CFD Trading In Namibia

Contracts for difference (CFDs) have become increasingly popular among Namibian traders looking to profit from price swings in various markets.

CFDs offer traders a strategic approach to capitalizing on the price fluctuations of Namibia’s primary exports, including gold.

They also open up possibilities beyond traditional markets. Namibians can venture into African equities, riding on the continent’s economic growth, or step into the volatile yet potentially rewarding realm of crypto.

This beginner’s guide provides a comprehensive overview of CFD trading in Namibia, exploring its benefits and drawbacks and the regulatory landscape governing this trading instrument.

Quick Introduction

- A CFD is a financial instrument that enables you to speculate on the price fluctuations of an asset, such as a stock or commodity without physically owning the underlying asset.

- Unlike traditional investing, CFDs do not grant ownership rights. This means you won’t be entitled to benefits associated with ownership, such as dividends in the case of stocks.

- Leverage is a distinctive characteristic, enabling you to manage positions that surpass your investment. This can magnify potential gains and losses. For instance, leverage of 1:20 allows you to hold a South African rand (ZAR) 100,000 position with a deposit of ZAR 5,000.

- CFDs are intricate financial instruments that involve substantial risks. Trading costs, including spreads, overnight fees, and commissions, can diminish potential profits.

- As derivatives, CFDs may exhibit slight price discrepancies compared to the actual market price of the underlying asset.

- Namibia’s financial markets are regulated by the Namibian Financial Institutions Supervisory Authority (NAMFISA), a ‘yellow tier’ regulator in DayTrading.com’s Regulation & Trust Rating, which does not have specific regulations governing CFD trading.

Best CFD Brokers In Namibia

These 4 CFD providers emerged as the best for traders in Namibia after rigorous testing:

How Does CFD Trading Work?

Consider a scenario where you’re intrigued by Vodacom, the South Africa-based telecommunications company listed on the Johannesburg Stock Exchange (JSE).

Rather than purchasing the actual shares, you could utilize a CFD to speculate on price fluctuations and potentially profit from rising and falling prices.

If you anticipated an increase in the value of Vodacom stock, you would initiate a ‘buy’ (or long) position on a Vodacom CFD. Conversely, if you foresaw a decline in the stock’s value, you would establish a ‘sell’ (or short) position.

This would enable you to trade on margin, implying you could manage a more prominent position with a smaller initial investment. Nevertheless, it’s important to remember that CFDs don’t confer ownership of the underlying asset.

Imagine Vodacom’s stock price is ZAR 10,000 per share, and you trade 10 CFDs representing 10 shares. The total value of this trade is ZAR 100,000.

However, due to the leverage inherent in CFDs, you only need to deposit a small percentage as margin. If the margin requirement is 10%, you must invest ZAR 10,000 upfront.

- If the price rises to ZAR 10,500, you make a profit. Each share earns ZAR 500 more, so your 10 CFDs earn a total profit of ZAR 5,000.

- If the price falls to ZAR 9,500, you lose money. Each share drops by ZAR 500, meaning your 10 CFDs would lose ZAR 5,000.

This example demonstrates how leverage can amplify profits and losses in CFD trading.It serves as a stark reminder of the imperative of prudent risk management, as the potential for losses is as significant as the potential for gains.

What Can I Trade?

CFDs let you speculate on a vast array of domestic and international markets. However, accessibility is contingent on your broker:

- Stock CFDs – CFDs enable you to trade a diverse range of assets, from prominent African stocks like Naspers to stocks from the US, Europe, Asia, and other global markets.

- Index CFDs – The FTSE/JSE Top 40 Index can be traded as a CFD, enabling speculation on the overall performance of the South African stock market. Additionally, global market indices like the FTSE 100 (UK) and DAX 40 (Germany) can be traded due to their higher liquidity and trading volume, often resulting in lower trading costs.

- Forex CFDs – The Namibian dollar (NAD) is pegged to the ZAR at 1:1. However, unlike the more frequently traded ZAR, the NAD has trading limitations due to its lower liquidity. It’s also not widely supported on trading platforms in our experience.

- Commodity CFDs – Commodity trading involves speculating on price fluctuations of raw materials and primary goods like energy (eg natural gas, oil), precious metals (eg gold, silver), and grains (eg soybeans, corn). While similar to stock trading, it focuses on physical commodities instead of company shares.

- Crypto CFDs – You can participate in the thrill and high risks of cryptocurrency trading in Namibia. However, you’ll usually have to do so through international crypto brokers, as Namibia lacks local crypto firms.

Is CFD Trading Legal In Namibia?

CFD trading is legal in Namibia but operates in a regulatory gray area.

Namibia does not have specific local regulations governing CFD trading or explicit oversight from financial authorities, which means traders typically access these services through international brokers.

Many of these brokers are regulated in other jurisdictions, such as Europe, Australia, or South Africa, and they extend their services to Namibian clients.

Additionally, CFD trading is highly speculative and carries a high risk of loss, so understanding the associated risks and employing robust risk management strategies is crucial.

Is CFD Trading Taxed In Namibia?

Profits from CFD trading in Namibia are generally subject to taxation, as they are considered income.

However, the tax treatment depends on individual circumstances and how the Namibia Revenue Agency (NamRA) categorizes such earnings.

If you trade CFDs as an individual and generate profits, these are likely considered part of your taxable income.

Namibia’s tax system has a progressive income tax rate from 18% to 37%, meaning your trading profits will be added to other sources of income, such as salary or business earnings, to determine your overall tax liability.

Given the complexity of tax laws and the potential implications of CFD trading, active traders in Namibia should seek professional tax advice from a qualified accountant or tax advisor.They can provide tailored guidance on specific tax obligations and ensure compliance with NamRA regulations.

An Example Trade

Let’s delve into a hypothetical trading scenario to grasp the practical application of CFD trading in Namibia.

Background

Naspers, a significant technology investment company on the JSE, released its quarterly earnings report.

The results surpassed expectations, primarily driven by solid performance from its stake in Tencent and other investments.

As a result, the stock was poised for a strong rally when the market opened and potentially throughout the entire trading day.

Based on this outlook, a CFD trader in Namibia could have taken a long (buy) position using CFDs.

Trade Entry & Exit

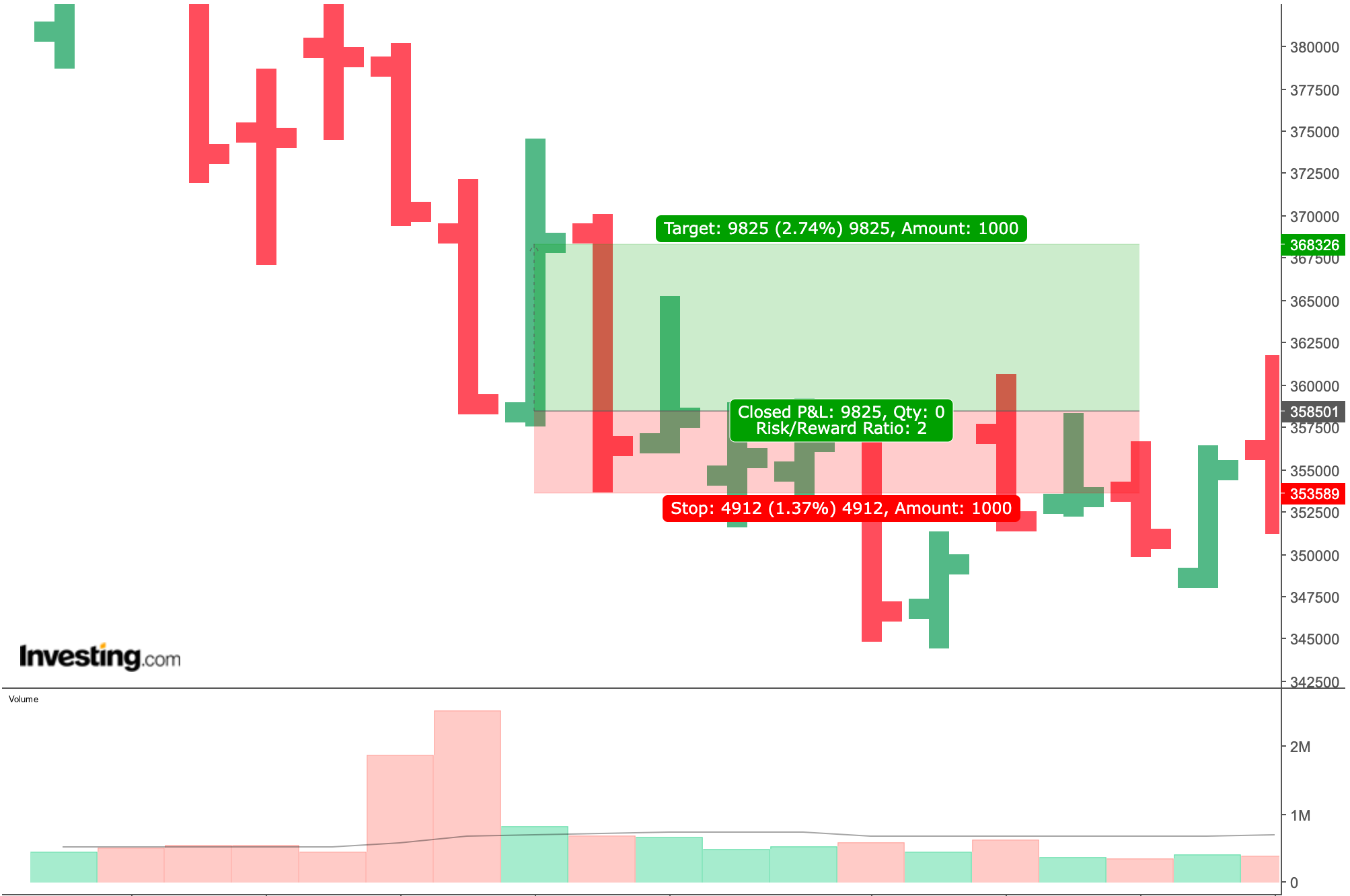

At the market opening, Naspers’ stock price began trading at ZAR 3,585.01 per share, reflecting the market’s positive reaction to the earnings announcement.

Believing that the bullish sentiment would sustain throughout the session, you could have opened a long CFD position at this level.

Thanks to leverage, CFDs allow you to gain total exposure to the stock’s price movements with a minor upfront capital requirement.

For example, using a position size that equaled an exposure of ZAR 3,585.01 and with a leverage of 1:5, you needed to deposit only 20% of this value as margin, which is ZAR 717.002.

A stop-loss could have been set at ZAR 3,535.89 to limit potential losses (-1.37%) in case of a reversal.

Naspers’ stock price climbed steadily throughout the day as buying pressure remained strong. By late afternoon, the stock reached ZAR 3,683.26 (+2.74%).

An ideal time to close your position to lock in profit would have been just before the market closed. This would have allowed you to capture the full upward movement during the day without needing to hold the position overnight, avoiding any additional risks.

Bottom Line

CFD trading is legal in Namibia but operates without specific local regulation, meaning traders typically access international brokers regulated elsewhere.

While it offers opportunities to profit from price movements in various markets, CFD trading is highly speculative and carries significant risk.

Profits from CFD trading are generally taxable as part of personal or corporate income under Namibia’s tax laws, so you should maintain proper records and seek professional advice to ensure compliance.

To embark on your CFD trading journey in Namibia, explore our leading CFD trading platforms and select one that aligns with your needs.

Recommended Reading

Article Sources

- Namibian Financial Institutions Supervisory Authority (NAMFISA)

- Johannesburg Stock Exchange (JSE)

- Namibia Revenue Agency (NamRA)

- Namibia Taxes on Personal Income - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com