Day Trading in Lesotho

Day trading in Lesotho is relatively small and underdeveloped compared with more established markets. However, with the country’s regulatory landscape progressing and its digital infrastructure improving, citizens’ interest in financial markets is picking up.

This guide will kickstart your journey to day trading in Lesotho. It discusses how the country’s financial markets are regulated, the taxes active traders pay, and walks through an example short-term trade on an African stock.

Quick Introduction

- Day traders in Lesotho can trade a variety of instruments, although crypto has been outlawed and the Maseru Securities Market (MSM) is a fairly new stock exchange with relatively low trading volumes.

- Financial market trading is regulated by the Central Bank of Lesotho (CBL). The CBL is categorized as an ‘orange tier’ regulator under DayTrading.com’s Regulation & Trust Rating.

- Active traders may need to pay progressive tax of between 20% and 30% to the Revenue Services Lesotho (RSL).

Top 4 Brokers in Lesotho

Following our exhaustive tests, these 4 platforms came out on top for day traders in Lesotho:

What Is Day Trading?

Day trading involves buying and selling financial securities within a single day to capitalize on short-term price movements.

Traders usually execute numerous trades using funds borrowed from their broker (known as leverage), a tactic that can supercharge returns if the market moves in the right direction.

Short-term trading like this relies on a strong understanding of technical analysis and the ability to make the right decisions quickly. Traders operate during regular market hours when liquidity is deep and there’s a greater chance of price volatility. Day trading is highly risky, however, and especially for those who use leverage.

Day trading in Lesotho is a relatively new activity, as the country’s financial markets are still developing. Traders often turn to international platforms to trade assets like stocks, commodities, and derivatives (like CFDs for Lesotho traders). Forex trading in Lesotho is also attracting heavy interest.

However, cryptocurrency trading has been banned in the country since 2018, putting Lesotho in a small grouping of African nations that have completely outlawed the promotion of and investment in digital counters.

Stock trading takes place on the Maseru Securities Market (MSM), a relatively new trading venue whose inaugural listing, that of real estate company RNB Properties, took place in 2021.

Local investors are instead likely to do business on the Johannesburg Stock Exchange (JSE), which is the largest and most accessible stock exchange in the region.

Is Day Trading Legal In Lesotho?

Yes. Day trading is overseen by the Central Bank of Lesotho (CBL), which works “to achieve and to foster the liquidity, solvency and proper functioning of a stable market-based financial system.”

The CBL licences, regulates and supervises financial institutions in the country to ensure that they are acting in accordance with local laws.

It set up the Financial Consumer Protection (FCP) division in 2018 “with the main objective of protecting the financial consumers from unfair, deceptive or abusive practices and taking action against [companies] that violate the financial consumer laws.”

How Is Day Trading Taxed In Lesotho?

Active traders must report their earnings – and pay any tax they owe – to Revenue Services Lesotho (RSL).

Personal Income Tax (PIT) is generally charged at a progressive scale of between 20% and 30%. The upper rate comes into play when earnings exceed 70,500 Lesotho Loti (LSL).

Lesotho’s tax year runs from 1 April to 30 March, and tax returns must be submitted by 30 June of the following year.

Getting Started

There are three tasks you need to complete before you can begin trading Lesotho’s financial markets:

- Select a broker. This can be the most time-intensive part of the process. The first part is to confirm that the brokerage you’re considering is approved to deal by the CBL, or by a reputable regulator in another financial territory like South Africa’s FSCA. Next, look at items like trading fees, the suitability of the dealing platform, trading execution speeds, and the range of financial securities on offer (not many brokers offer access to Lesotho securities in our experience).

- Open an account. You’ll need to provide some personal details to the broker you’ve chosen. You’ll likely have to provide them with information on who you are and where exactly you live, which may include supplying proof of ID and address. It’s likely the company will also want information on your trading experience, your investing goals, and your risk tolerance.

- Deposit some cash. Using a demo account can be a great first step for new day traders. Doing this could help you get up to speed with the financial markets and become familiar with the broker’s charting platform. Once you’re ready to trade in the real world, you’ll need to deposit some funds using a debit card or wire transfer. You may also be able to use the services of a regional online payments provider like M-Pesa.

A Day Trade In Action

With these steps completed, you’ll be ready to start dealing on the financial markets. But what might an actual day trade look like?

Let’s consider how trading shares on the JSE – a popular strategy with day traders in Lesotho – could happen.

The Background

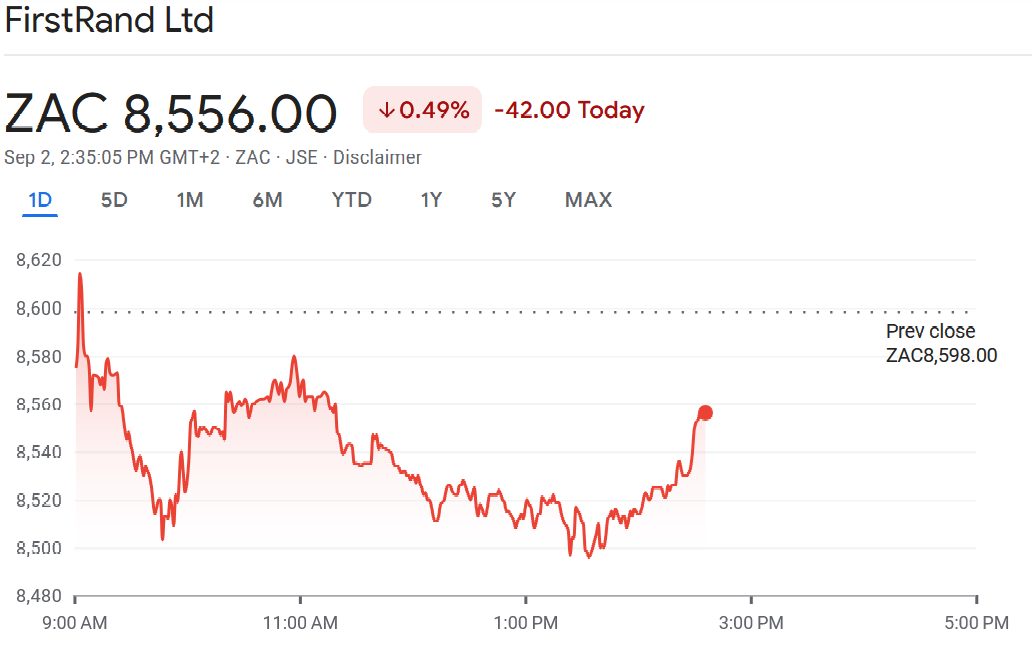

My plan is to buy shares in banking services provider FirstRand before the South African Reserve Bank (SARB) announces its next interest rate decision. The central bank is due to release its next rate statement later at 15:00 South African Standard Time (SAST), Lesotho’s official time zone.

My expectation is that the central bank will raise interest rates by a quarter of a percentage point, to 8.5%. The broader market is expecting policyholders to keep the lending rate on hold from the last meeting.

Higher interest rates give banks’ bottom lines a boost by increasing their net interest margins (NIMs). So if I’m correct, bank share prices could rise across the JSE.

As well as carrying out economic research before my trade, I also look at the charts to get a better idea as to where FirstRand’s share price might go after the SARB decision.

The effective use of technical analysis to identify chart trends, patterns and indicators is critical for any short-term trader.

The Trade

With my plan devised, I sit down at my trading terminal at 14:50 SAST to punch in my trade. I decide to place a ‘take profit’ instruction at 85.87 South African Rand (ZAR) per share, and a ‘stop loss’ order at 85.46 ZAR.

Both tools are useful for helping me to manage risk day trading. If FirstRand rises from current levels of 85.58 ZAR per share to my ‘take profit’ level, my position will automatically close, and I’ll have locked in a profit before prices get a chance to reverse.

The ‘stop loss’ works in the opposite way: my position is closed if the bank’s shares drop to my specified level, thus limiting any losses I may incur.

With these tasks completed, I sit back and wait for the SARB to put out its rate statement. Within a few minutes, the central bank announces, as I’d expected, an increase to 8.5%. In response, FirstRand’s share price rises to my ‘take profit’ level, and I make a profit of 29 South African cents for each share I bought.

Bottom Line

While gaining in popularity, day trading is still a small-scale activity in Lesotho. The range of local financial instruments (such as shares and currency pairs containing the Lesotho loti) is more limited than in many other territories, and the regulatory regime is also less sophisticated.

Short-term traders should ensure that the brokerage they use is approved by the CBL, or by a respected regulator in a region with mature financial markets, such as the FSCA in South Africa.

To get going, make use of DayTrading.com’s choice of the top day trading platforms.

Recommended Reading

Article Sources

- Maseru Securities Market (MSM)

- Africa’s Growing Crypto Market Needs Better Regulations – International Monetary Fund (IMF)

- Johannesburg Stock Exchange (JSE)

- Central Bank of Lesotho (CBL)

- Department of Financial Markets – CBL

- RNB Properties Ltd becomes the first company to list shares on the Maseru Securities Market (MSM) – CBL

- Revenue Services Lesotho (RSL)

- Lesotho Tax Table - Payspace

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com