Liquidity: What Is It & Why Is It Important?

The term liquidity refers to the ease and speed with which an asset can be bought or sold without causing a significant change in its price. Brokers with deep liquidity can help short-term traders minimize costs and reduce risk by being able to open and close positions rapidly.

This guide will explain the role of liquidity providers (LPs) in the financial markets and list brokers with excellent liquidity.

Quick Introduction

- Liquidity providers are institutions that allow trades to be made quickly and efficiently.

- They are essentially middlemen between firms that issue an asset, such as a stock, and traders.

- Choosing a broker with good liquidity can increase profit potential through cost reduction and mitigating risk by facilitating swift position management.

Brokers With Deep Liquidity

These 3 brokers offer good liquidity with competitive prices and reliable order execution:

What Are Liquidity Providers?

It is lawful for traders to deal directly with each other. This is known as off the exchange, as transactions are made outside of a centralized financial marketplace.

However, the bulk of trades are carried out on exchanges where market participants trade standardized securities. Exchange-based dealing makes it more straightforward for a buyer to find a seller, or vice versa.

Core liquidity providers – or market makers, as they are also known – play a critical role in allowing these financial exchanges to function.

They act as intermediaries connecting institutions issuing assets, like the London Stock Exchange in share dealing, with traders.

These trading facilitators hold inventories of one or more assets or financial instruments, and stand ready to meet buy or sell orders as they come in. This allows markets to keep moving by ensuring that a buyer or seller can always do business.

Some providers offer liquidity across a wide range of markets while others focus on specific asset classes like stocks, forex, commodities or cryptocurrencies.

Different Types Of Liquidity Providers

Core liquidity providers can differ greatly in size, and they tend to be banks, brokerages or other financial institutions. These market facilitators fall into one of two categories: tier 1 and tier 2.

Tier 1

Primary liquidity providers purchase big batches of assets from the institutions that issue them.

Most of these are large banking and financial institutions that have access to large pools of capital. For example, Deutsche Bank and Morgan Stanley are global, leading providers in forex.

Tier 2

Secondary liquidity providers are brokers and smaller financial institutions that act as intermediaries between tier 1 providers and end customers.

Tier 2 providers have partnerships with one or more tier 1 providers. The more partnerships a tier 2 provider has, the more aggregated liquidity and market depth they can offer.

Some online brokers act as tier 2 liquidity providers and, when you trade on their platforms, you will buy and sell assets directly from and to them.

Brokers can offer excellent liquidity by partnering with multiple tier 2 providers, or by being tier 2 liquidity providers themselves and partnering with tier 1 providers.

IG is a good example of a broker that has a subsidiary liquidity provider, called IG Prime.

Such brokers are sometimes known as retail liquidity providers.

Supplemental

Entities known as supplementary liquidity providers (SLPs) also work to provide liquidity across financial markets. Like core liquidity providers, they provide depth across a wide range of different asset classes.

Unlike market makers – which create liquidity by holding an active inventory of an asset – SLPs increase trading volumes by executing high-frequency, high-volume trades using algorithms.

These are also sometimes known as electronic liquidity providers, not to be confused with ECNs (electronic communications network brokers).

Why Is Choosing A Broker With Deep Liquidity Important?

Picking a broker with high liquidity is important for several reasons:

- Ease of trading – Investors can enter and exit trades quickly and simply, meaning that the risk of holding a position is greatly reduced.

- Better price discovery – The existence of a greater number of buyers and sellers leads to more accurate and reliable price information.

- Reduced risk of slippage – The difference between the expected price of a trade and the actual price is known as slippage, the risk of which is greater when liquidity is low. This is especially important for active, short-term traders.

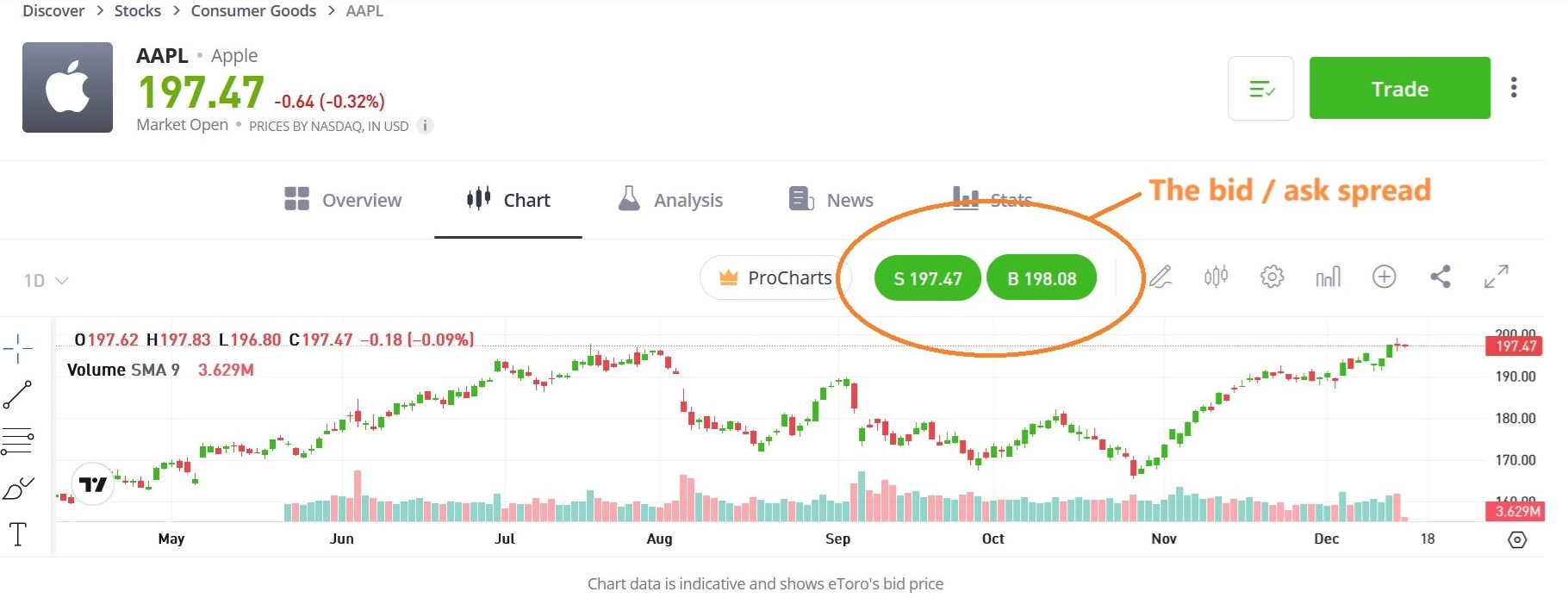

- Lower costs – In illiquid markets, finding willing parties for trades can be challenging, resulting in wide bid-ask spreads. Core liquidity providers maintain tighter spreads by supplying a constant flow of buy and sell quotes, profiting from the difference between bid and ask prices when the transaction is completed. Prices they set follow supply and demand, rising with increased buyer interest and vice versa.

Bottom Line

Financial markets require deep liquidity to function efficiently and in a cost-effective manner. To this end, liquidity providers like banks and brokerages provide an indispensable function to the modern-day trader.

Traders should ensure that the platform they select offers high levels of liquidity for their desired asset class.

FAQ

How Do Liquidity Providers Work?

Liquidity providers act as intermediaries between the institutions that issue an asset and the customer, such as a day trader.

They increase liquidity by having large quantities of the asset available and selling them to traders when required.

What Types Of Liquidity Providers Are There?

There are two main types of providers. Tier 1 liquidity providers are big banks and corporations that buy the asset from the issuers.

Tier 2 liquidity providers are brokerages and smaller companies that facilitate trading to retail brokers and traders.

Why Is Liquidity Important For Trading?

Liquidity is important because it can help keep costs down for traders. Liquidity providers hold large amounts of an asset, which means it is readily available for trading at a stable price while helping to avoid slippage.

Article Sources

- Guide To Financial Markets 7th Edition: Why They Exist And How They Work – The Economist, Mark Levinson

- Guide to Investing: The Definitive Companion To Investment And The Financial Markets – Financial Times, Glen Arnold

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com