Forex Trading in Nigeria

Nigeria is home to one of Africa’s busiest forex markets. Lagging only South Africa in size, thriving currency trading here reflects the country’s large economy and high demand for overseas currencies to support imports and investments.

The value of the Nigerian naira (NGN) was for years pegged (or fixed) to that of the US dollar. However, in June 2016 the Central Bank of Nigeria (CBN) floated the local currency in a bid to stimulate the economy and build its currency reserves. Its value is now determined by supply and demand forces in the global forex marketplace.

This guide describes how traders can deal currencies online in Nigeria. It runs through the country’s regulatory and tax regime, discusses the best time to trade forex, and reveals how a short-term trade involving the NGN/USD (US dollar) pairing could work.

Quick Introduction

- Nigeria’s large, import-driven economy means that it enjoys a bustling forex market, though the country’s local currency – the naira, or NGN – has fallen sharply in value due to a variety of economic problems.

- While regulated by the Central Bank of Nigeria (CBN) and the Nigerian Securities and Exchange Commission (SEC), forex traders only enjoy limited protections.

- Forex traders in Nigeria typically pay capital gains tax on their profits, at 10%, to the Federal Inland Revenue Service (FIRS).

Top 4 Forex Brokers in Nigeria

Our evaluations show these 4 platforms are the best for forex traders in Nigeria:

See all Forex Brokers in Nigeria

How Does Forex Trading In Nigeria Work?

A large economy, dependence on imports, and a huge oil industry mean Nigeria is one of Africa’s key forex hubs. In fact, trading activity is rising sharply thanks to changing exchange rate policies enacted by the Central Bank of Nigeria (CBN), combined with improving digital infrastructure.

Nigeria’s local currency is the naira (NGN), which is traded in huge volumes against major currencies (like the US dollar, British pound and the euro) alongside regional counters (such as the South African rand and Egyptian pound).

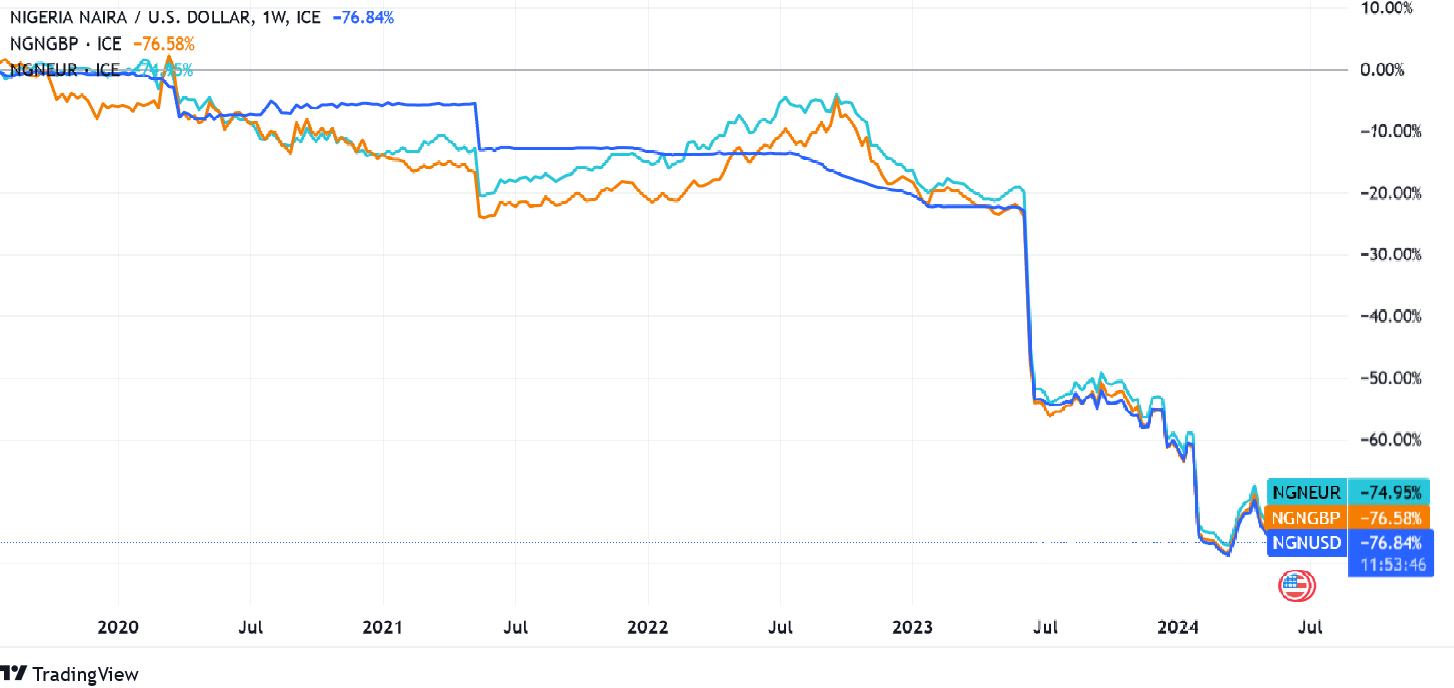

The naira has fallen sharply in recent times, reflecting in large part a fall in oil revenues entering the West African country. Volatile oil prices have reduced capital flows into its vital energy industry, while problems like theft and pipeline sabotage have reduced production levels.

This has led to a shortage of US dollars, making it difficult for Nigeria’s currency to maintain its value.

The naira has also been a victim of rampant inflation in the African country (which recently touched 28-year peaks). Economic mismanagement, capital outflows, and a combination of official, CBN-endorsed and unofficial exchange rates in 2023 have also pulled it lower.

Nigeria’s central bank is hoping ongoing interest rate increases will help the naira break out of its downtrend against a wide range of major, minor and exotic currencies. It had hiked them to 26.25% by May 2024, the eleventh consecutive increase.

Is Forex Trading Legal In Nigeria?

Yes. Currency trading is regulated and overseen by the CBN and Nigeria’s Securities and Exchange Commission (SEC). Forex brokers require a licence from the central bank to start operating, and may also require permission from the SEC to do business.

Furthermore, the commission is responsible for supervising financial markets and dishing out enforcement actions if required.

Regulations in Nigeria are steadily improving. But rules to protect investors and maintain market transparency and integrity are far weaker than in many other forex markets, so traders need to tread carefully.

Forex traders can obtain extremely high leverage in Nigeria due to lax regulations. Having access to greater levels of borrowed funds can significantly amplify gains, but it also leaves investors vulnerable to large losses if trades go wrong.

Is Forex Trading Taxed In Nigeria?

Any profits made from dealing in currencies are taxable and must be declared to the Federal Inland Revenue Service (FIRS).

Generally speaking, earnings are considered capital gains and are charged at a rate of 10%.

When Is The Best Time To Trade Forex?

As in other regions, traders can do business 24 hours a day, five days a week in Nigeria’s currency market.

Dealing begins on Sundays at 11:00pm West Africa Standard Time (WAT), which corresponds with the Monday morning market opening in Sydney. Trading carries through to the close of trading in New York five days later, at 10:00pm WAT.

However, the best time to trade currencies in Nigeria is arguably between 1:00pm and 6:00pm on weekday afternoons. During this period, there is significant overlap between the UK and US trading sessions, the world’s two largest forex venues.

A Forex Trade In Action

Now let’s consider what a Nigerian currency trade could look like in real life, focusing on a transaction involving the NGN/USD.

The Background

This particular forex pairing is extremely popular in Nigeria. This is perhaps unsurprising: the naira is the local currency, while the US dollar is the currency of the world’s largest economy, and one that plays a vital role in international trade.

Picking a popular currency cross like this means I have the benefit of deep liquidity and potential price volatility.

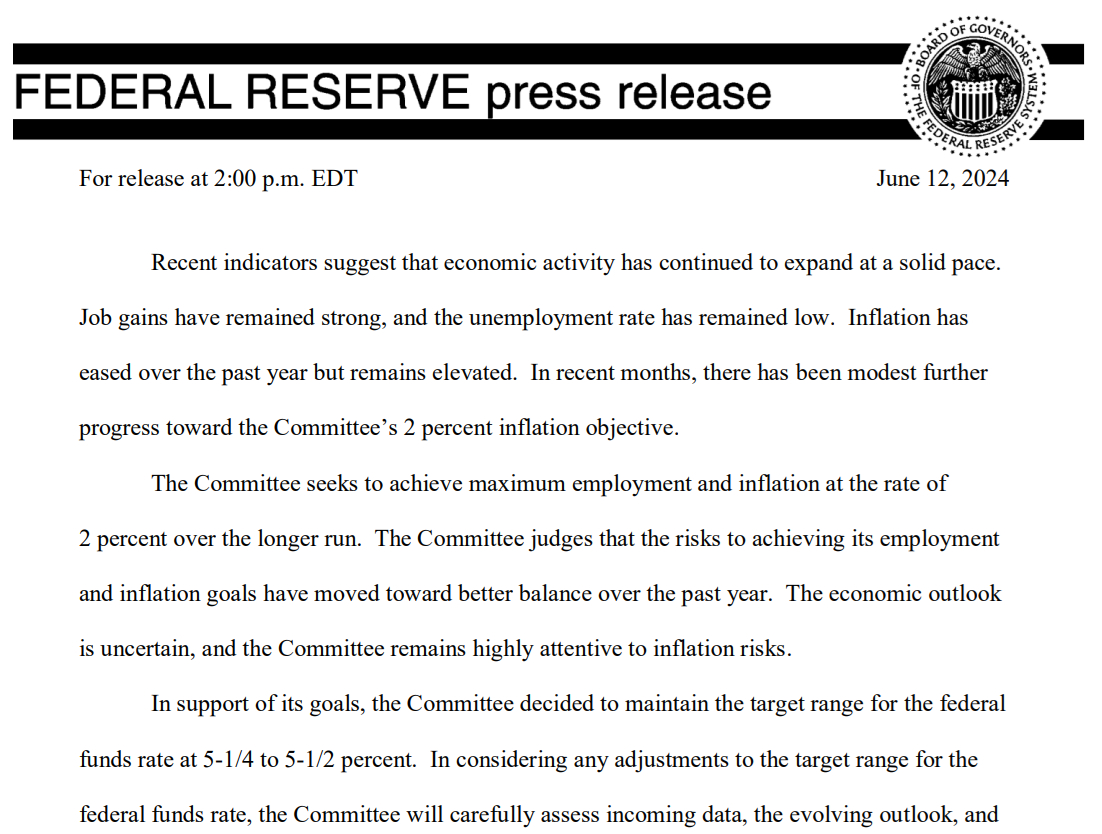

My plan involves trading the NGN/USD when the next Federal Reserve interest rate decision is announced. Even though this is due at 7:00pm WAT – which is just outside the prime period for forex trading – the economic significance of Fed rate announcements could still lead to significant trading opportunities.

The Idea

I expect that the Fed will keep its benchmark rate frozen at 5.25% to 5.5%. If I’m right, I have the potential to make a profit, as the broader market has priced in a 25-basis-point reduction.

My decision follows a close inspection of recent economic news and data from the US, including growth reports, employment statistics, and minutes from recent Federal Reserve policy meetings.

I also carry out technical analysis to identify patterns, trends and indicators on the charts. Examining the charts gives me an even better idea of where the NGN/USD might be heading.

If interest rates remain stable, the US dollar will likely strengthen against other currencies, and the NGN/USD would probably fall.

I decide therefore to take a short position in the currency cross. This involves me selling the naira (the base currency) while simultaneously buying the dollar (the quote currency).

The Trade

At this stage. I’m ready to finally place my trade. At 6.55pm WAT, I open my trading platform to find the pairing trading at 0.000635. At this level, I can get 1,574.80 Nigerian naira for $1.

I then place two trades:

- A ‘take profit’ order at 0.000628.

- A ‘stop loss’ order at 0.000642.

After a few further minutes, the Federal Reserve announces it has kept rates unchanged. And within the next hour, the NGN/USD drops to 0.000628, triggering my ‘take profit’ instruction. On this occasion, my trade has paid off and I’ve booked a 7-pip profit.

Bottom Line

Nigeria’s forex market offers excellent opportunities for short-term traders to make money. But while authorities are acting to improve investor protections and market stability, regulations in the country are not as robust as those of other countries.

Before you begin trading currencies, you must ensure that the forex broker you choose is authorized by the country’s central bank. Using a firm that’s licensed by authorities in more regulated markets can also help forex traders avoid fraudulent actors.

Recommended Reading

Article Sources

- What We Do - Securities and Exchange Commission (SEC), Nigeria

- Nigeria - Individual - Tax administration - PwC

- Capital Gains Tax – Federal Inland Revenue Service

- Nigeria invites bids for 12 new oil blocks, promises fair process – Reuters

- CPI and Inflation Report April 2024 – National Bureau of Statistics

- Nigeria’s currency has fallen to a record low as inflation surges. How did things get so bad? – Associated Press

- Nigeria Delivers Big Rate Hike to Aid Its Bruised Naira - Bloomberg

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com