Day Trading in Namibia

Namibia is home to a small but robust economy that benefits from political stability and strong management. The size of the country’s financial markets is modest, but interest in day trading is steadily growing as the popularity of personal investing grows.

Get started day trading in Namibia with our guide. We talk about how markets in the country are regulated, explain what taxes active traders must pay, and discuss the range of securities Namibians can deal in.

Quick Introduction

- Day traders in Namibia can choose from a broad selection of financial securities, including shares that are traded on the Namibian Stock Exchange (NSX), though low trading volumes hinder their suitability for day trading.

- Financial markets are regulated by the Namibian Financial Institutions Supervisory Authority (NAMFISA), which is classified as a ‘yellow tier’ regulator under DayTrading.com’s Regulation & Trust Rating.

- Short-term traders may need to pay income tax of between 18% and 37% on any profits they make to the Namibia Revenue Agency (NAMRA).

Top 4 Brokers in Namibia

After our exhaustive tests, these 4 platforms emerged as superior for day traders in Namibia:

What Is Day Trading?

Day trading is a fast-paced trading strategy where participants buy and sell financial securities, such as NSX-listed equities, Namibian currency pairs, or commodities like platinum as one of the country’s prominent resources, within the same day.

The goal is to capitalize on tiny price fluctuations that occur throughout the trading session.

Day traders typically operate during regular market hours when dealing volumes are high. This usually means that they enjoy better liquidity and greater price volatility that can be seized upon.

Successful day trading requires a deep understanding of technical analysis, which involves analysing price charts and using various indicators to predict future price movements.

The presence of leverage (or borrowed funds) is another key feature of day trading, and is permitted in Namibia, although this can be a double-edged sword by bloating profits or losses.

Day traders in Namibia can trade local shares on the Namibian Stock Exchange (NSX).The current NSX was founded in 1992 and is one of the largest share trading venues in Africa thanks to its partnership with the Johannesburg Stock Exchange (JSE) and resulting dual listings.

It’s home to roughly 40 companies, including banking giant FirstRand Namibia, alcohol manufacturer Namibia Breweries, and financial services provider Capricorn Investment.

Trading on the NSX usually takes place between the hours of 09:00 and 17:00 Central Africa Time (CAT) on weekdays.

Is Day Trading Legal In Namibia?

Day trading activities fall under general financial market trading, which is closely regulated by the Namibian Financial Institutions Supervisory Authority (NAMFISA).

This body was established at the turn of the Millennium to oversee a robust and transparent financial system and to promote the country’s economic growth.

NAMFISA’s mission, to use its own words, is “to regulate and supervise financial institutions and financial intermediaries to foster a stable, fair non-banking financial sector and to promote consumer protection and provide sound advice to the Minister of Finance.”

In 2023, the Virtual Assets Act was introduced to regulate cryptocurrency trading in Namibia, a popular asset class with short-term traders owing to its significant volatility.

Coming just six years after the practice was banned, the law aims to establish a regulator to oversee crypto service providers and their activities.

It is intended to protect consumers, prevent market abuse, and eliminate criminal activity like money laundering and the financing of terrorism. However, the Act has yet to come into effect.

How Is Day Trading Taxed In Namibia?

Active traders may need to declare their trading profits to the Namibia Revenue Agency (NAMRA), the body responsible for administering the country’s tax system.

Day traders could pay income tax on their earnings at the following rates:

- 0% on income up to 50,000 Namibian dollars (NAD)

- 18% on income between 50,001 NAD and 100,000 NAD

- 9,000 NAD plus 25% on excess of income between 100,001 NAD and 300,000 NAD

- 59,000 NAD plus 28% on excess of income between 300,001 NAD and 500,000 NAD

- 115,000 NAD plus 30% on excess of income between 500,001 NAD and 800,000 NAD

- 205,000 NAD plus 32% on excess of income between 800,001 NAD and 1,500,000 NAD

- 429,000 NAD plus 37% on excess of income above 1,500,001 NAD

As part of its cryptocurrency market shake-up, Namibia also plans to slap a specific tax on virtual currencies, digital assets, and virtual asset service providers (VASPs) to help fund the regulatory regime and raise revenues.

Getting Started

There are three tasks you’ll need to tick off before you can begin day trading in Namibia:

- Selecting a broker. Check that the brokerage is licensed to deal by NAMFISA, and/or by a top regulator in another country like South Africa’s FSCA. Other important things to consider are the functionality of the firm’s platform and/or app, the fees it charges, the tools it provides (like advanced charting), and the amount of leverage they offer (if your strategy uses popular derivatives among day traders like CFDs in Namibia).

- Opening an account. You’ll need to provide some personal details and supply documentation like a Namibian National Identity Card to verify your identification and address. The broker is also likely to ask you more trading-centric questions related to your investing style, experience and goals, with day trading remaining among the most high-risk approaches to online dealing.

- Depositing some cash. The exact method of transferring Namibian dollars will differ from broker to broker. Using a debit card or wire transfer are the most popular methods we see on day trading platforms, although some companies may also permit the use of an online payment provider like Namibia’s MobiPay.

A Day Trade In Action

With these stages completed, you’ll now be ready to start dealing in the financial markets. Here’s what a short-term trade involving a popular Namibian stock might look like.

The Set-Up

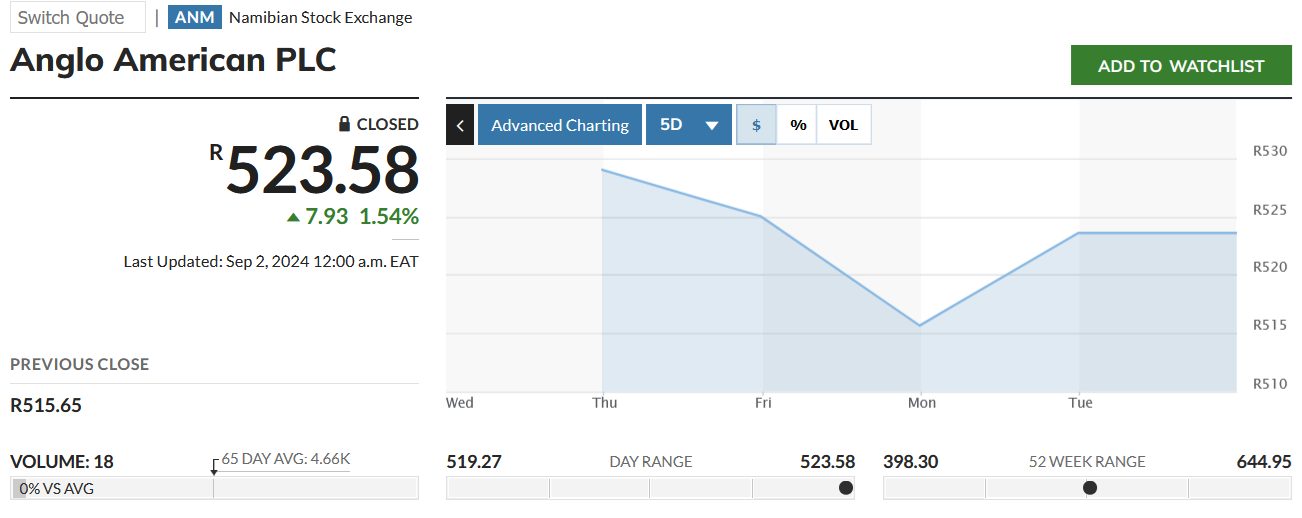

My plan is to trade Anglo American shares around the time that the next Purchasing Managers Index (PMI) from the US manufacturing sector comes out.

A strong reading is likely to signal robust demand for iron ore, copper, and other industrial metals that the miner produces.

The market is pricing in a PMI reading of 50.3 for last month (at the time of writing), just above the expansionary/contractionary watermark of 50 and up from 50.1 the time before.

However, after carrying out some economic research, I conclude that a reading of 50.5 is more likely, indicating sharper manufacturing growth.

In this scenario, shares in raw materials producers like Anglo American could rise in value. But before placing my trade, I also conduct some technical analysis to get a better idea of where the miner’s share price could potentially head.

The Trade

After finishing my research, I open my trading platform at 15:35 CAT. This gives me 10 minutes to input my long trade.

The process involves two steps: setting a ‘take profit’ order to lock in any gains I make, and establishing a ‘stop loss’ instruction to limit any losses.

These tools will automatically close my position if Anglo American shares either rise or fall to pre-set levels that I have selected. Thus they can be an effective way for me to manage risk day trading.

With the mining giant’s share price at 522.38 NAD, I place a ‘take profit’ order at 523.25 and a ‘stop loss’ at 522.03. I then sit back and await the release of those PMI numbers.

Eventually, the release comes out in my favor. It shows that the index rose to 50.5 last month, just as I’d predicted.

As a consequence, Anglo American shares rise, and within about 45 minutes my ‘take profit’ instruction is triggered. This gives me a profit of 87 Namibian cents for each share I bought.

Bottom Line

Day traders in Namibia can today choose from an attractive selection of financial instruments.

But they need to be vigilant when dealing in the country’s financial markets. While investors enjoy some protections from scammers, the regulatory regime isn’t as robust as in regions with more developed financial markets.

Traders must check that the brokerage they choose is licensed by NAMFISA before transferring any money. Alternatively, they should select an international platform that’s been approved by a top regulator in another territory like nearby FSCA in South Africa.

To get going, use DayTrading.com’s choice of the top platforms for day trading.

Recommended Reading

Article Sources

- The World Bank in Namibia – World Bank

- Namibian Stock Exchange (NSE)

- Namibian Financial Institutions Supervisory Authority (NAMFISA)

- Virtual Assets Act – Bank of Namibia

- Namibia Revenue Agency (NAMRA)

- Income TAX - NAMRA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com