Best Day Trading Platforms and Brokers in the Netherlands 2025

To day trade Dutch markets like stocks listed on the Euronext Amsterdam, the AEX Index, or currency pairs containing the euro, you’ll need to register with an online broker.

The Authority for the Financial Markets (AFM) regulates online trading in the Netherlands, though other European-regulated brokers can offer short-term trading products to Dutch investors through the EU’s cross-border initiative. In any case, traders should continue to adhere to their local tax rules.

We’ve ranked the best day trading platforms in the Netherlands following our hands-on assessments. Many of our recommended brokers offer services that will appeal to Dutch traders, including opportunities on financial markets in the Netherlands and across Europe, alongside popular local funding solutions like iDEAL.

Top 6 Platforms For Day Trading In The Netherlands

Following our extensive tests of hundreds of online brokers, these 6 platforms stand out as the best for short-term traders in the Netherlands:

This is why we think these brokers are the best in this category in 2025:

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Best Day Trading Platforms and Brokers in the Netherlands 2025 Comparison

| Broker | EUR Account | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|---|

| Eightcap | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 | ASIC, FCA, CySEC, SCB |

| AvaTrade | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| XM | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 | ASIC, CySEC, DFSA, IFSC |

| Deriv | ✔ | $5 | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | 1:1000 | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| IC Trading | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

| Pepperstone | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- After integrating TradingView and adding MT5 web trader, Deriv now offers a first-class selection of charting tools across desktop, web and mobile devices.

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

Cons

- Although there’s a basic blog, there's little in terms of technical analysis or market reports which could help active traders identify potential opportunities.

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Methodology

To identify the best day trading platforms in the Netherlands, we scoured our directory of 223 online brokers, focused on those that accept Dutch traders, and ranked them by their rating.

Our ratings are derived from over 100 data points and first-hand insights from our broker analysts.

- We confirmed that each broker accepts Dutch traders.

- We verified each broker’s regulatory status and trust score.

- We prioritized brokers with competitive trading fees.

- We favored brokers with a diverse range of markets.

- We focused on brokers with powerful charting platforms.

- We checked the leverage and margin requirements of each broker.

- We ensured each broker offers reliable order execution.

How To Choose A Day Trading Broker In The Netherlands

Based on our years of experience in the day trading industry, there are several factors to consider when choosing a brokerage:

Trust

Choose a secure and regulated broker.

This will ensure that you receive robust safeguards like negative balance protection so you can’t lose more than your balance while using popular short-term products like derivatives from CFD providers in the Netherlands. It also means you should be better protected from trading scams.

The Noord-Holland District Court, for example, sentenced two Dutch nationals to up to 4 years in prison for a large-scale trading scam in which they convinced victims to invest large sums of money on two fake websites. This incident underscores the importance of a trusted and regulated brokerage.

In the Netherlands, the Authority for the Financial Markets (AFM) regulates online trading, although very few day trading brokers hold a license directly with the AFM.

Instead, brokers regulated by other European ‘green-tier’ authorities are permitted to onboard Dutch traders through the EU’s cross-border initiative. If you choose this option, make sure you comply with the AFM’s regulations and tax rules in the Netherlands.

- AvaTrade is a highly trusted brand, operating since 2006 and holding multiple licenses with green-tier authorities, including the Central Bank of Ireland (CBI) which oversees the European branch. The firm also offers negative balance protection and a unique risk management tool, AvaProtect.

Day Trading Fees

Choose a broker with excellent pricing.

This is especially important for fast-paced traders executing frequent transactions per day.

Notably, we assess the broker’s spreads on popular markets, including those in Europe like the EUR/USD, as well as non-trading fees like account funding or inactivity charges.

Our firsthand observations also show that some brokers offer superior services in return for slightly higher fees. For example, getting free access to political updates or economic releases from De Nederlandsche Bank (DNB) may be particularly valuable for Dutch investors.

- Pepperstone continues to offer industry-leading pricing including spreads from 0.0 on EUR/USD and from 0.6 on the AEX Index, plus fee-free account funding. You also get access to a live economic calendar where you can filter events by ‘Netherlands’.

Market Coverage

Choose a broker with a diverse range of day trading markets.

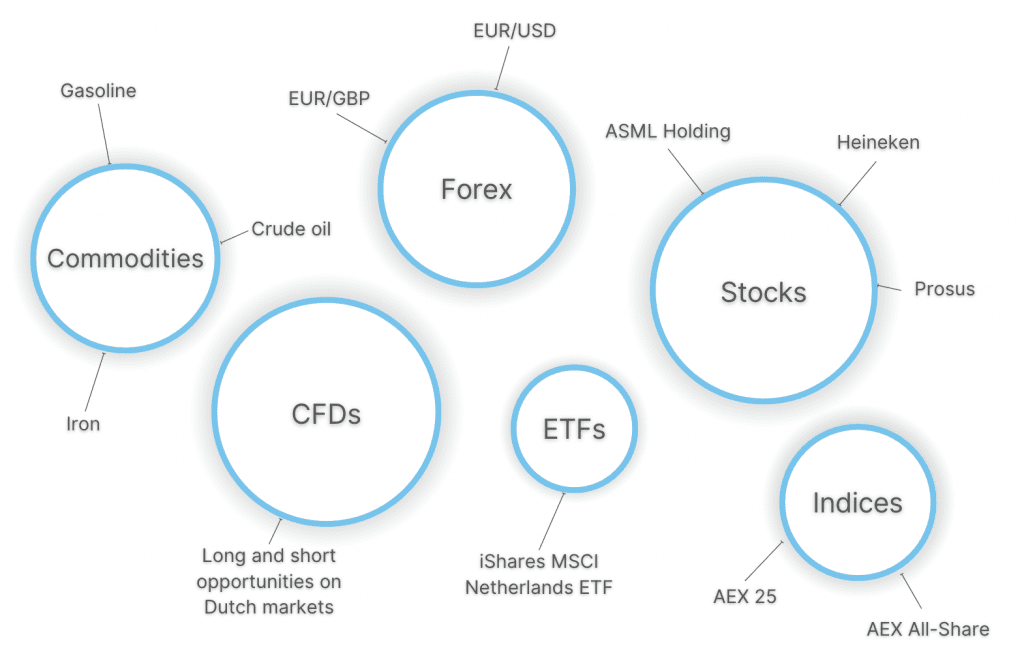

It’s important to select a broker that offers the assets you want to trade. For Dutch traders, these might be popular currency pairs involving the EUR, as well as the AEX Index and stocks listed on the Euronext Amsterdam.

- XTB stands out for its wide range of markets, with over 5600+ instruments, including the Netherlands 25 Index, numerous EUR currency pairs and a superb range of real shares and stock CFDs, including ASML Holding and Heineken.

Platforms & Tools

Choose a broker with reliable charting platforms.

A powerful charting platform will allow you to perform technical analysis – one of the most popular approaches used to identify short-term trading opportunities.

While MetaTrader 4 and MetaTrader 5 remain the most widely offered to retail traders, sleeker alternatives like cTrader and TradingView are rapidly catching up, with a growing number of brokers offering these alternatives.

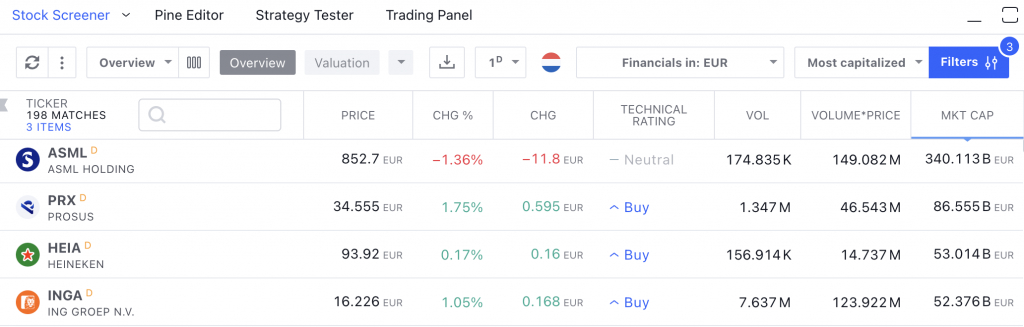

My favorite feature on TradingView is the in-platform stock screener, which makes it a breeze to filter Dutch stocks and view useful data like market cap and buy/sell signals.

The dependability and functionality of day trading apps have also made significant strides in recent years. We’ve used dozens of apps and more than ever they offer a comprehensive mobile trading experience.

- Eightcap offers a range of flexible platforms to suit all needs, including both MetaTrader terminals plus TradingView. With the addition of supplementary tools like Capitalise.ai and the AI-powered economic calendar, the brand offers the full package for short-term traders.

Leverage & Margin

Choose a broker with clear leverage and margin requirements.

You may need leverage if you want to maximize your potential profit, though beginners should be particularly cautious since the risk of losses is also increased.

Leverage allows you to amplify the value of your trade with just a small outlay (margin).

So if I put down €250 for a trade on the Ned 25 Index with a leverage of 1:5, my position would be worth €1,250,

My profits and losses would be multiplied by 5.

- Deriv offers very high leverage up to 1:1000 for experienced traders and multipliers up to 30x for beginners, with all rates provided upfront. The margin calculator is also a really useful feature that allows you to calculate how much you need to open and maintain a position.

Execution Quality

Choose a broker with fast and reliable order execution.

The quality of order execution determines how quickly and efficiently your positions are filled. In our experience, the best brokers for day trading deliver execution speeds of less than 100 milliseconds.

They will help ensure that orders are filled at the requested price, or a better price (positive slippage) and keep latency low, ensuring minimal time delay.

- Skilling boasts incredibly impressive execution speeds of 5 milliseconds, making it a terrific choice for traders using fast-paced strategies like scalping and day trading.

Account Funding

Choose a broker with a minimum deposit that suits your budget.

Most day trading platforms we evaluate offer beginner-friendly minimum investments from €0 to €250.

It’s also worth considering brokers that offer popular payment methods in the Netherlands which can help to minimize transaction costs and reduce processing times while ensuring hassle-free deposits and withdrawals.

According to research by PPRO, the most popular digital payment method in the Netherlands is iDEAL which has a 58% market share, though Klarna and Trustly are also widely used.

- eToro is an excellent choice if you’re looking for accessible accounts and funding options in the Netherlands. The firm offers EUR accounts with a low $100 first deposit for Dutch traders, plus a range of convenient funding methods, including iDEAL.

FAQ

Who Regulates Day Trading Brokers In The Netherlands?

The Authority for the Financial Markets (AFM) is responsible for regulating brokers that offer day trading products in the Netherlands.

That said, Dutch traders can also register with brokers regulated by other European authorities under the EU’s passporting scheme – one of the most prevalent is the Cyprus Securities & Exchange (CySEC). You should still comply with your local regulations and tax rules.

Which Is The Best Broker That Accepts Day Traders From The Netherlands?

Refer to our list of the top day trading brokers in the Netherlands to find one that best suits your needs.

If you’re looking for opportunities in local markets, for example, XTB offers 5600+ instruments including EUR currency pairs and Dutch securities. It’s also got a slick trading app that our experts love using.

Recommended Reading

Article Sources

- Authority for the Financial Markets (AFM)

- Euronext Amsterdam

- De Nederlandsche Bank (DNB)

- Netherlands 25 Index (AEX)

- ASML Holding (ASML) - Euronext

- Heineken (HEIA) - Euronext

- Payment Methods In The Netherlands - PPRO

- Large-Scale Investment Scam - De Rechtspraak

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com