Forex Trading in the Netherlands

The Netherlands is one of Europe’s largest currency trading venues. According to the Bank for International Settlements’ (BIS) triennial report, the Dutch forex market is the continent’s seventh biggest.

This guide discusses how online traders can deal in the Netherlands’ currency market. It discusses how the market is regulated and taxed, reveals the best times to trade, and runs through how a forex day trade could work in practice.

Quick Introduction

- The Netherlands is a major financial hub thanks to its well-regulated trading environment and economic standing.

- Pairings involving the euro (like the EUR/USD) are traded in high volumes in Amsterdam.

- Forex prices can be especially volatile when the European and North American trading sessions overlap.

- Currency trading in the Netherlands follows rules established by the Authority for the Financial Markets (AFM) and the European Securities and Markets Authority (ESMA).

Top 4 Forex Brokers in the Netherlands

Following years of testing, these 4 platforms emerge as the best for forex traders in the Netherlands:

More Forex Trading Platforms in The Netherlands

How Does Forex Trading In The Netherlands Work?

Forex dealing in the Netherlands has rebounded strongly following a steady decline in the mid-to-late 2010s. According to the BIS, the average daily turnover of currency transactions rose 16% between 2019 and 2022, to $74 billion.

Today the Netherlands is one of Europe’s top five forex trading destinations. It’s a position that reflects the country’s large economy – it is ranked seventh in Europe by GDP – and the major role it plays in international trade. Rotterdam is the continent’s busiest port by some distance.

Forex trading volumes have also spiked as financial services firms have relocated to financial hubs like Amsterdam following Brexit.

Currency trading is dominated by pairings that involve the euro. This is the official currency of the Netherlands, along with the 19 other nations that make up the eurozone.

In fact, the euro is the second-most traded currency globally, behind the US dollar. The EUR/USD major pairing accounts for almost a quarter of all forex trades, reflecting the economic importance of both regions.

The euro is also traded in large volumes in so-called minor pairings against the British pound (EUR/GBP), Japanese yen (EUR/JPY) and Swiss franc (EUR/CHF).

Is Forex Trading Legal In The Netherlands?

Currency trading in the Netherlands is legal and regulated by the Authority for the Financial Markets (Autoriteit Financile Markten, or AFM). The body’s aim is to ensure that financial markets operate in a fair and transparent way, and to protect investors from fraudulent activities.

All forex brokers in the Netherlands should be registered with the AFM to do business in the country. A list of authorized companies can be found here on the organization’s website.

As a European Union member, the Netherlands also adheres to regulations laid down by the European Securities and Markets Authority (ESMA). In 2018 the authority established the Markets in Financial Instruments Directive II (MiFID II), a regulatory framework that harmonises financial services industry rules across the 27 EU member states.

MiFID rules also place restrictions on forex traders who wish to trade currencies using derivatives from CFD brokers in the Netherlands. Rules include limits on leverage (or borrowed funds), and negative balance protection, which stops traders from losing more money than they have in their deposit accounts.

Is Forex Trading Taxed In The Netherlands?

Any profits made from trading currencies may be subject to tax, typically capital gains tax. They must be reported to the Dutch Tax and Customs Administration (Belastingdienst).

Income in the Netherlands is split into three different categories for tax purposes. Each of these is taxed separately under its own schedule, or ‘box.’ Box 3 – under which earnings from forex trading are declared – applies to taxable income from savings and investments.

Forex traders currently pay 36% tax on their box 3 income. Tax isn’t usually owed by those earning less than €57,000 in a year, though thresholds vary according to an individual’s filing status (i.e. single or couple) and other sources of income.

When Is The Best Time To Trade Forex?

Individuals have the option to day trade currency markets 24 hours a day, five days a week. This is the case wherever one chooses to set up shop.

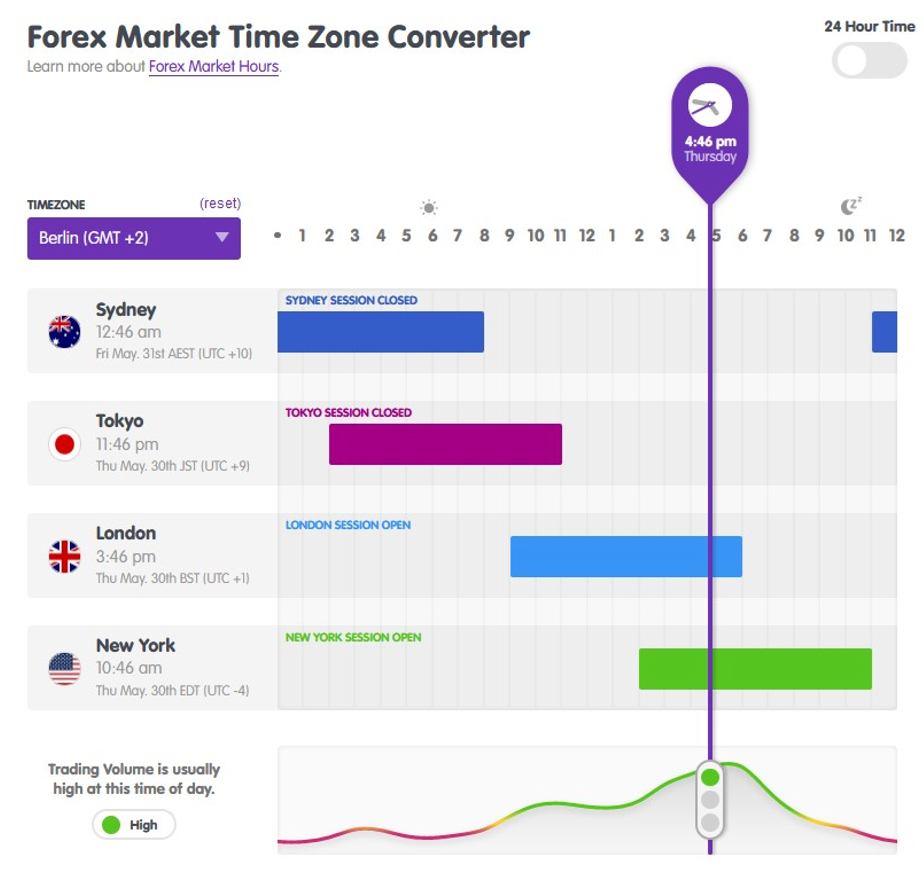

However, there are better times to do business than others, depending on where you are. In the Netherlands, this tends to be between the hours of 2:00pm and 6:00pm Central European Time (CET).

At this point, trading sessions in Europe and the US crossover, leading to a healthy uptick in dealing volumes. With deeper liquidity and the potential for greater volatility, traders can have a better chance to book a profit during these times.

A Forex Trade In Action

Now let’s look at how a currency trade could work in practice. In this example, I’ll be looking to capitalize on forex volatility following major economic news, a common strategy among day traders.

Selecting A Currency Pair

My pairing of choice is the EUR/USD. I’m hoping to capitalize on movements in the euro after the European Central Bank (ECB) – which sets monetary policy across the eurozone – makes its next interest rate announcement.

But why this pairing, you ask? As one of the world’s majors, it enjoys deep levels of liquidity, which in turn allows me to open and close positions more swiftly and easily.

What’s more, the high trading volumes of this particular cross makes for better price discovery. The real-world impact is that the difference between the buy (bid) and sell (ask) prices – known as the spread – tends to be narrower, which in turn can help me reduce trading costs (great for short-term strategies).

Pre-Trade Research

Interest rates are a significant determinant of currency values. So decisions by central banks on whether to raise, hold or lower their benchmarks can significantly move forex pairings (as well as broader financial markets).

Volatility can surge when rate-setters make an unexpected policy decision. This is something that I expect to happen over at the ECB. While the broader market is pricing in a rate freeze, after doing some economic research, I’m tipping the bank to cut rates in response to falling inflation.

This event would likely pull the euro much lower against the dollar.

Before executing the trade, I’ll carry out technical analysis to help me better speculate on where the EUR/USD could head to. Using charts, I’ll try to identify key trends and indicators using tools like support and resistance levels, moving averages, and the Relative Strength Index (RSI).

Executing The Trade

After this step, I’m ready to place the trade. I take a short position, which involves me simultaneously selling the EUR while buying the USD.

The pairing currently stands at 1.0845, which means I can get €1 for $1.0845. To manage risk, I establish a ‘take profit’ order at 1.0795, which closes my position if the cross falls to this level.

I also set up a ‘stop loss’ instruction at 1.0855. This exits the trade and helps me limit losses if the euro instead rises against the buck.

I place my orders at 14:10 CET on the day of the interest rate announcement – five minutes before the ECB puts out its press release – and sit back.

The news is good for me. The bank cuts its benchmark lending rate, pulling the euro lower in the process. Within half an hour the EUR/USD pairing drops to 1.0795, at which point my position is automatically closed and I book a profit of 50 pips.

Bottom Line

The Netherlands boasts a thriving forex market, ranking among Europe’s main destinations for currency trading. Its importance as a financial hub has strengthened even more following the relocation of financial services companies after Brexit.

The Dutch forex market enjoys deep liquidity, especially when trading hours overlap with those in the US. And thanks to tight regulatory frameworks and close supervision by local authorities, traders can confidently go about their business with forex day trading platforms in the Netherlands.

Recommended Reading

Article Sources

- About The AFM - Dutch Authority for the Financial Markets (AFM)

- Register - Dutch Authority for the Financial Markets (AFM)

- Final Report - European Securities and Markets Authority (ESMA)

- Turnover of OTC foreign exchange instruments, by country – Bank for International Settlements (BIS)

- Turnover of OTC foreign exchange instruments – Bank for International Settlements (BIS)

- How is my box 3 income calculated on my provisional assessment 2024? - Tax and Customs Administration (Belastingdienst)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com