Forex Trading in Norway

Foreign exchange (forex) trading is increasingly accessible to retail traders worldwide. This shift, driven mainly by advanced technological infrastructure, has sparked significant interest in Norway, mirroring European trends.

This guide explores the unique characteristics of the Norwegian krone (NOK), the tax and regulatory environment, the best times to trade, and strategy considerations with an example trade involving NOK.

Quick Introduction

- The Norwegian krone is influenced heavily by the country’s oil and gas exports. Currency pairs such as EUR/NOK and USD/NOK are popular among Norway’s traders, offering unique opportunities to profit from the NOK’s volatility and economic indicators.

- The Financial Supervisory Authority of Norway (Finanstilsynet) ensures the integrity and stability of the financial markets. Its regulatory oversight, combined with the availability of sophisticated trading tools, instils confidence in forex traders, both novice and experienced.

- Profits from forex trading in Norway are generally considered capital income and taxed at 22% with payments made to the Norwegian Tax Administration (Skatteetaten).

Top 4 Forex Brokers in Norway

Our tests point to these 4 platforms as the best for forex traders in Norway:

-

1

XM

XM -

2

Skilling56% of retail investor accounts lose money when trading CFDs with this provider.

Skilling56% of retail investor accounts lose money when trading CFDs with this provider. -

3

Vantage

Vantage -

4

AvaTrade

AvaTrade

How Does Forex Trading in Norway Work?

For many Norwegians, forex trading represents an opportunity to diversify investment portfolios. Individuals can hedge against economic uncertainties and explore new income streams by trading currencies online.

Norway’s economy is characterised by high wealth levels, low unemployment, and a well-managed fiscal policy underpinned by the Norwegian Government Pension Fund Global (the Oil Fund). This stability makes NOK attractive for investors seeking exposure to a robust economy.

NOK currency pairs are some of Norway’s most popular forex trading instruments. While not a major global currency, the NOK is classified as a commodity currency because of Norway’s substantial oil and gas exports. The NOK is sensitive to fluctuations in global oil prices, providing traders with opportunities.

NOK also offers diversification benefits. Its performance can differ from major currencies like the USD or EUR due to its commodity-linked nature. This makes it a practical component in a diversified forex portfolio.

Popular NOK currency pairs include:

- EUR/NOK (Euro/Norwegian Krone): EUR/NOK is the most actively traded NOK pair. The Eurozone is Norway’s largest trading partner, making this pair highly liquid. ECB monetary policy, Eurozone economic data, and European geopolitical events impact this pair.

- USD/NOK (US Dollar/Norwegian Krone): Given the USD’s role in global commodity pricing, oil price movements heavily influence the USD/NOK pair. US economic data, Federal Reserve policies, and global risk sentiment significantly affect this pair.

- NOK/SEK (Norwegian Krone/Swedish Krona): The NOK/SEK pair reflects the close economic ties between Norway and Sweden. It is influenced by both countries’ relative economic performance and monetary policies. Factors such as Scandinavian economic integration and regional political stability can impact this pair.

- GBP/NOK (British Pound/Norwegian Krone): The GBP/NOK pair is influenced by economic conditions and trade relations between the UK and Norway. This currency pair can affect post-Brexit trade agreements and economic policies.

Is Forex Trading Legal in Norway?

Yes, forex trading is legal in Norway.

Finanstilsynet supervises all financial markets in Norway, including the forex market. It ensures that financial institutions and brokers comply with national laws and regulations.

The authority conducts regular audits and inspections of forex brokers to ensure they adhere to regulatory standards and protect retail traders from potential fraud and malpractice.

Finanstilsynet mandates that forex brokers implement measures to protect retail traders’ funds. These include segregating client funds and reducing the risk of loss in broker insolvency.

Forex brokers must also provide clear and comprehensive information about their services, fees, and the risks associated with forex trading. This transparency helps Norwegian traders make informed decisions.

To protect retail traders from excessive risk, Finanstilsynet imposes limits on the leverage that brokers can offer. Brokers must implement robust risk management systems and provide tools to help traders manage their exposure effectively.

Brokers must also categorize clients based on their experience, knowledge, and financial situation. This ensures retail traders are offered products and services appropriate to their risk profile.

Is Forex Trading Taxed in Norway?

Forex traders may need to pay tax on any gains they make in Norway. These should be reported to the Norwegian Tax Administration (Skatteetaten).

Norway’s tax year follows the calendar year, running from 1 January to 31 December, and tax returns must be completed and submitted to Skatteetaten by 30 April the following year.

Profits from forex trading are generally considered capital income and are subject to a 22% rate, regardless of the amount. However, expenses like brokerage fees and other trading costs can be deducted. Consult a tax advisor for specific guidance.

When Is the Best Time to Trade Forex?

Although forex can be traded around the clock, if you’re interested in trading currency pairs like the EUR/NOK, USD/NOK, NOK/SEK, and GBP/NOK, you need to think about when the Norwegian krone and other currencies involved are most actively traded.

- EUR/NOK and GBP/NOK: The best time to trade EUR/NOK and GBP/NOK is arguably during the European trading hours, specifically between 9 AM and 5 PM Norwegian Time. The European markets, including Norway, the Eurozone, and the UK, are open during this period. This overlap ensures higher liquidity and potentially tighter spreads. Key economic data from both the Eurozone (for EUR/NOK) and the UK (for GBP/NOK) are often released during these hours, which can create significant trading opportunities.

- USD/NOK: The best time to trade USD/NOK is arguably during the overlap between the European and US trading sessions, specifically from 2 PM to 5 PM Norwegian Time. The overlap between the London and New York sessions provides high liquidity and increased volatility, which is ideal for trading USD/NOK. Important US economic releases, such as GDP, employment reports, and Federal Reserve announcements, generally take place during the New York session and can significantly impact USD/NOK.

- NOK/SEK: The best time to trade NOK/SEK is arguably during the Scandinavian and broader European trading hours, specifically between 9 AM and 5 PM Norwegian Time. Both Norway and Sweden are in the same time zone, and their financial markets are open concurrently. This overlap ensures higher liquidity for NOK/SEK trades. Key economic data from Norway and Sweden are released during these hours, potentially increasing maker moves.

A Forex Trade in Action

We’ve discussed NOK pairs’ appeal for Norwegian retail FX traders and highlighted the strong positive correlation between the global oil price and NOK as a commodity currency; if WTI rises, then NOK could, too.

So, let’s illustrate this correlation and point out the opportunity this phenomenon could offer a trader like me…

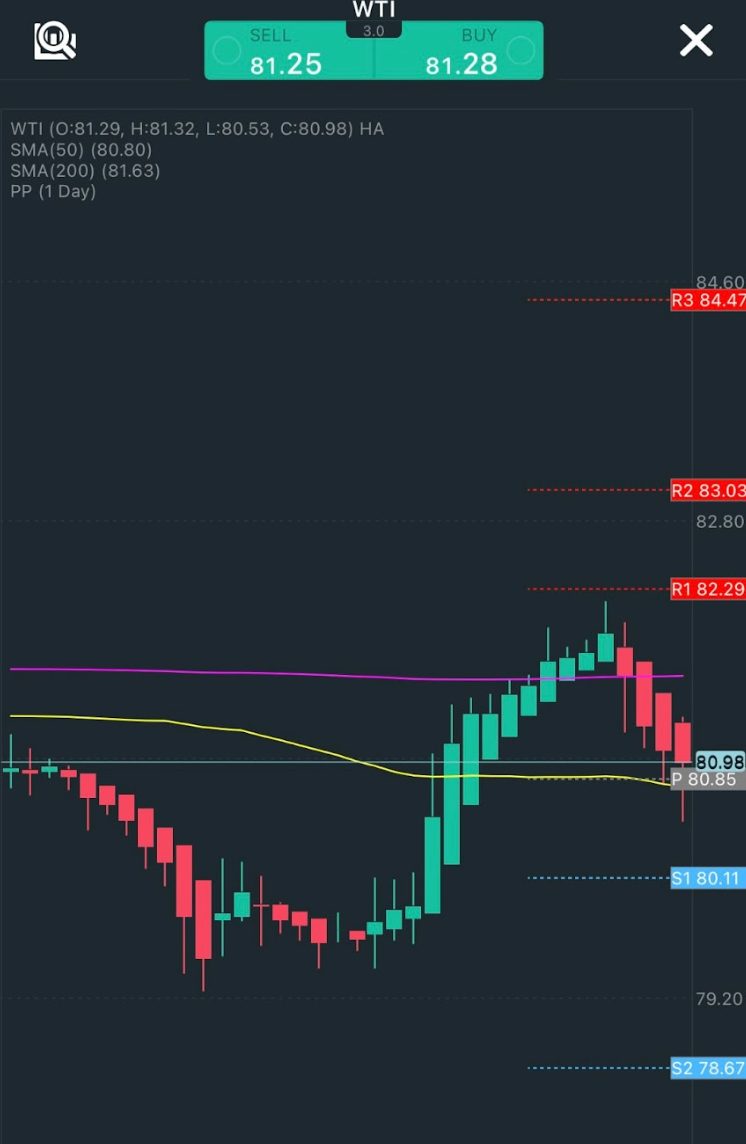

For this comparison, which highlights the correlation between WTI (oil) and USD/NOK, I’m concentrating on the Heikin Ashi 2-hr candles between June 15th and 18th. I’ll use candlestick formations only to determine price action.

As evidenced by the WTI sell-off on the 18th, the logical choice would be to only take a USD/NOK trade in the opposite direction of WTI. For example, if WTI falls, then the value of USD/NOK is likely to rise based on the historical precedents set by the strong correlation between WTI and NOK as a commodity currency.

Stretching my theory further, if I trade USD/NOK or EUR/NOK, it might be worth waiting until the WTI’s direction confirms my decision.

As we know, trading is underpinned by probabilities and risk management, so any indicator that helps me determine direction, and in this instance, WTI acts as a confirmation indicator, could help improve my positive expectancy and limit potential losses to a minimum.

In short, I should stay out of the market until both instruments (WTI and USD/NOK) move in opposite directions.

However, technical analysis correlations are not set in stone, and markets are volatile; therefore, individual traders should also pay attention to the fundamentals: Why is WTI rising or falling? Has Norway’s central bank or government stats department published data or advice regarding its fiscal or monetary policy? Perhaps OPEC has published a press release about supply.

Bottom Line

Norway’s retail FX market has experienced growth similar to those of other advanced European countries over recent years. The population mainly trades the major pairs or minor pairs containing NOK.

With a combination of technical and fundamental analysis and a trading strategy underpinned by risk awareness and tight money management, Norway-based traders can enjoy the same access and competitive spreads as their European counterparts.

To get started, open an account with a top forex broker.

Recommended Reading

Article Sources

- Financial Supervisory Authority of Norway (Finanstilsynet)

- Norwegian Tax Administration (Skatteetaten)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com