New Trading Opportunities: LiteFinance Adds 32 Stocks

LiteFinance has bolstered its selection of equities, providing exposure to fresh stocks listed on the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ).

Key Takeaways

- 32 new stocks are available on the LiteFinance platform, including American Airlines, Salesforce, Dell, and Goldman Sachs.

- The minimum trade size is 1 lot and the maximum trade size is 10,000 lots with 1 lot equal to 1 share.

- Up to 1:50 leverage is available on LiteFinance’s new stocks, representing a 2% margin requirement.

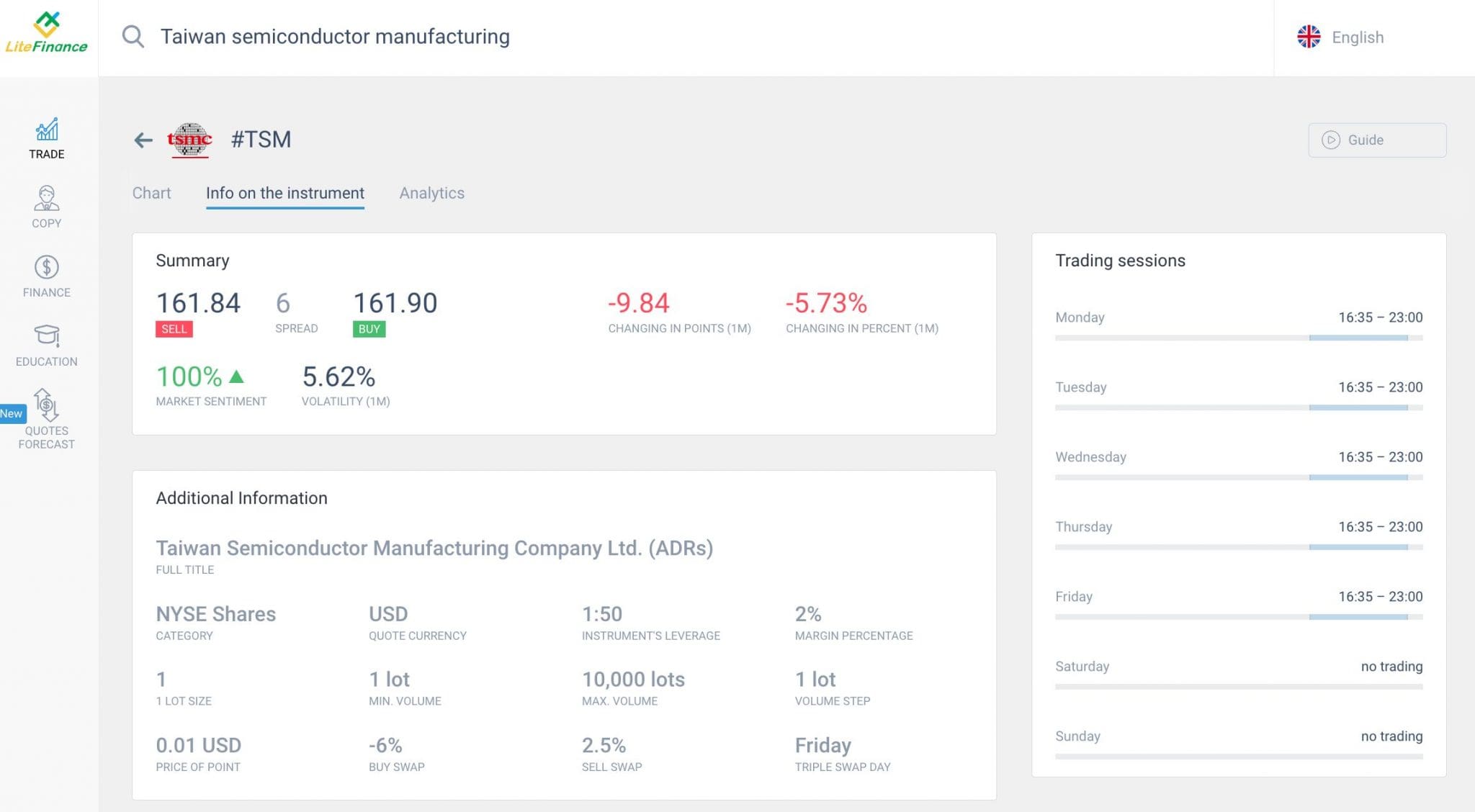

You can view details about each stock within the client area:

- ‘Chart’ brings up a dynamic graph of the security with timeframes ranging from 1 minute to 1 month.

- ‘Info on the instrument’ displays trading conditions like spread, leverage and trading sessions.

- ‘Analytics’ provides insights into price action and market sentiment.

Note that stocks labeled as ADRs are American Depositary Receipts. These are certificates issued by a US bank that represent shares of foreign companies traded on American stock exchanges.

About LiteFinance

LiteFinance is a forex and CFD broker established in 2005.

It has amassed a client base exceeding 500,000 traders and its European entity has secured a license from the Cyprus Securities & Exchange Commission (CySEC).

Alongside hundreds of shares from US, UK and European markets, users can trade currencies, commodities and prominent indices.

New traders can get started with a $50 minimum deposit, with accounts based in USD and EUR and popular payment methods like debit cards, WebMoney and Perfect Money supported.