CFD Trading In Nepal

With the financial markets opening up globally, Nepali traders are investigating contracts for difference (CFDs) as a flexible way to speculate on everything from Nepalese stocks and commodities to currencies.

This beginner’s guide walks you through the essentials of CFD trading in Nepal, from understanding how it works to navigating local regulations. We also take you through a CFD trade on the NEPSE30 index.

Quick Introduction

- CFDs are derivatives, so you’re trading on the price movements of an asset without actually owning it. This means you don’t have to worry about storing or handling the asset.

- Leverage allows you to control a much larger position with fewer Nepalese rupees, magnifying both your profits and losses, necessitating strict risk management.

- Unlike traditional investments, you’re not just hoping for prices to rise. With CFDs, you can “go long” (bet on price increases) or “go short” (bet on price decreases).

- You can tap into various global markets, from stocks and forex to commodities and indices, all from Nepal. This is fantastic if you want to explore opportunities outside the local market.

Best CFD Brokers In Nepal

Through our firsthand tests, we’ve identified that these 4 CFD providers are the best for active traders in Nepal:

How Does CFD Trading Work?

CFD trading lets Nepalese investors trade global markets without incurring the extra expense and administration needed to own the actual assets.

Leverage is a valuable and potent tool that, when used carefully, is an attractive element of CFD trading in Nepal. You get to control and open more significant positions but only commit a fraction of the total value (or margin) required to buy, for example, an equivalent number of shares listed on Nepal’s Stock Exchange.

Here, we’ll look at trading the Nepal stock market index, the NEPSE30 index, with a CFD to show you the opportunities and risks that leverage brings.

If you believe the NEPSE30 will rise, you’d consider buying a CFD position in the index. If each contract is valued at NPR 2,700, and your broker requires a 30% margin, then to take a position on 100 CFD contracts, you’d need a margin of Nepalese rupee NPR 81,000 (2,700 per contract x 100 contracts x 30%).

If the NEPSE30 rises to 2,800, the price increase will yield NPR 100 per contract. By closing your position, you would bank a total profit of NPR 10,000 (100 contracts x NPR 100), excluding broker fees. But, if the index falls to 2,600, you will lose NPR 10,000.

This illustrates the inherent risks of CFD trading; although you control increased size using leverage, both the gains and losses are amplified.

Understanding how margin and leverage work is imperative to your potential success. If you are new to CFD trading, consider opening a demo trading account.Virtually every broker offers them free of charge, and they’re a fantastic introduction to CFD trading. You can practice new strategies, experiment with indicators and build confidence before risking real rupees.

What Can I Trade?

Trading CFDs offers many opportunities in various financial markets worldwide and in Nepal:

- Stock CFDs – You can trade some of the most active individual and high-value Nepalese stocks listed on Nepal’s Stock Exchange, such as SMB and GLBSL. Or you could consider trading stocks from US, European, Asian and other global markets.

- Index CFDs – The NEPSE30 can be traded as a CFD. Some CFD traders prefer trading global market indices to capitalize on a stock exchange’s overall performance rather than trade (or invest in) individual stocks. You might also consider trading global index CFDs like the Dow Jones and S&P 500. These indices have high liquidity and trading volume, and are typically available to trade 24-5.

- Forex CFDs – The Nepalese rupee (NPR) is a currency traded in the foreign exchange market. A popular NPR currency pair is the EUR/NPR, which may provide opportunities for short-term currency traders interested in trading NPR. However, it’s important to note that the spreads are considerably higher than those for major USD and EUR pairs, potentially impacting the profitability of strategies.

- Commodity CFDs – Critical global commodities such as precious metals like gold and silver and crude oil can be traded as CFDs. Agricultural products like fertiliser are vital to Nepal’s economy and can also sometimes be traded as CFDs, allowing traders to speculate on price movements often linked to macroeconomic events.

- Crypto CFDs – The curiosity surrounding trading digital assets has grabbed the attention of Nepal traders. You can trade cryptocurrency CFDs like Bitcoin and Ethereum for quick access to the volatile and high-risk world of crypto.

The availability of assets to trade depends on your CFD broker. The Nepalese stock market is well-governed and reputable. However, the liquidity and trading volume are significantly smaller than those of the European and US markets, resulting in higher fees.So, do your homework to ensure any opportunity that flags up represents good value once you consider the costs and spreads.

Is CFD Trading Legal In Nepal?

The Nepal Rastra Bank (NRB) oversees the country’s financial and foreign exchange policies but has not issued formal guidelines regarding the legality of CFD trading.

This absence of regulation doesn’t explicitly make CFD trading illegal. Still, it does mean that traders in Nepal are operating without the formal protections or oversight that might be available in countries with established regulations.

Foreign Exchange And Outward Investment Restrictions

One of Nepal’s biggest factors affecting CFD trading legality is the country’s strict foreign exchange control.

The NRB has stringent regulations on the outflow of capital to manage foreign exchange reserves, which may impact Nepali citizens’ ability to transfer funds to foreign CFD platforms.

While it is technically possible for Nepali traders to use international platforms, moving money in and out of Nepal for trading can be complex and might conflict with foreign exchange restrictions.

Access To International CFD Platforms

Many Nepali traders bypass the lack of local CFD trading platforms by opening accounts with internationally regulated brokers, usually based in countries where CFD trading is legal and regulated, such as the UK, Australia, or Cyprus.

These brokers often offer accounts to international clients, including those from Nepal, allowing them to participate in CFD trading.

However, using these platforms does come with risks, as Nepal’s regulatory bodies don’t provide recourse for disputes or issues involving foreign brokers.

Potential Legal Risks And Grey Areas

Given the regulatory ambiguity, CFD trading is effectively in Nepal’s “grey” legal zone. Traders aren’t explicitly barred from trading CFDs but are not fully protected by Nepalese financial laws.

This can present some legal risks, especially if authorities decide to crack down on foreign exchange activities related to trading or tighten the restrictions on foreign investment outflows.

Any changes in regulation or enforcement might affect traders’ ability to withdraw profits or even access CFD platforms.

Is CFD Trading Taxed In Nepal?

Generally, any income earned by Nepali citizens, whether from local or foreign sources, can be subject to income tax.

Although CFD trading profits aren’t directly addressed in Nepal’s tax laws, they could still be classified as personal income and, therefore, subject to income tax.

Capital Gains Tax (CGT)

Nepal does have capital gains tax, particularly on real estate and certain investments like stocks traded on the Nepal Stock Exchange.

However, the CGT guidelines don’t currently extend to CFDs, as they are a derivative product rather than an ownership-based investment.

So, while there is no formal CGT on CFD gains, it’s still best to consult a tax professional to verify reporting requirements.

Foreign Income And Exchange Regulations

Profits from international CFD trading platforms may be considered foreign income, especially if the funds are outside Nepal.

The Nepal Rastra Bank (NRB) has strict foreign exchange regulations, which can complicate repatriating foreign earnings to Nepal.

Traders may need to clarify with Nepalese tax authorities or a financial expert whether these gains are subject to tax when brought back into the country.

Record-Keeping And Reporting Requirements

Since CFD trading falls in a regulatory grey area in Nepal, tax authorities might need a specific framework to track or assess CFD gains.

However, it’s still wise for traders to maintain records of all transactions, including deposits, withdrawals, and profit statements from international platforms, in case they are required for tax reporting.

An Example Trade

If I’m looking for a CFD trading example in a relatively unknown market like Nepal, my first port of call is market indices.

Why? Because they tend to have more liquidity and volume than, for example, trading a random and unfamiliar stock that my stock screener has alerted me to as an opportunity.

Also, an index is often a barometer of a country’s economy’s prevailing and underlying conditions. Therefore, you can apply a similar fundamental analysis to an index, as you would trading currency pairs, which I’ve done for about 20 years.

You can assess data on your economic calendar if you filter the particular country, such as government debt, inflation, GDP growth, unemployment, interest rates, the performance of major industries, etc.

For this example, I decided to trade the NEPSE30, and the textbook example I’m about to explain illustrated my faith in trading indices over and above individual stocks in an unfamiliar market.

Technical Analysis

If I’m trying to spot an opportunity to day trade a market index using technical analysis, I don’t have much time to decide. I have to be able to look at a chart, perform rapid analysis, and decide whether to get in or out, go long or short.

So, to make sure I can make quick decisions in any timeframe, I limit my use of technical indicators (TIs) to the minimum.

For awareness, there are four main groups of TIs: momentum, trend, volatility and volume, so although you could, in theory, use one from each group, that can often be overkill as some overlap and duplicate information and feedback.

Some of the most trusted and popular indicators are:

- Bollinger Bands

- Relative Strength Index (RSI)

- Exponential Moving Average (EMA)

- Moving Average Convergence Divergence (MACD)

- Parabolic SAR

- Pivot Points

Can you imagine the confusion if you applied each one of these indicators to your charts despite their credibility?

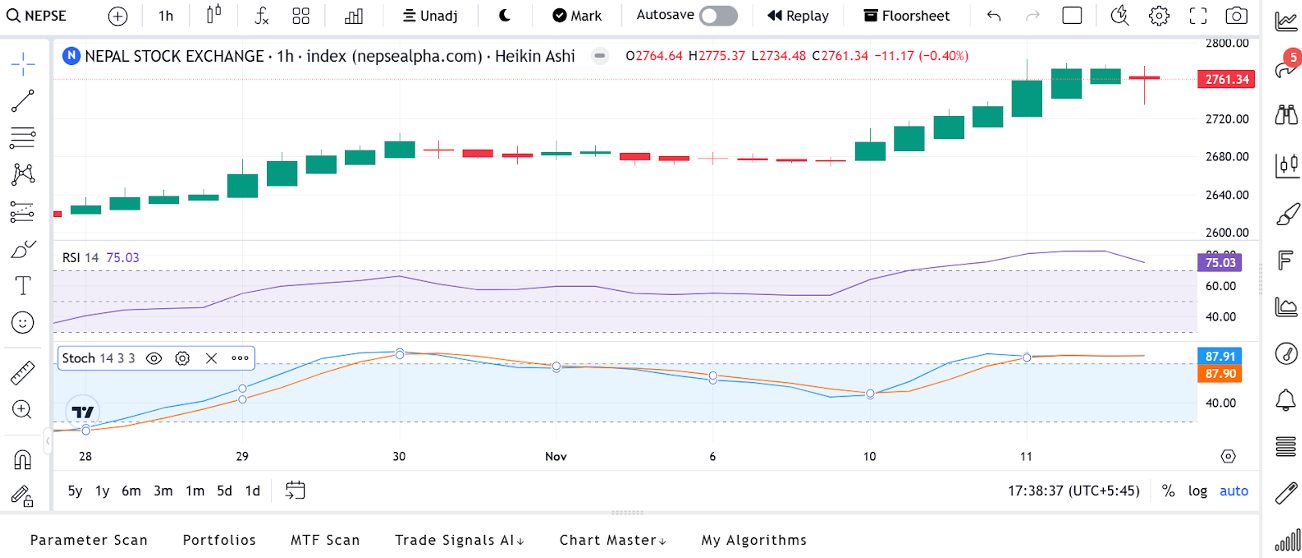

In this instance, I decided to apply the RSI left on its standard setting of 14 because it’s excellent at pinpointing potential oversold and overbought conditions and can exhibit volatility/volume values.

I also used the stochastic oscillator for the 1HR time frame because it can provide a signal to enter, exit, and manage live trades. On faster-moving markets and lower time frames (like the 1HR), I’ve discovered that settings of 14,3,3 work well.

1HR Timeframe

The below 1HR chart shows how I put the indicators to good use. But first, let’s note the three clear defining trends on the chart: from left to right, bullish, ranging and bullish. The Heikin Ashi candlestick formations quickly identify the price action.

In simple terms, if you’re struggling with basic candlestick formations and trying to get your head around concepts like bullish and bearish engulfing, then Heikin Ashi helps because it simplifies the process.

You’re looking for solid candles, minor wicks/shadows, and obvious turning points like hammers and dojis.

The chart shows that the initial bullishness was replaced by a period of ranging conditions. However, during the ranging period, the RSI wasn’t in the overbought zone of 80+ and as volume and volatility reduced, the RSI failed to breach the 50 median level in a downtrend.

This encouraged me to look out for a potential reemergence of bullish conditions. Once the stoch lines crossed, the RSI began to trend upwards, and the HA candles became bullish I entered.

I didn’t enter until the first 1HR candle had formed and waited until the second candle in the eventual three-soldier pattern began to form.

Execution

I was filled at 2,712 and placed my stop-loss order at 2,700 (the recent low). Once price reached 2,745, my stop-loss order was moved to 2,730. I was then in profit, whatever the trade outcome.

I used a CFD order to trade this opportunity. I risked 1% of my account and needed 30% margin to risk the equivalent of 100 contracts priced at 2,712 each.

I closed on an EOD (end-of-day) basis when the market closed, which, combined with the emergence of a doji candle indicating indecision and the RSI breaching the overbought zone, supported my decision.

Bottom Line

In a rapidly evolving financial landscape, CFD trading offers Nepali traders an exciting gateway to global markets, bringing unique opportunities and flexibility.

While there are some regulatory grey areas, the benefits of CFDs, from leveraging smaller investments to trading in diverse markets, make them a compelling choice for those looking to expand their portfolio and explore new strategies.

With the proper knowledge, a trusted platform, and an understanding of the risks involved, CFD trading can be a powerful tool in Nepal’s growing trading community. Still, never risk more than you can afford to lose.

To get started, make use of DayTrading.com’s pick of the top CFD trading platforms.

Recommended Reading

Article Sources

- Nepalese Stocks - Nepal Stock Exchange

- NEPSE 30 Index - Nepal Stock Exchange

- Nepal Rupee (NPR) - Trading Economics

- EUR/NPR - TradingView

- Nepal Rastra Bank (NRB)

- Nepal Inland Revenue

- Price Action - Wikipedia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com