer protects customers’ personal details and transactions using firewall barriers, industry-standard encryption, and authentication procedures. It is recommended that all customers implement biometric or fingerprint login features.

Plynk Verdict

Plynk is a decent investment app with extensive educational resources. Although slightly limited in terms of advanced features, it provides a straightforward trading environment for beginners. With SEC oversight, you can also trade with confidence.

It is worth noting, however, that the range of assets is limited versus competitors. Also, the steep wire transfer fees and lack of customer support may deter new traders.

FAQs

Who Owns Plynk?

Plynk brokerage services are provided by Digital Brokerage Services LLC (DBS). DBS works with its affiliated clearing broker, National Financial Services LLC (NFS).

Is Plynk Available Globally?

No – the Plynk app is available to US residents only who are at least 18 years old.

Is There A Minimum Deposit Requirement To Open A Plynk Brokerage Account?

There is no minimum deposit requirement to open a Plynk account. Retail investors can start trading from as little as $1.

Is Plynk Owned By Fidelity?

No, Fidelity does not own Plynk. Plynk brokerage services are provided by Digital Brokerage Services LLC (DBS).

Is Plynk Legit?

Yes, Plynk is a legitimate broker-dealer launched in 2021. Investment services are offered by Digital Brokerage Services LLC (DBS) working alongside clearing broker National Financial Services LLC (NFS). Both firms are registered with the US SEC as broker-dealers and are members of FINRA and SIPC.

Top 3 Alternatives to Plynk Invest

Compare Plynk Invest with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular online brokerage. It is also quick and easy to open a new account.

Plynk Invest Comparison Table

| Plynk Invest | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 4.7 | 4 |

| Markets | Stocks, ETFs, Mutual Funds, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | SEC, FINRA |

| Bonus | $10 Sign-Up Bonus | – | – | Deposit Bonus Up To $4000 |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 1 | 6 | 6 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plynk Invest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plynk Invest | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Plynk Invest vs Other Brokers

Compare Plynk Invest with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Plynk Invest yet, will you be the first to help fellow traders decide if they should trade with Plynk Invest or not?