Day Trading in Nigeria

Nigeria’s vibrant forex markets, varied commodities including among the world’s largest oil reserves, and the busy Nigerian Exchange Group (NGX) offer lucrative opportunities to day traders, whose numbers have been steadily rising in the country.

Nigeria is consistently among the top five economies on the African continent, with a GDP over $252 billion in 2023. The Nigerian naira (NGN) has suffered from high inflation and devaluation in recent years, but it is still an important regional currency due to the country’s high level of exports.

The Central Bank of Nigeria (CBN) is the country’s main financial regulator, with support from other bodies including the Securities and Exchange Commission (SEC), which oversees capital markets.

This guide will tell you everything you need to know to start day trading in Nigeria.

Quick Introduction

- Nigeria is a regional powerhouse with a thriving stock exchange in the NGX and lucrative exports including oil, cocoa, minerals, and fertilizer.

- Large companies on the NGX include cement manufacturer Dangote and BUA Foods. The exchange trades Monday to Friday from 10 AM to 2:20 PM, West Africa Standard Time (WAT).

- The CBN is Nigeria’s apex financial regulator, while the SEC oversees capital markets. However, neither body provides extensive protections to day traders, who may prefer brokers licensed by a ‘green tier’ regulator.

Top 4 Brokers In Nigeria

These 4 trading platforms impressed our experts as the best for active traders in Nigeria following testing:

What Is Day Trading?

Day trading involves speculating on assets like stocks, currencies and commodities with the aim to profit from short-term price movements by buying and selling within one day.

Active traders in Nigeria often trade equities in Nigerian companies, important local commodities like oil or cocoa, and even more novel markets such as cryptocurrencies. Additionally, forex trading in Nigeria is big business with currencies pairs featuring the naira.

Most retail traders use online brokers because these provide access to derivatives such as CFDs for Nigerians. With these, you can profit from important NGX-listed companies like DANGCEM or from key local commodities like oil and gold, without owning the underlying asset.

Is Day Trading Legal In Nigeria?

Day trading is legal in Nigeria, and the capital gains tax rate of just 10% makes the country an attractive option for traders.

The CBN and SEC are not among the top tier of watchdogs and you will find tighter oversight and greater protections in other countries. However, they do oversee financial markets and authorize brokers, as well as imposing penalties and shutting down untrustworthy firms.

The SEC blacklisted six unauthorized trading platforms in April 2023, and maintains a vigilant watch for scammers such as Mariam Suleiman, who was jailed for cheating investors out of 2 billion naira ($1.2 million) in a Ponzi scheme in 2024.

How Is Day Trading Taxed In Nigeria?

Profits from day trading are taxable in Nigeria, where they usually fall under the category of capital gains tax. This incurs a flat 10% tax rate, which is favorable compared to many other countries.

However, if short-term trading is your main source of income, then profits may be liable to personal income tax, which ranges between 7% and 24% depending on the amount you earn.

How To Start Day Trading

It is quick and easy to start day trading in Nigeria:

- Find a top broker. It’s crucial to register with a broker you can trust your nairas with, so look for one that’s licensed by a reliable global watchdog if not the Nigerian SEC. All of the brokers selected by our experts are reliable, as well as offering superior tools, platform options and tradeable assets.

- Open an account. Navigate to the broker’s sign-up page and enter your details, including proof of address and identification, to complete the onboarding process. You may need to provide a copy of your Nigerian National Identity card, for example.

- Fund your account. Choose a broker that supports convenient payment methods for you, and add some starting nairas to begin trading. Many Nigerian traders prefer e-wallets or mobile money payments, so brokers with digital funding through Flutterwave or Skrill could be good options.

A Trade In Action

To help you understand how a short-term trade could unfold in practice, let’s explore an example scenario…

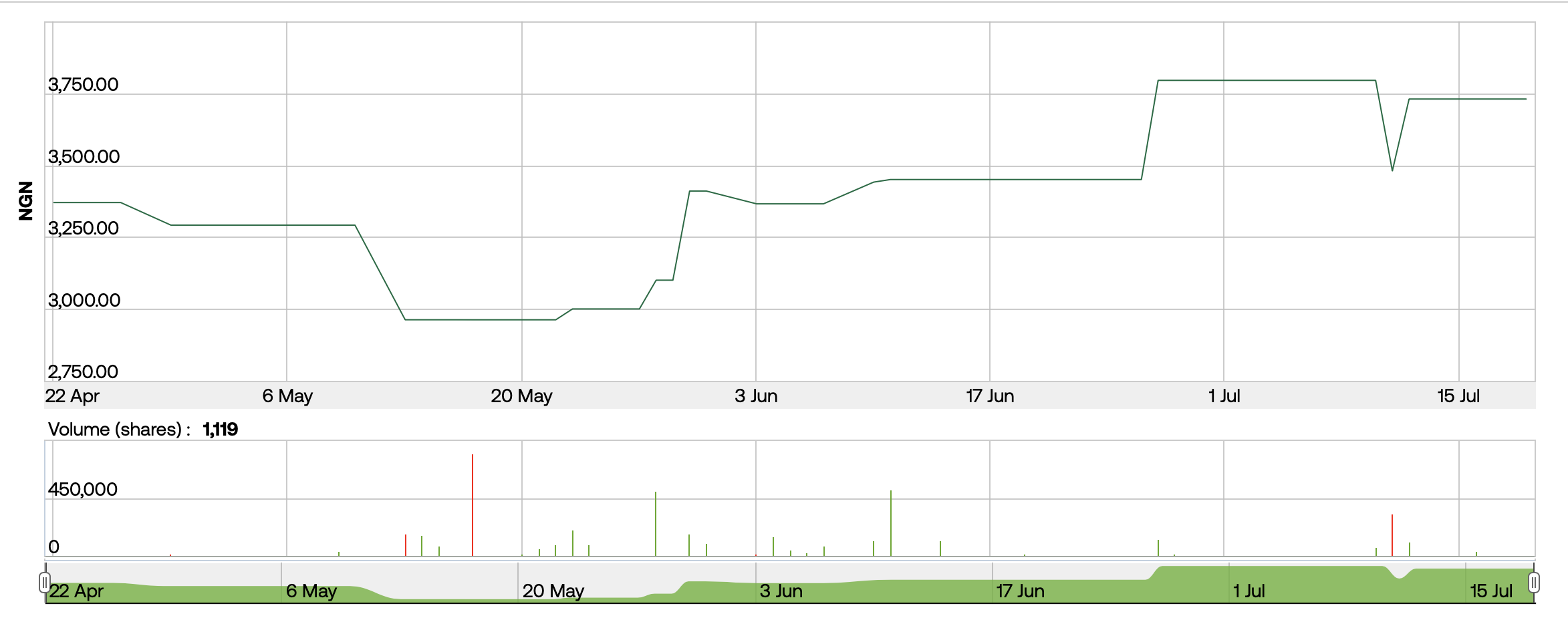

I have been keeping tabs on oil markets over the past year, so I decide to investigate a trade on Seplat Energy (SEPLAT), the biggest oil company listed on the NGX.

My intuition is that Seplat prices will continue to rise in the near-term. I’m basing this on three factors: the general upward trend in oil prices, the decreasing value of the Nigerian naira, which Seplat shares are denominated in, and news that Seplat has progressed in its planned takeover of Exxon Mobil’s Nigerian subsidiary.

After the positive news, I need to wait until the end of the Eid al-Fitr holiday before opening a long trade on Seplat. I do so when the market reopens, buying in at N3,450 and setting a stop loss at N3,278 and a take profit at N3,726.

Seplat’s price remains steady, but with no great downturn in oil prices I am confident that my trade will come good and willing to pay to keep it open.

Finally, the stock price rises to 3,795, hitting my take profit level and netting me a profit of N276 per share, minus my swap fees and other expenses.

Bottom Line

Despite setbacks caused by devaluation of the currency in recent years, Nigeria remains one of Africa’s most important economies and there are plenty of trading opportunities in the country’s many important sectors.

While the Nigerian SEC is not on our green list of regulators, it does take an active role in monitoring retail trading markets to uncover scams and unfair trading practices. Nevertheless, you should carefully research any broker you intend to do business with.

To get started, see our pick of the best day trading platforms.

Recommended Reading

Article Sources

- Nigerian Exchange Group

- Central Bank of Nigeria

- Nigerian Ponzi Scheme Boss Jailed For 5 Years

- SEC Blacklists 6 Unregulated Trading Platforms

- Securities and Exchange Commission, Nigeria

- Federal Inland Revenue Service, Nigeria

- NNPC Withdraws Challenge To $1.3 Billion Exxon Deal - Reuters

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com