Parabolic SAR

Parabolic SAR is a trend following indicator and is also popularly used among traders to set trailing stop losses.

The indicator was developed by Welles Wilder, who also developed and introduced the Average True Range, RSI, and Directional Movement (ADX) to the public in the late 1970s. All of these indicators remain widely popular today.

Brokers With The Best Parabolic SAR Analysis & Trading Tools

Parabolic SAR was originally named “Parabolic Time/Price System” with SAR an acronym for “stop and reverse”. Technical analysts often refer to the indicator as simply “SAR” by itself.

Part of the indicator’s popularity stems from its easy interpretation. It is distinct in that instead of lines, ranges, or “clouds” it uses dots to convey information on the chart.

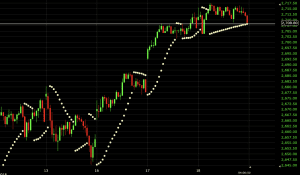

Dots that form underneath price and are rising in an upwardly sloping pattern suggest an uptrend. Dots that form above price and are falling in a downwardly sloping pattern suggest a downtrend. They may also represent the price where a trader could place a trailing stop, depending on whether SAR is used for this purpose.

Parabolic SAR plotted on a daily chart of the S&P 500

Calculation of Parabolic SAR

Parabolic SAR uses values of the previous period to come up with the new calculation. The calculation also differs regarding whether SAR is rising or falling.

Rising Parabolic SAR

In general, we have three elements – the prior SAR, and two indicator-specific values known as the extreme point (EP) and acceleration factor (AF).

Prior SAR is simply the SAR value of the previous period.

Extreme point (EP) is the highest high of the prevailing uptrend.

Acceleration factor (AF), under the indicator’s default settings, starts at .02 and increases by .02 whenever the extreme point (EP) makes a new high. Its maximum value is .20 regardless of how many new highs are made by the extreme point.

The acceleration factor value – both the rate at which it can increase and its maximum value – can be adjusted in the settings of the charting platform.

In the SAR calculation formula, the current SAR value is calculated by taking the prior SAR and adding it to the product of the prior acceleration factor and difference between prior extreme point and prior SAR:

Current SAR = Prior SAR + Prior AF * (Prior EP – Prior SAR)

Falling Parabolic SAR

The three elements stay the same – we use prior SAR, extreme point (EP), and acceleration factor (AR).

They are combined into the SAR formula very similarly, just that instead of adding the second part of the formula, it is subtracted instead.

Current SAR = Prior SAR – Prior AF * (Prior EP – Prior SAR)

Interpretation of Parabolic SAR

The parabolic SAR effectively operates like a trailing stop-loss. In uptrends, the SAR works to gradually “lock in” profits (or pull the stop-loss closer to breakeven) on the basis of its position below price. Many traders use SAR for stop-loss purposes and is largely its primary use.

For example, if we’re trading the daily chart of the S&P 500 and are currently long the market, we could set our stop-loss equal to the price level dictated by the SAR.

Depending on the trend, the SAR can be near or far from price. On this particular 15-minute chart of the S&P 500, SAR is less than one point (or under 0.04%) away from price, making a triggering of the stop-loss fairly likely.

Overall, this stop-loss will continue upward so long as the uptrend is in place. Once price breaks below the SAR level in an uptrend or above SAR in a downtrend, the indicator will reverse.

Accordingly, we never see SAR decrease in an uptrend or increase in a downtrend and continuously shifts with each period to protect any profits made on a trade.

Parabolic SAR can also be used as a trend following indicator in its own right. Traders using it in this sense would normally bias their trades to the long side when parabolic SAR is at levels below price (i.e., in an uptrend). Similarly, they might bias their trades to the short side when parabolic SAR is at levels above price (i.e., in a downtrend). But like all indicators, it should not be used in isolation and used alongside other technical tools and modes of analysis.

Adjusting the Settings of Parabolic SAR

The rate of change in parabolic SAR is dependent on the acceleration factor (AF), hence its designation as such. The settings of the AF can be adjusted, called the step.

The default for the step is .02. Its maximum value is 0.20 by default and is also adjustable.

SAR’s rate of change, sometimes called its sensitivity, can be altered by lowering the step. This works by increasing the distance between SAR and price. SAR reverses once price touches its level. Therefore, if SAR is further from price, a reversal in the indicator is less likely.

Take a look at this example of the daily chart of the S&P 500 using the standard settings (.02 step, .20 maximum).

And let’s compare this to different settings of a .01 step and .20 maximum.

We can see that the trend is less likely to shift back and forth.

Contrarily, SAR’s rate of change can be increased by increasing the step. This moves SAR closer to price, making a reversal in the indicator more likely. Here we have the settings of .04 in the step and .20 in the maximum.

We see a greater number of reversals and also the SAR lagging further from price.

Sensitivity also declines if we lower the maximum. If we reduce it from .20 to .04 we see that changes in trend are less likely. The maximum is more easily attained when set to lower levels. In this case, the calculation is less likely to change and we see less sensitivity. Moreover, SAR stays further from price.

What are the best settings?

Naturally, there is no correct answer to this. For those who want tighter stops to more easily protect profit or limit downside, having a higher step and higher maximum would be best.

For example, settings of .05 for the step and .40 for the maximum would produce fairly tight stops as represented by the level of the SAR dot and its proximity to price.

These settings would also be relevant for those who use parabolic SAR as a trend following indicator and prefer the indicator to have higher sensitivity and thus more frequent changes.

For those who want more accommodative stops to avoid getting stopped out prematurely and to allow “breathing room” in one’s trades, having a lower step and lower maximum would be appropriate.

In this case, settings of .01 for the step and .02 for the maximum would provide loose stops.

Those who use parabolic SAR for trend following might also prefer this setting to keep track of a broader view of the trend, rather than one that oscillates more frequently as with higher step and maximum values.

Conclusion

Parabolic SAR is regularly used to track trends. It also serves as a guide for where traders should place their stop-loss to limit the downside and/or protect the profit associated with their trades. The progressive dot configuration of the indicator functions very similarly to the adjustment of a trailing stop.

The settings of the indicator can be adjusted from its step and maximum value of .02 and .20, respectively.

Those wanting to increase the sensitivity of the indicator – which gives rise to more frequent changes in the trend (as diagnosed by the SAR) and tighter trailing stops – should increase the step and maximum value.

Those wanting to decrease the sensitivity of the indicator – less frequent changes in the trend and looser trailing stops – should decrease the step and maximum value.

The settings should be evaluated on a security by security basis and in line with one’s trading preferences. There is, of course, no correct answer as to which are best. The default settings are naturally the most frequently used.

Like all indicators, is should never be used in isolation. Developing a complete trading system involves using multiple modes of analysis, from looking at price action and/or other technical indicators and fundamental analysis.