Forex Trading in New Zealand

The forex market in New Zealand, while relatively small compared to global giants, has carved out a notable niche due to its advanced infrastructure and supportive regulatory environment.

According to the latest Triennial survey from the Bank for International Statements (BIS), the New Zealand Dollar (NZD) played one side of 1.7% of trades in the global foreign exchange market.

Let’s explore the basics of forex trading in New Zealand through practical insights and an example day trade.

Quick Introduction

- The Financial Markets Authority (FMA) oversees forex trading in New Zealand, a ‘green tier’ regulator, ensuring a secure trading environment with a high level of transparency.

- New Zealand forex traders benefit from a maximum leverage of 1:500, which is higher than many other regions, allowing for potentially larger trades with less capital.

- New Zealand currency traders face challenges such as the time difference with major financial centers like London and New York, which can limit access to high-liquidity trading periods.

Top 4 Forex Brokers in New Zealand

Our latest tests indicate these 4 platforms are the best for forex traders in New Zealand:

How Does Forex Trading Work In New Zealand?

Forex trading in New Zealand involves the buying and selling of currency pairs in the foreign exchange market, such as NZD/USD (New Zealand dollar/US dollar) and AUD/NZD (Australian dollar/New Zealand dollar), with the goal of profiting from price fluctuations.

To start day trading currencies online, you’ll need to:

- Open an account with a forex broker – we recommend choosing an FMA-regulated firm.

- Deposit funds – consider selecting an NZD-based trading account to cut conversion fees.

- Execute trades – your broker will provide a desktop or web terminal or a forex app.

Is Forex Trading Legal In New Zealand?

Forex trading is legal in New Zealand. The Financial Markets Authority regulates forex trading activities to ensure they are conducted in a fair and transparent manner. The FMA provides oversight to protect retail investors, including day traders, and maintain market integrity.

Forex brokers operating in New Zealand must be registered and comply with the regulatory standards set by the FMA, which include ensuring client funds are held in segregated accounts and providing adequate disclosure and reporting.

New Zealand forex regulations are thorough, but there are notable differences when compared to those in Australia (ASIC), Europe (CySEC), and the UK (FCA).

For example, while ASIC, CySEC, and FCA enforce a leverage cap of 1:30 for major forex pairs to mitigate risk, the FMA permits significantly higher leverage up to 1:500.

Additionally, negative balance protection, a safety feature mandated in these top-tier jurisdictions to prevent you from losing more than your deposited funds, is not required by the FMA in New Zealand.

Is Forex Trading Taxed In New Zealand?

In New Zealand, while there aren’t specific tax regulations exclusively tailored for forex trading, the Inland Revenue Department (IRD) of New Zealand considers profits derived from forex trading as taxable income.

In practical terms, this means that you are subject to the same tax requirements as any other individual earning income from diverse sources. You must adhere to the country’s tax laws by accurately reporting your trading income and ensuring compliance to avoid potential penalties or legal complications.

When Is The Best Time To Trade Forex In New Zealand?

The optimal time to trade forex in New Zealand largely depends on your individual trading strategy, preferences, and the specific currency pairs being traded.

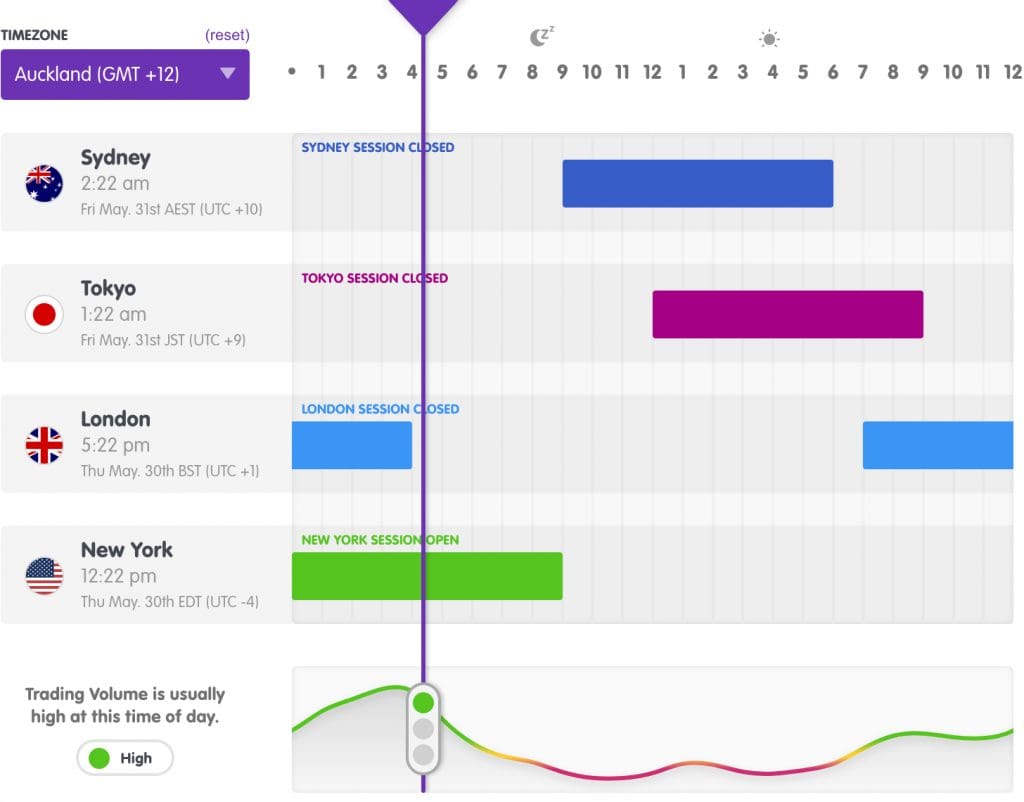

However, there are key overlapping trading sessions that offer increased liquidity and volatility, which are generally favored by traders in New Zealand:

- Asian Session (Tokyo Session): This session overlaps with the start of the New Zealand trading day and typically offers increased activity in currency pairs involving the JPY. It can be a volatile time for traders interested in NZD/JPY or AUD/JPY pairs.

- Australian Session: As New Zealand and Australia share similar time zones, the Australian trading session also aligns with the New Zealand trading day. During this period, currency pairs involving the AUD and NZD see heightened activity.

- London Session: The London session overlaps with the end of the New Zealand trading day. It’s known for high liquidity, especially when it overlaps with the Asian session. If you focus on EUR/NZD, GBP/NZD, or other European currency pairs, you may find this session particularly advantageous.

- Overlapping Sessions: The most liquid and volatile period occurs when multiple trading sessions overlap. For New Zealand traders, the overlap between the New York, Australian and Asian sessions (roughly from 8:00 AM to 1:00 PM NZST) can provide ample trading opportunities.

Example Trade

To share practical insights into forex trading for New Zealanders, here’s the process I followed for executing a day trade on the NZD/USD currency pair:

Event Background

Responsible for steering New Zealand’s monetary and fiscal policy, the Reserve Bank of New Zealand (RBNZ) plays a pivotal role in the nation’s economic management.

The RBNZ was about to announce its latest monetary policy decision. This announcement could include changes to interest rates, forward guidance on future monetary policy, and insights into the state of the New Zealand economy.

As a day trader, I was particularly interested in how this announcement may impact the NZD/USD currency pair, given the potential for volatility and short-term trading opportunities.

Market Analysis

Before the RBNZ announcement, I analyzed the NZD/USD currency pair. I looked at recent price action, key support and resistance levels, and any prevailing trends.

I also assessed market sentiment using indicators such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), and considered any other major economic events or news that could influence the pair.

Interpretation Of Data

The key economic indicator I focussed on for the RBNZ announcement was the interest rate decision – either to change or to maintain. Based on the RBNZ’s decision and accompanying statement, I interpreted how it may impact the NZD/USD currency pair.

For example, if the RBNZ surprised the market by raising interest rates, this could strengthen the NZD against the USD. Lowering the interest rates would likely have the opposite result and weaken the NZD. Even if interest rates were to remain the same, I expected some short-term volatility.

Position Sizing & Risk Management

I calculated the appropriate position size based on my risk management rules, taking into account factors such as the size of my trading account, the potential loss if the trade went against me, and the distance to my stop-loss level.

I always set a stop-loss order to limit my potential loss in case a trade doesn’t go as planned.

Trade Entry

Once the RBNZ announcement was made and the interest rate was maintained, I assessed the market reaction on a 5-minute chart. There was a relatively large 50-pip bullish move in just 15 minutes, so I decided to trade a 30-pip pullback (short position) using a Fibonacci retracement tool for a 1:3 risk-to-reward trade (risking 10 pips to make 30 pips).

Trade Exit

I monitored the trade closely, paying attention to price action and any new developments that may have affected the NZD/USD pair. However, as I had set predetermined take-profit and stop-loss levels, I could watch the trade play out without having to worry about significant changes in market conditions.

On this occasion my analysis was correct and my take-profit target was reached in 1 hour 45 minutes.

Post-Trade Analysis

After closing the trade, I reviewed my performance and analyzed the outcome of the trade. I assessed whether I followed my trading plan, if there were any lessons learned, and how I could improve my forex trading strategy for future trades. This analysis helps me to refine my trading approach and become a more effective trader over time.

Bottom Line

Forex trading in New Zealand falls under the oversight of the Financial Markets Authority (FMA), ensuring adherence to regulatory standards and safeguarding investor interests.

Accessible through online platforms provided by FMA-regulated brokers, you can engage in trading various currency pairs, such as NZD/USD or EUR/NZD, from virtually anywhere with an internet connection.

While offering opportunities for you to participate in global currency markets, forex trading in New Zealand demands careful consideration of regulatory guidelines, risk management practices, and ongoing education to navigate the complexities of the market effectively.

Recommended Reading

Article Sources

- Financial Markets Authority (FMA)

- Inland Revenue Department (IRD) of New Zealand

- Reserve Bank of New Zealand (RBNZ)

- Forex market time zone converter - Babypips

- Bank for International Statements (BIS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com