Plus500 US Review 2025

Awards

- Best US Broker Runner Up 2025 - DayTrading.com

Pros

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls, instilling a sense of trust

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Plus500 US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

Plus500 US Review

Our exhaustive review of Plus500 US examines the broker’s instruments, trading terms, regulatory oversight and other key areas to assess how it stacks up against the competition.

Regulation & Trust

3.5 / 5Plus500 US is trusted for several reasons:

- Plus500 US is overseen by the tier-one Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) through the registered company Cunningham Commodities LLC, license no: 0001390.

- The firm’s registration with the CME Group entails additional risk management and financial surveillance protocols.

- Plus500 Ltd is listed on the London Stock Exchange (LSE), ensuring a high degree of financial transparency.

Plus500 US has only been in business since 2021, but the brand brings almost 20 years of global experience to US investors.

Accounts & Banking

3.7 / 5Plus500 US has a single account type that’s quick and easy to set up with everything required clearly laid out on the broker’s website. Signing up takes just 10 minutes.

The trading account is geared toward the retail market and will appeal to newer investors looking for a straightforward route to online trading.

The $100 minimum deposit is higher than alternatives like Interactive Brokers which has no minimum, but it’s still accessible for most aspiring traders.

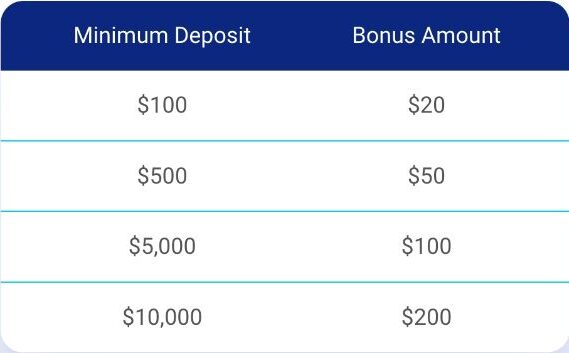

Plus500 US also stands out with its welcome deposit bonus, with up to $200 in trading credit available depending on your initial investment:

Deposits & Withdrawals

Plus500 US accepts funding via debit cards or ACH and bank transfers.

They are also the first brand to accept deposits from both Apple Pay and Google Pay.

Demo Account

Plus500 US offers an unlimited demo account, and I enjoyed being able to use the simulator to develop a strategy before committing my own money.

The demo account registration is an extremely simple matter that takes just a few clicks from the Plus500 home page and can be finished in minutes.

I recommend that prospective clients start with the demo account to see how they enjoy the platform before signing up.

It’s also a great way to practice and improve in parallel with your live trading.

Assets & Markets

3.5 / 5Plus500 US offers a limited product portfolio with just 50+ futures contracts spanning popular asset classes including forex, commodities, and cryptocurrencies.

The presence of some less common assets like interest rates stands out, and the broker’s e-mini and micro contracts make it easier for lower-budget traders to get involved.

The most glaring absence from the roster is stocks. This is due to futures trading not including equities.

The 10 global index futures offered by Plus500 are a consolation, and allow traders to access equity price changes another way.

Rivals such as Interactive Brokers and NinjaTrader, which specialises in 100+ futures – are also limited in their ability to offer direct access to stocks, as CFDs are not available in the US.

I was able to trade the following assets while using the platform:

- Crypto – Micro-Bitcoin and Micro-Ethereum

- Agriculture – Eight agricultural products such as wheat, live cattle and soybeans

- Precious Metals – Four metals including gold and silver

- Forex – 10+ currency pairs such as GBP/USD and CAD/USD

- Interest Rates – Four interest rate futures such as US T-Bond and the Micro 10-Year Yield

- Energy – Eight energies including natural gas and Brent crude oil

- Equity Indices – 10 index funds such as NASDAQ 100 and S&P 500

I find the narrow investment offering to be a huge departure from Plus500’s other international entities, which offer thousands of assets including US stocks.

The major difference is that Plus500 is primarily a CFD broker, but these instruments are banned in the US.

Margin Trading

Plus500 US is a futures broker and these derivatives are traded with margin with an initial investment opening a position worth a larger amount and further deposits made to cover ongoing margin requirements and losses.

The initial margin requirements for Plus500 US’s contracts include:

| Gold | Micro Gold | Natural Gas | EUR FX | Australian Dollar | |

|---|---|---|---|---|---|

| Margin Requirement | $500 | $50 | $1000 | $300 | $400 |

Trading with leverage involves risk

Fees & Costs

3.3 / 5By offering very competitive trading fees, Plus500 US goes a long way toward making up for its limited investment offering.

With no inactivity fees, platform fees, live data fees, routing fees, or charges to deposit or withdraw funds, clients don’t have to worry about non-trading costs.

As for trading fees, there are both Micro and Standard contracts available, and these come with commissions per side of $0.49 and $0.89, respectively. This is a big advantage overE-Trade, which charges $1.50.

I can happily class Plus500 US as a low-cost broker as a result, and its excellent pricing competes well against the likes of Interactive Brokers, one of our top picks in this department, which charges $0.85.

Plus500’s only real drawback in comparison is that it doesn’t have anything comparable to Interactive Brokers’ tier system which reduces the fees to a minimum of $0.25 for the highest volume traders.

This is another point where Plus500 US is clearly geared toward the casual side of the retail market over seasoned, high volume day traders.

Platforms & Tools

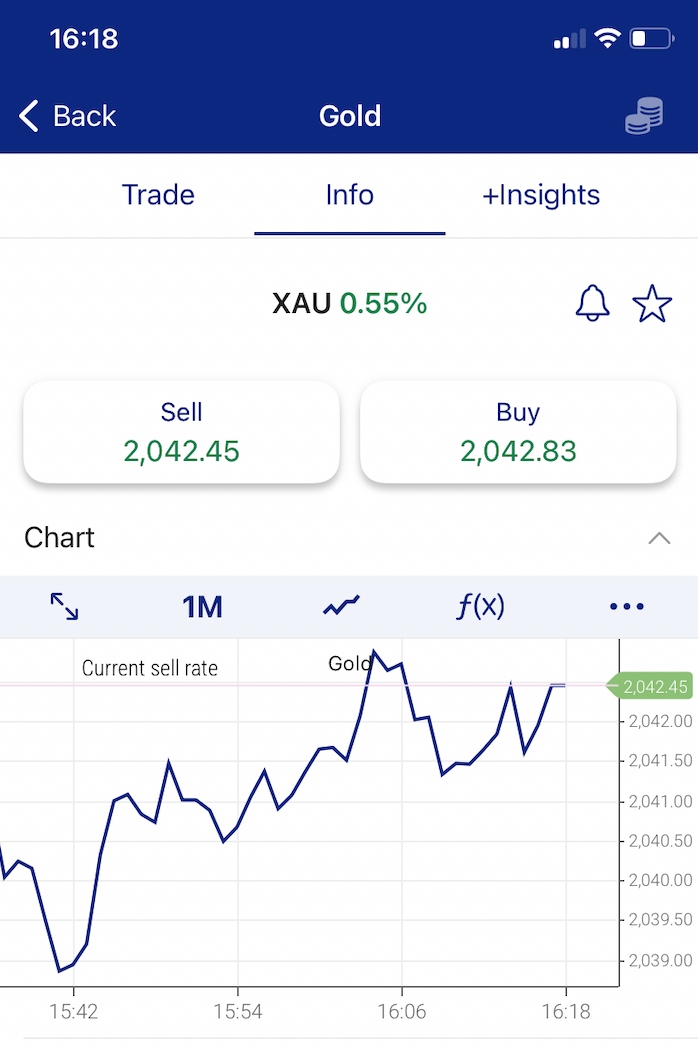

3.3 / 5Plus500 US is known for its excellent proprietary software, and I find trading on this platform quick and intuitive. I enjoy the simplicity of the user-friendly interface with dynamic charts and helpful analytic tools.

As well as being clear and concise, the platform has a lot going on under the hood with sophisticated features including 100+ indicators alongside live price alerts and risk management features including take profit and stop-loss orders.

Simply put, it has everything you would expect from a modern trading platform, and Plus500 US make it easy for anyone to start trading in a few clicks regardless of their experience.

That said, traders who are looking for more advanced tools will be frustrated as Plus500 lacks some cutting-edge functions such as in-depth performance analytics, and the platform is not customizable in the same way as some third-party platforms.

This is one reason that the lack of additional options like MetaTrader 4 hurts, though its absence is in itself frustrating simply because this platform is so popular and many experienced traders prefer using it for familiarity.

Nevertheless, the Plus500 platform is more than adequate and will be an especially good match for the newer traders that this brokerage is aimed at.

Mobile App

The Plus500 mobile app works well on both Apple and Android phones and has the same functionality as the desktop solution with no limits to the instruments on offer.

I find it quick and straightforward to trade on the move and there are none of the common frustrations of trading on a small screen.

Ultimately, Plus500 US ensures seamless integration between iOS and Android desktop and mobile apps.

Research

2.8 / 5While Plus500 does have some useful in-house analysis available on its website and via its platform, overall the range of research tools is lacklustre.

The economic and earnings calendars are always nice to see, as are the news feed and graphics showing current sentiment, which are handily displayed on the platform while you set up a trade.

However, this is about all there is, and I find the lack of expert commentary to be very limiting.

Compare this to Interactive Brokers, which provides access to a huge amount of research analysis sources, and Plus500 is left behind.

Education

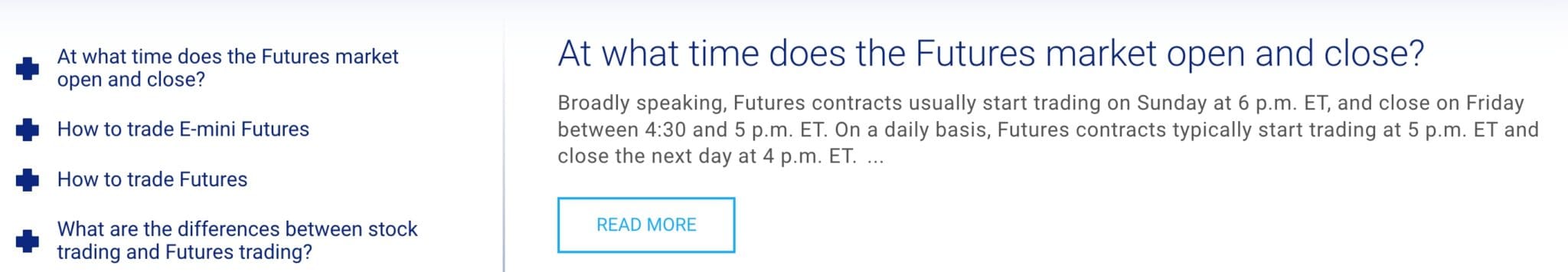

3.5 / 5There are some excellent educational resources available at Plus500’s Futures Academy, including a wide range of articles and video resources with plenty of information to help beginners get started.

A highlight is the video tutorials, which cover a range of topics such as trading strategies and the benefits of investing in futures contracts.

I like that you can also filter educational resources by asset class, which makes the information more tailored to your interests and portfolio. The introductory videos are particularly strong, with all the basics of trading futures contracts covered.

Though I don’t find the information as extensive as the resources offered by alternative US brokers like IG, I feel there is enough content to suit novice traders, and I appreciate the information specific to trading futures with the firm.

Customer Support

3.5 / 5I was initially disappointed with the Plus500’s customer support, which provided me with no way to contact the broker by phone.

Fortunately Live chat has been added, offering direct access to the support teams.

In addition, I do think the comprehensive online help center, with FAQs and step-by-step guides, gives a good range of information on the fundamentals. Although I would prefer a search bar or to have questions split into categories/topics, I find that, overall, these work well for common queries.

There is also an email support option. I tested this service as part of my Plus500 US review and received a response within just eight minutes, which is about as fast as you can expect from this contact method.

Most importantly, the agent was knowledgeable and provided clear answers to my questions, as well as responding swiftly and accurately to my follow-up questions.

Should You Trade With Plus500 US?

Plus500 US continues to offer a trustworthy trading environment, and its transparent trading conditions, user-friendly platform and responsive customer support are all big advantages.

Though the product lineup is not the most extensive and the platform lacks some advanced features, the mini and micro futures contracts and competitive fees make this a great stop for newer traders seeking to speculate on forex, commodity, crypto and interest rate markets.

FAQ

Is Plus500 US Legit Or A Scam?

Plus500 US is the United States entity of the respected Plus500 brokerage, backed by an established fintech company with a solid track record. The brand is trusted by more than 24 million traders globally, thanks to its smooth account opening, low fees and intuitive trading tools.

Is Plus500 US Regulated?

Yes, Plus500 US is licensed under Cunningham Commodities LLC. The firm is a Futures Commission Merchant, registered with the US Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA).

Is Plus500 US Suitable For Beginners?

Plus500 US is suitable for beginner traders. There is a range of training articles and video tutorials which are ideal to use alongside the demo account before opening a real-money profile. The broker’s customer support team are also helpful, which is reassuring for platform help and account guidance.

Does Plus500 US Offer Low Fees?

Plus500 US offers low trading, currency and funding fees. Micro contracts have a $0.49 commission per side, and standard contracts $0.89. Day trading margins are also competitive and vary depending on the market.

Is Plus500 US Good For Day Trading?

Plus500 US’s intuitive platform, low fees, margin trading and fast execution speeds make it suitable for day trading. That said, it trails our best-in-class day trading broker – Forex.com because it doesn’t offer advanced charting tools or support automated trading.

Top 3 Alternatives to Plus500 US

Compare Plus500 US with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Plus500 US Comparison Table

| Plus500 US | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 4.5 | 3.6 |

| Markets | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $100 |

| Minimum Trade | 0.0 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CFTC, NFA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | FINMA, JFSA, FCMC |

| Bonus | Welcome Deposit Bonus up to $200 | – | Active Trader Program With A 15% Reduction In Costs | 10% Equity Bonus |

| Education | Yes | Yes | Yes | Yes |

| Platforms | WebTrader, App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | JForex, MT4, MT5 |

| Leverage | – | 1:50 | 1:50 | 1:200 |

| Payment Methods | 7 | 6 | 8 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plus500 US and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plus500 US | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Plus500 US vs Other Brokers

Compare Plus500 US with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 2 Plus500 US customer reviews submitted by our visitors.

If you have traded with Plus500 US we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Plus500 US

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

I’ve used several trading apps and Plus500 definitely stands out as one of the better ones. It didn’t take me long to learn how the features work, which I did in the demo mode before depositing funds and trading with real money. I’d like to see them offer more instruments though, the lack of stocks is annoying and I’ve seen other brokers in the US offering shares.

I’ve been trading forex futures with Plus500 for several months and enjoy the trading platform – it’s easy to learn with all the basic charting tools I need. The day trading margins are low, just beware of the bank transfer fee.