Opening Range Breakout Strategy

The opening range breakout (ORB) strategy aims to profit from price action at the initial stages of the core market hours. By determining the upper and lower boundaries of an asset’s price range, users can trade on trends as its price breaks out. This tutorial will explain how the opening range breakout strategy works, tips for day trading with it, plus the benefits and risks of the ORB system.

Key Takeaways

- The opening range breakout strategy enables traders to capitalize on short-term volatility when the market opens

- It is a viable option for day traders of various experience levels as advanced technical analysis is not generally needed

- The ORB day trading strategy suits various intraday time frames, from 60 seconds through to 15 or 30 minutes

Top 4 Brokers For Trading Opening Ranges

What Is The Opening Range Breakout Strategy?

The opening range breakout strategy involves using the price action at the beginning of the key trading hours when assets are more volatile to suggest future trends.

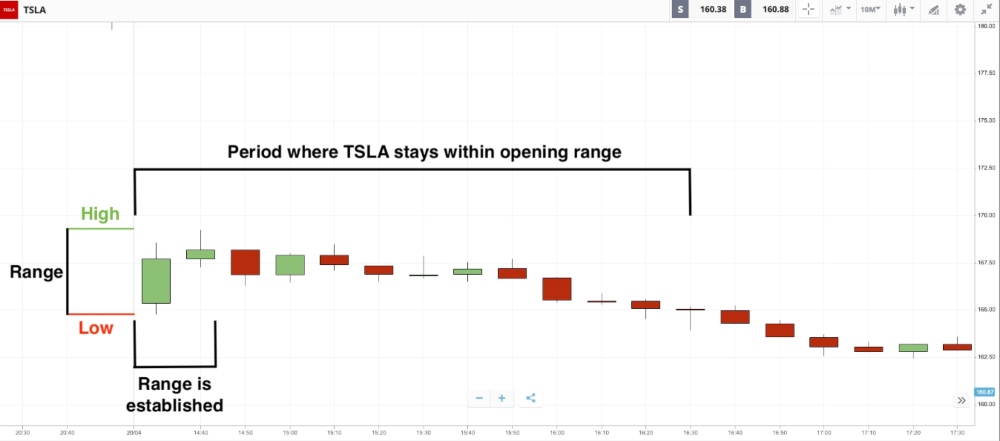

In this strategy, traders establish a high and low range of an asset using the first two or three candlesticks.

An example of this range can be seen below where the price of Tesla stays between $164.7 and $196.2 for around two hours after the market opens.

Once the opening high-low range has been established, traders wait for the price to break out:

- An upwards breakout above the high boundary suggests that a bullish trend will follow and therefore the trader could buy.

- A downward breakout going below the low boundary signals the opposite and the trader could sell to capitalize on a subsequent bearish trend.

Example Explained

Let’s look at an example of how trading opening ranges could work…

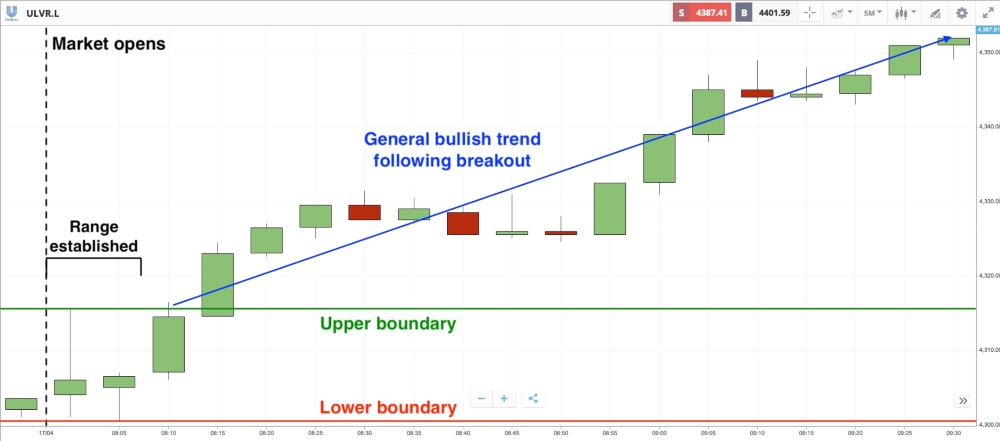

The image below is a price chart of Unilever stock traded on the London Stock Exchange at the beginning of the core trading hours on 17 April 2023.

As the image shows, the first two candlesticks establish an opening range between 4,315.5 GBx and 4,300.5 GBx.

By 8:10 AM, ULVR has increased past the upper boundary limit. At this point, you could use a long CFD.

Over the next 1 hour and 20 minutes, ULVR follows a bullish trend, ultimately peaking at 4,352 GBx at 9:30 AM, representing a total appreciation of 48 GBx since the market opened.

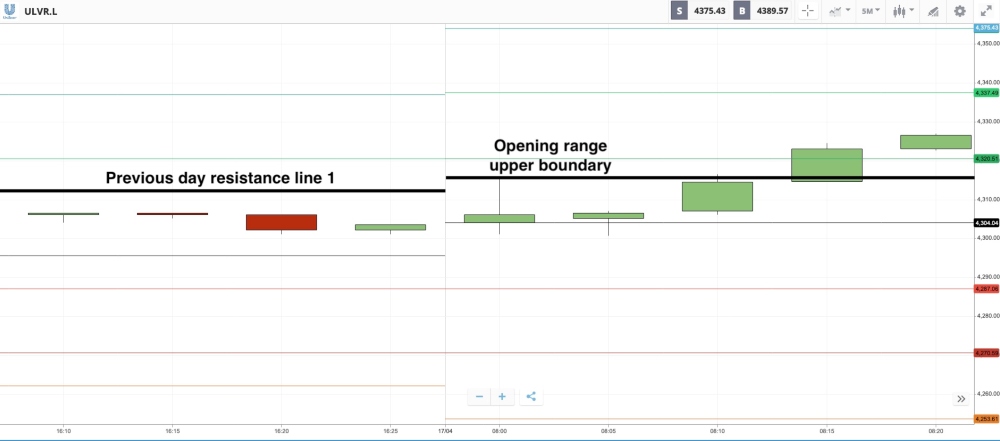

You can also use the pivot points indicator for added verification of upcoming trends. If the breakout passes an opening range boundary that falls close to the previous day’s resistance or support line, you could assume the trend has extra confirmation.

You can see an example of this in the image below, which also shows the Unilever example.

The previous day’s first resistance line strikes at 4,312 GBx, only 3.5 GBx away from the opening range upper boundary on the 17th. This provides added confirmation that the upwards trend is a true breakout and therefore could be worth trading on.

Trading Tips

Practise

The opening range breakout strategy is relatively straightforward to carry out, but it still requires work to get it right.

We recommend opening a demo account with the broker you plan to trade with so you can practice the strategy before risking real money.

This will allow you to build up experience to recognize true vs false breakouts and find which time frame works best for you.

Limit Orders

The use of limit orders is good practice when trading online, especially for the opening range breakout strategy. Both stop loss and take profit orders can help to reduce your risk exposure.

Typically, you will want to place your stop limit order on the opposite boundary of the range. So, if a stock breaks out above the high boundary, you could place the stop loss at the value of the low boundary.

The take profit order limit strike is at your discretion – build some experience to learn how to gauge this effectively, as each trade and asset will be different.

Patience

Patience is a virtue with opening range breakouts since not all stocks, for instance, will develop a clearly defined range and then break out at market open. You may need to wait for days until you find instances of genuine ranges being developed.

If you find that you are struggling with identifying ranges, you could try using different time frames.

Overnight News

Following news publications may help you gauge trader sentiment before the market opens in the morning.

Check for any events or announcements that came after the previous day’s close which could impact the value of the asset you want to trade. This could help you make better-informed predictions for potential price action.

For instance, an announcement for a product recall could mean the stock price will drop once the market opens the following morning.

Pros

- Advanced technical analysis is often not required

- Works well with indicators such as pivot points

- Relatively straightforward to understand and execute

- Can be used with multiple day trading time frames

Cons

- There is a risk of false breakouts

- Opportunities are limited to the start of the trading day

- The strategy is intense – you may need to monitor many assets at once

Final Word

The opening range breakout strategy provides day traders with a system to interpret and capitalize on the price changes at the beginning of the core market trading hours. It is relatively simple to execute, making it a viable option for traders of different experience levels. It can also be carried out without rigorous technical analysis.

On the downside, it is limited to the period of elevated volatility at the beginning of trading days. A useful tip is to test out the strategy on a demo account before putting real money on the line. And never risk more than you can afford to lose – there is no guarantee it will work.

FAQs

What Timeframe Should I Use For The Opening Range Breakout Strategy?

The opening range breakout strategy is a day trading strategy that uses short-term time windows. You can determine opening ranges using numerous time frames from 60 seconds up to 30-minute intervals.

With that said, it’s worth noting that breakouts tend to be smaller over short timeframes.

Can I Generate Profits With The ORB Day Trading Strategy?

The opening range breakout strategy can be profitable but positive returns are not guaranteed. Use stop loss and take profit orders to manage your risk. You can also practise with a demo account before trading with real funds.

Where Should I Place Limit Orders For The Opening Range Breakout Strategy?

Stop loss orders for opening range breakout strategies are often placed at the opposite end of opening ranges. If there is a bearish trend with the price breaking beyond the lower boundary, you could place the stop loss at the upper boundary.

The strike price for the take profit order will be determined by you and your risk appetite, with a larger gap between the current price and the strike requiring a greater risk appetite.

You can also use the support and resistance lines of the previous day and the current day to suggest where the bullish or bearish trend may stop.

What Markets Can I Trade The ORB Strategy With?

The opening range breakout strategy is often best suited to stocks that are traded on exchanges such as the NASDAQ, NYSE and LSE. These have clearly defined market trading hours that you can target every day of the working week.

Other markets such as forex and commodities may still be viable, however, they are open 24 hours throughout the working week. This means you will need to modify your use of the strategy by finding a suitably volatile period to trade. The cryptocurrency market, unfortunately, is less viable as it is open 24/7.

Should I Use The Opening Range Breakout Strategy?

The opening range breakout day trading strategy can be effective at the start of the trading day. It allows traders to capitalize on short-term volatility that is expected once the core market hours begin.

Whether it is right for you or not depends on your risk tolerance and trading ability. If you are unsuccessful on a demo account, it may be worthwhile adopting a different strategy.