Day Trading in Pakistan

As the world’s fifth most populous country with a young demographic, an emerging economy, plus large agricultural, manufacturing and service sectors, Pakistan offers a dynamic environment for day traders.

The Pakistan Stock Exchange (PSX) incorporates the Islamabad, Lahore and Karachi exchanges, listing around 375 companies with a market capitalization of approximately 8 trillion Pakistani rupees (PKR).

Discover everything you need to become a day trader in Pakistan.

Quick Introduction

- Pakistan is a fast-growing economy with a GDP above PKR94 trillion and significant exports like textiles, agricultural products and chemicals, providing trading opportunities.

- The State Bank of Pakistan (SBP) and Securities and Exchange Commission of Pakistan (SECP) oversee the financial markets, but they are not the most active regulators of brokers and do not qualify for ‘green tier’ status in DayTrading.com’s Regulation & Trust Rating.

- Profits from day trading in Pakistan are taxable at a rate that depends on your main source of income, usually up to 35%. Payments can be made to the Federal Board of Revenue (FBR).

Top 4 Brokers In Pakistan

Our exhaustive tests show these 4 platforms are superior for active Pakistani traders:

All Day Trading Platforms in Pakistan

What Is Day Trading?

Anyone who executes a trade and closes their position within the same day has completed a day trade. Unlike long-term trading, day traders aim to profit from near-term and generally smaller price movements.

Pakistan’s diverse economy provides a wide range of opportunities for short-term trading, including PSK-listed companies like the Oil and Gas Development Company Limited (PSX:OGDCL), indices like the KSE All-Shares Index, and commodities like wheat (Pakistan is the world’s ninth largest producer).

Is Day Trading Legal In Pakistan?

Day trading is legal in Pakistan and hundreds of thousands of retail traders hit the PSX to speculate on markets every day.

However, it’s important to make sure both you and the trading platform you use comply with Pakistan’s rules and regulations on online trading.

For most active traders in Pakistan, that mainly means keeping up with your taxes which we unpack below.

How Is Day Trading Taxed In Pakistan?

Profits from day trading in Pakistan are subject to tax, so you may need to report your earnings to the country’s tax authority, the Federal Board of Revenue.

If day trading is your main source of income, you may need to pay regular income tax. Pakistan has a progressive tax rate, with the lowest band at 5% starting after your first PKR600,000, and the 35% highest band kicking when you earn more than PKR4.1 million.

Traders who only occasionally earn money from online trading may be able to pay a lower rate, such as the 15% flat rate for profits from securities sales.

The tax system for active traders in Pakistan can be difficult to get your head around, especially if you have more than one source of income.I therefore strongly recommend consulting a local expert who understands the Pakistani tax system so you know you’re complying with the latest rules and not paying over the odds.

Getting Started

Follow these basic steps to get the best start to your day trading journey:

- Choose a top broker in Pakistan: Even if you don’t find a suitable option with a license from Pakistan’s State Bank, you can still choose a trustworthy trading platform with oversight from one of DayTrading.com’s ‘green-tier‘ regulators.

- Activate your account: You’ll need to verify your personal information to complete the sign-up process. This usually involves sending proof of address, such as a bank statement or approved bill, as well as potentially providing verified identification like Pakistan’s online Pak-ID card.

- Make a deposit: Once you fund your account using a wire transfer, debit card or popular e-wallets in the country like Payoneer, you can start trading. Select a stock traded on the PSX, an important Pakistani commodity like wheat, or any other financial instrument offered, for example derivatives offered by CFD brokers in Pakistan.

A Trade In Action

To help you understand what a short-term trade could look like in practice, here is an example scenario…

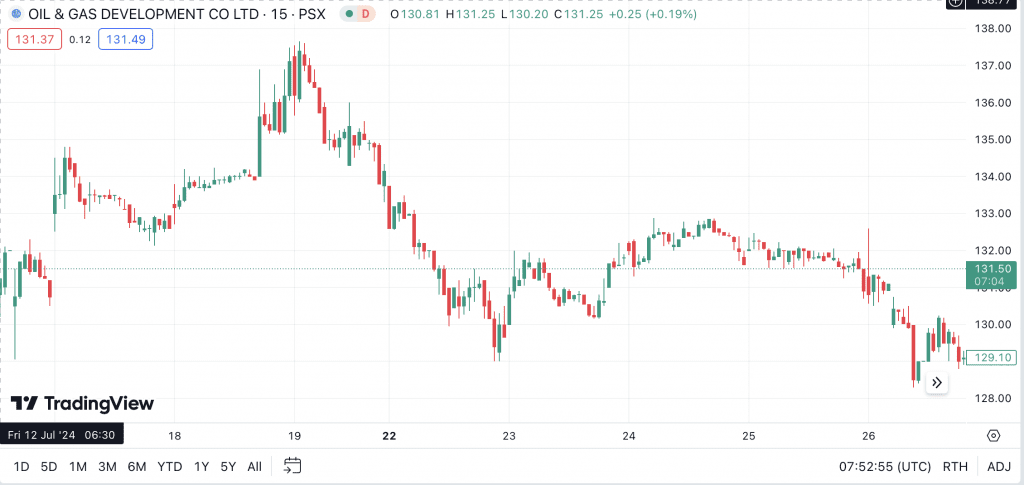

Pakistan’s largest company, the Oil & Gas Development Co (OGDCL), has already been on my radar due to the positive inflation data from the US and the likelihood that this will lead to rate cuts and increased demand for energy.

After also reading about discoveries of gas reserves by OGDCL on Monday morning, I am convinced that there will be a significant upside for the company during Monday’s trading session.

Checking my charts, I see that the price declined by nearly PKR8 over the previous week to languish at around PKR129 by EOD Friday, down from PKR137 the Friday before.

I believe this leaves room for significant growth toward recent highs after the positive news, so I open a market order on Monday morning, which fills just below PKR130 as the stock begins to rise.

Anticipating the chance of a pullback before OGDCL continues to rise, I set a stop-loss order at PKR127. Since I’m fairly confident that the price increase will continue, I set a take-profit order at PKR135.

By around 10 am the price has risen to PKR133.60, and then it begins to pull back.

Although it hasn’t yet hit my take profit order, I decide to close the trade at PKR132.8 an hour later, locking in nearly PKR3 profit per share.

Bottom Line

Pakistan offers an enticing environment for active traders with an increasingly financially literate population, an emerging economy and a wealth of short-term trading opportunities spanning popular markets like shares on the PSX and prominent export commodities like wheat.

To get started, see DayTrading.com’s selection of the best day trading platforms in Pakistan.

Recommended Reading

Article Sources

- State Bank of Pakistan (SBP)

- Securities and Exchange Commission of Pakistan (SECP)

- List of Registered Brokers and Agents - SECP

- Pakistan Stock Exchange (PSX)

- Federal Board of Revenue (FBR)

- Pakistan: OGDCL announces discovery of hydrocarbons in TAL Block at Razgir-1 exploratory well - Energy Pedia News

- Country Population - Worldometer

- Pakistan GDP (converted to PKR at the time of writing) - Statista

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com