Nutmeg Review 2024

Awards

- Best Buy ISA (2022)

- Stocks and Shares ISA of the Year (2015 - 2019)

Pros

- FCA-regulated

- Socially responsible investing

- Financial advisors with premium profiles

Cons

- Relatively high pricing

- Basic market research

- Narrow range of investments

Nutmeg Review

Nutmeg is a popular wealth management platform in the UK. The robo-advisor offers several investment accounts including ISAs, pension plans, and general savings profiles. This Nutmeg review will examine the benefits of each account, from performance and fees to the registration process and minimum investment requirements. We also look at how Nutmeg compares to alternatives.

What Is Nutmeg?

Nutmeg was the first digital wealth management service in the UK, founded in 2011. The company was purchased in 2021 by JP Morgan for an undisclosed value.

Today, the brand has over 200,000 registered customers and a reported value of £4.5 billion in assets under management (AUM) in 2022.

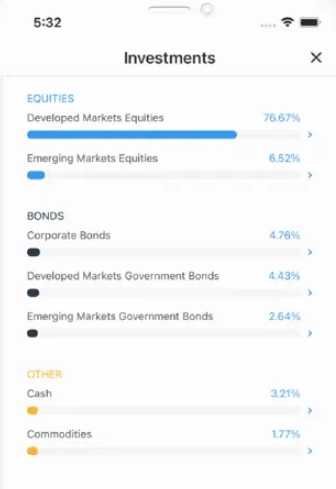

Nutmeg offers various investment solutions, such as pensions and stocks and shares ISAs. Products are invested in through diversified portfolios of exchange-traded funds (ETFs), covering stocks, bonds and commodities. These include developed equities, emerging market equities, global equities, emerging and developed government bonds, and corporate bonds.

The company offers a choice of investment management styles, from fixed allocation portfolios and fully managed profiles to socially responsible trading accounts.

Performance

Nutmeg has outperformed its peers in each of its 10, risk-based managed investment portfolios:

Products & Accounts

Nutmeg offers five investment products: Pensions, Junior ISA, Lifetime ISA, Stocks & Shares, and General Investment.

Pension Account

The Nutmeg personal pension account is a tax-efficient vehicle, with funds available at retirement. UK customers are eligible for up to 20% tax relief on all contributions, depending on personal circumstances.

The pension account is fully customisable, meaning you can set financial goals and choose how your money is invested. Customers are also permitted to transfer funds from alternative providers. Nutmeg provides a flexible drawdown policy, meaning you have full control over withdrawals.

All clients receive quarterly and yearly fund performance statements, though you can view your pension investment status via the web or mobile app in real-time.

The broker also offers some other useful tools including a pension calculator and access to blog-style forums for the latest news.

There is a minimum investment of £500.

Junior ISA

A Junior ISA is a tax-efficient savings account for children under 18 with a £9000 annual limit. The profile can be set up and maintained by a guardian until the child turns 18.

Nutmeg customers can choose from several portfolio styles designed around risk appetite and domestic or international assets.

There is a minimum investment of £100.

Lifetime ISA

The Lifetime ISA is a government-backed savings scheme for UK residents aged between 18 to 39. Also known as a LISA, it is designed for individuals saving towards a property purchase or retirement.

There is a £4,000 annual limit with up to 25% bonus reward per year.

Withdrawals are permitted at the time of purchase of your first property or when you reach the age of 60 for retirement. You may be liable for withdrawal fees or bonus penalties if you request to remove funds early.

Nutmeg offers these profiles via stocks and shares ISAs only.

There is a minimum investment of £100.

Stocks & Shares ISA

The stocks and shares ISA account offers tax-efficient savings, with an annual investment limit of £20,000. Note, this is not a traditional savings account as the money is invested in a number of financial products.

Nutmeg portfolios are designed around ETFs with an allocation of corporate bonds, funds, and stocks.

There is a minimum investment of £500.

General Investment Account

The Nutmeg general investment account is a flexible savings profile for UK residents over 18. It can be used alongside the ISA account as it does not contribute to the annual allowance.

Like the other accounts, funds can be invested through ETFs. Portfolios can be designed based on specific industries, indices, shares, and more. Cash held within Nutmeg accounts is also eligible for interest gains, set at the BoE base rate minus 0.75%.

There is a minimum investment of £500.

Investment Styles

Clients have a choice of four investment styles: Fully Managed, Smart Alpha, Socially Responsible, and Fixed Allocation.

Fully Managed Account

The Nutmeg Fully Managed profile is a hands-off approach to investing. The platform’s experts do all the leg work, including performance monitoring and asset rebalancing.

The account constitutes a portfolio of exchange-traded funds (ETFs) operating across 10 risk levels. Asset allocations can be determined between domestic and international markets.

In the last 10 years, Nutmeg has posted average returns of +42.4% vs +39.2% by its peers.

Fixed Allocation Account

The Nutmeg Fixed Allocation profile is similar to the Fully Managed account, though it does not offer the ongoing services of an investment expert.

The brand’s technology still provides auto-rebalancing to maintain a portfolio in line with your goals, however, the asset allocation will only be reviewed once per year. There are also 5 risk levels vs 10 for the Fully Managed profile.

Given the reduced wealth management services, you can expect lower fees, as we outline below.

In the last three years, Nutmeg has generated average returns of +51.4% vs +30.1% by its peers.

Socially Responsible Account

The Nutmeg Socially Responsible portfolios offer all the benefits of a fully managed profile, though investments are selected from organisations and bonds issuers complying with environmental, social, and governance (ESG) values.

The brand uses the expertise of Morgan Stanley Capital International (MSCI) to select products that contribute to a socially responsible future.

Portfolios are overseen and maintained by Nutmeg’s team of experts. This includes asset rebalancing and adjustments based on any company charges.

In the last three years, Nutmeg has generated average returns of +45.2% vs +30.1% by its peers.

Smart Alpha Account

The Smart Alpha account is Nutmeg’s most expensive solution.

The profile was launched in 2020 in collaboration with JP Morgan, Nutmeg’s affiliate firm. Asset allocation is set and maintained using JP Morgan’s extensive research-driven selections and teams with years of experience.

Smart Alpha investments are also permitted to include active ETFs including those with a focus on ESG considerations.

Since the introduction of these portfolios, Nutmeg has achieved average returns of +17% vs +4.9% by its peers.

Markets

The Nutmeg team have access to a pool of over 1,800 exchange-traded funds that can be used within each bespoke portfolio plan. These cover several markets:

- Commodities – Exposure to the price of gold without holding the physical product

- Emerging market equities – Shares from growing economies such as China and Brazil

- Developed equities – Major stocks from developed global markets including the UK and USA

- Government bonds emerging markets – A debt instrument issued by governments in developing economies. These are typically issued in local currencies or US Dollars

On the downside, this is a narrow range of markets and ETFs than some alternatives.

Nutmeg Fees

When we used Nutmeg, we were pleased with the price transparency. A useful calculator is also available on the firm’s website to generate estimated charges based on investment values.

However, its fees are not the cheapest in the market. Moneyfarm, for example, offers actively managed accounts for portfolios with a value of less than £100,000 for a 0.75% fee. With that said, there are no set-up, transaction, trading or exit fees.

The Nutmeg fee model is simply a percentage charge based on the value of your investments. Charges vary between the four investment styles and fees are collected monthly.

Smart Alpha

Total fees: 1.17%

- Fund costs – 0.35%

- Market spread – 0.07%

- Nutmeg fees – 0.75% up to £100,000 AUM, 0.35% thereafter

Socially Responsible

Total fees: 1.12%

- Fund costs – 0.30%

- Market spread – 0.07%

- Nutmeg fees – 0.75% up to £100,000 AUM, 0.35% thereafter

Fully Managed

Total fees: 1.03%

- Fund costs – 0.21%

- Market spread – 0.07%

- Nutmeg fees – 0.75% up to £100,000 AUM, 0.35% thereafter

Fixed Allocation

Total fees: 0.71%

- Fund costs – 0.19%

- Market spread – 0.07%

- Nutmeg fees – 0.45% up to £100,000 AUM, 0.25% thereafter

How To Open A Nutmeg Account

It is quick and simple to sign up for a Nutmeg account:

- Enter an email address and create a password

- Verify your registered email address and sign in to your account

- Add contact details and identity information and select ‘Continue’

- Input your UK national insurance number and confirm your nationality

- Add your bank details

- Agree to the terms and conditions and select ‘Confirm Details’

The joining process then involves answering three questions:

- Outline your savings goals – What do you want to achieve and by when?

- Select an investment style – Choose one of the four investment profiles and deposit funds to get started

- Portfolio selection – Pick an investment portfolio or allow the Nutmeg team to create a diverse product assortment

The brand also provides free telephone guidance for prospective customers. You can book a time slot to access financial guidance or receive more information on the products offered by Nutmeg.

Payments

Deposits

You can start investing with as little as £100 with a Lifetime and Junior ISA. The Nutmeg pension account, stocks and shares ISA and general investment account have a minimum deposit requirement of £500.

Customers can make ad hoc payments to an investment account or create a direct debit for regular payments each month. The latter is a good option for those seeking a hands-off approach to investing.

Accepted payment methods include debit cards, Apple Pay, Google Pay, and bank wire transfer. While using Nutmeg, we found that ‘Easy bank transfers’ offer the fastest processing times, with funds available in your account within one working day.

Funds will typically be held as ‘unallocated cash’ rather than being invested into a particular portfolio. You will then need to allocate funds to a specific account/product.

Withdrawals

Nutmeg allows customers to withdraw funds at any time.

With that said, the benefits associated with ISAs mean that it will be advantageous to treat these as longer-term investments. There could be a 25% penalty if money from a LISA is not used towards retirement or the purchase of a first home.

It was good to see that Nutmeg does not charge any fees to withdraw from accounts.

Allow between three to seven working days for funds to be transferred back to a registered bank account.

How To Make A Deposit/Withdrawal

From the website:

- Sign into the Nutmeg client dashboard

- Select ‘Pay In’ or ‘Withdrawals’ from the side menu

- Choose the payment method

- Complete the relevant payment details in the following screen and select ‘Submit’

Alternatively, you can deposit from the Nutmeg mobile app. Simply select the ‘£’ logo from the menu along the bottom and choose ‘Pay In Now’.

On the downside, we were disappointed to find that it is not possible to withdraw from the app.

Mobile App

Nutmeg offers a free, intuitive mobile app, available for free download on iOS and Android devices.

This is common practice for large money management firms including Vanguard, Moneybox, and Wealthify.

App users can register for an account, deposit funds, access investment accounts, and monitor portfolio performance.

The mobile application is easy to navigate with simple switching between savings pots.

The application also hosts a ‘Discover’ section with a selection of blog posts, trading updates, and investor podcasts.

The app is rated an impressive 4.8/5 on the Apple App Store.

Nutmeg Regulation

Nutmeg is a trustworthy company with strong regulatory oversight.

The firm is authorised and regulated by the Financial Conduct Authority (FCA), firm registration number 552016. Nutmeg segregates customer funds from the business’ accounts. The wealth management provider has partnered with custodian State Street, the second-largest custodian depository in the world to hold client assets.

Customers also have access to the Financial Services Compensation Scheme (FSCS), meaning that up to £85,000 reimbursement can be obtained in the event of business failure or insolvency.

Customer Support

Nutmeg is available to contact during standard working hours (9.00 am to 5.30 pm, Monday to Thursday; and 9.00 am to 4.30 pm on Friday). The brand offers several contact options including live chat, email, and telephone.

Alternatively, the FAQ and support sections on the firm’s website are extensive. There is a wealth of information on the brand, ISAs, investments, and account queries, ideal for quick self-help guidance.

- Client Services Telephone Number – 020 3598 1515

- Nutmail – A secure messaging service, available via the firm’s homepage

- Email – support@nutmeg.com (existing clients) or newclient@nutmeg.com

- Live Chat – Available from the bottom right of the brand’s webpage or in the mobile app

- Address – Nutmeg, Unit 201 – 2nd Floor Vox Studios, 1- 45 Durham Street, London, SE11 5JH

There are also options for a free call with a personal wealth manager to help with specific investment queries or ideas.

Additional Features

Nutmeg offers a good selection of educational materials and resources that can help individuals new to trading and investing.

Guidance

The brand provides free financial guidance and advice. Support is provided with no minimum investment required. The team can provide suggestions based on your existing investments, regular spending habits, and long-term goals.

Alternatively, a personalised plan can be generated for a one-off £575 fee. This includes ongoing support to help you implement the strategy. On the downside, this is a hefty charge for many novice investors.

Nutmegonomics

Nutmeg also provides a wealth of articles and resources to aid investment decisions. The materials are easy reads, covering several topics including the economy, retirement, and Brexit.

The wealth management provider also has a YouTube channel with investor updates and global market news. This is useful for staying up to date with the latest economic developments and may help with savings ideas and plans.

There are also plenty of user guides, including details on how to transfer to an ISA, exchange-traded fund examples, and a summary of key terms.

Refer A Friend

The wealth management provider offers a refer-a-friend scheme. Existing Nutmeg customers can refer a friend or family member and they will not be liable for management fees for the first six months.

A £100 gift voucher bonus will be offered to the referrer for new clients opening an ISA, pension, or general investment profile. A £50 reward is available for customers registering for a LISA or Junior ISA.

Always check the terms and conditions before signing up for financial incentives.

Safety & Security

Our experts are comfortable that Nutmeg complies with the highest security standards. The website protects transactions using TLS encryption and alerts will be generated if a login attempt is made from an unrecognised IP address.

Customers can also add multi-factor and 2-factor authentication (2FA) for additional account login protection. Customers using the Nutmeg mobile application must login with their registered email address and password. They will then be asked to set a 4-digit code and given the option to add biometric facial recognition.

In addition, the Nutmail secure messaging service is designed for sharing sensitive data, such as financial statements and portfolio performance reviews.

Nutmeg Verdict

Nutmeg is a solid wealth management provider for UK residents. A choice of financial products and investment styles make it a fully flexible solution, and ideal if you want a hands-off approach to making your money work harder. The only major drawback is that the fees are higher than some competitors.

FAQs

What Is Nutmeg Investment?

Nutmeg is an online wealth management provider based in London, UK. The firm offers several investment solutions including pension plans, ISAs, and general savings accounts. Customers can select from four investment styles, from fully managed accounts to portfolios designed with a focus on ESG criteria.

Is Nutmeg A Good Investment Firm?

Our experts were impressed with the services offered by Nutmeg. Customers benefit from a wealth of financial resources and guidance from a team of financial managers. Investment portfolios are designed around risk appetite and financial goals, and are tailored to the customer’s needs. On the downside, fees are higher than some alternatives, including Moneyfarm.

Does Nutmeg Have A Minimum Investment?

Yes, minimum investments apply for Nutmeg accounts. The highest minimums are with the standard ISA, pension, and general investment accounts at £500. Lifetime ISAs and Junior ISAs require a minimum investment of £100.

What Financial Products Does Nutmeg Offer?

Nutmeg offers several financial products including personal pensions, junior ISAs, stocks and shares ISAs, lifetime ISAs, and general investment savings accounts. Customers can choose how their funds are invested, through a range of investment styles and ETFs.

Is Nutmeg Legit Or A Scam?

Nutmeg is a legitimate company regulated by the Financial Conduct Authority (FCA). The FCA oversees all investment firms in the UK and enforces strict standards to protect customers. This includes separated client accounts and compensation up to £85,000 in the case of business insolvency. Overall, our team are confident that Nutmeg is not a scam.

Top 3 Alternatives to Nutmeg

Compare Nutmeg with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Nutmeg Comparison Table

| Nutmeg | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.3 | 4.7 | 4.3 | 4.5 |

| Markets | ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | £100 | $0 | $0 | $100 |

| Minimum Trade | £100 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 4 | 6 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Nutmeg and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Nutmeg | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Nutmeg vs Other Brokers

Compare Nutmeg with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Nutmeg yet, will you be the first to help fellow traders decide if they should trade with Nutmeg or not?