Day Trading in Mexico

Day trading in Mexico is gaining momentum as the country’s economy continues to show robust growth and resilience. With a GDP of over $2 trillion, Mexico is the 12th largest economy globally. It boasts a diverse industrial base that includes manufacturing, oil, and gas, as well as a burgeoning tech sector.

This guide will help equip you with the tools to navigate the Mexican trading landscape.

Quick Introduction

- The financial markets in Mexico, including online trading, are regulated by the Comisión Nacional Bancaria y de Valores (CNBV).

- Mexico’s stock exchange, the Bolsa Mexicana de Valores (BMV), is the second largest in Latin America, with a total market capitalization of over $530 billion.

- In Mexico, all trading profits are taxable and must be reported to Mexico’s Servicio de Administración Tributaria (SAT).

Top 4 Brokers In Mexico

Our tests show these 4 platforms are in their own league for active Mexican traders:

All Day Trading Platforms in Mexico

What Is Day Trading?

Day trading involves buying and selling financial instruments like stocks or bonds within the same day, capitalizing on short-term price movements.

Day trading opportunities in Mexico include a range of diverse instruments, such as stocks listed on the BMV and key export commodities like gold, silver, and copper. Derivatives like CFDs in Mexico can be used so you don’t have to take ownership of the underlying asset.

Forex trading in Mexico is also big business, featuring currency pairs related to the Mexican peso (USD/MXN).

Is Day Trading Legal In Mexico?

Yes, day trading is legal in Mexico. The financial markets, including activities like intraday trading, are regulated by the CNBV, which ensures compliance with established laws and regulations.

Adhering to these regulations is not just a requirement, but it also ensures transparent and fair trading practices, providing a sense of security and confidence in your trading activities.

Additionally, the BMV provides a legitimate platform for such trading activities.

How Is Day Trading Taxed In Mexico?

All trading profits in Mexico are subject to income tax (Impuesto Sobre la Renta or ISR) and must be declared to SAT.

It’s important to note that the first MXN 125,900 of your trading profits is tax-exempt. However, income beyond this threshold is taxed according to Mexico’s progressive tax brackets, which range from 1.92% to 35%.

How To Start Day Trading

The Mexican trading landscape is dynamic and full of potential. Follow these key steps to thrive in this fast-paced environment:

- Select a top-rated day trading platform in Mexico with a robust regulatory background to start your journey on solid ground. For added security and trust, prioritize those licensed by Mexico’s CNBV (a list of registered brokers can be found here), or a ‘green tier’ regulator like the UK’s FCA and Australia’s ASIC.

- Account verification usually involves your Mexican passport and a recent utility bill. Once approved, you can conveniently fund your account through wire transfers, debit cards, or regional options like PicPay and Mercado Pago.

- Stock traders can speculate on various Mexican companies, including Fomento Económico Mexicano, Walmex, and others. Currency traders can capitalize on fluctuations in Mexico’s official currency with popular forex pairs like USD/MXN and EUR/MXN.

Example Trade

To grasp how short-term trading operates in Mexico, let’s consider a scenario with Walmex, a Mexican company that operates self-service discount stores, hypermarkets, wholesale-price membership stores, and supermarkets.

Event Background

Walmex released its earnings report after the market closed. The report showed a significant increase in revenue, beating analysts’ expectations with a 14% increase in first-quarter net profit as sales rose in Mexico and Central America.

Sales grew 9.8% to MXN 226.19 billion. A favorable calendar effect contributed 2.5 percentage points to sales growth, partially offset by the stronger Mexican peso.

Trade Entry & Exit

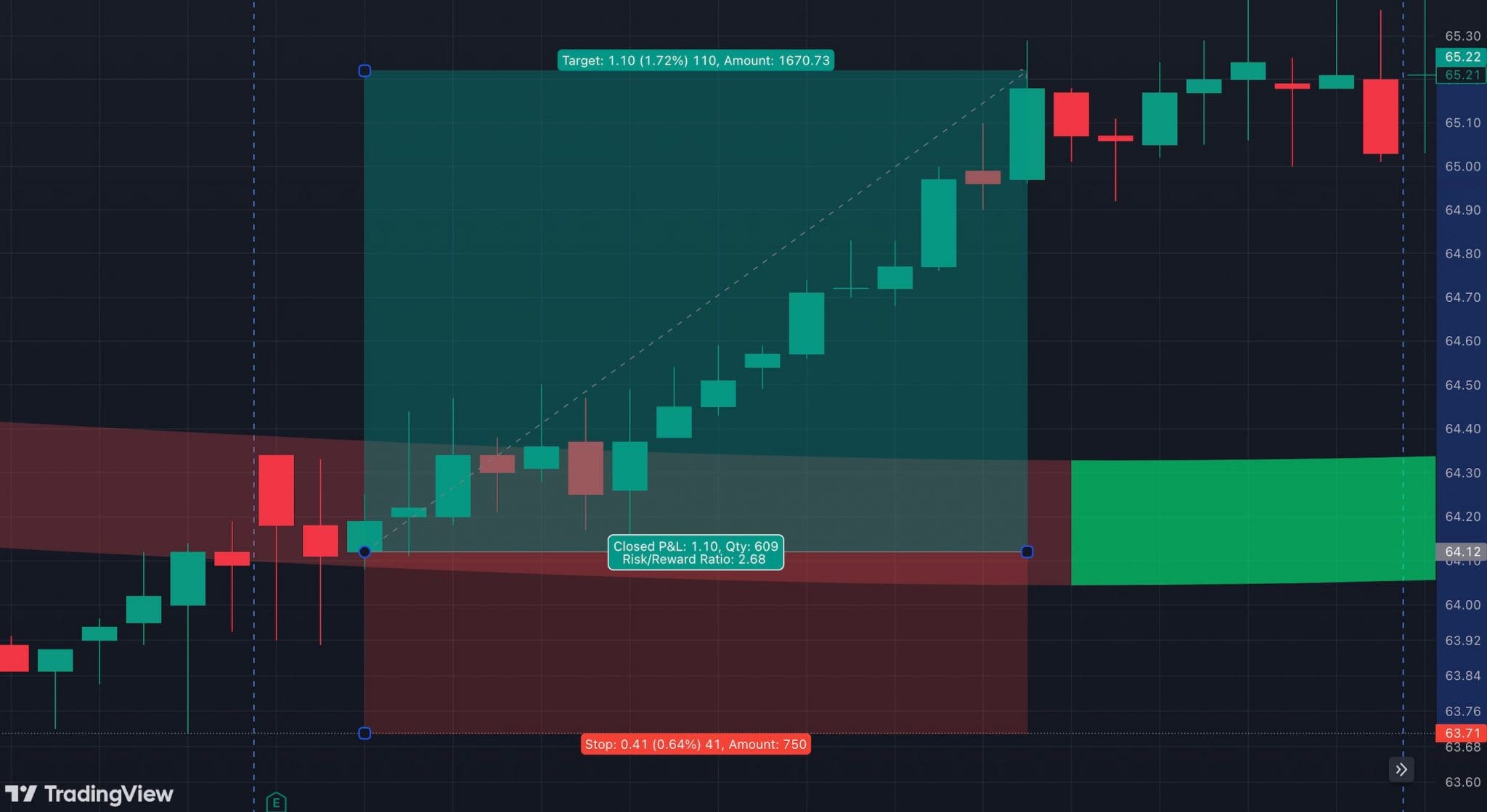

The market reacted positively to the news the following day, with the stock price opening higher than the previous day’s close. The positive results suggested a potential upward trend for Walmex’s stock price, so I wanted to capitalize on the momentum.

With the market open, I monitored Walmex’s price action closely. As expected, the stock opened with a gap up but experienced some profit-taking pressure shortly after. I decided to wait for a pullback before entering a long (buy) position.

Around mid-morning, the stock pulled back to a key support level. This presented a potential buying opportunity. I purchased shares of Walmex at MXN 64.12. To minimize risk, I set a stop-loss order at the previous day’s low. This meant the maximum I could lose on the trade was -0.64% ROI.

After establishing my position, I focused on monitoring price action and looking for profit-taking opportunities. The stock continued to climb throughout the day, surpassing my initial profit target of MXN 64.76 (1% ROI).

I implemented a trailing stop-loss order, a risk management tool that automatically sells shares if the price drops by a specified amount. As the stock continued to rise, I adjusted the stop-loss level to lock in profits, a strategy that can help to manage risk effectively.

Towards the end of the trading day, Walmex’s stock price had reached MXN 65.22, and I decided to exit my position entirely to secure a 1.72% ROI.

Bottom Line

Day trading in Mexico is a legal and increasingly popular activity, supported by the sophisticated infrastructure of the BMV and regulation by the CNBV.

With comprehensive regulations and taxation, you must stay informed and compliant to succeed in this dynamic environment.

To get started, use our pick of the best brokers for day trading in Mexico.

Recommended Reading

Article Sources

- Bolsa Mexicana de Valores (BMV)

- Comisión Nacional Bancaria y de Valores (CNBV)

- Servicio de Administración Tributaria (SAT)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com