Best Day Trading Platforms and Brokers in Poland 2026

To place short-term trades on financial markets like stocks listed on the Warsaw Stock Exchange (GPW) or currency pairs involving the Polish złoty (PLN), you’ll need to sign up with a broker.

The Polish Financial Supervision Authority (KNF) supervises brokers, however Poles can also use other EU-regulated platforms through the region’s passporting scheme.

Jump into DayTrading.com’s pick of the best day trading brokers in Poland. Some of our platforms specifically cater to Polish traders with local markets, convenient payment methods like Przelewy24, and even PLN accounts.

Top 6 Platforms For Day Trading In Poland

After testing hundreds of online brokers, these 6 stand out as the best for active traders in Poland:

-

1

LiteForex Europe

LiteForex Europe -

2

XTB75% of accounts lose money when trading CFDs with this provider.

XTB75% of accounts lose money when trading CFDs with this provider. -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

IC Trading

IC Trading -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

This is why we think these brokers are the best in this category in 2026:

- LiteForex Europe - LiteForex Europe is a CFD broker established in 2008 and authorized by the CySEC. The brokerage offers forex, commodities and indices via the MT4 and MT5 platforms. Spreads are ultra tight on ECN accounts and leverage is available up to 1:30 in line with EU regulations. LiteForex also offers a rich education centre for new day traders and social trading capabilities.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Best Day Trading Platforms and Brokers in Poland 2026 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|

| LiteForex Europe | $50 | CFDs, Forex, Indices, Commodities | MT4, MT5 | 1:30 | CySEC, AFM |

| XTB | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 (EU) 1:500 (Global) | FCA, CySEC, KNF, DFSA, FSC |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| IC Trading | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

| Pepperstone | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

LiteForex Europe

"LiteForex is a good option for active day traders with variable spreads from 0.0 pips, daily analysis and high-quality training guides. The forex copy system also lets you duplicate the positions of experienced traders."

William Berg, Reviewer

LiteForex Europe Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities |

| Regulator | CySEC, AFM |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CHF |

Pros

- There's a comprehensive analytics portal by Claws&Horns, which offers video reviews, expert insights and short-term trading signals

- LiteForex has been established for 15+ years and is regulated by a trusted regulator, CySEC

- The broker offers a VPS server for experience day traders looking to run their auto strategies continuously

Cons

- The range of day trading markets is limited compared to alternatives, with no share CFDs offered

- Fees are fairly high, with spreads starting from 2.0 pips in the Classic account and $10 forex commissions in the ECN account

- There are limited funding methods compared to other brands

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs (On ETFs and real shares, or 0.2% with transactions over €100k) for UK clients with a huge range of markets available.

- With an excellent range of educational materials, including training videos and articles integrated into the platform, XTB supports traders at all levels.

Cons

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

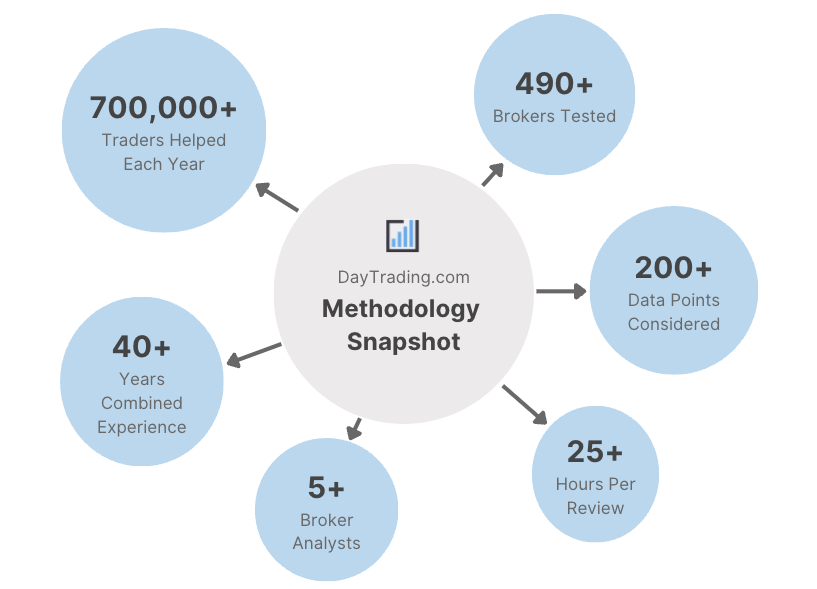

Methodology

To identify the best day trading platforms in Poland, we took our database of 140 online brokers and removed any that don’t accept Polish day traders.

We then sorted the remaining by their overall rating, which blend hard data with our first-hand observations during testing.

- We confirmed that each broker accepts Polish traders.

- We verified that each broker is regulated, if not by KNF.

- We favored brokers with a wide range of day trading markets.

- We prioritized brokers with competitive day trading fees.

- We confirmed that each broker offers excellent charting platforms.

- We focused on brokers with transparent leverage requirements.

- We investigated each broker’s execution quality.

How To Choose A Day Trading Broker In Poland

Based on our extensive experience testing day trading platforms that accept Poles, there are several factors to consider when choosing a provider:

Choose A Trustworthy Broker

This is essential if you want peace of mind when depositing złoty in your trading account.

Brokers regulated by credible authorities can help to protect you from trading scams, such as the ‘Fool Me Twice‘ scheme which made headlines after hundreds of Polish investors lost over 9 million PLN.

The Polish Financial Supervision Authority (KNF) oversees financial markets in the country, though our investigations show only a limited number of brokers are directly regulated by the authority. Fortunately, other European-regulated brokers can onboard Polish traders through the EU’s cross-border initiative.

Brokers with oversight from a ‘green-tier’ body, as per DayTrading.com’s Regulation and Trust Rating, offer the highest standards of financial safeguards.For instance, Poles can get up to €20,100 through the KDPW Investor Compensation Scheme should their broker become insolvent.

- XTB is the most trusted day trading broker in Poland based on our evaluations. It’s the only brokerage to be listed on the Warsaw Stock Exchange, with authorization from the KNF, and a 20+ year track record.

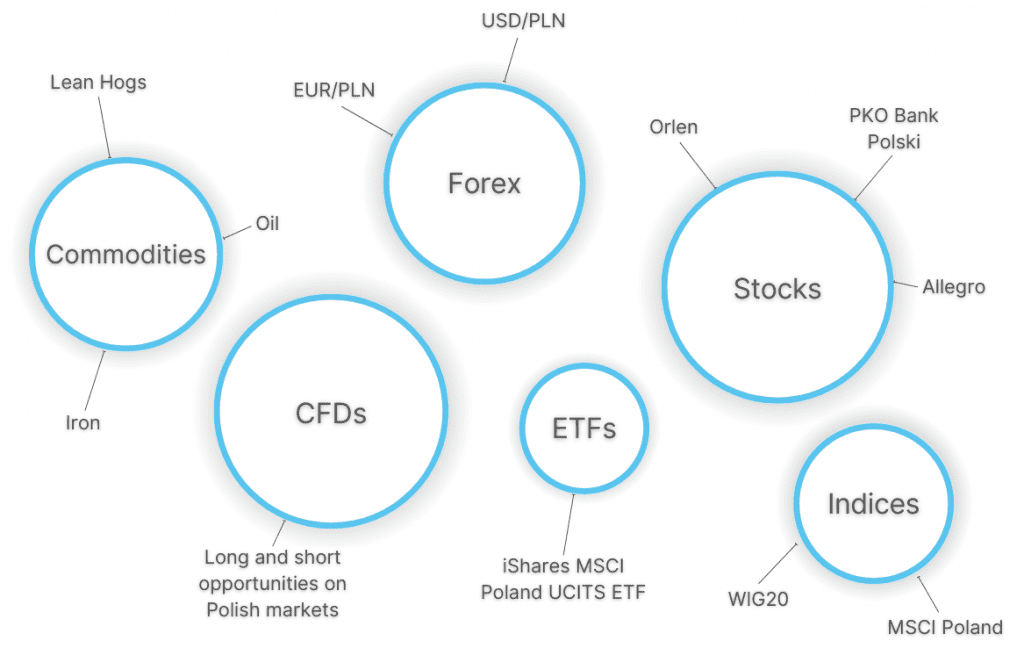

Choose A Broker With A Range Of Markets

Choose a broker with the instruments you want to trade, whether Polish securities, regional assets relevant to Europe, or global markets.

For Polish traders, this might include exotic currency pairs involving the Polish złoty (PLN) like EUR/PLN, stocks listed on the Warsaw Stock Exchange, or the country’s key export commodities like oil and iron.

Importantly, day trading strategies lend themselves to liquid instruments with large price swings, allowing traders to move in and out of fast-moving markets while keeping trading costs down.

Polish stocks like PKN Orlen and PKO Bank Polski tick these boxes, but forex pairs like EUR/PLN, while volatile, are traded in smaller volumes than say EUR/USD, typically resulting in greater costs.

Choose A Broker With Competitive Day Trading Fees

Protecting your profits by keeping transaction costs down should be a priority for active traders.

Spreads, commissions and funding charges are the main types of fees you’ll encounter. You may also need to consider any conversion charges if depositing in Polish złoty, as the vast majority of brokers we’ve evaluated do not support PLN accounts.

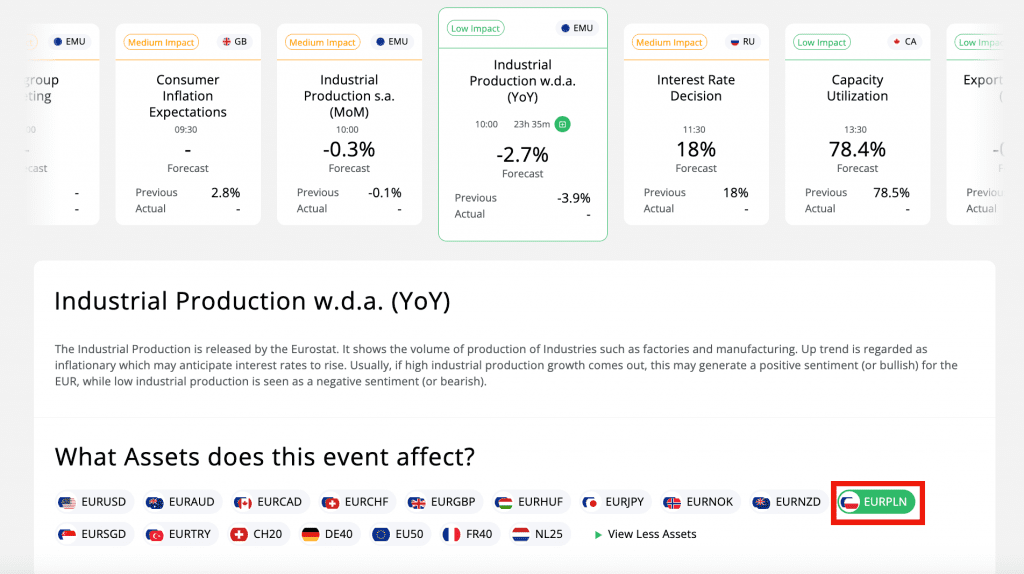

Additionally, it’s worth considering whether any higher fees could be justified in return for superior trading tools and execution speeds. For example, you may get insights from in-house analysts into fiscal updates from the Narodowy Bank Polski that could affect the value of the PLN, or market sentiment data on Warsaw-listed stocks.

- LiteForex continues to offer tight ECN spreads from 0.0 pips and low commissions from $5 per lot – ideal for day traders. It’s also one of the few brokers that offers PLN as an account base currency, which could help reduce conversion fees for Polish traders.

Choose A Broker With Powerful Charting Platforms

Active traders need access to reliable charting platforms to deploy day trading strategies.

Popular software like MetaTrader 4, MetaTrader 5, cTrader and TradingView offer superb charting packages with enough indicators, drawing tools and short-term timeframes to meet the needs of beginners through to advanced traders.

However, novice traders may still prefer a proprietary, web-based terminal which often provides a more user-friendly trading experience based on our tests, with modern interfaces and less noise in terms of charts and data.

- Eightcap delivers a first-rate toolkit for day traders at every level, with MT4, MT5 and TradingView. There are also fairly unique tools that I love, including the FlashTrader risk management feature, plus an AI-powered economic calendar which lets you analyze events that impact Polish markets, such as EUR/PLN.

Choose A Broker With Transparent Leverage Requirements

Leverage trading, popular with day traders, and available through derivatives like CFDs, allows you to gain exposure to larger positions with a small outlay, thereby magnifying your returns (and losses).

However, it’s important to pick a broker that’s upfront about the amount of leverage available and margin requirements (how much you need to deposit and maintain in your account).

Let’s say I want to trade the EUR/PLN with leverage of 1:20. My outlay of PLN 500 would magnify my trade 20x, giving me PLN 10,000 in buying power.This means my potential gains, or losses, would be 20x greater than if I had just traded with the cash in my account.

Given the risk of substantial losses, we do not recommend that beginners trade with high leverage. Fortunately, the KNF, in line with European Securities and Markets Authority (ESMA) guidelines, helps by not allowing brokers to offer leverage to retail investors beyond 1:30.

- eToro’s in-platform trade panel makes it a breeze to understand margin requirements before placing a trade. You simply need to select the asset from within the dashboard and click ‘buy’ or ‘sell’ to view margin requirements. It’s also one of the most user-friendly trading platforms I’ve used.

Choose A Broker With Reliable Execution

To trade short-term assets, especially volatile Polish securities like PKN Orlen and Bank Pekao, you need a broker with fast and stable order execution.

The best brokers we test typically execute orders faster than our benchmark of 100 milliseconds. They also ensure low slippage rates (the difference between the requested price and the actual price) and latency (the measure of time delay when placing a trade).

- Moneta Markets uses a hybrid STP/ECN execution model, with multiple trading servers connected to Tier 1 liquidity providers. As a result, and impressively, the broker aims to execute speeds in under 15 milliseconds, which beats most competitors and is ideal for active traders.

Choose A Broker With Accessible Account Funding

Choose a broker with a deposit you can afford and convenient payment methods.

Our investigations show most providers require a minimum deposit of up to USD 250 to open an account (approximately 965 PLN). That said, the best platforms let you start with much less, or even zero.

A day trading platform that supports convenient deposit options can also make for a straightforward trading experience. According to research by PPRO, Przelewy24 remains one of the most popular payment methods in Poland.

- Deriv’s $5 starting deposit is accessible for beginners, and the ongoing minimum deposit of $5 is lower than many alternatives (important for active traders making frequent transactions). Additionally, Deriv is one of the few brokers that offer deposits via Przelewy24, providing ultimate convenience for Polish traders.

FAQ

Who Regulates Day Trading Platforms In Poland?

The Polish Financial Supervision Authority (KNF) is responsible for overseeing online trading providers in Poland, although Poles can also register with other European brokers who are authorized under the EU’s passporting scheme.

Whichever broker you choose, make sure you continue to follow KNF regulations and Polish tax rules.

Which Is The Best Broker That Accepts Day Traders From Poland?

Use our list of the best day trading trading platforms in Poland to find an optimal broker for your needs.

Eightcap, for example, offers a superb selection of platforms and tools for analyzing Polish assets, whilst Deriv is a low-cost and convenient option for traders looking to deposit and withdraw in Przelewy24.

Recommended Reading

Article Sources

- Warsaw Stock Exchange (GPW)

- Polish Financial Supervision Authority (KNF)

- Narodowy Bank Polski

- Payment Methods In Poland - PPRO

- Poland 'Fool Me Twice' Trading Scam - Finance Magnates

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com