OANDA US Review 2025

Awards

- Best US Broker 2023 - DayTrading.com

- Best Trading Tools winner 2021 - Online Personal Wealth Awards

- Awarded highest overall client satisfaction 2021 - Investment Trends US Leverage Trading Report, Margin Forex

- Awarded highest client satisfaction for mobile platform/app 2021 - Investment Trends US Leverage Trading Report, Margin Forex

Pros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

OANDA US Review

OANDA Corporation is a US-regulated trading broker and market maker. The brokerage offers opportunities in popular financial markets, including forex. We also rate that OANDA facilitates leveraged trading with tight spreads and no minimum deposit.

In this review of OANDA, we assess the suite of trading assets, deposit and withdrawal methods, demo account, safety, and more. Our experts also share their verdict on whether to open a live account today.

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses.

OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange.

Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

Daytrading.com receives a commission from OANDA when users sign up and fund an account through the link on this page

About OANDA

Before we get bogged down in the facts and figures of this broker review, it can help to first paint a picture of where OANDA started.

OANDA’s launch dates back to 1996, making it one of the early online forex brokers. Today, the brand is well established in retail trading circles, offering a long list of forex instruments, global corporate FX data services, plus currency management solutions.

US traders also benefit from spreads starting at 0.0 pips, cash rebates or commission markdowns, plus periodic welcome bonuses. Perks and trading conditions will depend on your account and trading activity, details of which we have broken down further below.

And despite failing to get a mention in many OANDA review forums, the FxTrade platform, launched in 2001, was actually the first fully automated forex trading platform.

OANDA Corporation is regulated by the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC). We consider this a promising sign that OANDA is a legitimate, trustworthy broker.

Minimum Deposit

OANDA has historically stuck to requiring no minimum deposit.

It ensures aspiring day traders and those with limited capital do not have to deposit more than they can afford as they find their feet. It has also made the brand popular in forex broker reviews.

Spreads & Commissions

OANDA US offers a spread-only account plus a core pricing solution. As the name suggests, traders pay just the spread with the spread-only account, while with the core pricing option, investors pay a reduced spread plus a fixed commission which starts at $50 per million.

Importantly, fees compare well to alternatives. This makes the broker a good option if you want to keep trading costs down.

Other Trading Fees

The firm charges an inactivity fee. But fortunately, this effective tax will only affect those who do not place any trades for at least one year. This is a much longer period than most rivals and we don’t consider it a major drawback.

It is also worth keeping an eye on the official website for any changes to overnight (rollover) fees, also known as financing charges.

Leverage

The maximum leverage available to US traders is 1:50. Margin rates vary between assets with a full breakdown available on the OANDA Corporation website.

On the downside, negative balance protection is not provided. Whilst fairly common among US brokers, this does raise the risks – you may lose more than your account balance if the markets move against you.

With this in mind, utilize stop-loss orders to limit potential losses. We rate that the broker’s selection of trading platforms also offer a range of risk management alerts and tools.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone.

OANDA Platforms

OANDA Trade

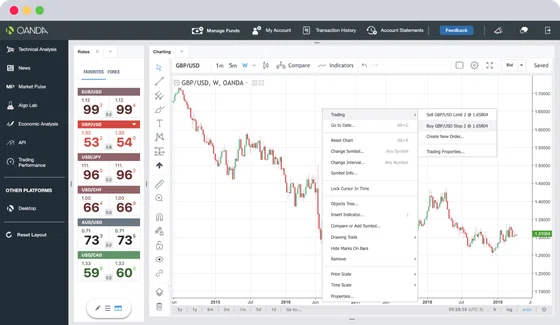

Our OANDA Trade review was pleased with the broker’s in-house platform, available as a free download or via major web browsers. Our experts found the system is well designed and easy-to-use, offering a multitude of tools and analytical features. Clients can trade directly from charts. Investors also benefit from complex order types, such as buy, sell, plus trailing stops.

Account analytics are also at your disposal. In addition, the financial trading software includes charts from MultiCharts, which allow for advanced and sophisticated studies and display styles.

On top of that, you get watch lists, news feeds, plus economic analysis. Accessing historical and live exchange rates is also straightforward.

On the downside, the platform lacks an ultra-modern look and some functions are awkward to use. Instead of being able to open news announcements, forums and economic analysis on the platform, they open as web pages in separate browsers. Again, you open OANDA’s order book outside the application. This can all prevent a smooth trading experience at times.

Speed tests show server times and execution rates are industry standard.

The conclusion – the OANDA Trade platform caters to the needs of most traders. A decent selection of tools and features are available and it’s relatively easy to pick up for beginners.

OANDA Trade API Libraries

A subscription to OANDA also means you can explore automated trading. API python tutorials can be found online to help you get the most out of your API instruments. Automated trading essentially allows you to execute more trades than you could manually.

Notifications can be created for when you enter and exit positions and pre-programming your criteria can be done with the aid of Algo Labs. In our experience, this affords you more time to download historical data, analyze tick data and craft effective strategies.

For experienced traders and technophiles, the API libraries can help with the following:

- Access current and historical market data

- Stop-loss, take-profit or entry orders

- Access past trading transactions

- Risk-free testing

- Trade requests

MetaTrader 4

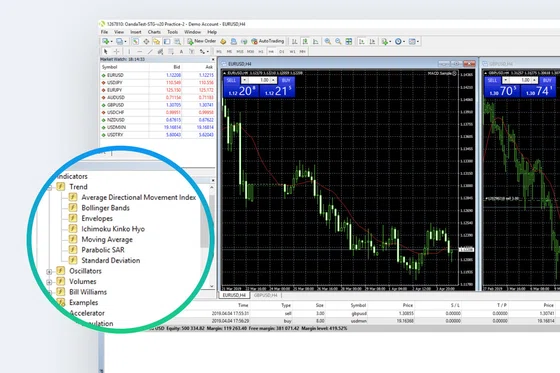

If OANDA’s desktop platform doesn’t appeal, you have the option of the MetaTrader 4 (MT4) download, web-based solution, or mobile app. The industry-standard platform offers advanced charting, watchlists, plus trade automation via an ‘Expert Advisor’ (EA) plugin.

Traders can also save layouts and chart profiles. In addition, users can see swap rates and view live and monthly exchange rates from within the platform. Drawing up a forex order book, indicators and potential strategy are also quick and easy. For those wanting to hedge, it is not prohibited. You can also view both long and short positions on the MT4 platform.

On the downside, creating or amending Expert Advisors (EAs) can be challenging. This is especially true for new traders who may be unfamiliar with the programming language. And whilst the audible alerts can be annoying, there are customizability options, not to mention a mute button, so we can let that drawback slide.

Other Platforms & Tools

Our experts appreciated the several additional helpful trading tools available at OANDA:

- TradingView – An industry leader in user-friendly technical analysis tools. TradingView users benefit from rich market data with intuitive drawing tools. Monthly subscriptions are also reimbursed if you qualify for the Elite Trader program.

- MotiveWave – This professional charting and technical analysis platform offers more than 250 built-in studies/indicators and 30 built-in trading strategies.

- Market Reports – Powered by AutoChartist, this tool provides a summary of financial markets. An email is sent to traders before they start analysis for the day ahead. Importantly, Market Reports provide a technical outlook of the forex markets for the next 48 hours.

On the downside, MetaTrader 5 (MT5) is not available. This is a drawback for traders that prefer the latest and more powerful software from MetaQuotes.

Mobile Apps

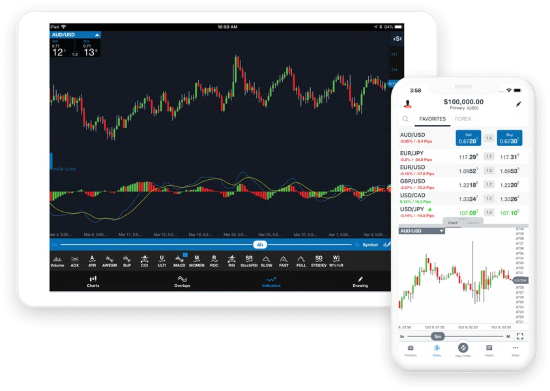

If you are frequently on the move, being able to enter and exit positions from your mobile or tablet device can prove useful. Those looking for an OANDA mobile and iPad review will be impressed with the capabilities of the OANDA Trade mobile platform. The application also provides integration with a range of devices, from iPhones to the Windows Phone 8.

Once you have your web login details, you can download historical quotes, battle with spot and forward rates and start speculating on popular trading assets. The platform is straightforward to navigate and the sleek design allows for a stress-free experience.

There is access to OANDA’s trading instruments, spread history, account analytics, as well as complex order types. Clients also retain the ability to trade directly from charts with one-click trading, plus indicators and price overlays. Users also have the option to tweak display styles to find a format that compliments their trading style.

As a bonus, the news, economic calendars, and financial announcements all open with ease from inside the app. This makes gauging market sentiment easier. In addition, there is regular maintenance to ensure instrument lists are up to date. This also means any issues and glitches are swiftly remedied.

Overall, their mobile offering allows for a hassle-free transition from the desktop application.

Note, clients can also speculate on popular financial markets using the MT4 mobile app.

OANDA Payment Methods

An increasing number of day traders are looking for straightforward deposit and withdrawal systems. Fortunately, you can make deposits and withdrawals to your OANDA account using:

- Debit cards (Visa & Mastercard)

- Automated Clearing House (ACH)

- Bank wire transfer

Available base currencies: USD, EUR, HKD, SGD,CAD, AUD, JPY, CHF, GBP.

When we used OANDA, we appreciated that the official website guides you through the payment process and the customer service team can help with any withdrawal problems.

Overall, OANDA traders are content with the current money transfer options, as demonstrated by other user reviews.

Account Types

OANDA offers a Standard account solution with both spread-only pricing or and an Elite trader program.

Elite Trader Program

This is an attractive scheme for high-volume traders. Clients that trade at least $10,000,000 per month can qualify for cash rebates of between $5 and $17 per million. This can save traders up to 34% on trading fees.

There is also a selection of other useful rewards, including a relationship manager, free VPS, free wire transfers, API support, plus a subscription reimbursement on TradingView’s advanced packages.

Users can join the Elite Trader scheme through a simple registration form.

Demo Account

In conducting our demo account review, we were quick to find an impressive perk to the free practice account. Whilst many forex brokers offer a practice download for a limited period, OANDA’s demo account is available for as long as traders need to hone their strategy and build their confidence. The paper trading account can also be opened via popular social media messaging platforms.

Once you have your demo login details, you have nearly all the same functionality as live account holders. Funded with simulated money, the practice account is the ideal way to get familiar with market conditions and test drive OANDA as a potential broker.

Once your confidence has grown with volume indicators, currency heat maps and backtesting, you can then upgrade to a live account.

Additional Features

OANDA offers an impressive list of additional features. Their learning portal/trading academy, for example, offers:

- Webinars – Online videos cover a host of subjects, from ‘Getting Started in Trading’ to more advanced topics, such as ‘Fibonacci Retracements and Clusters: An Advanced Look at Trend Formation.’

- Interviews – Learn from experienced traders as they discuss a range of topics, from trading plans to strategy.

- Articles – These detailed articles appeal to investors of all experience levels.

- Tutorials – Tutorials can help users with a range of topics, including reading data feeds and identifying correlations. In addition, you can learn how to start scalping and compare recent live spreads. All of which may help increase your intraday trading salary.

- Referrals – A lucrative referral scheme that benefits both the referee and referer. Note, this promotion is not always available – check the official site for the latest details.

As well as the above, OANDA provides straightforward access to historical average exchange rates. Viewing open and long-short positions and ratios is also quick and easy. Furthermore, monthly and yearly averages, plus historical classic interest rates can be found.

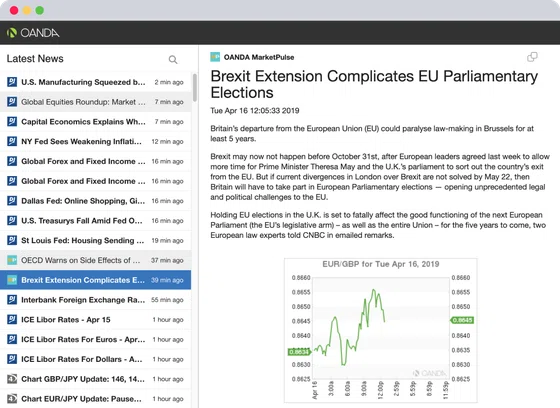

You can also benefit from news reports from a range of sources on OANDA. These include MarketPulse, where you will find breaking news, trend analysis, plus policy commentary. In addition, there is straightforward access to margin and leverage calculators to help you establish potential profit and loss.

The only downside is that with so many resources available, locating them can be a bit of a minefield.

Safety & Security

With an increase in cybercrime, digital security has become a prominent concern. So, is OANDA a reliable broker?

Fortunately, personal data and trading activity are kept secure. They do this by using high-tech, sophisticated encryption technology. Two-factor authentication is also available on some of the broker’s trading platforms.

OANDA Regulation

In recent years, some traders have fallen victim to unscrupulous brokers. This makes selecting a licensed and regulated brokerage all the more important. OANDA’s proactive approach to regulation should bring peace of mind to customers.

OANDA Corporation is regulated by the Commodity Futures Trading Commission and the National Futures Association (Member ID: 0325821).

Detailed Benefits

This 2025 OANDA review found several key benefits to opening a live trading account:

- Products – As an active day trader, a range of products often means more opportunities. With OANDA, you get access to 68 major and minor currency pairs,

- Regulation – As outlined above, OANDA impresses with regulatory oversight from a number of bodies. This should help reduce concerns over frauds and scams.

- Applications – Clients can use OANDA’s proprietary desktop software and platforms like MetaTrader 4. Developers also regularly implement updates.

- Direct chart trading – Clients can enter and close positions directly from live charts, available on all of the broker’s trading terminals.

- No minimum account size – This allows you to open accounts with as little as $1, making it ideal to test and develop intraday strategies.

- Demo account – Traders get a lengthy free trial and it’s easy to download the MetaTrader 4 demo account. You can then open positions and get your head around average exchange rates live.

- Additional features – Scalping and hedging strategies are permitted on the broker’s trading platforms. Profit calculators, depth of market data, and comprehensive quote lists are also provided.

Detailed Drawbacks

Despite the advantages of registering with OANDA, there are also some downsides:

- Limited additional protection – Whilst OANDA does comply with regulatory standards, extra slippage and deposit protections could further benefit online traders, particularly in volatile markets. In addition, more could be done in terms of negative balance protection.

- Slow customer service – In a business where time is money, OANDA’s sometimes slow customer service could hamper and frustrate active traders and beginners.

- Disorganised resources – On the positive side, OANDA offers a multitude of educational and trading resources, from webinars to news feeds. However, these resources are somewhat disorganised and are sometimes only available after launching external web pages.

- Missing instruments – Traders looking for binary options will be disappointed. In addition, copy trading and live signals aren’t available.

- ECN – OANDA is not an ECN broker, it is a market maker. This means traders may find tighter spreads with competitors.

Trading Hours

OANDA’s trading hours coincide with global financial markets. Trading is available from approximately 17:00 on a Sunday to 17:00 on a Friday EST – 5.

Contact & Customer Support

Every platform glitch and account issue can cut into profits. Therefore, having fast and effective customer support is important. Fortunately, OANDA trading reviews are quick to highlight the company offer 24/5, multilingual support.

Apart from holiday trading hours, you can contact the broker’s customer service team via email around the lock (frontdesk@oanda.com). Alternatively, live online chat and telephone support are available during trading hours.

- United States: 212-252-2129

- Toll free contact number in Canada and the United States: 1 877 626 3239

The live chat team are available in English, Spanish and Mandarin.

Support via WhatsApp, Telegram and Skype is not available. With that said, OANDA US can be found on Facebook, Twitter, LinkedIn, Instagram and YouTube.

It is also worth highlighting that response times were relatively slow in our tests. Nonetheless, hotline staff remained polite and helpful when we used OANDA, endeavouring to use their support website and archives to answer questions fully.

Overall then, users can trade confidently knowing effective support is on hand, regardless of location and time zone.

OANDA Verdict

So, is OANDA a good forex broker? Well, they score highly in many broker ratings and traders’ reviews. They offer a straightforward setup, competitive pricing, 68 forex assets, not to mention sophisticated trading platforms. So, even when you compare OANDA vs FXCM and other well-known brokers, the firm still impresses.

On the negative side, while using OANDA we found there is room for improvement in terms of customer service. Ultimately though, this OANDA review found that the company remains an attractive proposition to traders from all over the world.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Top 3 Alternatives to OANDA US

Compare OANDA US with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

OANDA US Comparison Table

| OANDA US | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| Rating | 4.5 | 4.3 | 4.5 | 3.6 |

| Markets | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | NFA, CFTC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | FINMA, JFSA, FCMC |

| Bonus | – | – | Active Trader Program With A 15% Reduction In Costs | 10% Equity Bonus |

| Education | Yes | Yes | Yes | Yes |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | JForex, MT4, MT5 |

| Leverage | 1:50 | 1:50 | 1:50 | 1:200 |

| Payment Methods | 5 | 6 | 8 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by OANDA US and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OANDA US | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

OANDA US vs Other Brokers

Compare OANDA US with any other broker by selecting the other broker below.

The most popular OANDA US comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 OANDA US customer reviews submitted by our visitors.

If you have traded with OANDA US we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of OANDA US

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

I mainly trade on the OANDA app and find it really reliable. Responsive charts with reliable execution. It also seamlessly integrates with the desktop software.