CFD Trading in Norway

Contract for difference (CFD) trading became popular in Europe in the 2000s, and Norway, along with other European countries, saw rising adoption as a way to trade rising and falling markets with modest investments.

Norway’s robust economy, characterized by a high standard of living and a strong GDP per capita, presents an attractive environment for CFD traders. The country’s position as a European leader in energy, maritime, and technology sectors offers diverse opportunities.

Are you interested in CFD trading in Norway? Let’s begin with this beginner’s guide.

Quick Introduction

- Unlike stocks, representing ownership in a Norwegian company like Equinor, CFDs allow you to trade on price fluctuations without owning the underlying asset.

- Unlike traditional investing, CFDs offer leverage. This means you can trade more prominent positions with a smaller investment. However, this amplifies both potential profits and losses so risk management is vital.

- Norway boasts a well-regulated environment overseen by the Financial Supervisory Authority of Norway (Finanstilsynet), adhering to high standards, notably leverage limits of 1:30 to protect retail investors from excessive losses dealing in high-risk CFDs.

Best CFD Brokers in Norway

Through firsthand tests, we've identified these 4 platforms as the top providers for CFD traders in Norway:

How Does CFD Trading Work?

Unlike traditional investments in stocks or bonds, CFDs are financial contracts that allow you to profit from price changes without owning the underlying asset. Instead, you agree to exchange the difference in price between the contract’s start and end.

This active trading style provides access to a wide range of Norweigan, European and global markets, including:

- Norwegian stocks on the Oslo Børs, stocks listed on the Euronext, and stocks listed on the US NASDAQ

- Norwegian currency pairs like the USD/NOK and EUR/NOK and majors like EUR/USD and USD/JPY

- Commodities like crude oil and natural gas, given Norway supplies a significant portion of both to Europe

- Index CFDs like Norway’s Oslo OBX or the US’s S&P 500

Is CFD Trading Legal In Norway?

CFD trading is legal in Norway and regulated by the Financial Supervisory Authority of Norway.

However, as part of the European Economic Area (EEA), Norway adheres to regulations from the European Securities and Markets Authority (ESMA) restrictions, which include leverage limits and investor protections to ensure responsible trading practices.

These regulations aim to protect retail investors from excessive losses while ensuring transparency and accountability from CFD providers:

- For retail traders, leverage is limited to 1:30 for major currency pairs, 1:20 for non-major currency pairs, gold, and major indices, 1:10 for commodities other than gold and non-major equity indices, 1:5 for individual stocks, and 1:2 for cryptocurrencies.

- Firms must provide negative balance protection, ensuring that you cannot lose more Norwegian Krone than you have deposited in your accounts.

- Brokers are required to implement a margin close-out rule on a per-account basis. This means positions are automatically closed when your margin falls to 50% of the required minimum.

- Providers are prohibited from offering bonuses or other incentives that encourage high-risk CFD trading, like deposit bonuses for opening new accounts.

- Brokers must display clear and standardized warnings about the high risk of losses in CFD trading. These warnings often include the percentage of retail investors who lose money trading CFDs with the broker (usually found at the top or bottom of a broker’s site).

Is CFD Trading Taxed In Norway?

In Norway, profits derived from CFD trading are typically classified as capital gains and are subject to taxation. The capital gains tax rate for individuals stands at 22%.

You can offset losses incurred from CFD trading against gains, reducing your taxable income.

It’s important to note that frequent CFD trading activity could lead the Norwegian Tax Administration to reclassify you as a professional trader.

In such cases, your trading income could be treated as regular business income, potentially subjecting it to different tax rates and regulations.

To ensure accurate tax reporting and compliance, maintain meticulous records of all your CFD transactions, including the underlying asset, trade size, entry and exit prices, and associated costs.I also recommend consulting a professional familiar with the latest tax regulations in Norway and how they apply to CFD trading activities.

A Trade In Action

To explain how CFD trading in Norway really walks, let’s run through a detailed trade from start to finish.

Let’s explore a hypothetical scenario where I day trade Equinor, a Norwegian state-owned multinational energy company headquartered in Stavanger, Norway.

Event Background

I closely followed the Norwegian stock market and noticed a significant shift in oil prices due to an unexpected decision by OPEC. The organization had agreed to increase production quotas, leading to an oversupply in the global oil market.

Given Norway’s heavy reliance on oil exports, this news shocked the stock market, mainly affecting companies listed on the Oslo Børs.

I anticipated that the share prices of major energy firms, such as Equinor, would react negatively to this event.

Believing this downturn would be short-lived due to strong underlying fundamentals, I decided to capitalize on the market volatility by placing a CFD trade to short Equinor stock for a quick intraday profit.

Trade Entry & Trade Exit

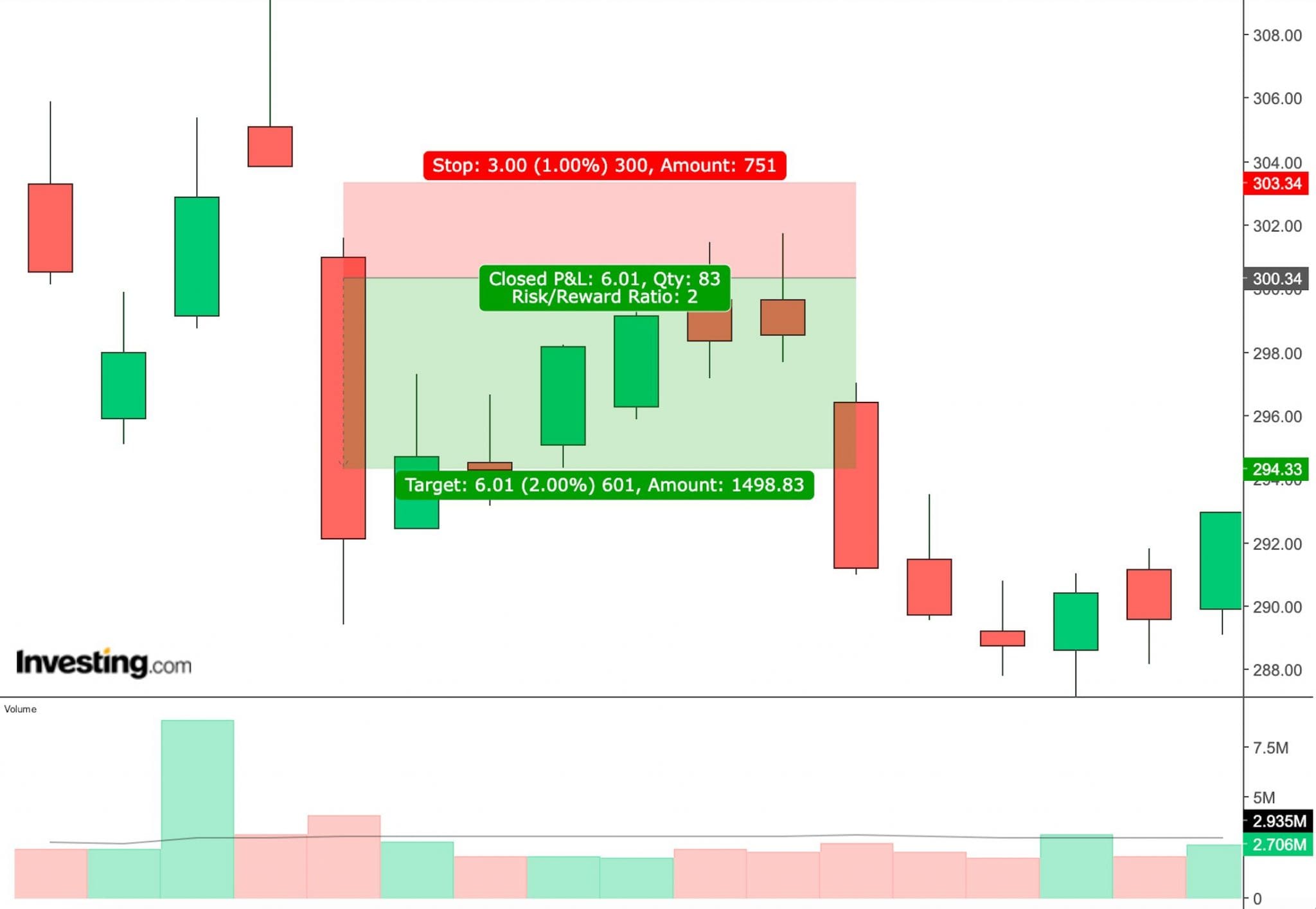

Equinor’s stock was trading at NOK 300 per share at the market’s opening. I decided to open a short CFD position on 100 shares, speculating that the price would decline throughout the day.

Since CFDs allow for leveraged trading, I utilized 1:5 leverage, which meant I only needed to deposit 20% of the trade value as margin.

The total value of the trade for 100 shares was NOK 30,000, but thanks to leverage, I only had to put down NOK 6,000 in actual capital, giving me control over a much larger position with a small upfront investment.

As the day progressed, my expectations proved correct. Equinor’s stock price dropped to NOK 294 due to the continued downward pressure from falling oil prices.

I decided to close my position, locking in a profit from the NOK 6 per share decline. By shorting the stock at NOK 300 and selling at NOK 294, the total value of the shares had fallen from NOK 30,000 to NOK 29,400, resulting in a NOK 600 profit.

This trade highlights the flexibility of CFD trading, where leverage allowed me to amplify profits on small price movements.

However, it also serves as a reminder that leveraged trading carries significant risks, and careful risk management is crucial to avoid heavy losses if the market moves in the wrong direction.

I used a 1:2 risk/reward ratio in this trade example, meaning I risked a NOK 3 price move in the hope of capitalizing on a NOK 6 price move.

Bottom Line

CFDs provide a flexible way to trade on price movements of various financial assets, including stocks, indices, commodities, and currencies, without owning the underlying asset. In Norway, CFD trading is regulated, ensuring a secure environment for retail traders.

CFDs carry significant risks, however, including market volatility and leverage. Understanding these risks and complying with regulations is essential for successful CFD trading in Norway. And never risk more Krone than you can afford to lose.

To start trading CFDs, visit DayTrading.com’s selection of the top CFD day trading platforms.

Recommended Reading

Article Sources

- Norway GDP - International Monetary Fund

- Financial Supervisory Authority of Norway (Finanstilsynet)

- Euronext Oslo Børs

- European Securities and Markets Authority (ESMA)

- Norway Capital Gains Tax - PWC

- Norwegian Tax Administration

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com