Long-Term Trading

Long-term trading is a strategy where you buy and hold financial assets, such as stocks, bonds, or other securities, for an extended period, typically several weeks or months.

This guide for beginners explains the principles of long-term trading, as well as the best investing vehicles, popular strategies and tips.

Quick Introduction

- Long-term trading involves holding positions for upwards of several weeks.

- Long-term trades are more concerned with the fundamental factors affecting an asset’s value, rather than short-term price fluctuations.

- Diversification strategies are often used, spreading trades across different asset classes, industries, or geographic regions to reduce risk.

- In addition to capital appreciation, you may also seek income from your trades, such as dividends from stocks or interest from bonds. This income can be reinvested or used as a source of passive income.

- Long-term trading tends to incur lower trading costs because it involves buying and holding rather than frequent trading, which can involve transaction fees and taxes.

Best Brokers For Long-Term Trading

These are the 4 best trading platforms for long term investments based on our assessment:

What Is Long-Term Trading?

Long-term trading is considered a more conservative approach to trading, and it is often recommended for individuals with a long-term financial goal, such as retirement planning, wealth preservation, or funding a child’s education.

However, it is essential to conduct thorough research and consider your risk tolerance and financial objectives before adopting a long-term trading strategy.

Pros

- Reduced Stress And Emotion-Driven Decisions: Long-term trading typically involves less frequent buying and selling of assets compared to short-term trading. This reduces the emotional stress and anxiety often associated with monitoring markets on a daily or even hourly basis. You can take a more relaxed approach, focusing on the fundamentals of your trades rather than reacting to short-term price fluctuations.

- Compound Interest: By reinvesting earnings, such as dividends or interest, and allowing your trading account to grow over time, your initial capital can multiply. This compounding effect can lead to substantial wealth accumulation over the years.

- Tax Benefits: Many tax codes offer preferential tax treatment for long-term investments. For example, in the United States, long-term capital gains are often taxed at lower rates than short-term capital gains. This tax advantage can result in higher after-tax returns for long-term traders.

- Less Transaction Costs: Fewer transactions mean lower brokerage fees and commissions, which can help preserve more of your returns.

- Time For In-Depth Research: Long-term trading allows more time for thorough research and due diligence, letting you carefully assess the fundamentals of your chosen assets, understand market trends, and make informed trading decisions. This research-focused approach can lead to better trading choices.

Cons

- Lack Of Liquidity: Long-term trades are typically illiquid, meaning it can be challenging to access your funds quickly when needed. Selling long-term assets might take time, and you may not receive the full market value if you need to sell during a market downturn.

- Market Volatility: Long-term trades must be prepared to weather market volatility and downturns. While markets tend to trend upward over the long run, there can be extended periods of market turbulence that test your patience and resolve.

- Opportunity Cost: Long-term trades tie up capital for extended periods. This can limit your ability to take advantage of short-term trading opportunities or react to changing financial needs. Missing out on potentially profitable short-term trades can be viewed as an opportunity cost.

- Limited Income Generation: Long-term trading may not provide regular income, especially if your portfolio consists mainly of growth-oriented assets like stocks. If you intend to rely on income from your trading, you may need to look for additional income sources.

- Inflexibility: Once you commit to a long-term trading strategy, it can be challenging to adapt to changing circumstances or financial goals. Long-term trading may not align well with life events that require a significant amount of liquidity, such as buying a home, paying for education, or dealing with unexpected emergencies.

Best Long-Term Trading Instruments

Here are some popular trading vehicles for long-term investing:

- Stocks: Trading in individual stocks of established companies or exchange-traded funds (ETFs) that track broad market indices is a popular choice for long-term traders. Stocks have historically provided strong returns over the long term and trading in stocks of companies that pay consistent dividends can provide a steady income stream.

- Bonds: Bonds are relatively less volatile than stocks and can provide a steady stream of income through interest payments. They are often used to add stability to a long-term trading portfolio.

- Mutual Funds: Mutual funds offer diversification by pooling money from multiple traders and investing in a variety of assets like stocks, bonds, or a combination of both.

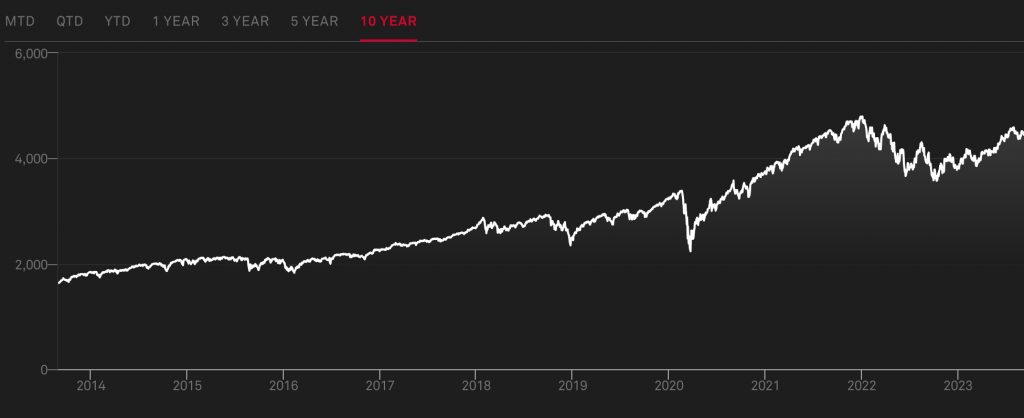

- Index Funds: These passive investment funds aim to replicate the performance of a specific market index, like the S&P 500. They are known for their low fees and can be excellent choices for long-term traders looking for broad market exposure.

- Precious Metals: Assets like gold and silver can be considered as a hedge trade, especially during economic uncertainties.

- Cryptocurrencies: While highly volatile, you could consider a small portion of your portfolio to cryptocurrencies like Bitcoin and Ethereum as speculative long-term trades.

An Example Strategy

A long-term trading strategy aims to capitalize on the potential for market growth over time while minimizing the impact of short-term market volatility.

It is important to align your strategy with your specific financial goals and risk tolerance, and to regularly review and adjust your portfolio as needed to stay on track.

Here is an example long-term ETF strategy to illustrate the processes involved in long-term trading:

- Asset Selection: Choose a set of ETFs that align with your long-term trading goals and risk appetite. For example, you might select ETFs representing broad market indices, such as the S&P 500 for U.S. stocks and a total bond market ETF for fixed income.

- Initial Investment: Begin by making initial trades in your selected ETFs. This investment should be in line with your overall portfolio allocation. For instance, if you decide on a 70% equity (stocks) and 30% fixed income (bonds) allocation, allocate your funds accordingly.

- Dollar-Cost Averaging (DCA): Implement a dollar-cost averaging strategy. This involves making regular, fixed-dollar trades at set intervals (e.g., weekly or monthly), regardless of market conditions. DCA helps spread risk and takes advantage of market volatility over time.

- Rebalance Annually: Annually or as needed, review your portfolio’s asset allocation to ensure it remains in line with your long-term goals. If market movements have caused your allocation to deviate significantly, rebalance by buying or selling ETFs to bring it back to the desired allocation.

- Dividend Reinvestment: If your ETFs pay dividends, consider reinvesting these dividends back into the same ETFs. This can help accelerate growth over the long term.

- Monitor and Adjust: Keep an eye on your portfolio’s performance and make adjustments if your financial goals or risk tolerance change. However, resist the urge to make frequent trades based on short-term market fluctuations.

- Tax Efficiency: Be mindful of tax implications. ETFs are known for their tax efficiency, but you should still consider tax-efficient placement of your trades within taxable and tax-advantaged accounts.

- Stay Informed: Stay informed about economic and market trends, but avoid making impulsive decisions based on short-term news. Long-term trading requires patience and a focus on your overall strategy.

Long-Term Trading vs Short-Term Trading

Both short-term and long-term trading have their advantages and drawbacks, and the choice between them depends on your financial goals, risk appetite, and trading preferences.

Experienced traders often adopt a hybrid approach, combining both strategies in their portfolio to achieve a balanced strategy.

Here are the main differences:

Trading Frequency

Short-term trading, also characterized as day trading or swing trading, involves holding assets for a very brief period, ranging from seconds to a few days. The focus is on exploiting short-term price fluctuations by reacting to technical indicators, news events, and short-term trends.

Long-term trading involves holding assets for an extended period, typically weeks or even months and years. The focus is on gradual wealth accumulation over time, rather than short-term market fluctuations.

Trading Goals

The primary goal of short-term trading is to profit from short-term price movements, often aiming for quick gains regardless of the underlying fundamentals of the assets.

Long-term trading aims to build wealth over the long run, focussing on the fundamental strength and growth potential of assets, with the expectation of capital appreciation.

Risk Tolerance

Short-term trading can be riskier due to the higher volatility and uncertainty associated with short-term price movements. Leverage is also often used to amplify gains (and losses).

Long-term trading is generally considered less risky because it allows for the smoothing out of market fluctuations over time. Market downturns can be withstood, with a focus on the long-term perspective.

Analysis Methods

Short-term trading often relies on technical analysis, charts, and short-term indicators to help you make trading decisions, rather than delving deeply into the fundamental analysis of assets.

Long-term trading emphasizes fundamental analysis, assessing the financial health, growth prospects, and competitive advantages of assets.

Trading Costs And Taxes

Short-term trading can result in higher transaction costs due to frequent buying and selling. Short-term capital gains are usually subject to higher tax rates.

Long-term trading tends to have lower transaction costs because of fewer trades. In some jurisdictions, long-term capital gains may qualify for preferential tax treatment.

Psychological Factors

Short-term trading requires quick decision-making and can be emotionally taxing, especially after a run of losing trades. Stress and discipline need to be managed to avoid impulsive actions.

Long-term trading allows for a more patient and less emotionally charged approach, as day-to-day price fluctuations are less important.

Investment Vehicles

Common short-term trading vehicles include stocks, options, forex, and cryptocurrencies.

Long-term trading often involves a diversified portfolio of assets, including stocks, ETFs and commodities.

Bottom Line

Long-term trading can yield regular or compounding returns if you are willing to lock up capital for extended periods. In addition, strategies such as crypto staking and dividend investing can generate lucrative passive income. Another key benefit of long-term trading is the potential to use tax-advantaged accounts to maximize gains.

However, the suitability of long-term trading depends on your financial goals, risk tolerance, and time horizon. While long-term trading is well-suited for building wealth gradually over time and achieving long-term financial objectives, it may not be suitable for everyone.

Some traders prefer a combination of long-term and short-term strategies to strike a balance between long-term growth and short-term liquidity needs. Additionally, diversifying a trading portfolio can help mitigate some of the disadvantages associated with long-term trading by spreading risk across different asset classes and investment horizons.

FAQ

What Is Considered Long-Term Trading?

Long-term trading refers to a trading strategy where you buy and hold assets, such as stocks, currencies, or commodities, for an extended period of time, typically several weeks to months or even years.

The goal of long-term trading is to capitalize on the potential for asset value appreciation over time, rather than seeking short-term gains from frequent buying and selling. This approach is often associated with a focus on fundamental analysis, diversification, and a tolerance for market fluctuations.

Is Long-Term Trading Profitable?

Long-term trading can be profitable for traders who are patient and have a well-thought-out strategy. This approach minimizes the impact of short-term market volatility and allows you to benefit from compounding returns and the potential for assets to appreciate over time.

However, the profitability of long-term trading depends on factors like the choice of assets, diversification, market conditions, and your ability to stick to your trading plan through market ups and downs. It is not a guaranteed path to profit, but it can be a prudent and rewarding strategy.

Is Long-Term Trading Better Than Day Trading?

This depends on your financial goals, risk tolerance, and trading expertise. Long-term trading is generally considered less risky because it involves buying and holding assets for an extended period, allowing time for market fluctuations to potentially work in your favor and capitalizing on compounding returns.

Day trading, on the other hand, is highly speculative and involves frequent buying and selling within the same trading day, which can be risky and often results in losses for inexperienced traders.

Long-term trading is more aligned with wealth accumulation and financial stability, whereas day trading is more akin to a full-time job and can lead to significant losses if not approached with caution and skill.

Article Sources

- Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies, Sixth Edition By Jeremy J. Siegel, 2022

- Patient Capital: The Challenges and Promises of Long-Term Investing By Victoria Ivashina, Josh Lerner, 2021

- The Standard & Poor's Guide to Long-term Investing: 7 Keys to Building Wealth By Joseph Tigue, 2004

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com